Whew. That was too close. Our friends in Washington decided to walk us right up to the line yet again on the debt ceiling. Cooler heads finally prevailed. In fact, it was one of the most bipartisan things we have seen out of Washington in a long, long time. The bill to extend the ceiling passed the House with 165 Democrat votes and 149 Republican votes. And it cleared the Senate with 46 Democrats and 17 Republicans. The most extreme voices on both sides of the isle lead the opposition, but the middle held and got the job done.

You may recall our comments in our last memo that we were concerned Washington would just punt and we would have to do this all again in a few months. The best news from the deal? We do not have to have this discussion again until January 2025.

The result is we can now get back to the issues that matter in the economy. And there is just one more big one standing in the way of a good back half of the year: The Fed.

You all know this story very, very well by now. We have written about it (endlessly, it seems) since this time last year. It was at the beginning of this year that we said:

“The market consensus today is that rates will peak between 5.00% and 5.50% and the peak will be reached by the May or June Federal Reserve meetings”.

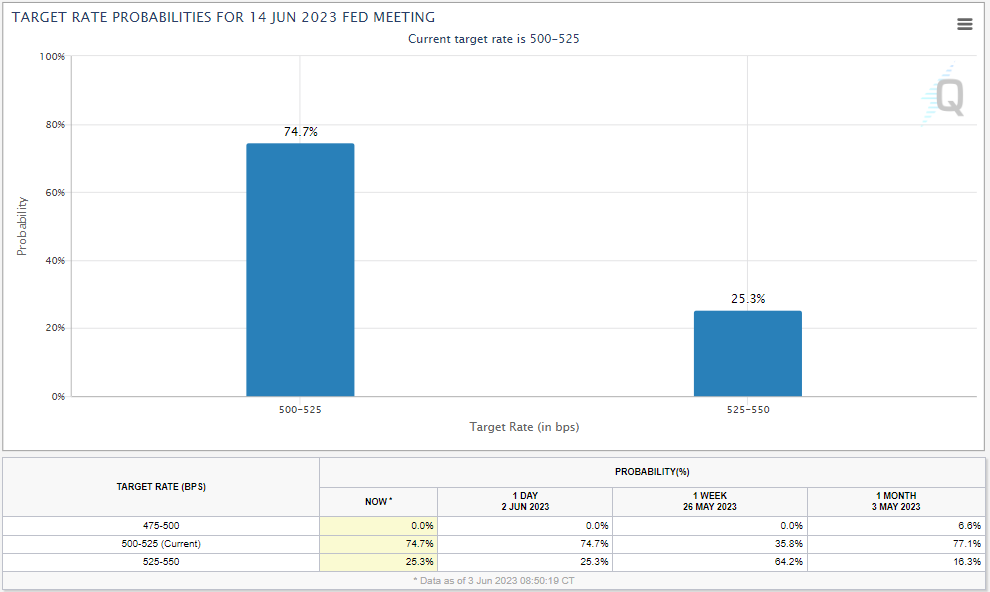

Well, here we are. 10 days away from the June FOMC meeting with the current Fed Funds rate at 5.00% – 5.25%. A “pause” here and the market is going to get optimistic very quickly. Another hike will yield the opposite result.

What is the result going to be? The comments from the various Fed Governors who have spoken have been all over the board.

- Philadelphia Fed President Patrick Harker said last week that “it’s time to at least hit the stop button for one meeting and see how it goes”.

- New York Fed President John Williams, just a few weeks ago, took a different stance: “In my forecast I see a need to keep a restrictive stance of policy in place for quite some time”.

- Chicago Fed President Austan Goolsbee said last week it is still too early to “prejudge” a June decision.

Simply put, they are all over the board. The market is not, however. After a major dip a week ago, the current consensus is back where it was a month ago: 75% percent odds of a “pause” in rate hikes.

Source: CME Group

Past performance is not indicative of future results.

It is the dip a week ago, however, that has us a bit on edge. It was caused by the unequivocal – and disappointing – comments by Fed Governor Christopher Waller. He was crystal clear in his opinion. In a speech titled “Hike, Skip, or Pause?” he made it clear that he believes the Fed has made little progress in its goal to bring down inflation.

