In case anyone was thinking we’d slowly ease into 2023, the market and the news cycle said “not so fast” last week. Between the latest jobs report and the battle to choose a new Speaker of the House in Washington, much was going on that may impact markets over the coming weeks and months. We will dive into both of those topics in a moment, but we wanted to discuss a few financial planning issues first before we dive into the news.

Secure 2.0

We addressed the “Secure 2.0 Act” in a memo last month (here), but now that it has become law, we wanted to highlight a few items that may impact you as investors. Here are the highlights:

- Required Minimum Distributions (RMDs): You may recall that during the Trump Administration, Congress changed the RMD age from 70 ½ to 72. In the Secure 2.0 legislation, they have continued to ramp the age up – but it does come with some variability.

- If you were already 72 by December 31, 2021, your RMD age is 72.

- If you turn 73 at any point in 2023, your RMD age is now 73. If you turn 73 this year, you must take your first distribution no later than April 15, 2024.

- If you will turn 75 in 2033 or later (meaning you were born in 1958 or later), your RMD age will be 75.

- RMDs in Roth 401(k)s: There was a discrepancy in the past between a Roth 401(k) and a Roth IRA in that those invested in Roth 401(k)s were forced to take RMDs, while that was not the case for Roth IRAs. That difference was trued up in the new legislation and Roth 401(k) investors no longer have to take RMDs.

- RMD Penalties: Penalties for those who miss their RMD have been reduced from 50% to 25% – and even further to 10% if the error is “corrected in a timely manner”. For those of you who are clients at Insight, we’ll continue to work with you to make sure this isn’t an issue. But it is good news for those who make an honest mistake.

- 529 Portability: One of the biggest concerns parents often have about 529 plans is what happens to the money if it doesn’t get fully used for college. Congress has supplied a partial fix for that. Going forward, any 529 plan that has been funded for 15 years will be eligible to roll the funds into a Roth IRA up to a limit of $35,000. That is an aggregate limit over the lifetime of the beneficiary.

There’s a lot more in this bill, especially if you’re a business owner and sponsor of a 401(k). We’d be happy to address it with you and answer any questions you may have.

Iowa Tax Law Changes

This one is specific to our home state clients, so if you don’t live in Iowa, you can skip right over this section. But for those of you here in God’s Country (😊), there are a few tax law changes for 2023 that are important.

- Income Tax Rate: This is the first year of the planned four-year reduction in Iowa income taxes. Eventually we will be going to a flat 3.9% income tax rate, but that will happen over time. This year, the top income tax bracket in Iowa will drop from 8.3% to 6.0%.

- Tax Free Retirement Income: Retirees in Iowa are getting an extra boost. If you are over age 55, any distributions from retirement plans will not be taxed as income in Iowa. It is important to note that if you are married, and only one spouse is over 55, only that spouse will get the benefit of this income exclusion.

- Tax Free Farm Income in Retirement: Like the retirement income exclusion, anyone over 55 who is generating income from a farming operation – and who is not involved in the active operation of the farm – will be able to exclude this income from their taxes. Most commonly this would apply to lease income from those leasing their farmland to someone else to operate. To be eligible for this exclusion the retiree must have executed a formal lease agreement with the Lessee.

These will add up to be significant changes for our Iowa clients who are over the age of 55. Please contact us if you have any questions about how this may apply to you. Scott Manhart and his team at Insight CPA have analyzed the changes extensively and are ready to help you understand what it means for you.

https://tax.iowa.gov/expanded-instructions/pension-retirement-income-exclusion-2021

The Speaker Battle

Now on to the news of the week and how it has – and may in the future – impact the markets. The biggest news was undoubtedly the long and drawn-out election of Kevin McCarthy as Speaker of the House of Representatives.

Much debate can be had on this topic, but we’re not here to talk politics. Instead, what will this mean for your portfolio? It may have a more direct impact than you think.

We all knew heading into this year that a divided Congress would make it less likely for any significant legislation to move to the President’s desk. As far as the market is concerned, that may be a good thing. But what’s notable about the Speaker’s battle is that division just became notably more pronounced.

Love it or not, the four-day battle produced a number of concessions to the House Freedom Caucus that are going to make it more difficult for the House and the Senate to pass bipartisan legislation. The list of supposed concessions is long – including things like membership on the House Rules Committee, changes in how many members it takes to call for the firing of the Speaker (now only one!), and how appropriations bills are handled.

But there is one concession that causes us the most concern: how the debt ceiling is going to be handled. It is widely understood that the Freedom Caucus demanded – and McCarthy conceded –there be no increase in the debt ceiling without cuts to future spending.

We understand the motivation. Our $32 trillion in Federal debt is unsustainable. But we have talked about this before. The debt ceiling is about spending already agreed to (an area where Republicans are just as guilty as Democrats). Will the Treasury Department be allowed to borrow the money necessary to pay the bills Congress has saddled them with?

We understand that everything in Washington is about leverage. And the debt ceiling extension gives conservatives leverage to negotiate for what they want (future spending cuts). But the risk of not extending the debt ceiling? It’s two-fold.

