The Weekly Insight Podcast – What Goes Up

Three years ago this week was the first time we wrote one of these memos. 156 weeks – and 156 memos – later, we will be the first to admit it is sometimes hard to produce a topic to talk about each week. What is important? What will you – our readers – find interesting?

Over the last several years, the entire world has been consumed by creating “content”. People are falling off cliffs to get an Instagram photo. A Fast Company article from 2019 discussed Meenakshi and Vishnu Moorthy, a couple famous for their Instagram account. In a post the couple asked “A lot of us including yours truly is (sic) a fan of daredevilry attempts of standing at the edge of cliffs and skyscrapers…Is our life just worth one photo?” A few months later, both would be killed trying to take a photo for Instagram in Yosemite National Park.

The financial media is no different. Talking about money, the economy, or the markets is not inherently exciting. Sometimes, it seems, they need to punch it up a notch to encourage people to read, watch, or listen. And the funny thing is, once a story takes hold, everyone seems to try to get their piece of it.

This week we got a doozy of an example: the “No Landing Scenario”. We’re not sure who was first to come up with this idea. But if you do a Google News Search on the topic, you find 267,000 results! It is the financial media’s version of the Ice Bucket Challenge. Everyone had to get in on the action.

But here is the problem… It. Makes. No. Sense. Let’s look at why.

What Is the No Landing Scenario

We’ve heard for months the discussion of a hard landing, or a soft landing, as it relates to how the economy will revert from the inflationary issues we’ve experienced for the last 18 months. It all has to do with how the economy will react to the Fed’s interest rate policy. A hard landing means the economy will crater into a tough recession. A soft landing means we will slowly ease out of our inflationary issues and no significant impact will be felt.

So, what is “No Landing”? It’s fairly simple: the economy continues to grow and inflation never comes down. We just continue to muddle around in this environment for several years. Essentially the argument is that this is the 1970s all over again.

Why Now?

Why has this just started to become a topic of conversation? Just a week ago we were talking in these pages about how – despite a little bit of volatility – expectations on inflation and interest rates were unchanged – at worst – from the beginning of the year. What changed?

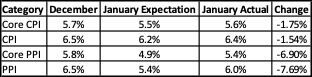

It comes down to three data sets from January: the jobs report, the consumer spending report, and – most importantly – the CPI and PPI data. The jobs report and the consumer spending report showed a strong and growing economy. And the CPI and PPI data showed inflation that was not coming down as quickly as some would have hoped. But it is really the inflation data that has mattered most in this conversation.

January Inflation Was Better – but Not Great

We have seen some nasty inflation numbers over the last year. Take, for example, the March 2022 PPI data. The expectation was the year of year number would come in at 10.6%. It came in at 11.2%. Or the May CPI data that was supposed to come in at 8.3% but hit 8.6%. We have had some very big misses to the upside.

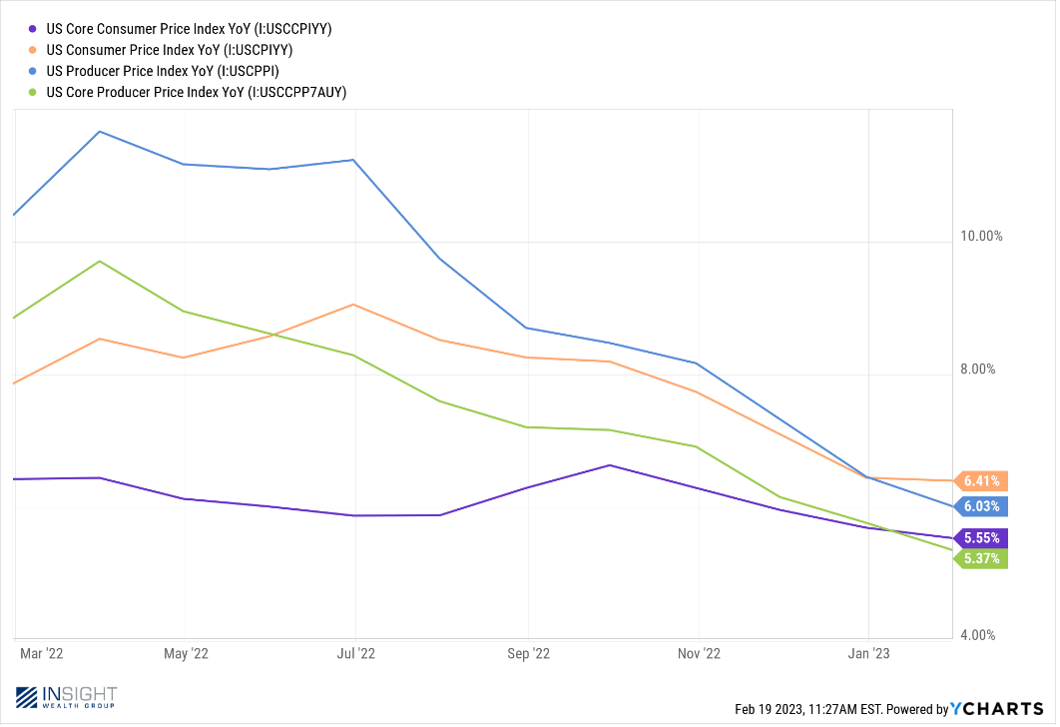

What we saw last week was not that. We had misses. But they were about how quickly inflation was coming down, not misses about how much inflation was going up. Year-over-year CPI and PPI – both core and total – all dropped in January. Just not as much as was expected.