“I do not expect the data coming in over the next couple of months will make it clear that we have reached the terminal rate. And I do not support stopping rate hikes unless we get clear evidence that inflation is moving down towards our 2% objective”.

Your author coaches his son’s youth baseball team. And there are many, many times he wants to start barking at the refs over a bad call. But it is important to remember that we cannot see the call quite like the guys on the field. The same theory applies here. But we are going to bark anyway. You don’t have “clear evidence” that inflation is moving down towards the 2% goal?? Are you kidding?

How about this chart?

Past performance is not indicative of future results.

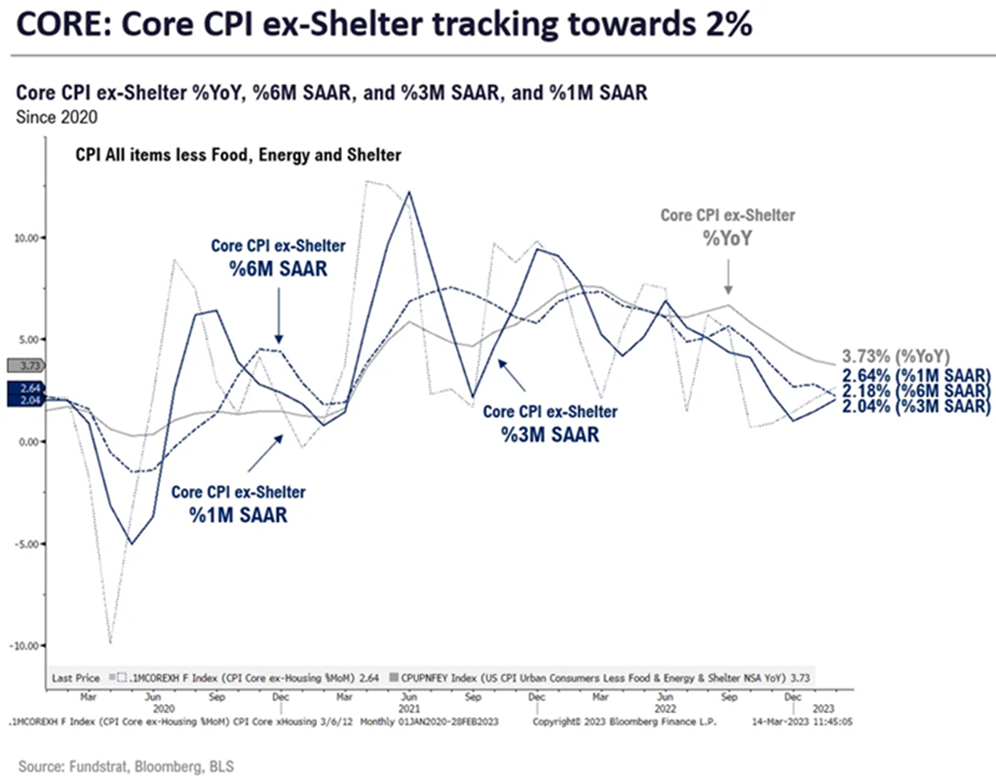

Or better yet, how about this one? It shows that the 1-month, 3-month, and 6-month Core CPI ex-shelter are all down below 3%! And you know by now the Fed’s measure of shelter inflation is just…bad.

Past performance is not indicative of future results.

We have all been hard on the Fed for a while. Not all the complaints have been well deserved. They stuck with this process when they needed to. But now they’re at risk of repeating the mistake they made at the beginning of the problem: being too late to the game. They were too late in starting rate hikes. And now they are risking being too late in stopping them.

So, we wait. And we watch. But we are also ready to pull the trigger because equities look remarkably attractive if the Fed does press the pause button. The S&P 500 – when you remove the FANG+ stocks – is trading at a P/E of just 14.8x. That is well below both the near-term and long-term historical averages.

Past performance is not indicative of future results.

But we also cannot get greedy. This could turn the other way quickly on us if the Fed leans towards Wallers way of thinking.

We are *this close*! But we’re not there yet. Hopefully two weeks from now we will be telling you it’s time to rock and roll.

Sincerely,