This is the Weekly Insight Memo, each and every year, which is tough to write. As we wrote in last year’s “end of year” memo:

“(It)…is tempting to write…the “Crystal Ball” memo, laying out what we think is going to happen in 2022. The trouble is, someone broke our crystal ball, and we did not get a new one for Christmas”.

We have long said in these pages that no one can predict the future. Anyone who tells you they knew the peak of the market in 2022 would be on January 3rd and the S&P would end the year down 20% is full of it.

So, what do we do instead? The boring thing. Find and understand the big things moving the market and – as we said on December 27th last year – “use that information to craft and manage a resilient portfolio that can withstand the times we’re wrong”.

We certainly were not right on everything this year. How about our statement to start the year that “we would argue there remains a strong transitory bent to what is happening (with inflation) today”? Not completely wrong, but we all had to learn a new definition of “transitory” as inflation was much stickier than we thought.

And then there is Fed policy. The consensus at the end of last year was the Fed would raise rates by 0.75% this year. That could not have been more wrong, as we now sit here up 4.25% from the start of the year. We noted that any rapid acceleration from that expectation could have a negative impact on the market. Guess we nailed that one!

But on the big trends, we were largely correct: COVID (remember Omicron last January?), inflation, and interest rates were our biggest concerns leading into the year. The one no one had on their bingo card – the Russian invasion of Ukraine – was the only big catalyst that no one could have predicted. Our more defensive posture in portfolios in 2022 lead to results that – while not ideal – were much better than the returns found across public markets (both equity and fixed income).

So, what are the “big trends” we are watching for 2023? Let’s take a look.

Guess Who’s Back?

We are starting the year with a dramatic visit from an old friend: COVID. Three years into the COVID story, we are all ready to be done with it. But just as the Omicron wave of the virus in early 2022 had a significant impact on the economy, we must prepare ourselves for the impact of the current outbreak in China.

China is now living with the decisions made by Chairman Xi and the political class over the last few years. The decision to exclude western vaccines from the country and rely on a subpar domestic version made their “COVID Zero” strategy necessary to control the spread of the virus. Now, after much public pressure, COVID Zero is gone, and the virus is running the course we saw here in late 2021/2022.

The problem with China is one of honesty. It is clear to everyone that they are going through a difficult time right now. Hospitals are packed with COVID patients. Health risk analysis firm Airfinity said last week it estimates they are currently dealing with 9,000 daily deaths and 1.8 million new infections per day in the country. They estimate China will see 1.7 million fatalities from the virus by the end of April.

But according to the Chinese government? They announced 5,500 new cases of COVID and one death last Friday. Everyone knows they are lying. But the big question is what this level of infection in the world’s second largest economy will do. Will we see more supply side issues like we saw in 2020? Will the rate of infection slow down consumer purchases in China? Or will the end of COVID Zero – despite the infections and deaths – improve China’s economy. This is going to be a big one to watch as they go through this wave over the next few months.

The End of Rate Hikes?

Much like 2022, the first half of 2023 is going to be dominated by discussion of Federal Reserve policy. How high will rates eventually go? How long until the Fed begins pulling back? Will 2022’s aggressive rate hikes result in a recession in 2023?

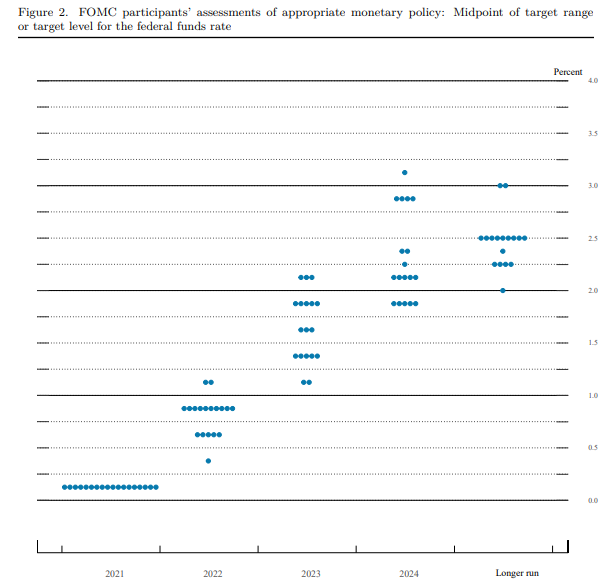

As we noted above, predicting rate moves is an exercise fraught with risk. If the Federal Reserve cannot predict what they will do (see their December 2021 dot plot below!), how could we do so? The highest any member of the FOMC thought Fed Funds rate would go was one member who thought rates would hit 3.125% in 2024! Today we sit at 4.375%. Talk about a miss.

