The Weekly Insight Podcast – All Around The Margins

Most of you reading this – and the whole team writing this – are a bit cynical about good news these days. That is understandable. Ten days from now will be the three year anniversary of our first “COVID Memo”. It has not exactly been a three-year period full of good news. We’ve had a worldwide pandemic, a contested Presidential election, violence at our Nation’s Capital, more pandemic, the first war in Eastern Europe since WWII, more pandemic, and runaway inflation. Anybody tired yet?

It’s understandable, then, when we have a good start to the year – as we have so far in 2023 – we’re all waiting for the other shoe to drop. This week we want to dive into that “other shoe” and why, even if it does drop, we still think portfolios can have a strong recovery year. Let’s dive in.

Christmas Morning Syndrome

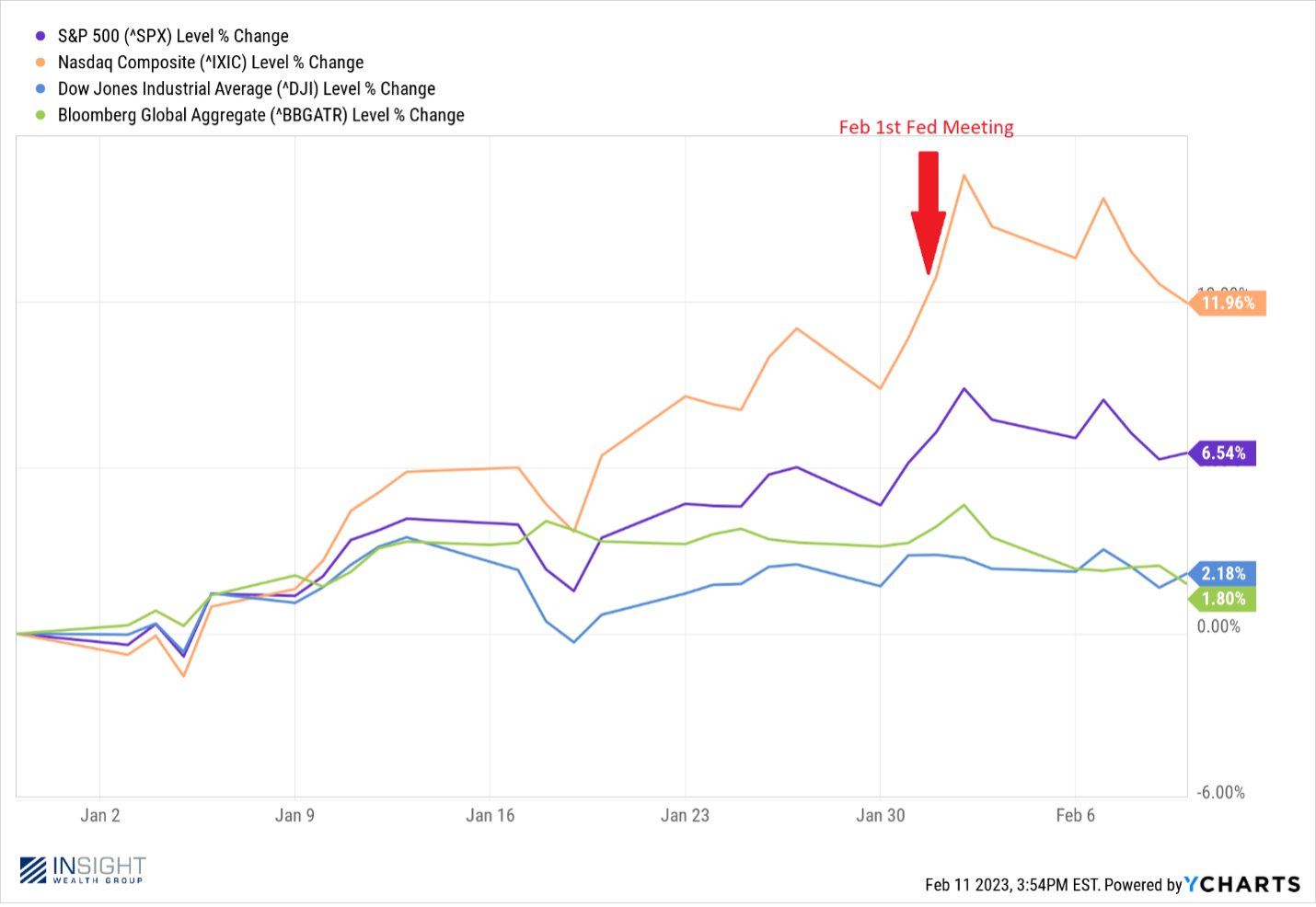

We spent a good bit of time last week walking through the market’s response to the February 1st Federal Reserve Meeting. In that discussion (you can find it here) we worried that maybe the public was pulling the good from Chairman Powell’s remarks, but ignoring the rest of his comments.

But that is not really a new thing. In fact, the market has been doing it since the beginning of the year, well prior to Powell’s comments.

We started the year with the big banks and research shops lowering their expectations for a recession in 2023. On January 5th, Goldman Sachs put out a much read piece which lowered the probability of a recession to 35% and indicated they believed much of the drag from Fed rate increases had already been felt.

