The Weekly Insight Podcast – Cleared for Landing

We’ve been building up to this week in our last few memos, so we’re going to dive right in: It was Fed Week last week. And one of the most highly anticipated Fed weeks in a while. What did they say and what does it mean for you?

Before we jump off, let’s run through a quick reminder of the expectations leading up to this meeting. First, everyone anticipated a rate hike of 0.25%. That was not the question at hand. The questions were instead would they:

- Announce a pause in future rate hikes?

- Announce a plan to continue to increase rates? Or,

- Punt until the next meeting?

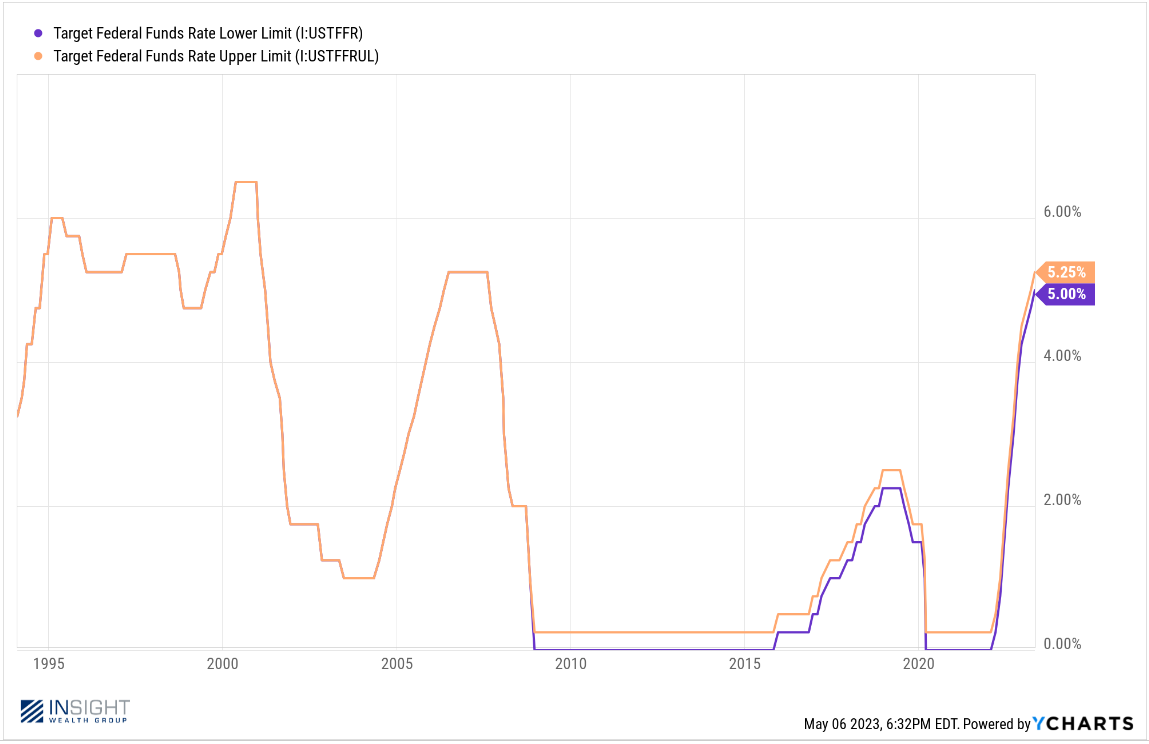

The widely expected hike happened. And, in normal times, the hike itself may have been the story. In fact, the range of 5.00% – 5.25% is the highest we’ve seen since January 2006.

Past performance is not indicative of future results.

But that’s not what mattered to the market. What mattered was what came next.

Sufficiently Restrictive

We’ve said repeatedly in our reviews of Fed meetings that words matter. We hate parsing words to try to divine some sort of outlook. But Chairman Powell made that point explicitly in his comments after the meeting. He drew reporters’ attention to a slight – but particularly important – change in the post-meeting press release.

For some time now, the Fed has had the following comment in their post-meeting statement:

“The Committee anticipates that some additional policy firming may be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time”.