Source: Federal Reserve

Past performance is not indicative of future results

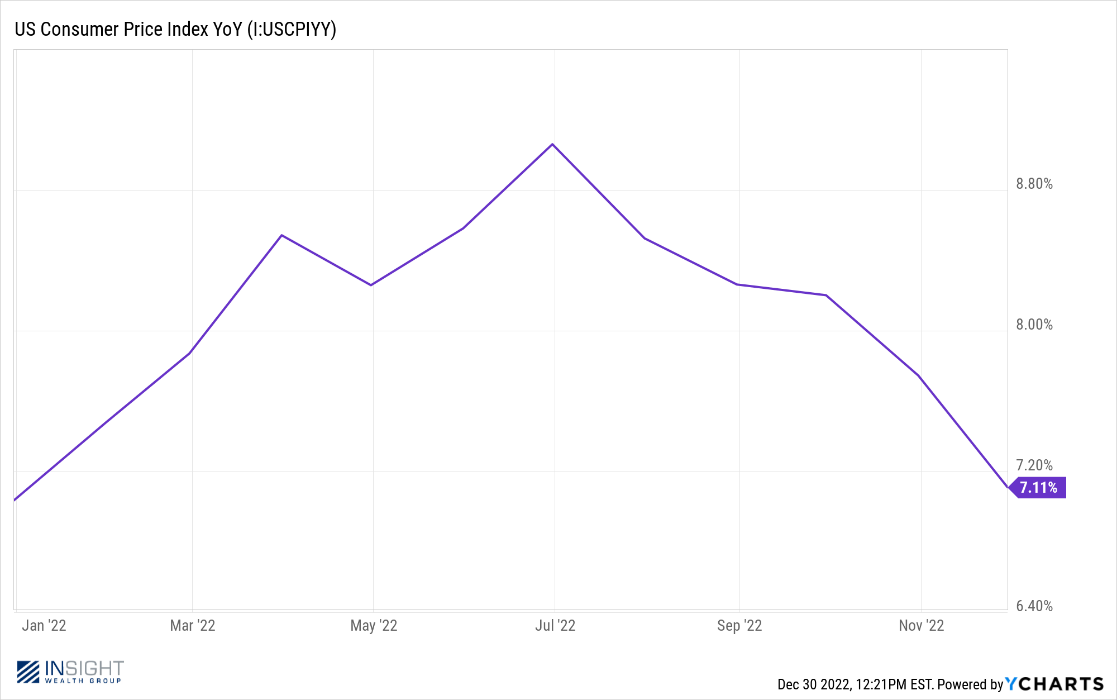

So, we will not try to predict rates. But we can understand a few important things. First, inflation is unquestionably improving. CPI has now returned to the levels we saw at the start of the year and is down dramatically from its peak in June.

Past performance is not indicative of future results

The second is that the Federal Funds rate is not going to go up infinitely. We are much closer now to the peak in rates than we were last January when rates were at 0.00%. the debate today is much more around the margins than it is about the core problem of rate increases.

