The Weekly Insight Podcast – I’m Lovin’ It

Many of you know that Insight Wealth Group is a family business, of sorts. Andrew and Karlton Kleis are, clearly, brothers. Andrew Dorr grew up with the Kleis boys and his sister married Karlton. We have been together for nearly 40 years at this point.

What you may not know is that, long before we started Insight, we all worked at everyone’s favorite fast food joint: McDonald’s. We can sling burgers with the best of them.

Working at – and managing – a McDonald’s restaurant was a formative experience. You learn things like customer service, inventory management, payroll, etc. But the most important thing of all was the experience managing people. It was, quite simply, labor that meant the difference between a profitable store and a dying store. The ability to have the right people and manage your labor costs meant all the difference.

The impact of labor costs is one of the primary things impacting the economy – and the Federal Reserve policy discussion – today. Our readers know well the issues at hand: a shortage of labor, which drives up the cost of labor, which drives up the cost of goods. That is a big part of the inflation saga we’ve been experiencing for the last 18 months.

Ironically enough, it turns out our experience at McDonald’s does have more economic implications than we may have thought when we were 18 years old. In 1986, The Economist devised something called the “Big Mac Index”. The theory behind the index is that, since the Big Mac is so prevalent worldwide, you could use it’s price in various locations to better understand the relative value of currencies in countries across the world. We never knew those burgers we were flipping had such meaning!

The cost of a burger at McDonald’s holds value in other ways as well. We can look back in time and better understand how costs have changed. We remember well the drama in the mid-90s when the cost of a single cheeseburger jumped from $0.69 to $0.79 on our local McDonald’s menu. We definitely had some unhappy customers. Today, our local McDonald’s charges $2.49 for the same 1/10th pound burger. That is an annualized growth rate of 8.61%!

This is the part where we scream about those nasty, horrible corporations, right? Maybe we’re still loyal to the Golden Arches, but it’s not all their fault. The cost of their inputs increased dramatically. The cost of a pound of ground beef is up 184% over the same period. The cost of cheese is up nearly 85%. The cost of ketchup is up 81%.

