The Weekly Insight Podcast – Short Term Bias

First, we would like to apologize for the delay in the distribution of last week’s Memo and Podcast. No excuses – your author screwed up the sending of the email! – but we didn’t notice until an alert client notified us on Wednesday night.

Shortly after it did (finally!) go out, another client – who is a pilot – reached out on our discussion of the “no landing” scenario being pitched by so many pundits today. He said the following:

“A ‘go around’ is an aviation term. When you are on final approach to the runway, you are ALWAYS aware that something could preclude the landing. Either something on the ground or in the aircraft. At that point, you go around and try it again. Your description of our economy resembles a ‘go around’ to me. We have decided not to have a recession. We have approached that point and ‘gone around’.”

That is such an interesting way of thinking about things – especially after this week in the market. We had a great deal of fretting this week. Higher than expected PCE numbers. Renewed focus on the war in Ukraine. Growing expectations of Fed rate hikes over the coming months. The mood has shifted from the optimism we saw in January.

But did the plane lose power? Did we shear off a wing? No. At best we had a little turbulence.

Everyone reading this has likely been on a plane that has gone through a patch of rough turbulence. Despite all the information you have to the contrary (quality plane, well trained pilot, knowledge that turbulence doesn’t crash planes!), there is nearly always a short-term negative reaction, right? A tightening of the seatbelt, a gripping of the arm rest, a little extra sweat on our brow.

That is short-term bias. An immediate negative (or positive) reaction to the stimuli we are given. And the market was full of it last week. We want to address a few of those short-term concerns and look at the core data behind it.

Consumers Are Running Out of Cash/Credit Card Debt is Rising

There was a lot of noise this week about the rise in credit card delinquencies. If you read any of the articles, the consensus was this: delinquencies are rising, consumers are out of cash, here comes the end of the world!

The only problem is the report that lead to these articles – put out by the New York Fed – is 46 pages of data. And it is not easily distilled into a short article (by us or the news!). We all know the adage – if it bleeds it leads! – means the negative version of the story is much more attractive. But what did the data really say?

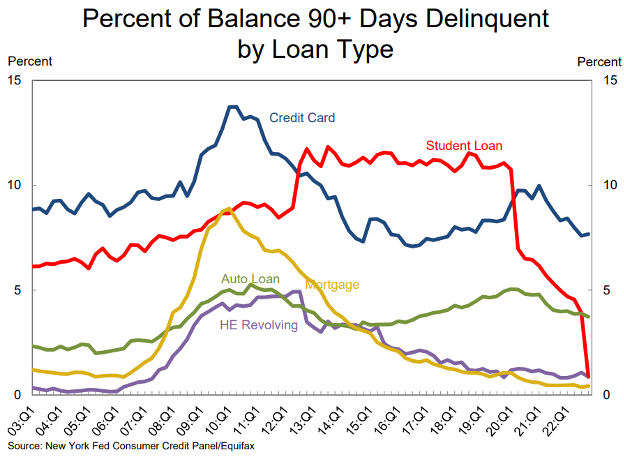

Yes, credit card delinquencies rose in Q4. But they are still well below pre-COVID levels. And total household delinquencies? They’re at some of the lowest levels we’ve seen since the “Great Financial Crisis”.

Past performance is not indicative of future results

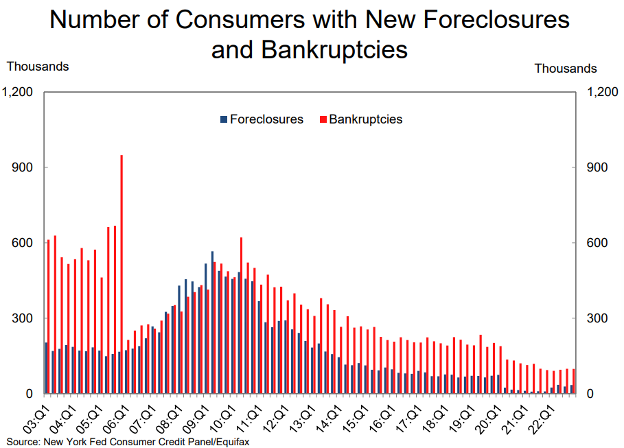

Foreclosures, another area the market focuses on have risen as well. The scary version? Foreclosures are at their highest level since the start of the pandemic! The more realistic version? They are still at historically low levels. The same goes for consumer bankruptcies.