Past performance is not indicative of future results

OK – so it was not the ideal result everyone was hoping for. But can you discern a trend over the last twelve months?

Past performance is not indicative of future results

“No Landing” Does not Tell the Full Story

The pundits screaming about “No Landing” are not telling the whole story, either. Maybe that’s because the whole story is too complicated. Or it doesn’t fit into a nifty soundbite. But it is important, and you need to hear it. There are two particularly important things that are going to impact inflation over the coming months that don’t match the no landing story.

The first is the “base effect”. It’s boring, so we’re guessing that’s why it’s not leading the news. It’s a math problem. Let’s run through it.

Imagine you have three numbers in sequence: 100, 150, and 200.

What is the growth rate from 100 to 150? It’s 50%.

But what, then is the growth rate from 150 to 200? It’s grown by the same amount (50), but the percentage change is different because we have a different denominator (or base). Now the growth rate is 33.33%. It has shrunk.

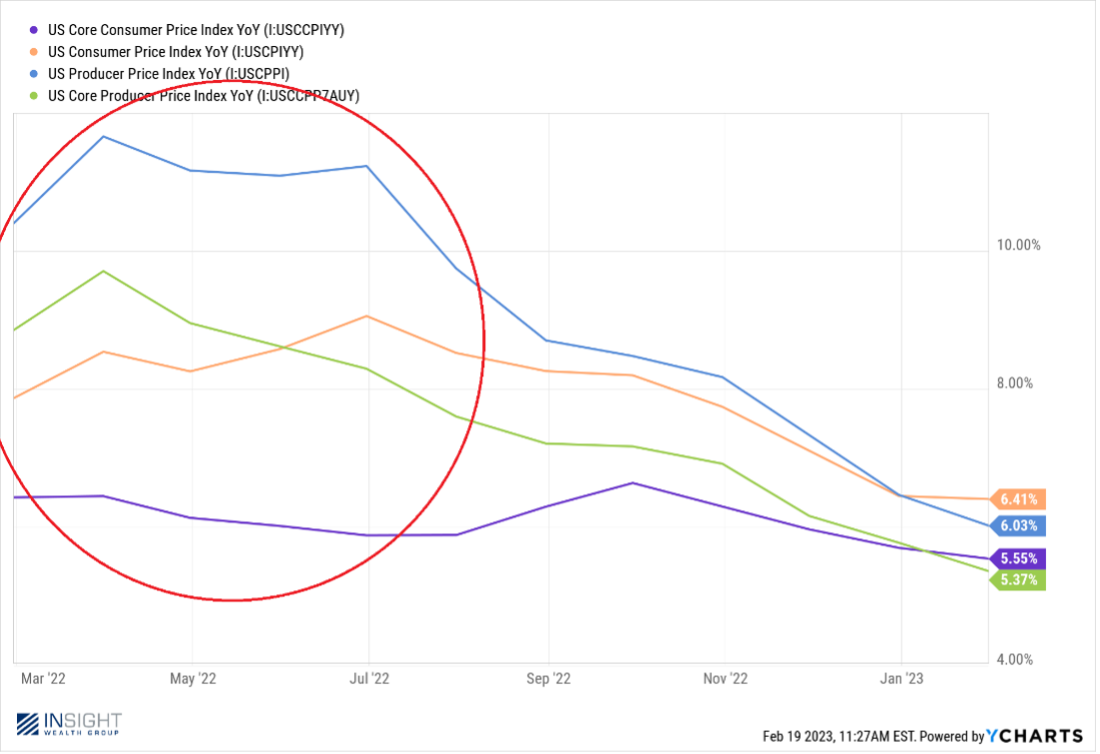

The same thing is going to happen with inflation. Let’s look at the year-over-year chart we used just a few minutes ago, but now look at the area on the left hand side of the chart.

Past performance is not indicative of future results

Over the next four or five months, we are going to be measuring year-over-year inflation against a very high “base”. The simple arithmetic tells us the year-over-year inflation numbers are going to be dropping dramatically. The math is on our side.