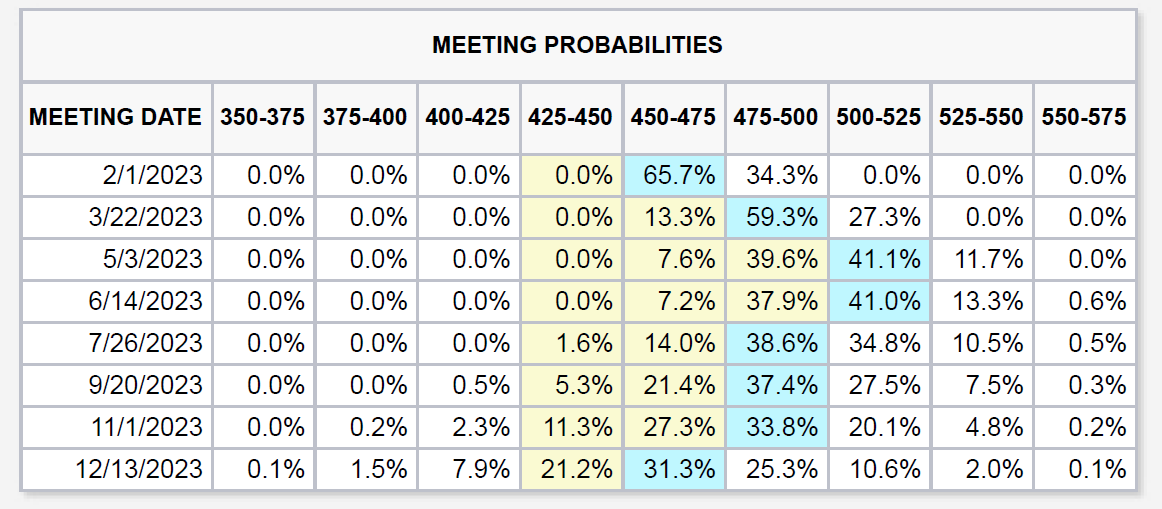

The market consensus today is that rates will peak between 5.00% and 5.50% and the peak will be reached by the May or June Federal Reserve meetings. To put that in perspective, which would mean three more 0.25% rate hikes, one each in February, March, and May.

The debate is not about rates going to 6.50%. It is instead about “will we get a 0.50% hike. February or a 0.25% hike?” or “will we get 0.75% in total hikes this year or 1.00%?”. Again, this is all around the margins. Barring dramatic changes in inflation, the era of 0.75% hikes is over. That is a good thing for markets.

Source: CME Group

Past performance is indicative of future results

A Recession? Maybe…But Not in Earnings

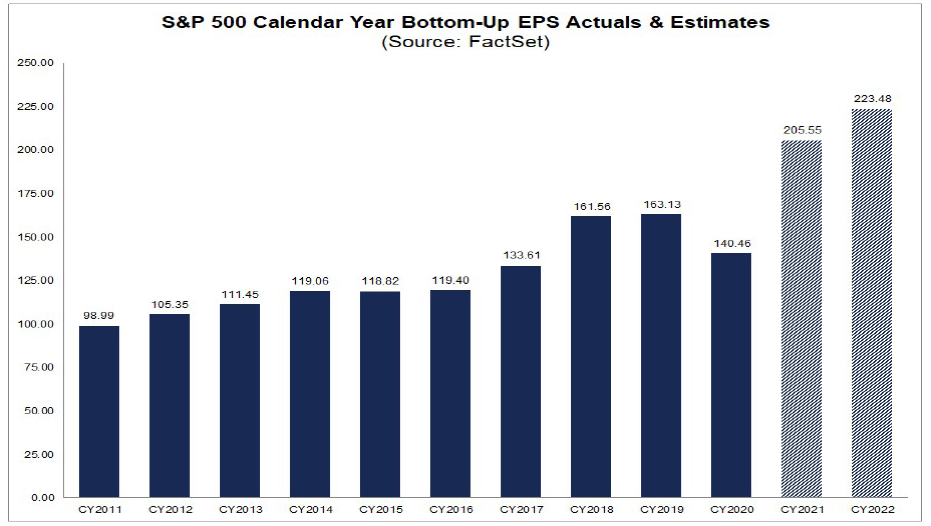

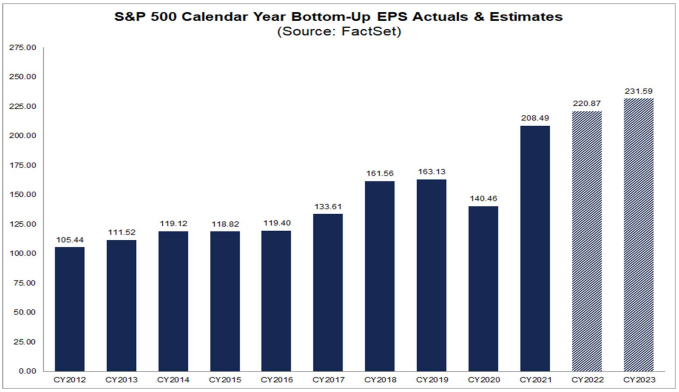

In our last memo of 2021, we spent some time focused on looking at what earnings expectations were for 2022. It is a good exercise and one we will do again today. But before we look ahead, let’s look back at the data from 2021. As you can see from the chart below, the expectation was that the S&P 500 would have earnings in 2022 of 223.48.

Source: FactSet

Past performance is not indicative of future results

To be fair, we do not yet know what that number will be as we wait for the Q4 earnings data. But the expectation today is the number will be 220.87. That would be a miss of 1.17% from last year’s guess.

But that also means that – even with significant inflation, Fed policy that set records, a war in Eastern Europe, the Omicron wave, and a stock and bond market that performed as badly as they have in the last 14 years – earnings still went up(!) 5.94%.

So, with all the recession talk, clearly we must be expecting earnings to take a dip next year, right? Nope. The current estimate is earnings will grow an additional 4.85% next year.

