Before we dive into this week’s memo, we wanted to provide a brief personnel update that will hit home with many of you. As you may recall, Insight Wealth Group was founded a bit over eleven years ago. At that time, we started with two employees – Kelly Boesch and Erin Kinman – who were brave enough to give us a chance even when we didn’t have any clients yet!

Kelly and Erin have stuck with us through thick and thin. But, as they say, all good things… Kelly let us know last year that she was hoping to retire so she could spend more time with her husband, Jake, and their two kids. Her last day will be June 15th. We’re incredibly happy for her and grateful that she helped us make this transition a smooth one.

We’re also just one week away from being able to make another exciting announcement about a long-time friend and colleague who will be stepping into Kelly’s shoes. They’re hard to fill, but we’re confident our clients will continue to have the best service in the game.

Now onto the memo…

Let’s imagine a scenario. Here’s the information you have available:

- Historically low unemployment

- Stable (to falling) interest rate policy

- Falling inflation

- P/E ratios in the S&P 500 8.6% lower than last year

- S&P 500 down 12.6% from its high – but up 9.2% year-to-date

If we gave you this information and asked you to predict what would happen over the six months in the market, what would you say? Our guess is you would be pretty positive about things. Potentially even bullish. And that would be well justified.

But let’s change the question: instead of it being a six-month time period, let’s shorten it to two weeks. What do you think would happen then? Any guesses?

Good luck figuring that one out! We can’t pick the day-to-day swings in the market in “normal” times. And these times aren’t normal. We have a debt ceiling problem.

Debt Ceiling Update

This should be a quick update: no progress has been made since last week! The two sides are still talking, and President Biden shortened his G7 trip to get back to deal with the problem. But we still don’t have an answer.

We remain hopeful that the parties will get it figured out – like they have 102 times before. There are “common ground” issues that can give each side a win. Clawing back unspent COVID-19 funds is an easy one. Some limited spending caps – instead of the GOP’s more drastic proposal – should be feasible.

But there is one technical aspect of this conversation that isn’t be brought up much that should be addressed: the X-Date. Everyone is acting as though June 1st is the deadline for this decision. What if it isn’t?

June 1st is the date Treasury Secretary Yellen gave all parties to have this figured out. She predicted it to be the date the Federal Government would run out of money. But that date isn’t totally fixed. It depends on a lot of variables. And part of that is based on when the money comes in. Tax revenues are a big piece of this conversation.

Not everyone believes June 1st is the X-Date. CitiGroup thinks it will be pushed back to June 15th. Wrightson ICAP thinks it is more like July 25th. JP Morgan puts it at June 9th. Barclays thinks we’ll scrape by June 15th and stretch it until late summer.

June 15th is a big date here. Why? Because that’s when quarterly income tax payments start to come in. If Yellen can stretch the checkbook until then, the pressure will ease a bit.

That variance in the deadline also makes it more likely the two parties will come to a short-term compromise and extend the debt ceiling out through the budgetary process at the end of September. That’s good news in the short-term. But it also means we get to go through this dance again later this year.

Why the Long Face?

Why the Long Face?

This debt ceiling issue – and the risk it poses to the economy – is undoubtedly why folks are concerned today. But given all the positives we mentioned at the front end of this memo, the bearishness in the market is remarkable.