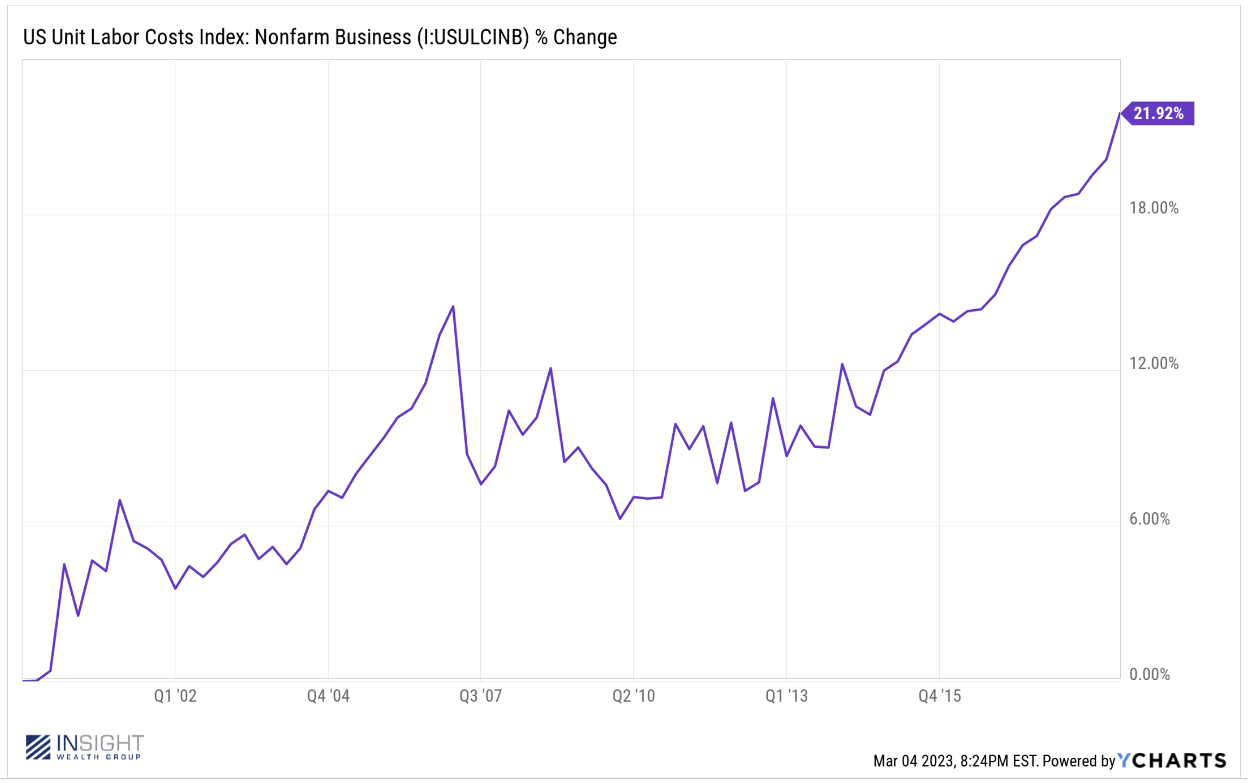

What kept prices relatively low and stable in the U.S. for a long time is that wage growth was largely stagnant. In fact, over the 20 years after we left McDonald’s, wages in the U.S. only grew 21.92% – or just over 2% per year.

Past performance is not indicative of future results

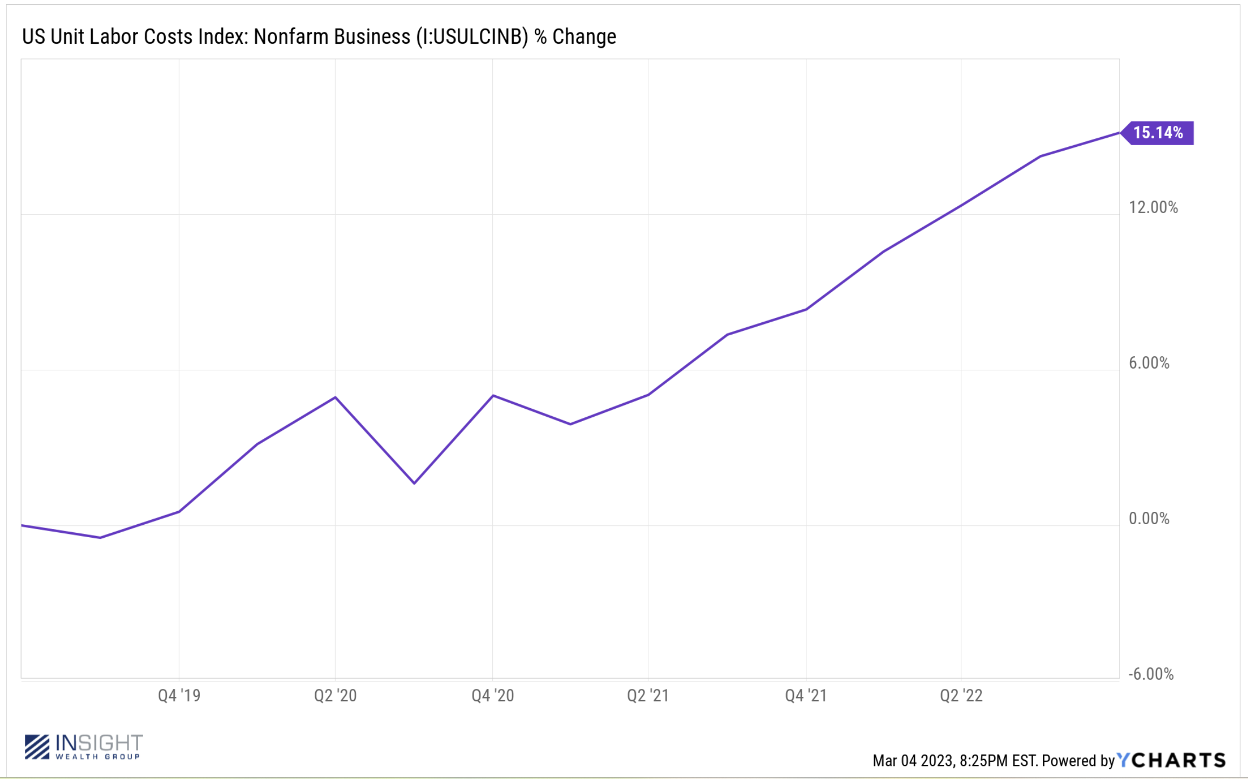

In the four years since? Over 15% growth in wages. We’ve more than doubled the rate of wage growth – and almost all of that has come in the last two years. That is a big, big change.