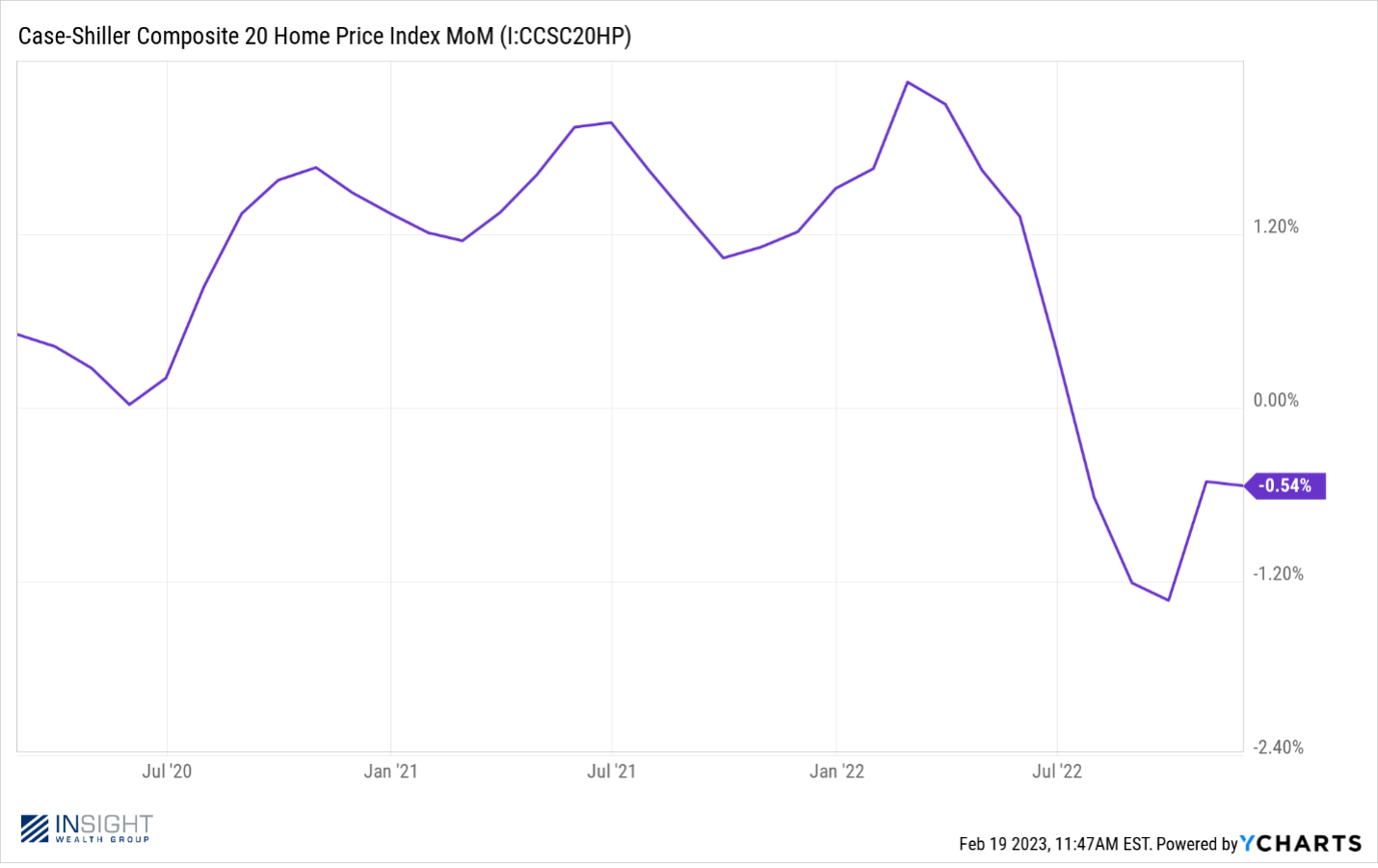

The other issue is one we have been harping on for a while now: housing inflation. We’ve written about this issue a lot over recent months, so if you want a refresher, you can find it here. The basic rundown is this: shelter makes up an outsized amount of the calculation for CPI and the Bureau of Labor Statistics’ calculation for shelter costs is…well…wrong. And when it eventually reverts, it’s going to have a significant impact on inflation (to the good).

But what no one was talking about last week is that it just got more wrong. The Bureau of Labor Statistics just increased the weight of shelter in the CPI calculation. It now makes up 43% of the Core CPI calculation. And, according to the BLS, we just had the highest increase in history in the cost of shelter. It went up 0.8% month-over-month in the latest CPI read.

The only problem? That does not match what is actually happening in the economy. Just take a look at the Case-Shiller Composite Home Price Index for the last three years. The month-over-month numbers clearly show that home prices have been falling since last July!

Past performance is not indicative of future results

What does this all mean? Inflation is falling. It has been falling for some time. And it will continue to fall.

How fast? How hard will the landing be? We do not know – and neither does anyone else. But the idea of a “No Landing Scenario”? It’s a half-baked idea to get clicks and have something to talk about on TV. We have a lot to worry about in this world. This is not one of those things.

Sincerely,