Source: FactSet

Past performance is not indicative of future results

The most interesting part about the chart above is not the expectation for next year, however. It’s the past. Do you remember the years from 2012 to 2017? They were pretty dang good in the markets, were they not? The average earnings growth over that period was 5.34% annually. The average for 2022 and 2023 using the expected data noted? 5.39%.

History Is a Guide

As the saying goes, history doesn’t repeat itself, but it often rhymes. The same can be said of the history of the stock market. When trying to understand big trends, history can be a good guide.

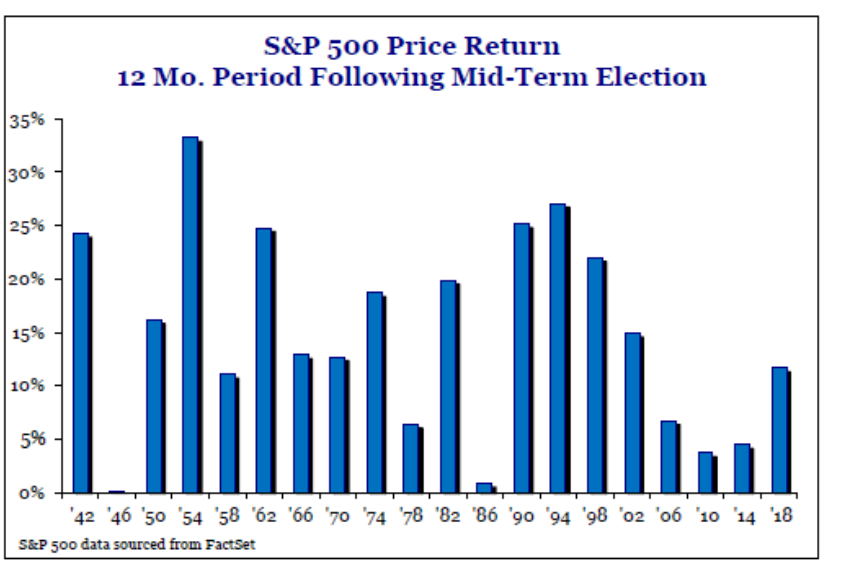

So, what does history tell us after a year like the one we just had? It’s pretty positive. Remember the impact of elections on markets (we have talked about this a lot before). One of the things that keeps repeating itself is the market’s return history after a mid-term election. We have not had a negative year in the year following a mid-term going all the way back to 1942.

Past performance is not indicative of future results

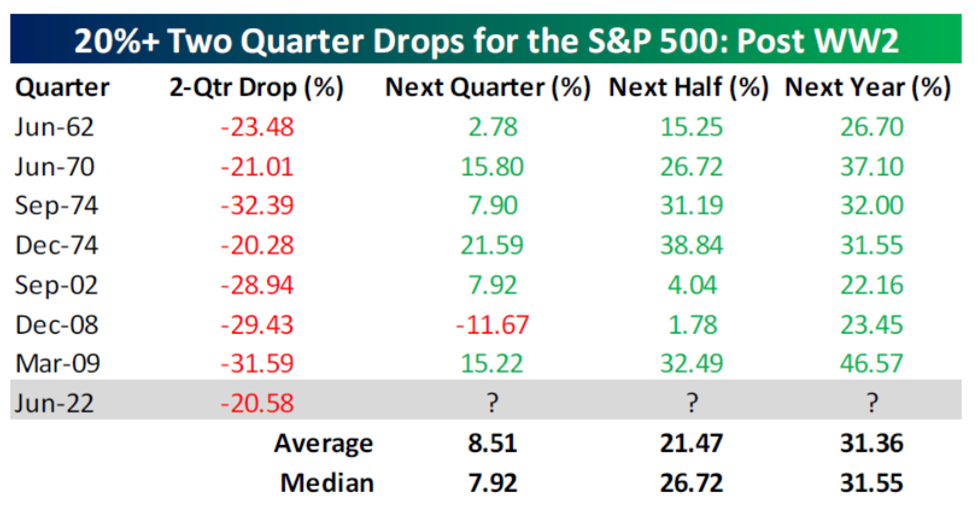

And, more broadly, the S&P has had a positive return 82% of the time the year following a negative year. It’s even more notable when you look at a period when the market is off 20% for two quarters.

Past performance is not indicative of future results

Simply put, the world is not ending. We may see a recession from the Fed policy which was implemented in 2022. But the market has already priced in a lot of that pain. If we can see moderating inflation, the end of rate hikes, 4.85% earnings growth, and consistency with historical norms? We would expect to see a good recovery in the market in 2023. It just might be a fun year!

Sincerely,