The Weekly Insight Podcast – Where’s the Peak? Part 2

Editor’s Note: The world is, as we all know, a fast moving place. Since this memo was drafted (on Friday), much has changed. Specifically, the failure of Silicon Valley Bank and Signature Bank. Before we dive into our original memo, we wanted to address that issue directly.

The news on both banks was, to put it mildly, a shock to the market. But before we begin to spread words like contagion around, it’s important to understand what these two banks are. Both are (or were) very specialized banks. SVB had a unilateral focus on venture capital funding (especially of start-up tech companies) and Signature Bank had significant exposure to crypto currency. The drying up of funding in both areas have had significant impacts on their loan portfolio. When you combine that with rising interest rates and the impact on their investment portfolio, it’s easy to see how things turned upside down quickly.

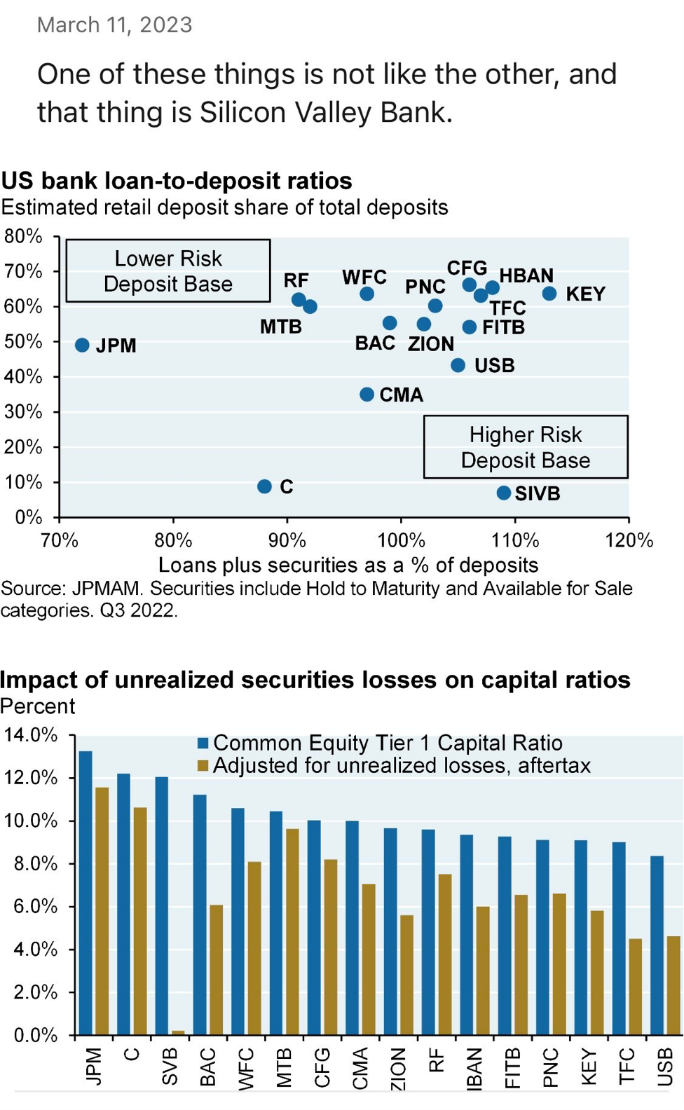

Insight clients have zero direct exposure to either bank. Even so, late last week and this morning, the news had a negative impact on all financial stocks. But their financial situation is vastly different than the high quality (and very large) banks we hold in portfolios. These two charts spell it out incredibly well.

Past performance is not indicative of future results.

