There’s a game folks who do “messaging” play – whether it be in politics, in finance, or any other public communications field. It’s simple: change the narrative. When you don’t want to be talking about “X” anymore, start talking about “Y” and choose to ignore “X” …no matter what anyone says.

It was interesting to see that game play out last week. The April CPI data dropped on Wednesday and suddenly, everyone and their cousin was talking about a new term: Super Core Inflation.

You’ll recall us talking many times in these pages about CPI (everything) and Core CPI (everything minus food and energy). Those numbers hit almost exactly as expected. Core grew 0.4% month-over-month and dropped to 5.5% year-over-year, in line with economists’ expectations. All-Items CPI also grew at 0.4% month-over-month, as expected, and dropped to 4.9% year-over-year, which was a touch better than expectations.

None of this is bad news. But the messaging train for Super Core started flowing anyway. What is Super Core? It’s All Items CPI minus food, energy, and housing. Simply put, it’s mostly a gauge of services inflation. That number rose just 0.1% in April, the lowest number in a long, long time.

That’s good news. And it’s a sign markets are fully digging into the idea we’ve been talking about for months: housing price inflation – or at least the way it’s measured – is a joke. Once we see that number turn south, inflation is going to fall in a hurry. The fact that other core inflation items aren’t contributing substantively to inflation right now is just another great sign for the future.

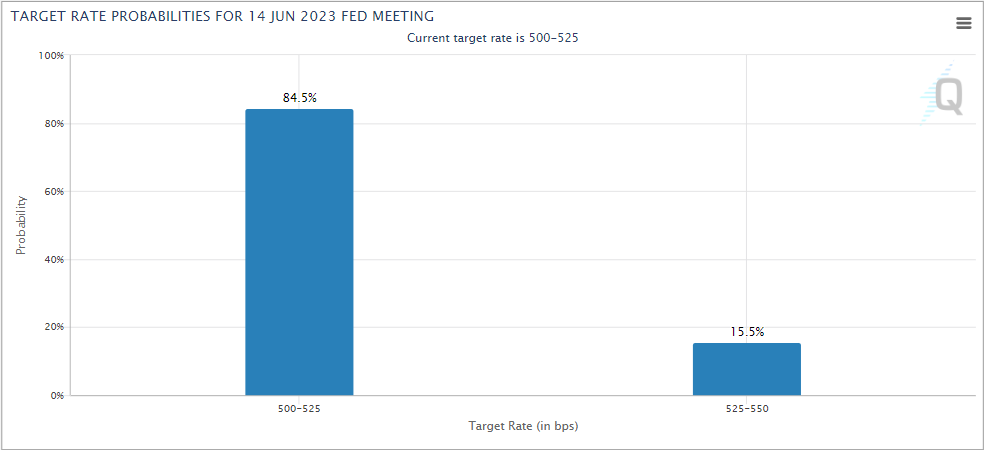

The result is the market still believes the Fed is going to “pause” their rate hikes at their next meeting four weeks from now. Current odds of a pause are 84.5%.

Source: CME Group

Past performance is not indicative of future results.

It’s Not Rocket Science

The airwaves are full of these “messengers” who make these conversations sound complicated and difficult. They want us all to believe it takes a PhD to understand where the world is going. In the end, however, a little common-sense matters.

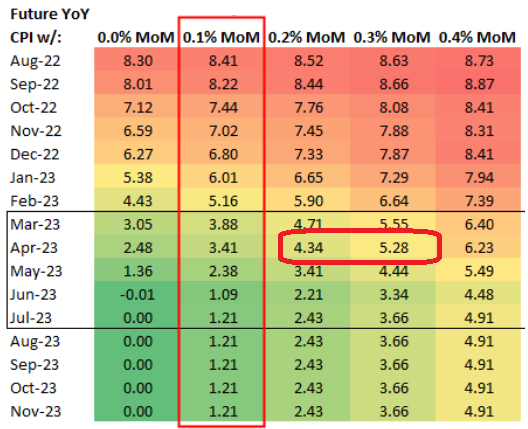

It turns out, we’ve all known the path for inflation for some time. In fact, we wrote about it eight months ago in these pages. At the time, inflation was peaking, and we looked at what various month-over-month changes would mean for the rate of inflation as time moved forward. As scary as things seemed at the time, we noted “It is important to remember that we are entering a period where we are measuring inflation against high inflation from the previous year, not low inflation…we are getting an improvement in the ‘base case’…”

The chart below is the chart we included in the memo back in September. Note where we are for April 2023 CPI.