But on Wednesday, that language changed. There was no “anticipation”. And no discussion of finding “sufficiently restrictive” rates. Instead, it read:

“The Committee will closely monitor incoming information and assess the implications for monetary policy. In determining the extent to which additional policy firming may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments”. (Emphasis added)

That’s a real word salad, but it’s important. Let’s break it down.

- “Sufficiently restrictive”: In past memos, the Fed has been raising rates to try to find a rate that was sufficiently restrictive. There’s no mention about needing to “attain” a stance of policy which will do that. Some could then assume that we have attained that level.

- “Additional firming”: The Fed does punt here a bit because they leave open the possibility of additional firming. But it is qualified with a “may be appropriate” – not a “will be”.

- “Cumulative tightening”: The last sentence is the big one, as it specifically identifies letting the previous rate hike work. It also notes there is a lag between the hikes and their impact on the economy. And it offers a subtle nod to the slowdown in lending that’s happening outside of the Fed’s activity.

In the end, the Fed punted. But they really, really pushed us to understand they will likely pause soon.

And Then Powell Speaks…

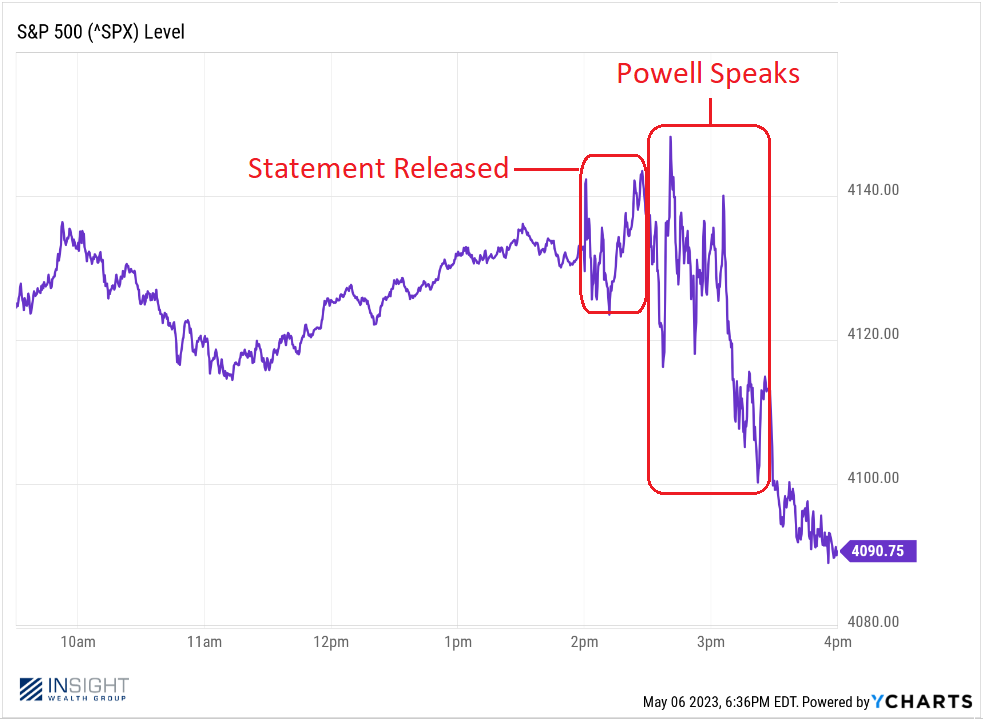

In true Jerome Powell fashion, no good news goes unanswered. The market loved the Fed’s statement released at 2:00PM EDT and responded as such. Then Powell stepped to the podium at 2:30PM to let the air out of the balloon. The market really doesn’t like it when he has a microphone.

Past performance is not indicative of future results.

By the time the market closed, it was down 1.50% from when Powell took the podium. But to be fair to Powell, we don’t think he stepped in it too bad this time. His commentary was in keeping with the statement.