Past performance is not indicative of future results

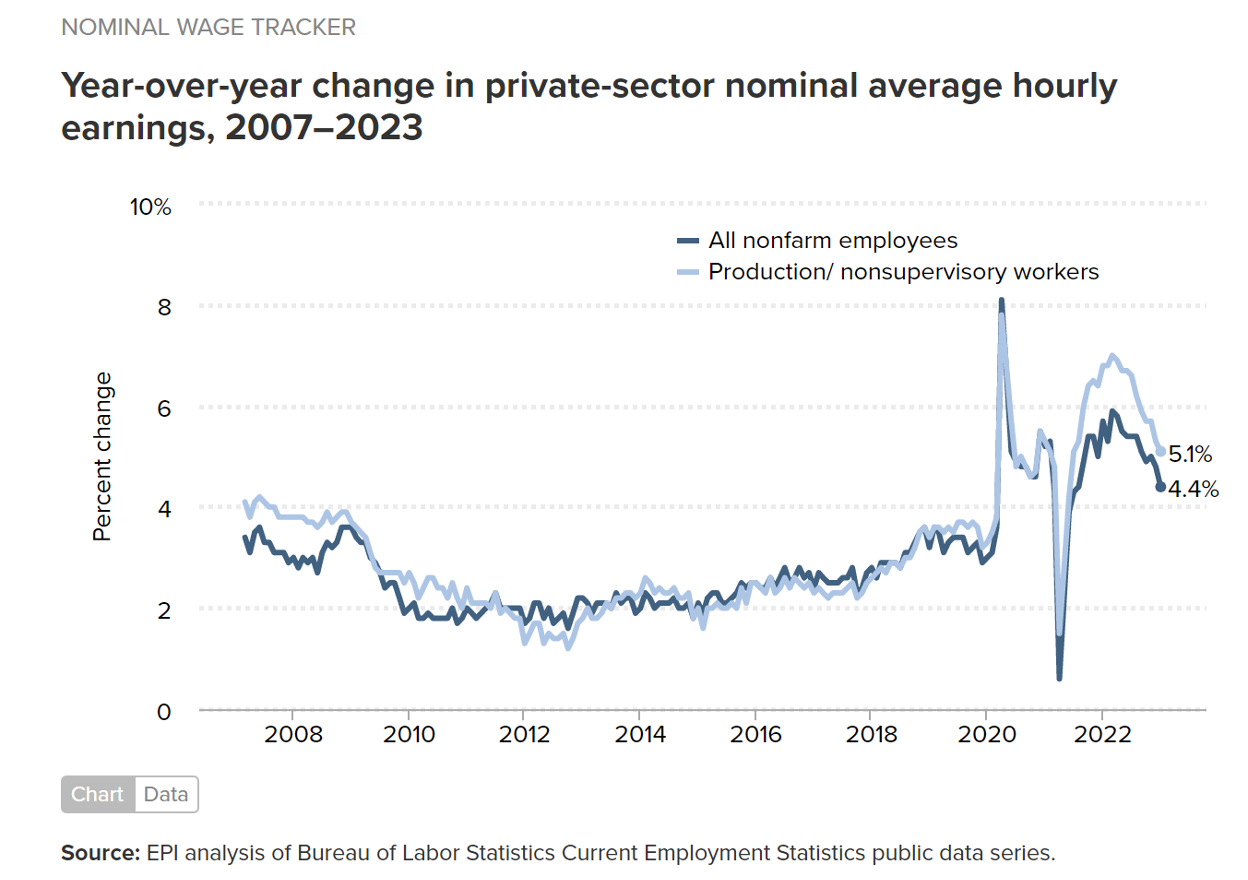

And that is exactly the big question the markets are struggling with today. Higher wages aren’t a bad thing. But long-term expansive wage growth is. Stabilizing the rate of wage growth is important to bringing inflation back in line. Chairman Powell has said it 1,000 times if he’s said it once: It’s going to be a huge part of whether or not the Fed continues to slow and/or stops rate increases.