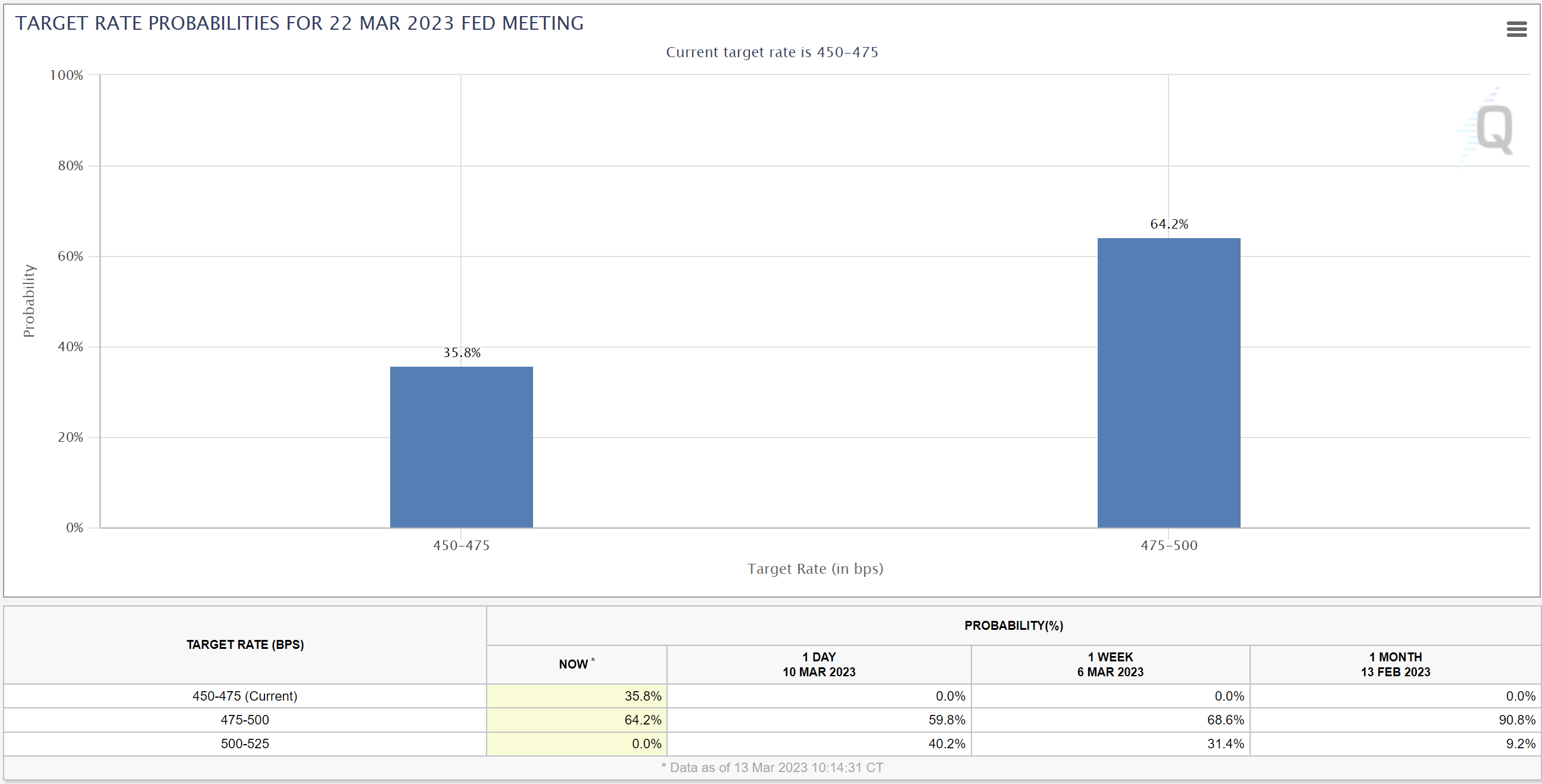

In the memo below, we noted the rising likelihood of the Fed raising rates more than 0.25% in their meeting coming up just over a week from now. The market perception of that issue changed dramatically over the weekend. There is some belief that these bank failures might drive the Fed to change this thought process. In fact, this morning, there are currently 38% odds the Fed won’t raise rates at the next meeting. We’re not in that camp – yet – but it’s going to be an important trend to watch – especially after the CPI release tomorrow morning.

