The Weekly Insight Podcast – Fattening the Bull

It was all over the news this week: we are in a BULL MARKET! The S&P is officially up 20% from the bottom we experienced in October of last year. On its face, that’s great news. And something portfolios are very grateful for. But does this bull have legs? Or is this instead just one heck of a Bear Rally? Let’s look at what we know and what it means we can expect over the coming weeks and months.

This Bull Is Skinny…

The first thing we must understand is this bull rally is driven by very few names. And it is almost entirely driven by the market embracing the idea that Artificial Intelligence (A.I.) is the next big game changer.

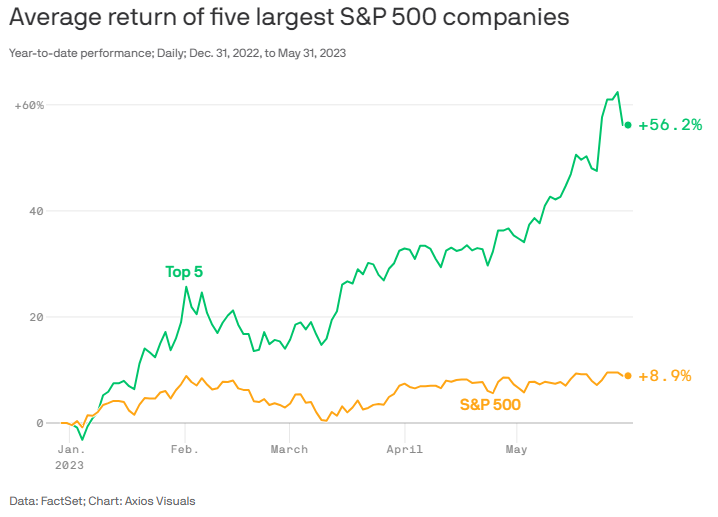

The big five stocks so far this year are Apple, Microsoft, Alphabet, Amazon & Nvidia. Combined they are up an average 56.2% for the year.

Past performance is not indicative of future results.

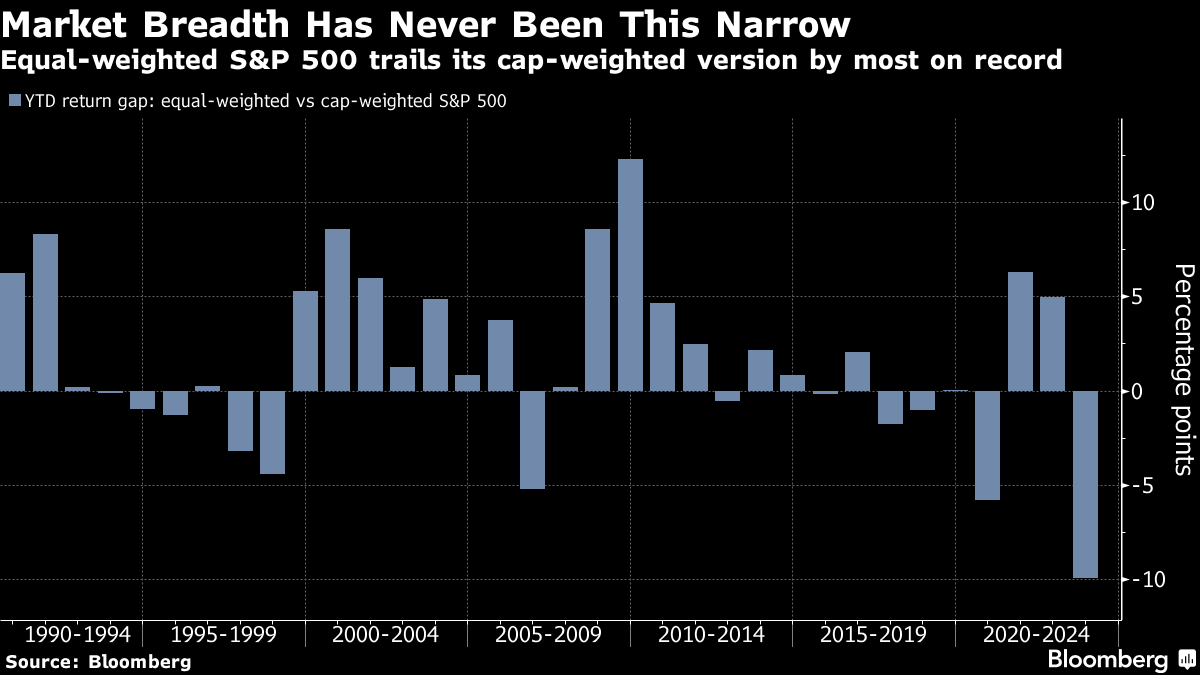

If you remove those five names and look at the “S&P 495”? It is up just 1.5% year to date. If you pull Meta and Tesla out of the mix (up 120% and 66% respectively), the S&P 500 would be down for the year. Seven tech names have accounted for ALL the market’s positive results year to date. In fact, market breadth has never been this narrow before. The “equal weight” S&P is underperforming at a level not ever seen.

Past performance is not indicative of future results.

But that does not mean we cannot fatten the cow. In fact, there is a bit of history to show that outperformance by the big mega cap names can be a sign of good things to come. The S&P has averaged a 6.7% gain in the six months following a surge of mega cap outperformance. And the 12-month number is significantly better (+22.2%).

Past performance is not indicative of future results.

So, Where’s the Cattle Feed?

