The Weekly Insight Podcast – True Hope vs. False Hope

We were at a conference with a group of clients in early March. At dinner one evening, a client commented on the content of the Weekly Insight and said something to the effect of “why are you guys always so optimistic?”. It’s a valid question – and potentially a critique – and has been ringing in your authors’ ears for the last 45 days.

The simple answer is that the long-term trend for markets and the economy – despite frequent volatility – is growth. Patient investors win. Those that panic when things look ugly don’t.

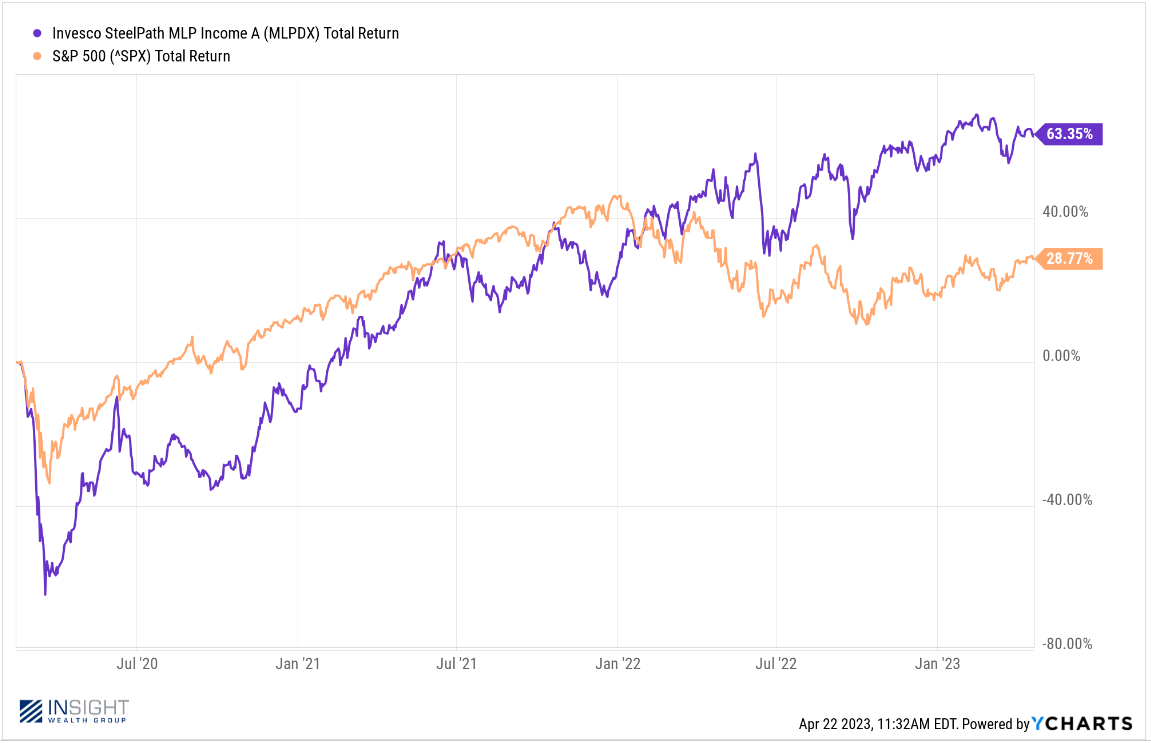

One of our most glaring “misses” is an excellent example of this trend. You may recall at the heart of the COVID panic that we held a significant weight in an energy MLP fund (MLPDX) which massively underperformed at the start of the pandemic. When the S&P was down nearly 35%, it was down nearly 65%. We looked pretty dumb.

It all happened so fast; it would have been tough to avoid. But then we get to the question of what to do next. The easy answer is to dump the fund, call it the cost of doing business during the pandemic, and hope everyone forgets about it. But that’s not the path we chose.

Instead, we had “optimism” (albeit an optimism some of you thought was a bit crazy at the time!) that the world wasn’t ending, and people would once again need energy. We held on. Despite the long road to recovery, that fund has now significantly outperformed the broader market. Patience paid off. And the long-term trends worked.

Past performance is not indicative of future results.

Much like March of 2020, we’re still broadly optimistic today. Inflation is falling. Employment is strong. The banking system isn’t failing. Equities are 25% cheaper today (on a P/E basis) than they were one year ago.

But there is a difference between optimism…and blind optimism. Part of good asset management is good risk management. And there is one particular risk growing right now that must be addressed: future interest rate policy.

We wrote a memo last week addressing the growing debate amongst Fed members about what the right path was for interest rate policy. (You can read it here.) The gist was there are two competing camps at the Fed today – those that want to slow/stop rate increases and those that want to keep hitting the gas.