Past performance is not indicative of future results.

We’ll be monitoring this issue closely throughout the week and will have more on this topic in the next memo. It’s important to note, however, that after all the drama this weekend, the core message of our memo below remains unchanged. We hope you’ll take a look.

There are a lot of things we’d like to write about in these pages right now (we have a doozy coming soon on the Federal budget deficit!). But sadly, they’re going to have to sit on the sidelines for a few weeks. Because – yet again – it’s Fed time. The only thing dominating market discussions right now is the tug-of-war between inflation and rising interest rates. How high will they go? How long will they stay there? Will inflation ever come down?

The drama reignited with the January CPI data which came out last month. It accelerated with Chairman Powell’s comments to Congress last week and the most recent jobs data. And it’s going to come to a head over the next two weeks with the February CPI data on Tuesday and the Federal Reserve announcement on interest rates next Wednesday.

Let’s get the obvious stuff out of the way first: we don’t know what’s going to happen this week! We have no secret insight into the CPI data or the Federal Reserve’s decision making. But, as we’ve said many times before, understanding the expectations is just as important. Because it is hitting or missing those expectations which will affect how the market reacts.

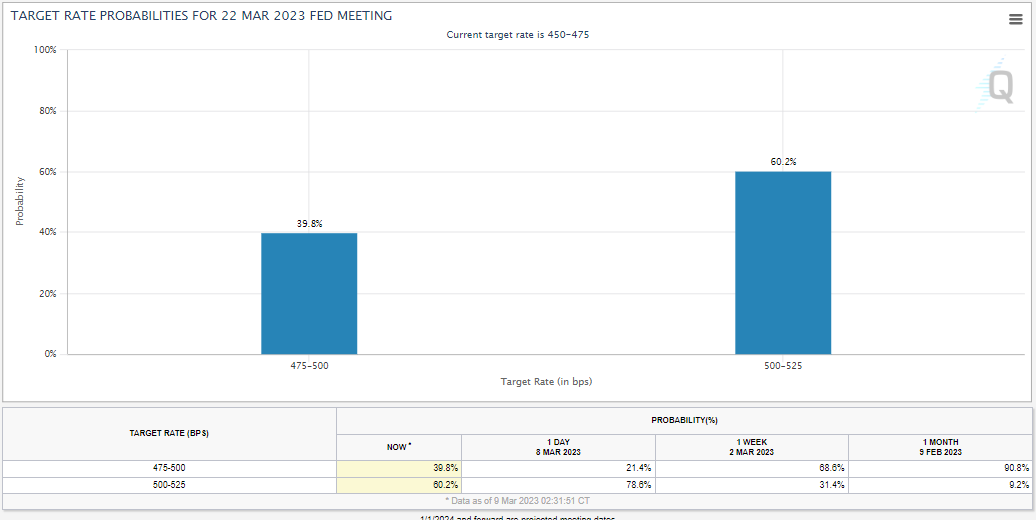

In recent weeks, those expectations have turned more negative. CPI is expected to grow at 0.4% month-over-month which would match the higher than expected numbers we saw in January. And now, after a month of fretting, the market is expecting the Fed to raise rates by 0.50%, double the 0.25% we saw just over a month ago. You’ll note that just 30 days ago, the odds of that happening were less than 10%.

Past performance is not indicative of future results.

Why the big shift? The first, and most obvious, answer, is Chairman Powell’s comments to Congress last week. The most important quote was this:

That means higher (“ultimate level of interest rate hikes”) and faster (“increase the pace of rate hikes”) than the market was anticipating just a few weeks ago.