But here’s the good news: wage growth numbers are normalizing! Year-over-year wage growth for non-farm employees maxed out at 5.9% and has fallen to 4.4%. And this is not a one-time good data set. Wage growth peaked in March of last year and have now been falling for twelve months.

Past performance is not indicative of future results

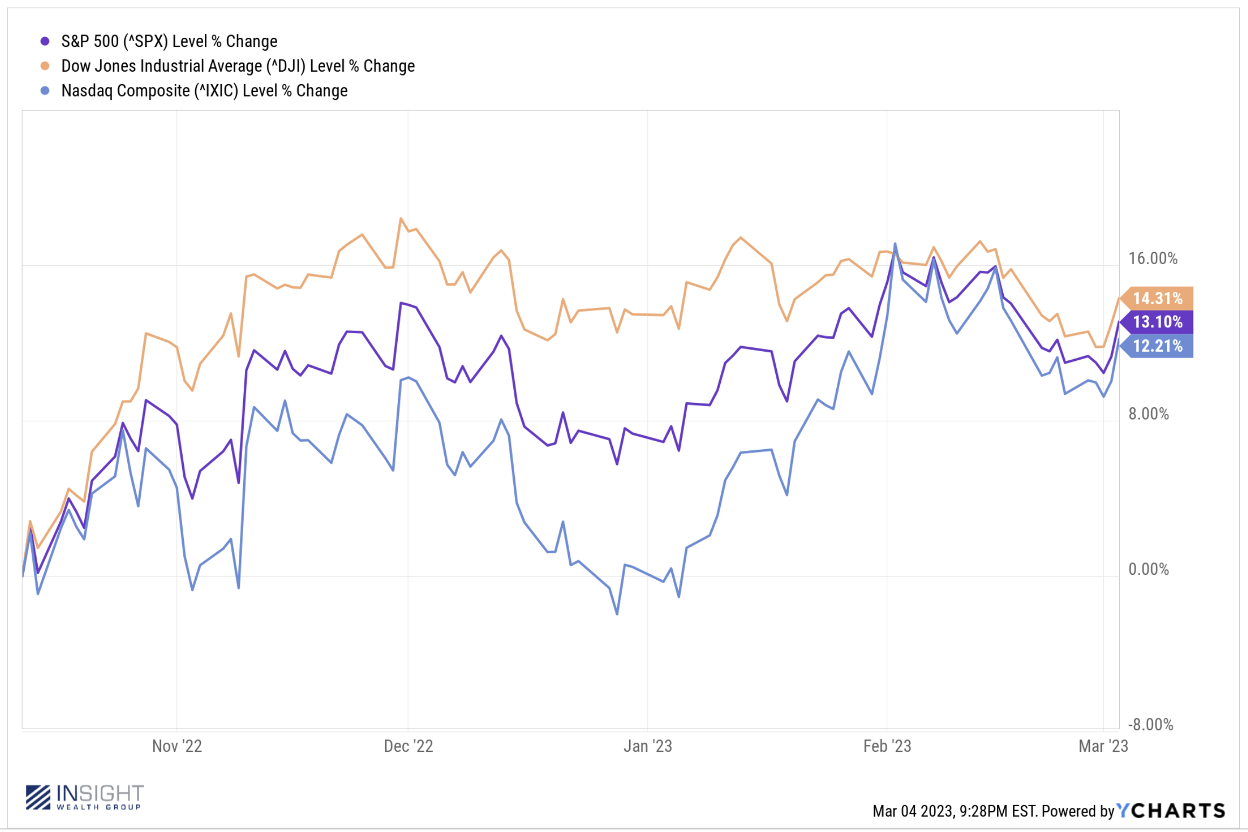

We know – as do our readers – that February wasn’t much of a fun month in the markets. Each of the major indices was off more than 4% for the month and – yet again – the bond market was down as well. It seemed a lot like a reminder of the pain we all felt in 2022.

But what if we told you the last six months has been an excellent time to invested in the markets? It sure doesn’t feel like it sometimes, but it has been. Equity indices have grown at a better than 20% annualized rate.

Past performance is not indicative of future results

Why? Because wage growth is falling. Inflation is falling. The plan is working. It just isn’t always fun. And we are not getting the immediate results our society seems so intent upon. If we can be patient, we may just be singing that famous McDonald’s slogan: “Da-da da da-daaa…I’m lovin’ it”.

Sincerely,