The first risk is a shutdown of the Federal Government. That will have a short-term impact on people’s lives and the economy. Given the debt ceiling is supposed to expire in the middle of the year – right about the time economists worry about the economy slowing from the interest rate increases – it wouldn’t be ideal. But it also wouldn’t be catastrophic.

The second risk is much more important: an impact to the credit rating of the United States. The one constant for the last 247 years has been that the “full faith and credit of the United States” meant something. Much like the Lannister’s from Game of Thrones, America always paid its debts. If that changes – and forces a change in our credit rating – the cost of the $32 trillion we already have in debt gets much, much more expensive. Those economic impacts would be substantively more serious. Let’s hope Congress is adult enough not to play games (yeah…we know…that’s not likely).

Unemployment Data

We got the December unemployment data on Friday. In any normal economic time, it would have been fantastic. 220,000 new jobs were created in December. The unemployment rate dropped to 3.5%. Labor force participation went up a bit. All “good news”.

But as we mentioned in several memos last year, good jobs report have often meant bad news for the markets. Any sign that the labor market continued to be tight was an indication the Fed would continue to raise rates. That led to our often-used phrase: “Good jobs bad, bad jobs good”.

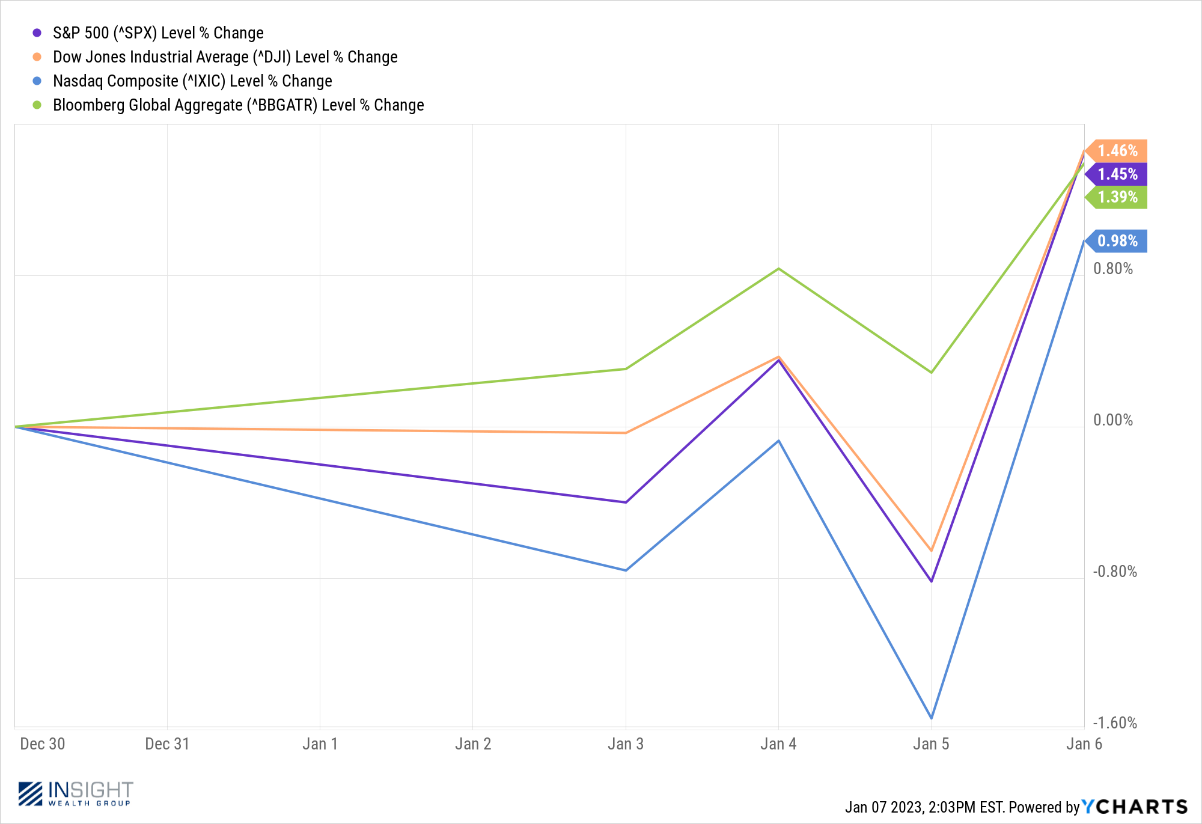

But Friday was different. The market loved the good jobs report and it led to a very positive day in markets and, ultimately, a positive first week for equities and fixed income.

Past performance is not indicative of future results

But, why? Why would things suddenly be so different? Is it New Year’s optimism? The markets are too cynical for that. Instead it had to do with the data on wage growth.

Wage growth slowed yet again last month, coming in at a year-over-year number of 4.6% (0.3% month-over-month). Wage growth slowing while jobs are increasing. That’s the dream for economists right now. It shows it might be possible to beat inflation without killing the economy.

We are a long way from being able to count on that scenario. But it certainly was good news to start the year.

Sincerely,