Then there was the expectation for what the Fed would do. After a year of wild rate increases, the expectations for what the Fed was going to do began to shift. Expectations for the February meeting dropped from a 0.50% increase to a 0.25% increase (which ended up being correct). More importantly, the expectation for the terminal rate changed. Where previously investors had expected the rate hike process to end in may at a rate of 5.00% – 5.25%, now traders were expecting it to end in April at a rate of 4.75% – 5.00%.

All that lead to a great first month of the year – across all sectors of the market. And while we have had some negative results over the last week (since the jobs report), gains still persist in the major indices.

Past performance is not indicative of future results

We’ve taken to calling this the Christmas morning syndrome. Those of you who have or are currently raising kids know what it’s like when Christmas morning rolls around. There’s excitement – yes. But there is also a significant lack of patience. The wait can just be a bit too much for little ones.

The same may be happening here with the market. We know there is good news on the horizon. We. Just. Can’t. Wait! It’s been far too long.

Playing Around the Margins

That leads us to where we are today. Sentiment has yet again shifted. Once the market actually digested Chairman Powell’s comments – and the blowout jobs report – opinions began to shift on interest rate policy. Now the expectation is we have three rate increase this year and the Fed is done in May. There’s also very little hope of an interest rate cut before the end of the year.

But here’s the thing: that’s well within what we all thought at the beginning of the year anyway!

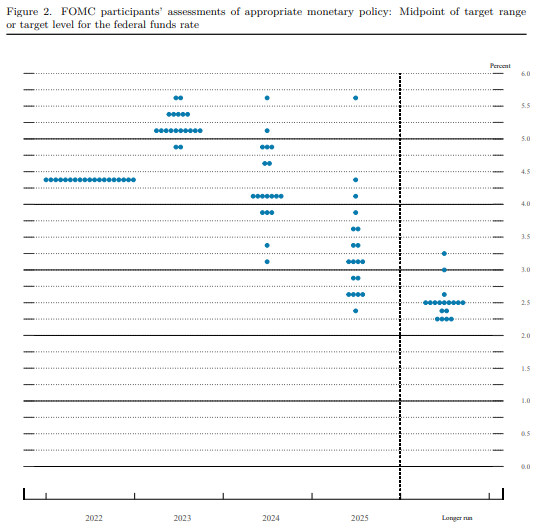

First and foremost, the current expectation is nearly perfectly in line with what the Fed said they were going to do at their last meeting in December. The majority of the Committee believed rates would peak at 5.00 – 5.25% and remain there through the end of the year.