Past performance is not indicative of future results.

We’re on pace to be somewhere between 2.5% – 3.5% CPI by June. And the housing data hasn’t even started to hit yet. This – more than anything – is why we expect a pause from the Fed. And it’s why the market showed surprisingly good stability this week despite the “other stuff” happening in the world.

The Other Stuff

As much as folks like us would love it if the markets were simply about “the numbers”, it’s not that easy. In fact, it’s never been that easy. Expectations matter. Public policy matters. International affairs matter. They all get mixed into the pot which will eventually determine market returns. Oftentimes, those things matter more than earnings reports or inflation numbers.

Which brings us to the two big issues which are going to move the markets in the short-term: Ukraine and the debt ceiling. We can’t control either of them, but we better understand them.

On Ukraine, we’re entering an interesting – and dangerous – time. The likely already started “Spring Offensive” by the Ukrainian Army is a good thing for freedom loving folks. But it brings into question just how Vladimir Putin and his cronies are going to react. We’re already seeing dissention between his army and PMCs like the Wagner Group. We’re seeing strikes deep into Ukraine. Will Putin – if cornered – make a dangerous decision which could draw the world deeper into this conflict? It’s hard to say, but we better be aware and nimble in portfolios.

And then there’s the looming disaster of the debt ceiling. Little was done last week as the Friday meeting between the White House and Congressional Republicans was delayed until this week. McCarthy and crew sound resolute in walking up to the cliff. Biden & Co. are starting to talk about the President’s power under the 14th Amendment of the Constitution, which would start a much bigger battle.

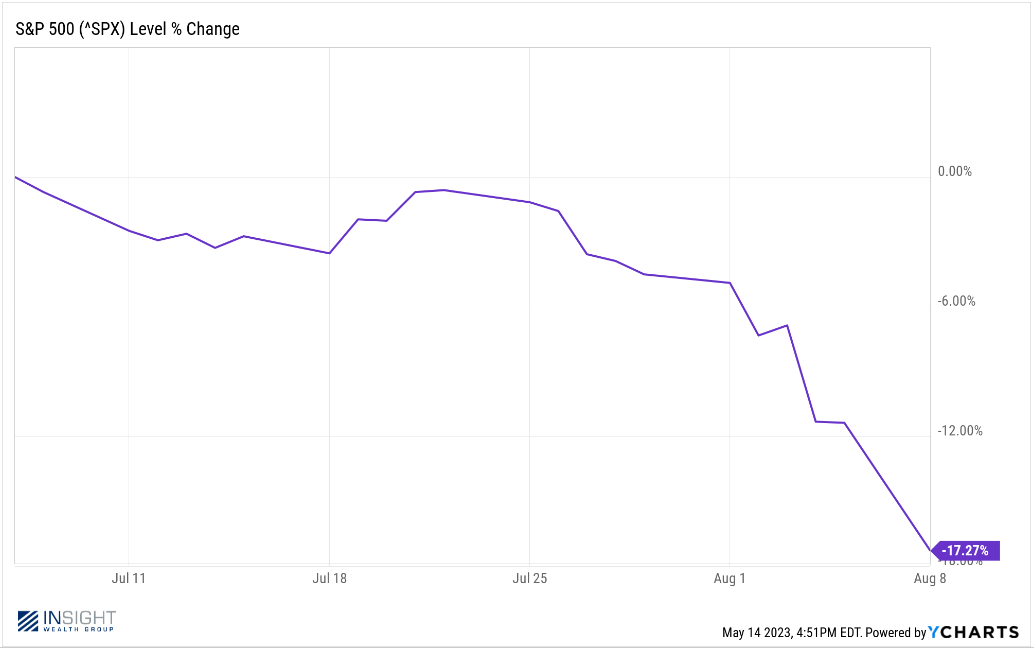

Much like Ukraine, this is a “hope for the best, prepare for the worst” situation. The last time we walked up to this line – July of 2011 – the stock market was off nearly 18% over the next month.

Past performance is not indicative of future results.

But here’s the good news. If Washington does what is – comes to a resolution on the debt ceiling – we’re setting ourselves up for a great summer. Falling inflation, stable – or falling – interest rates, and little drama from Washington. It may be a dramatic few weeks, but it might be setting up a great few months. Strap in!

Sincerely,