First, he specifically pointed out the change in the post-meeting statement. He stated:

“You will have noticed that, in the statement from March, we had a sentence that said the Committee anticipates that some additional policy firming may be appropriate. That sentence is not in the statement anymore. We took that out and, instead, we’re saying that…the Committee will take into account certain factors”.

It was the nine words ahead of that quote, however, which the market hated the most: “A decision on a pause was not made today”. Anything but a pause was not going to be good enough news for some.

He then went on to talk in depth about the impact of tightening credit conditions across the country. That’s a euphemism for “bank failures are making lenders much more cautious”. In that regard, the banks are doing the Fed’s work for it. Less lending means slower economic growth and less inflation. It’s a rate hike without a rate hike.

Then Came Jobs

So, we got through Wednesday, and Thursday was a bland day in the markets. We closed near the lows for the day, but it wasn’t much to write home about.

But then came Friday morning. You may recall us writing a memo several months ago called “Good Jobs Bad/Bad Jobs Good?”. You can read it here.

The gist of that memo was that the market wanted to see bad jobs reports as they would be indicative of inflation starting to slow and interest rate policy starting to bite. A good jobs report, on the other hand, was seen as bad news. That’s been the story for the last year.

Friday morning, we woke up to the April jobs report. And it wasn’t bad. In fact, it was exceptionally good. Nonfarm payrolls jumped 253,000 jobs last month vs. an expectation of 180,000 jobs. Unemployment dropped from 3.6% to 3.4%, one of the lowest numbers in history.

Uh oh. Here we go again, right?

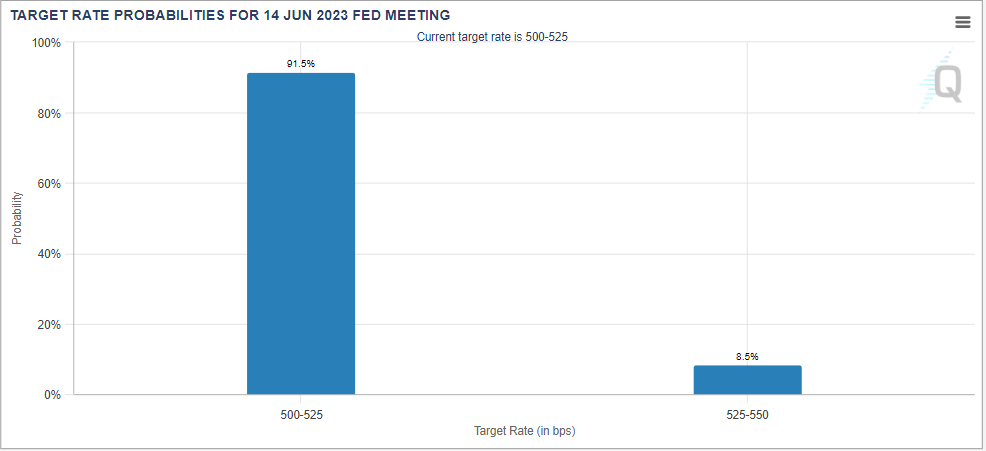

Wrong. The market loved it. The S&P 500 was up 1.85%. The Nasdaq was up 2.25%. The old narrative wasn’t working anymore. Jobs were good news for the economy. And expectations for future Fed hikes after the jobs report? Still nearly non-existent, with 91.5% odds that the Fed will do nothing next month.

Source: CME Group

Past performance is not indicative of future results.

Why? Maybe Powell didn’t screw things up as bad as he normally does. Because we think it ties back to this comment last Wednesday:

“You know, it wasn’t supposed to be possible for job openings to decline by as much…as they’ve declined without unemployment going up. Well, that’s what we’ve seen…It just seems that, to me, that it’s possible that we can continue to have a cooling in the labor market without having the big increases in unemployment that have gone with many, you know, prior episodes”.

A few sentences later, he hit us with this:

“I think…the case of avoiding a recession is, in my view, more likely than that of having a recession”.

Jerome Powell just told us he thought we could have the long sought after “soft landing”. And whether or not the market digested that on Wednesday, they sure responded to it on Friday with the jobs report. The narrative is starting to shift. And that’s good news.

Sincerely,