But here’s where we’re about to step into dangerous territory in this commentary: You shouldn’t worry about Powell’s comments! Heck, we should stop writing about them. Everyone reading these pages is a long-term investor. As such, we should have all admitted to ourselves by now that we: 1) can’t predict the future; and 2) shouldn’t try to trade the day-to-day machinations of the market.

In fact, we wrote a whole memo about this issue at the beginning of the year. It was titled Big Trends (you can read it here) and the whole point was that the key to investing well is to do the boring things and understand the “big trends” that matter. Inherent with that is ignoring the day-to-day noise.

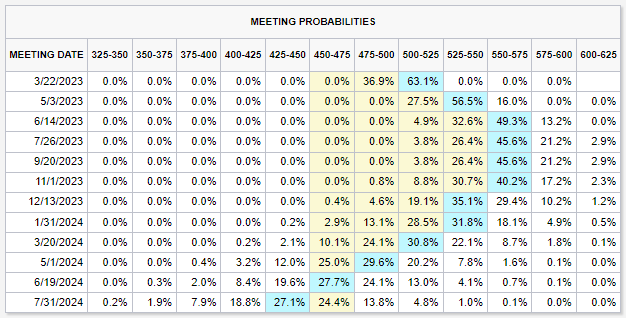

In that same memo we said the following: “The market consensus today is that rates will peak between 5.00% and 5.50% and the peak will be reached by the May or June Federal Reserve meetings…The debate is not about rates going to 6.50%…Barring dramatic changes in inflation, the era of 0.75% hikes is over”.

All of that is still true today! The current consensus is that rates will peak at 5.50% – 5.75% in June of this year. That’s no different than what we said 70 days ago. The only difference is the market got extremely optimistic in January and thought things would end more quickly. Then, in February, when it became clear that wasn’t true, the optimism was quickly replaced with pessimism. But the result is still the same.

Past performance is not indicative of future results.

Which brings us to why this memo is titled “Where’s the Peak? Pt. 2”. Back in September we wrote a memo called “Where’s the Peak” (read it here). Much like now, we were coming off a not-so-good August CPI report and the memo highlighted the market’s – and the Fed’s – shift in expectations.

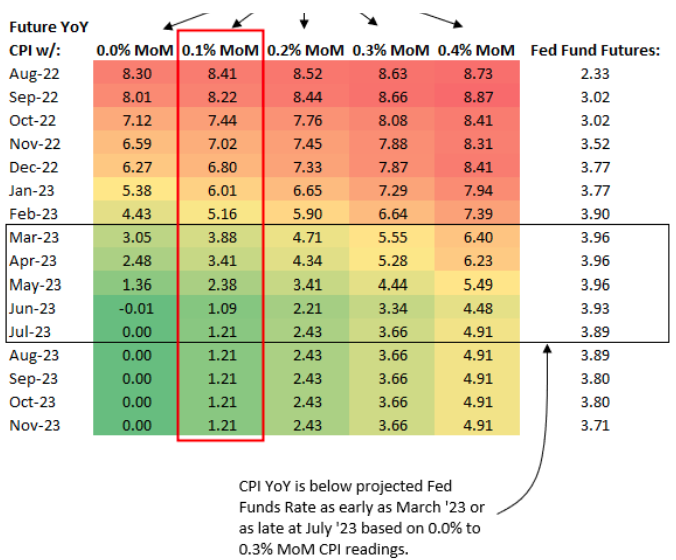

In that memo, we noted the chart below which explains what various amounts of month-over-month growth in CPI would mean to the year-over-year total. After all the hemming and hawing since that CPI report, it’s notable that CPI has had an average month-over-month growth rate of 0.23%. And CPI has now fallen to 6.4% as of the January read. That puts us fully on pace to be down to sub-3.5% inflation by the end of June.

Past performance is not indicative of future results.

Our point? The big trends really haven’t changed much! The big trends are moving in our direction. Inflation is falling. The Fed will eventually end rate hikes. The economy is still strong. And the thesis from last September is still in good shape.