In the end, it comes back to fundamentals. If this bull market is going to survive, it is going to need some breadth. And breadth is going to come from performance from the rest of the market.

The first thing to understand is valuations. We have talked a lot about P/E ratios in these pages over the years. We do so because they are a good measure of how cheap or expensive the market is at a given time. The forward P/E for the S&P 500 sits at 18.5x earnings. That is cheaper than a year ago (21.54x) and cheaper than the 5-year average (18.6x), but a little pricier than the10-year average (17.3x).

But we also must understand where those values are coming from. The big five names we talked about before (Apple, Alphabet, Microsoft, Amazon & Nvidia) make up 23.67% of the market and they all have elevated P/Es (ranging from 23x for Google to 79x for Amazon). Combined, they make up nearly half the weighted forward P/E for the market. That means the other 495 names have a combined forward P/E of 12.25x. That’s cheap.

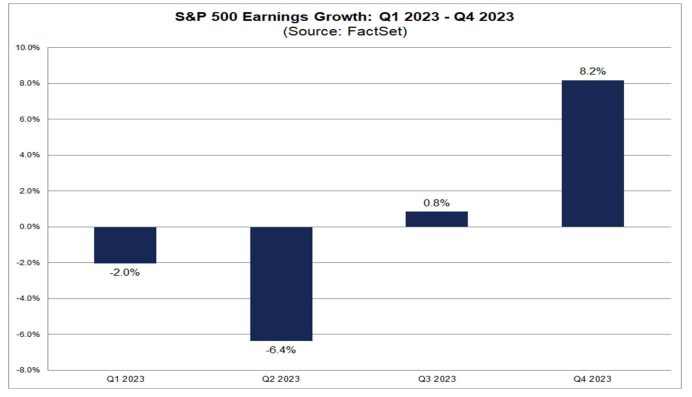

The P/E calculation has two variables: price and earnings. If price goes up, and earnings stay flat, the P/E ratio goes up and vice versa. So, the expectations for future earnings are especially important. You may recall us talking in the past about the “earnings recession” analysts were predicting at the beginning of the year. It is still expected to happen, but the depth of the drop in earnings is narrowing drastically. And the expected recovery later this year is expanding rapidly as well.

We are going to be seeing Q2 earnings next month. Right now, they are expected to drop 6.4% before rallying nearly 9% in the second half of the year. That kind of rally in earnings – combined with a cheap P/E for most of the market, just might be the cattle feed this skinny bull market needs.

Past performance is not indicative of future results.

But Don’t Get Too Excited…

As much as we love to have discussions about market fundamentals in these pages, we all know it is not just about the fundamentals, right? There are still certain factors outside the market that have a significant impact. We have experienced a lot of them in the last few years: COVID, Ukraine, debt ceilings, inflation, & interest rates all come to mind.

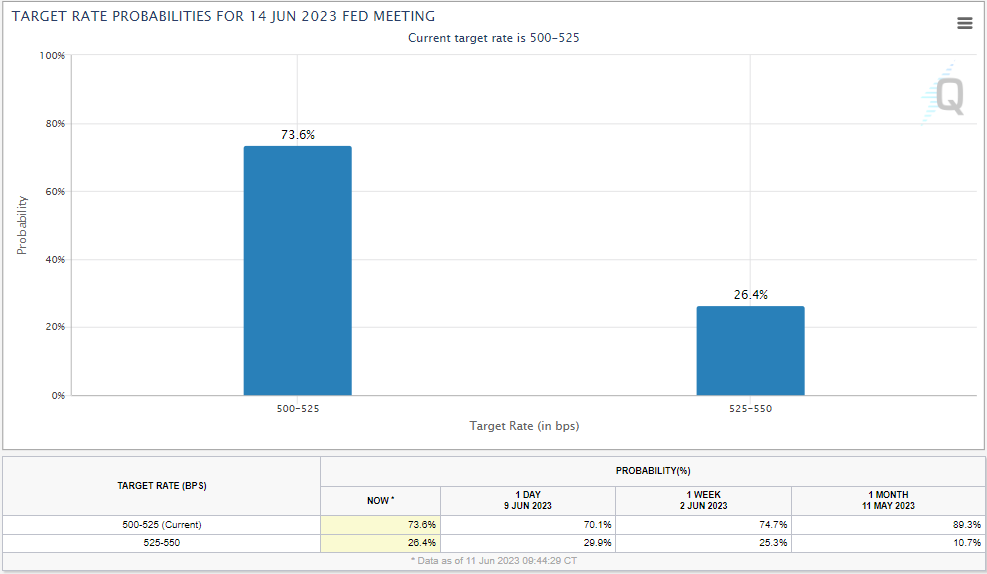

And there is one thing that needs to be solved before we can get excited about equities: the Fed. This week is a BIG week in Fed Land. We get CPI data tomorrow and have the Fed’s interest rate decision on Wednesday.

Our readers know as well as anyone that handicapping what the Fed is going to do is a pointless endeavor. But we better understand the consequences of the outcome. The market thinks the Fed is going to “pause” interest rate hikes. The 74% probability of a pause is almost exactly where it was a week ago.

Past performance is not indicative of future results.

If the market gets what it expects, that should be good news. But it is never that simple. Any good news will be tempered by the Fed. And the possibility of bad news is still a very real possibility. Investors should expect volatility this week as the anticipation builds and the results come in. We will be watching closely and look forward to addressing it in detail with you next week.

Until then, buckle up!

Sincerely,