The Weekly Insight Podcast – Debt Ceiling Danger

Last week was fairly uneventful. There was a good bit of volatility, but the result was unremarkable. Stock and bond indices were broadly up for the week – but that all happened on Friday.

And it wasn’t like there was a whole lot of drama in the market Friday. We had some good earnings reports this week, which helped. And we had some decent economic data, which also helped. But in the end, it was a non-descript week. Our guess is that’s because everyone was hunkering down waiting for next week and the big Fed meeting. You can read more about that in last week’s memo here.

We wanted to take advantage of this lull in the news to address another looming concern: the debt ceiling. Picking up Washington’s latest political hot potato can’t be problematic, right?

In all seriousness – we want to tackle this issue in the least political way possible. Are we fiscally conservative folks? You bet we are – and we’d bet you like that from your financial advisor. But we also think it’s possible to have an intellectually honest conversation about these topics – despite the current level of vitriol in American politics. We hope you’ll let us know your thoughts on all of this as well. We’re certainly open to learning.

What IS the Debt Ceiling?

The “debt ceiling” debate has been a Washington staple for a long time. But very rarely have we ever heard it explained factually. Let’s start by laying out the facts.

The first thing to understand is that the debt ceiling is not about authorizing spending. It is about the spending that Congress has already authorized. Think about it this way:

- Congress authorizes (and the President approves) spending in the budget process. For the last many, many years, that spending has been more than the income the government receives from tax revenue. That creates “deficits”.

- To cover these (Congressionally mandated) deficits, the Treasury department borrows money by issuing government securities (treasury notes, bonds, etc.). As everyone reading this memo knows, the debt issued by the U.S. Government is widely considered to be one of the safest investments in the world. The U.S. has never defaulted on its debt.

- Separate from this process, Congress has – since World War II – imposed a limit on the amount of money the Treasury Department can borrow on behalf of the government. This limit – known to us as the Debt Ceiling – has nothing to do with the amount of spending that is authorized.

- If the debt ceiling is not raised to match the spending authorized by Congress, the Treasury Department will eventually run out of money and be unable to pay its debts. This would lead to a default on Treasury securities.

Political Football

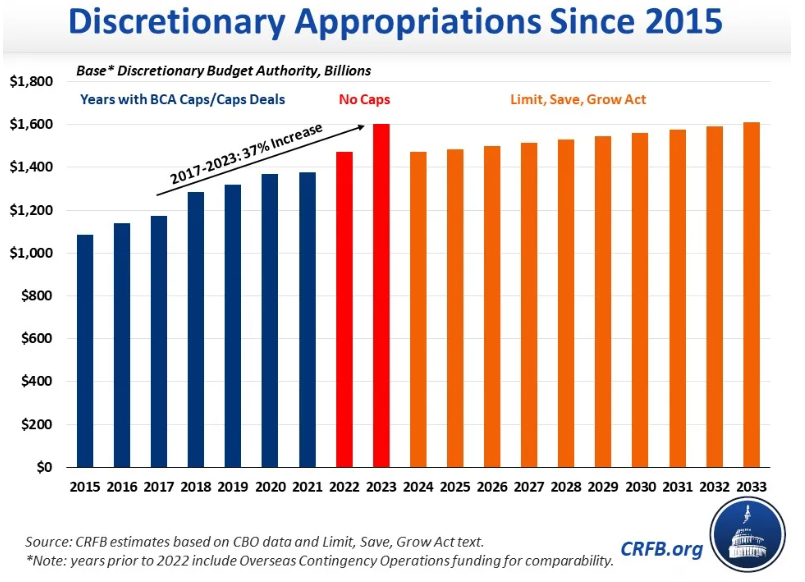

House Republicans last week passed the “Limit, Save, Grow Act”. This bill, if approved by the Senate and the President, would authorize an increase in the debt ceiling while also placing limits on future spending. It was the opening salvo in the long-running debate on this process. President Biden’s response was, essentially, “No chance!”.

Both sides have a decent argument. And both sides are both being disingenuous as well. Let’s break down what they’re saying.

For Biden, it’s straightforward and ties back to the facts of the debt ceiling noted above. His point is that this is not a spending question – it’s authorizing the debt necessary for the spending that was already approved. Congress put us in this spot. To then not authorize the necessary debt is silly. To hold that authorization hostage over something you want politically is shady.

For McCarthy, it’s just the opposite. He and Republicans don’t have a lot of chips in the big game right now. They don’t control the White House, or the Senate and their House majority is slim. This is one of the few places where they can successfully exert power. Thus, he’s taking advantage of the moment. And the Limit, Save, Grow Act would successfully limit discretionary budget growth at the Federal level for some time.

The disingenuous part of this? This is a game Republicans and Democrats have played. Ironically, it was then-Senator Biden out front leading the charge on this back in 2003, 2005, and 2006 when the Democratically controlled Senate made this an issue for the Bush Administration. And on the other side? We never heard McCarthy and his “fiscally conservative” Republicans complaining about increasing the debt ceiling when Trump was in office.

They’re Both Right!

Biden is right. We have a debt ceiling problem, and we shouldn’t have to horse trade every time the government needs to pay its bills. It’s a risky proposition. One day we’re going to walk too close to the edge of this cliff and things won’t go well. If America defaults on its debt, everything gets harder. It becomes harder to borrow money. Interest rates for our debt go up. It will cause substantial damage to the economy.

But McCarthy is right, too. We have a spending problem. And, while McCarthy’s bill does something, it barely scrapes the surface.

Past performance is not indicative of future results.

You’ll note that the big “win” on this bill is around limiting the growth of discretionary appropriations. The truth is that doesn’t fix anything in the long run. Eighty-one percent of spending growth in the Federal budget is not coming from these items. It’s coming from health care, Social Security, and interest payments on our debt.

In fact, a recent study showed that, if you wanted to create a deficit-free Federal budget but were unwilling to cut non-discretionary programs and the military, you would be forced to cut all other Federal programs by 78 percent! That’s roads, bridges, schools, law enforcement, food stamps, etc. That’s everything for which we tend to count on the government!

This isn’t a problem we’re going to fix anytime soon. If we really want to address it, it’s going to take years of hard work and conscientious attention by our leaders in Washington.

That’s unlikely. So how about just don’t crash the plane just to score some political points? This economy has borne a lot. A miss on the debt ceiling in a few weeks may be one too many blows.

Sincerely,