The Weekly Insight Podcast – Hearing What We Want to Hear

There have been many “post-Fed” commentaries in these pages over the last year, an indication of just how important interest rate policy has been to the market and the economy. We’ve digested and expounded on countless Powell-isms and tried to read the tea leaves of where the Fed is going.

We’ve also been frustrated at times. Frustrated by the slowness to act in early 2022. Frustrated by the overreaction on the other side, leading to the fastest rate increase we’ve seen in over 40 years. The Fed has not been perfect in this process. And Insight – nor any other outlet – has been perfect in predicting what they’re going to do next.

But there is a trend worth paying attention to: Since Chairman Powell’s aggressive comments at the Jackson Hole Economic Summit last August (remember when he scolded us like a grumpy dad?), it has been a mistake to assume he’s not going to do what he says he’s going to do. He told us then he was aggressively going to raise rates and he has.

Which brings us to last week’s Federal Reserve meeting and the subsequent press conference by Chairman Powell. Let’s be very clear on one point: there was a significant amount of optimism coming out of the meeting. That included:

- The FOMC doing what the market had assumed and slowing the rate of interest rate increases. They raised rates by 0.25% to a range of 4.50% – 4.75%.

- The Fed removed their reference to the War in Ukraine being an inflation driver. That seems to be a nod to an expectation that energy prices aren’t going to spike and drive inflation again in the near term.

- Powell said – for the very first time – that the “disinflation process” is beginning. This is the first overarching statement from the Fed that inflation is coming down.

- Powell was very bullish on the overall economy and cited the possibility that a “soft landing” was still possible. His statement that “My base case is that the economy can return to 2% inflation without a really significant downturn or a really big increase in unemployment” is one of the most optimistic things to come out of his mouth in a long, long time.

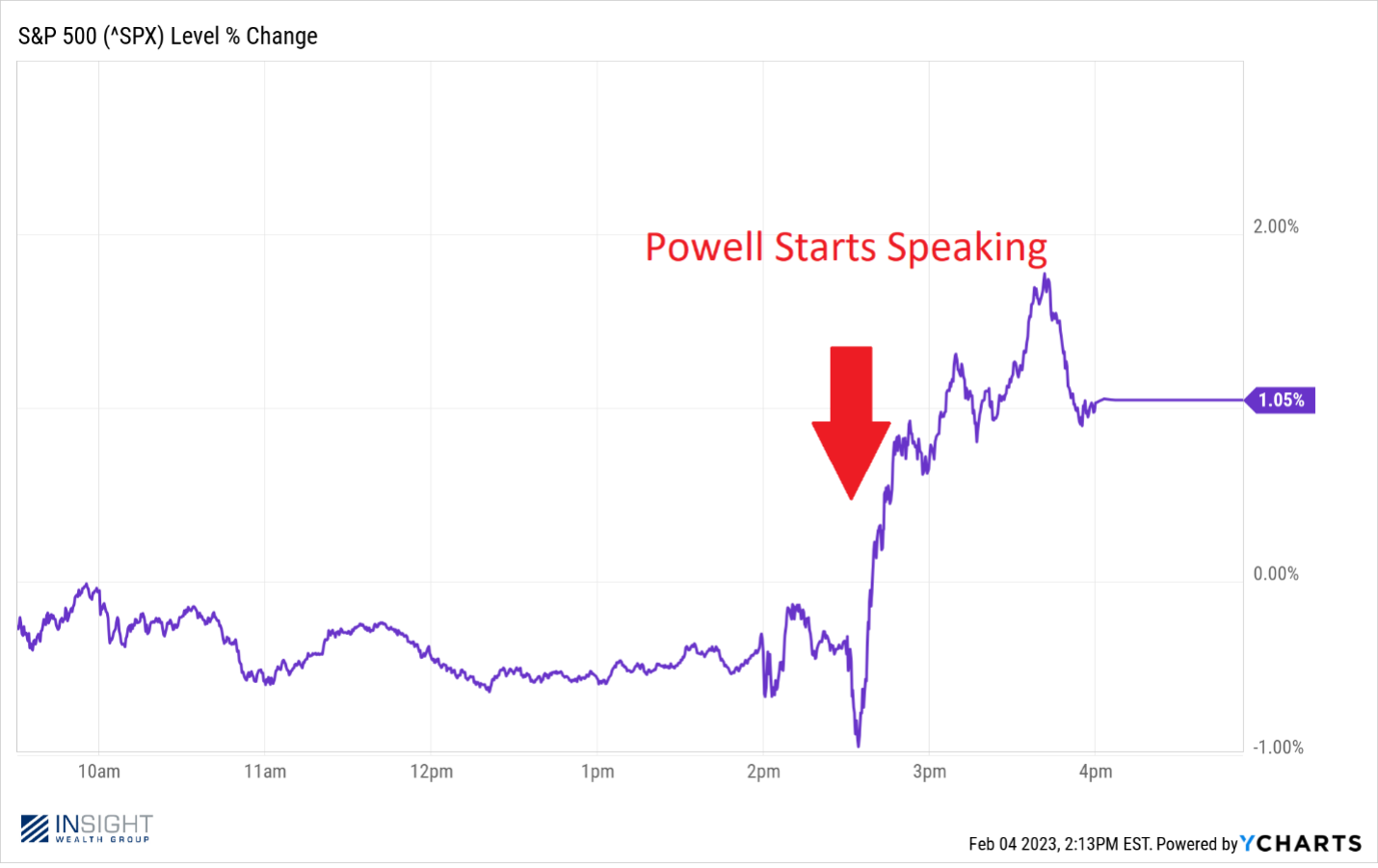

The market took notice of these statements. We have often made fun of Chairman Powell’s ability to turn good news into a market disaster during his press conferences. Last Wednesday was the exact opposite. If his oral skills are graded by market performance, he got an A+.

Past performance is not indicative of future results

Yes and no. President Harry Truman once asked his staff to find him a one-armed economist. When asked why, he stated that every time they came to give him advice, it was always “On the one hand… But on the other hand…”

Powell was not a one-armed economist last week. One could argue these were some of the most optimistic comments he has made so far, but there were also many cautionary notes that we should take note of. And it’s very important that we don’t hear just what we want to hear.

He was clear that, while the disinflation process had begun, “it would be premature…it would be very premature to declare victory, or to assume we’ve really got this.”

He also stated that while he expected the economy would grow this year, he anticipated it would be at a slow rate.

And probably most important: while we’re getting to what will likely be the peak in rates, he doesn’t anticipate them coming down anytime soon. “Given our outlook, I don’t see us cutting rates this year”, he stated.

We’re not ones to look a gift horse in the mouth. Certainly his comments – and the Fed’s actions – we’re more positive than many expected. You might recall us last week discussing how Powell may choose to be pessimistic if for no other reason than to reign in the public markets. He clearly did not feel that need.

But, like he said, it’s too early to declare victory. This process didn’t happen in a day, and it won’t end in a day. Take, for example, Friday’s jobs report. If there is one thing Chairman Powell remains most concerned about it is the job market running too hot. At the very time he has been talking about driving unemployment up for the good of the economy, the January jobs report blew expectations out of the water.

Analysts were expecting 185,000 new jobs and the unemployment rate to climb from 3.5% to 3.6%. Instead, we got 517,000 new jobs and an unemployment rate of 3.4% – the lowest number since 1969. That’s not going to encourage Powell to start cutting rates any time soon.

But, on the whole, this was a good week. We even got the Golden Cross we discussed last week, which is undoubtedly a bullish signal. Things have been worse for the market.

Past performance is not indicative of future results

Sincerely,