Past performance is not indicative of future results

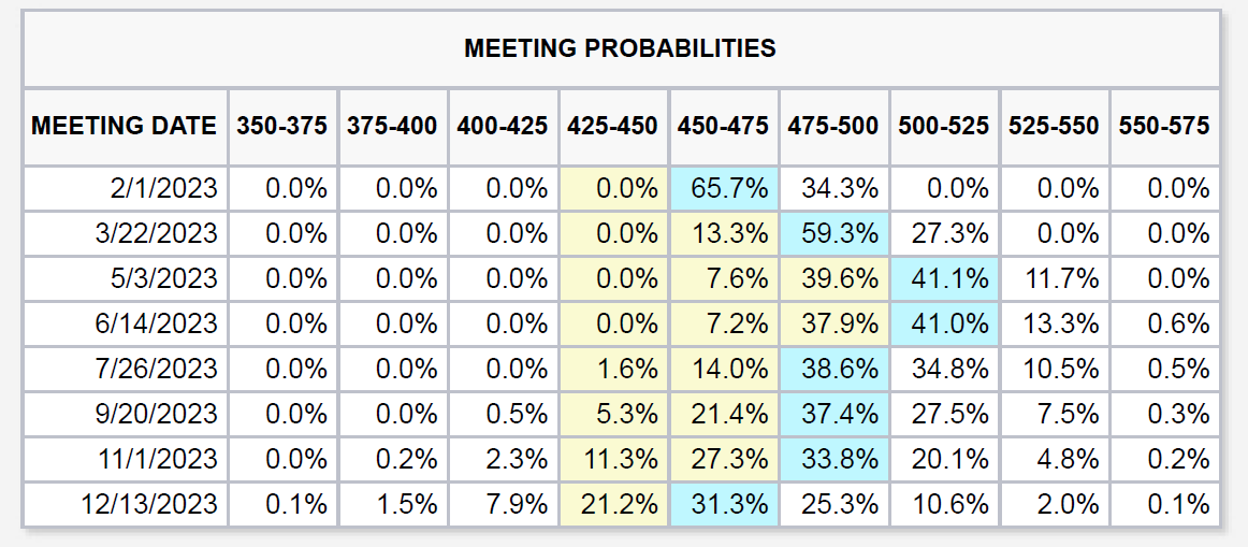

In our memo from January 3rd, we included the probability chart for rate increase from the CME Group. It looked like this at the beginning of the year.

Source: CME Group

Past performance is not indicative of future results.

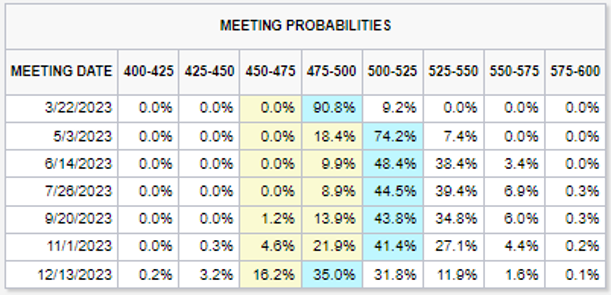

The chart today really does not look much different. The only significant changes are the belief that we’d raise rates 0.50% in January (instead of 0.25%) and the belief that the Fed may trim rates by the end of the year. Even so, we’re within 10 – 15% probabilities at the end of the year from the January 1st data.

Source: CME Group

Past performance is not indicative of future results

Which brings us back to what we said about this process at the start of the year:

The debate is not about rates going to 6.50%. It is instead about “will we get a 0.50% hike in February or a 0.25% hike” or “will we get 0.75% in total hikes this year or 1.00%”. Again, this is all around the margins. Barring dramatic changes in inflation, the era of 0.75% hikes is over.”

It’s all around the margins. That’s what we need to understand right now. Until we get to the end of this rate hike process, the mechanics of it are going to be debated. Markets are going to fluctuate. We’re going to have good months (January) and bad weeks (last week). But the script is largely written. The market and the Fed are just filling in the dialogue now.

Bluntly, we’re a little surprised at how well markets have performed this year. We continue to believe the back half of this year – after the Fed is done raising rates – is where the real potential for performance lies. But this positive performance just gives us room for error as we work toward that jumping off point.

So, as we have volatility over the coming weeks and months, just remember the issues we’re experiencing right now are not groundbreaking ones. It is not a pandemic, or a war, or inflation. It’s the machinations of how we end rate hikes and it’s not nearly as concerning as what we’ve been through in the past few years.

Sincerely,