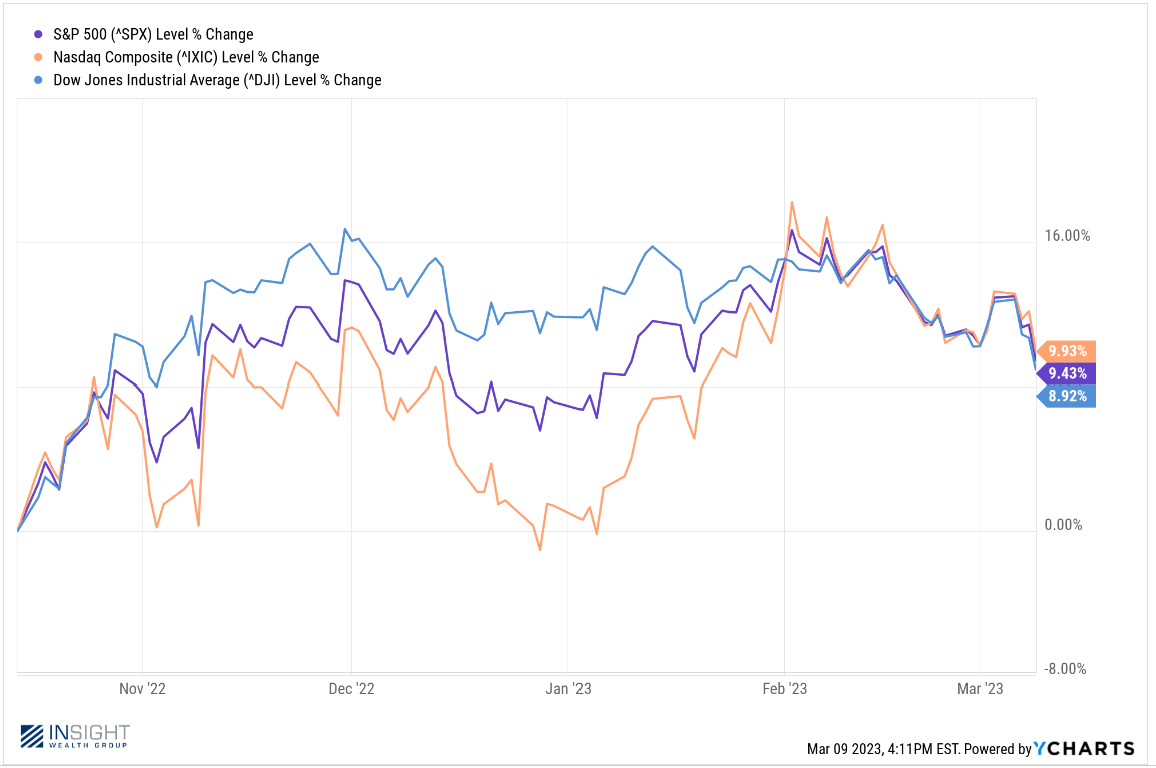

And we now know “where the peak” was. It was in February of 2022 for CPI and July of 2022 for Core CPI. We noted at the time that – “barring an apocalypse” – peak CPI has always corresponded with a positive time to invest in equities. Equities bottomed just a few weeks after that memo was written and are now up substantively. Our confidence in the big trends has been rewarded.

Past performance is not indicative of future results.

So, does this mean we’re just going to ignore what CPI tells us next week? Or what Powell and the Fed do? Of course not. We’ll be back in your inbox every Monday with a breakdown of everything that happens and what it means. But it also means you shouldn’t have to live your life “Fed meeting to Fed meeting”. Our message from January 3rd remains intact:

“If we can see moderating inflation, the end of rate hikes, earnings growth, and consistency with historical norms? We would expect to see a good recovery in the market in 2023. It just might be a fun year!”

None of that has changed. But it’s too boring to ever make the headlines.

Sincerely,