The Weekly Insight Podcast – Threadin’ the Needle

Last week was a big week – and there is a lot to discuss. But before we dig into that, there are some administrative items at the bottom of this memo for Insight clients. Please take a moment to review!

The tale of Jerome Powell & The Interest Rates is a little bit like that thriller book you pick up which starts strong, but never seems to end. At some point the author lost the plot and does not know how to wrap it up. That is where we found ourselves last week with the Fed.

But before we get to what they said (and did), let’s first talk about the data we saw last week on inflation. Because, yet again, it was pretty darn good.

CPI

You know the story well by now: CPI is falling. Core CPI is the issue. But Core ex-shelter tells us a much different story. This month was not much different.

Overall CPI is dropping like a rock. In fact, this is the quickest drop in year-over-year CPI since the Volker years in the early 1980s. Hard to see the Fed not winning the inflation war when you look at this information.

Source: Bespoke

Past performance is not indicative of future results.

But Core, Insight! But Core! Of course, Core is the preferred measure of the Fed. And you have heard from us many times that Core is broken. Core posted a 0.4% month-over-month growth and dropped from 5.5% year-over-year to 5.3%.

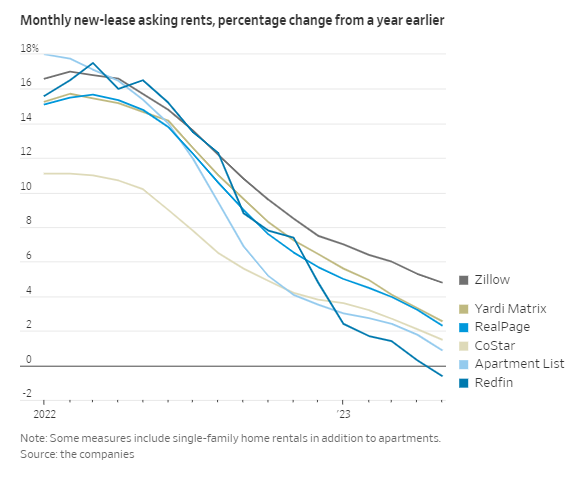

But once again, the shelter number was…stupid. According to the Bureau of Labor Statistics, the cost of shelter – which makes up 42% of the Core CPI calculation – rose 0.6% month-over-month and 8.0% year-over-year. All during a time when we see this happen with apartment rents:

Source: Wall Street Journal

Past performance is not indicative of future results.

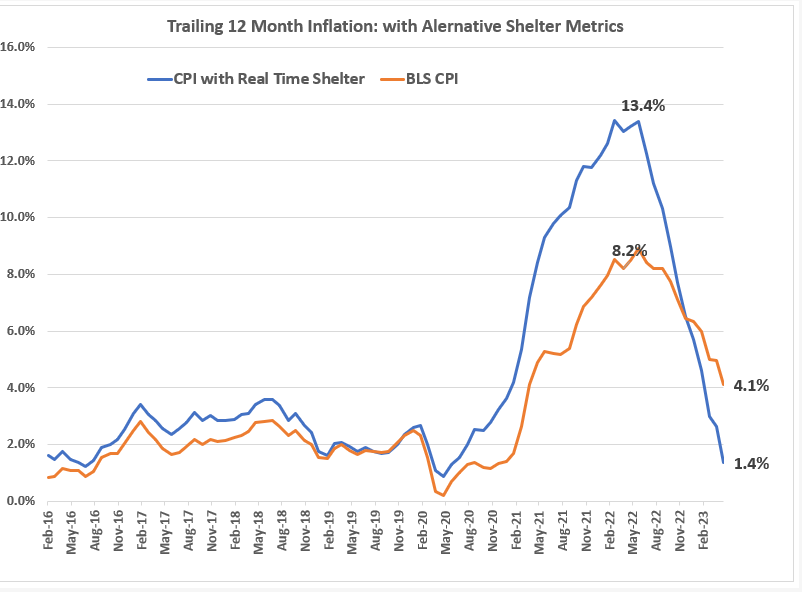

So, what happens if you adjust the inflation data for the real-time shelter data? A stunning shift:

Source: Wisdom Tree

Past performance is not indicative of future results.

So that gets us to Powell and the Inflationettes. What happened with the FOMC meeting on Wednesday and what does it mean for the future?

Threading the Needle

Given all the information we just went through, one could be forgiven for thinking the Fed is done with rate increases. One might even consider that rate cuts are on the horizon.

Jerome Powell does not want you to think that way.

“Inflation pressures continue to run high, and the process of getting inflation back down to 2% has a long way to go”.

“Looking ahead, nearly all Committee participants view it as likely that some further rate increases will be appropriate this year”.

And on top of that, there is no member of the FOMC that is currently anticipating a rate cut this year. The median position right now is that there will be two more twenty-five basis point hikes between now and the end of the year.

Source: FederalReserve.gov

Past performance is not indicative of future results.

So, what gives? Why does the Fed continue to talk like nothing good has been happening to inflation when it has been falling for a year? Why do they continue to talk like we are on the precipice of a terrible inflationary environment? Why does Powell say things like rate cuts could be “two years away”?

The answer, we believe, goes back to Powell’s comments in Jackson Hole last August. You may recall the speech (we described it as taking “the market to the woodshed”). It was his clarifying moment when he made sure the market understood this was not going to be a brief battle against inflation and there would be pain along the way.

His point at the time was that “restoring price stability will require maintaining a restrictive policy stance for some time. The historical record cautions strongly against prematurely loosening policy”.

The opposite is also true. Maintaining a restrictive policy stance for too long will have detrimental effects on the economy as well. You know it as a recession.

So that gets us to the needle that Powell & Co. must thread. Let off the gas too early and inflation roars back. Stay on too late and you crater the economy. How do we get through it when it comes close to the end of the process? Slow (i.e., pause) the hikes. Our guess is Powell is going to:

- Let the economy do its work.

- Keep the language less optimistic so the market does not go for a wild run.

- Maintain flexibility to raise rates again in case things do not pan out as hoped.

The messaging is working right now. The market strongly believes the Fed is going to raise rates in July (74.4% probability as of Sunday). Consumers’ inflation expectations remain well grounded (down to 3.3% in Friday’s UMichigan release). And the market continues to do well. Overall, not a bad result. But just questionable enough to keep a lid on the market. Powell may be sneakier than we think.

Schwab Transition Information

For our clients, a quick update. You may recall that Charles Schwab purchased TD Ameritrade. Our transition to the Schwab platform is going to happen over Labor Day weekend.

It is our understanding that this will be a “paperless transition”, and nothing will be required of you to execute the change. That said, you are going to be receiving a good bit of communication from the TD/Schwab team over the coming weeks and we want to keep you informed.

Starting this week, you are going to be receiving a letter for each account you hold at TD Ameritrade. It is called a “negative consent” letter. It will give you an opportunity to “opt out” of the transition. We do not recommend using that path as it will require identifying a new custodian for your assets.

We are happy to discuss this process in detail individually if you would like. Please do not hesitate to contact our offices at (515) 273-1333.

Welcome Kristen!

Finally, we would like to take this opportunity to welcome Kristen Crouthamel to our team. Kristen will be taking over for Kelly Boesch whose retirement started last Thursday. Kristen has a long record of accomplishment in the industry and has worked in both customer service and advisor roles for more than 19 years. She has had an opportunity to train with Kelly and we are confident she is going to fit seamlessly into her new role.

If you need to reach Kristen, she can be reached at kristen@insightwealthgroup.com or by calling our home office.

Sincerely,