Past performance is not indicative of future results

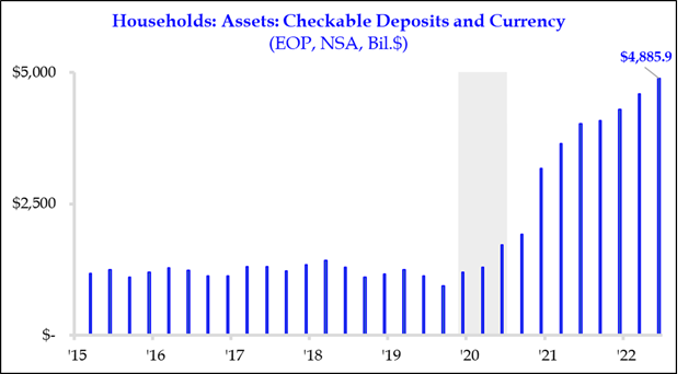

Part of this conversation is tied to a chart we have shown you many times before: the checkable deposits (cash) consumers have on hand. The number is still fantastically high – nearly five times the historical average.

Past performance is not indicative of future results

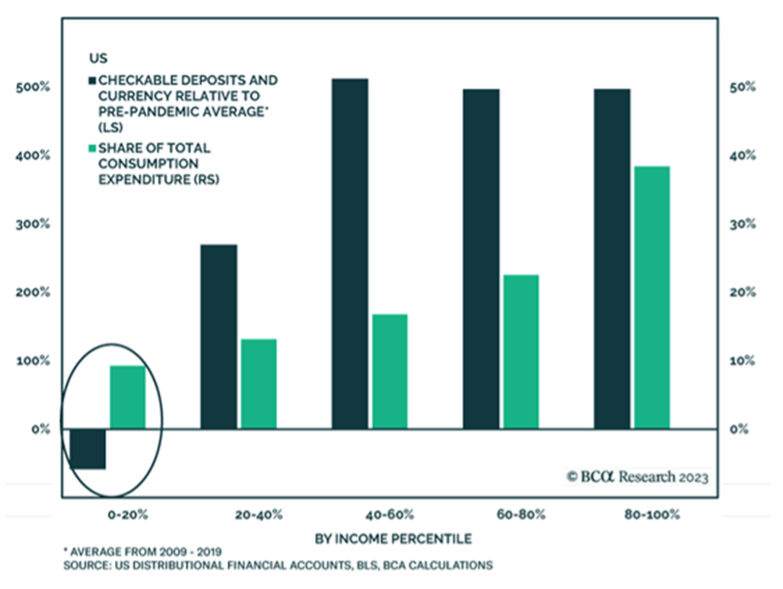

That’s good news, but it does not tell the whole story. It turns out that the top 80% of income earners are doing very, very well. The 2nd quintile of income earners have 250% more cash than they did prior to the pandemic. The third, fourth, and fifth – nearly 500%. But it’s a much different story for the bottom quintile.

Past performance is not indicative of future results

This is where inflation’s sting bites the most. Those with the least income are most impacted by rises in the price of gas, or food, or shelter. For those with more income, it has a diminishing impact.

That issue is – in a nutshell – exactly why the Fed has done what they have done over the course of the last year. And that’s a good thing. But it’s also important to note the difference between the individual impact of inflation and the economic impact. Because that bottom 20% – the group that is suffering – also makes up the smallest amount of consumption in the economy – less than 10%. They are not the drivers of economic activity and growth. Those who are the drivers have been largely unaffected. In whole, the consumer is in particularly good shape.

Companies are Driving into an Earnings Ditch

It will be no surprise to our regular readers that Q4 2022 earnings…weren’t good. 94% of S&P 500 companies have now reported earnings for the quarter and the overall decline on a year-over-year basis is -4.8%. If it holds, that would be the worst quarter since Q3 2020.

It’s important, first, to remember this isn’t a surprise. Analysts have long expected a fall in earnings for the quarter and – while it is a bit worse than what was expected – it is within the margins.