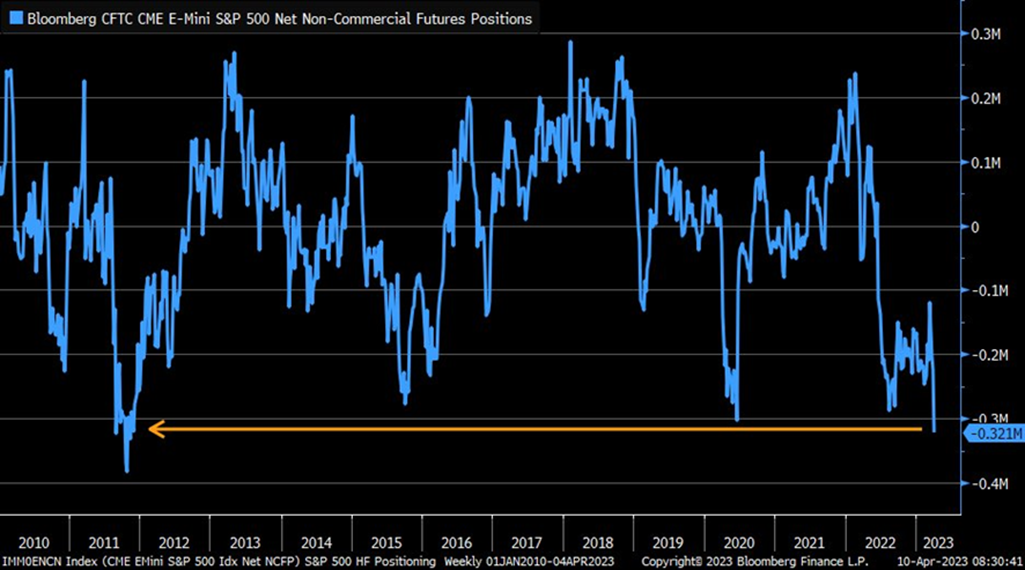

Short positions on the S&P 500 are at the most extreme level we’ve seen since 2011. That’s not a surprise since that was the last time we saw such a dramatic debt limit discussion.

Past performance is not indicative of future results.

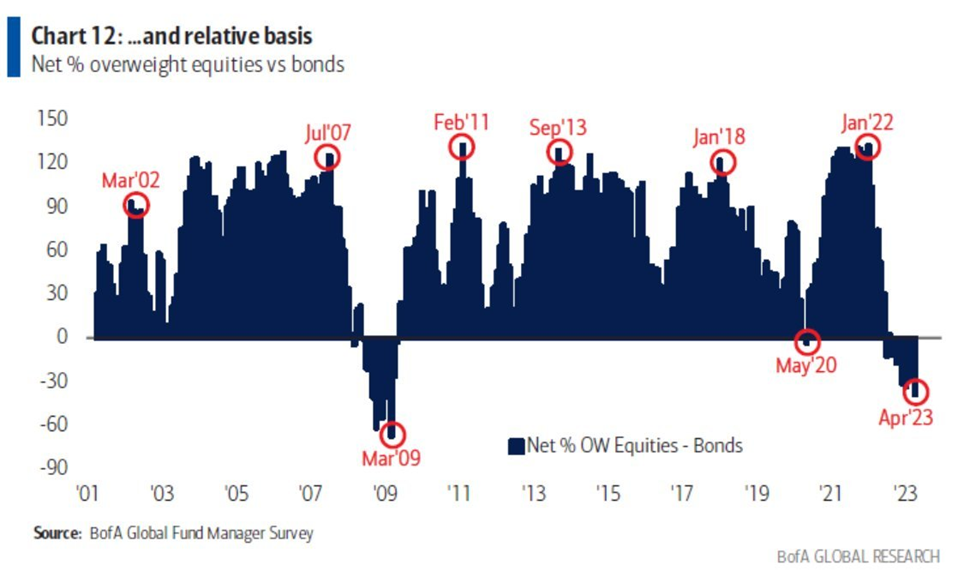

But even more notable is the positions institutions are taking right now. The underweight to equities amongst portfolio managers is the largest we’ve seen since the bottom of the market in 2009. They’re significantly more bearish than we saw at the depths of the COVID pandemic!

Past performance is not indicative of future results.

This brings to mind our favorite – and oft quoted – Warren Buffett-ism: “Be fearful when others are greedy and greedy when others are fearful”.

This market is fearful right now. Historically fearful. It’s not time yet to jump on the opposite side of that trade. If Washington butchers the debt ceiling discussion, we will have a short-term downstroke in equities. But if they get this figured out, it’s going to be time to step on the gas. We’re so close right now. We just have to get over this hump.

So now is a time for patience. But not fear. The rest of the market has that one covered for us.

Sincerely,