Friday marked the start of the “blackout period” when members of the Federal Open Market Committee are no longer allowed to make public comments prior to the upcoming FOMC meeting on May 3rd. They were out in full force talking about what’s to come (albeit in their typical Fed Speak). But one thing was clear: there is no consensus. Some, like Chicago Fed President Austen Goolsby and Philadelphia Fed President Patrick Harker were saying things like “hold rates in place and let monetary policy do its work”. Others, like New York Fed President John Williams and Governor Michelle Bowman were saying things like “inflation is still too high, and we will use our monetary policy tools to restore price stability”.

None of us at Insight have a PhD in economics. And we’ll be the first to acknowledge the Fed is at the most difficult part of this process: when to stop. No one will know the right answer until long after the decision has been made.

But the market has made its decision: The Fed needs to raise rates one more time and halt. If not, the market believes we’ll see a significant economic slowdown.

So that brings us to Powell’s comments coming up in just 9 days. As we see it, there are three options:

- A 25-basis point hike and clear discussion about pausing rate hikes for the foreseeable future.

- A 25-basis point hike and a punt of future policy until the next meeting.

- A 25-basis point hike and a clear discussion about continuing rate hikes into the future.

There are two potential market outcomes from these choices. If Powell & Co. move forward with #1 – a clear discussion of pausing rate hikes – the market is going to love it. Equities will respond broadly, and we’ll look to expand our exposure to value driven equities in portfolios.

But both options #2 and #3 would be seen negatively. Equities will suffer and we’ll want to expand our exposure to longer duration fixed income.

We don’t know what the result will be. Our gut says it’s likely to be #2 (a punt), but we don’t get a vote. We do get a vote in portfolios, though. And that’s why we decided to take a bit of risk off the table last week in our core portfolios (Conservative Growth and Balanced). It wasn’t a big move, but we moved 5% of the portfolios from shorter duration corporate bonds to longer duration treasuries (switching from RNDLX to IEF) on Thursday.

If the Fed disappoints, this hedge will help protect our downside. And we’ll move rapidly to expand that exposure. If they give us everything we want (option #1), this hedge won’t materially impact our ability to participate in the expansion of equities and we can move quickly back out of the position if necessary.

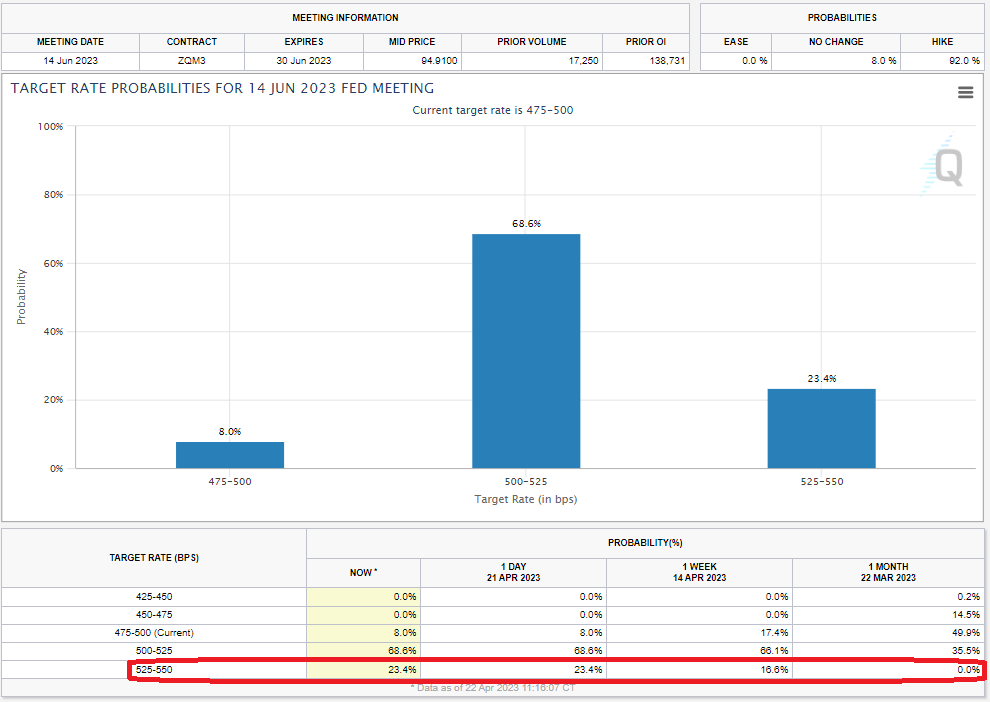

It’s worth noting we’re not the only ones starting to be concerned about this outcome. One month ago, there were 0.00% odds the Fed would raise again in the June meeting. As of Friday, those odds had crept up to 23.4%.

Source: CME Group

Past performance is not indicative of future results.

Let’s hope we’re wrong and the Fed does the right thing. But hope can only take us so far. As Harvard physician Dr. Jerome Groopman once said:

“False hope can lead to intemperate choices and flawed decision making. True hope takes into account the real threats that exist and seeks to navigate the best path around them.”

We may be optimists. But we also understand the need to consider “the real threats” and the need to “navigate the best path around them”. Now is the time to do just that in portfolios.

Sincerely,