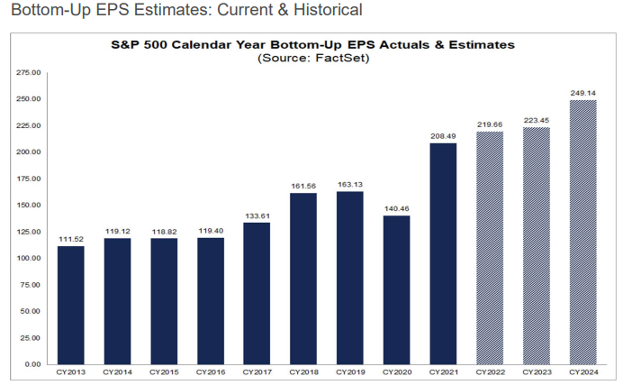

The question, though, is whether or not this is a blip or the start of something more serious? Let’s first look at what the “analysts” are expecting for 2023:

- Q1 2023: Earnings decline of -5.7%

- Q2 2023: Earnings decline of -3.7%

- Q3 2023: Earnings growth of 3.0%

- Q4 2023: Earnings growth of 9.7%

- Full Year 2023: Earnings growth of 2.2%

That lines up a lot with what we have been saying about the path of the broader economy this year: volatility in the first half as the world deals with rising interest rates and inflation, and more optimism as we get past that process. And while the full year does not look great, look at expectations for 2024: nearly 11.5% earnings growth.

Past performance is not indicative of future results

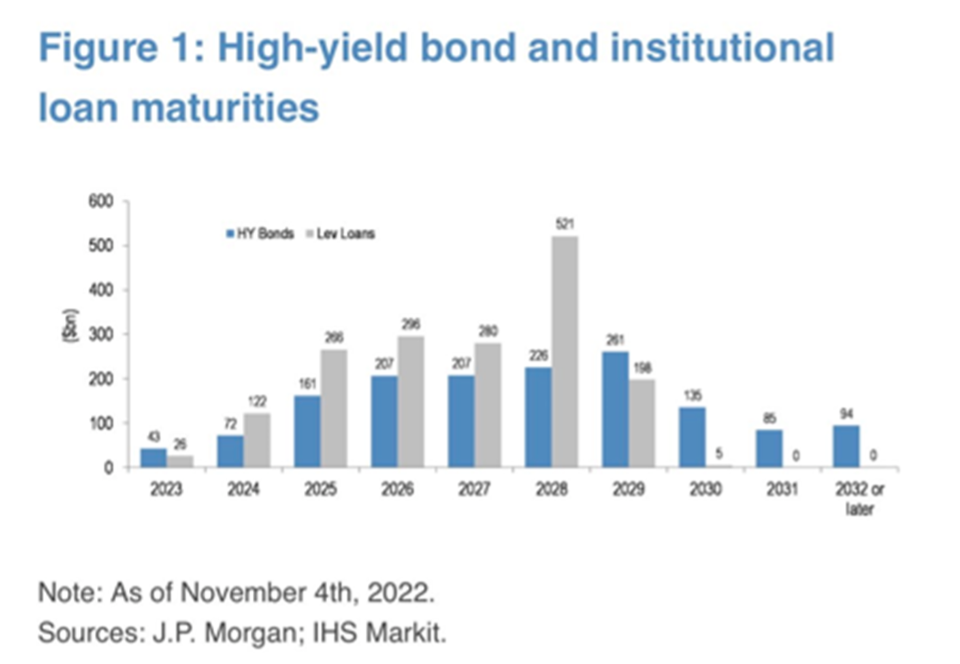

Why the optimism? Companies are better situated for the future than we sometimes think. Much like consumers, businesses took advantage of the low interest rate environment in 2020 and 2021 to lock in cheaper debt. The result, as rates are skyrocketing, is very little maturities/refinancings over the course of the next two years.

Past performance is not indicative of future results

There is a lot of debt coming due in 2025 – 2028. But if you compare that maturity with where rates are expected to be, companies should be in good shape to refinance their debt at much lower rates than we see today.

This all lends to a much different picture than the short-term, “the plane is crashing” approach we’ve been seeing lately. Yes – the markets were down last week. They are still up for the year. And the long-term future does not look that bad. We just need to be patient.

Sincerely,