Please note: Insight Wealth Group will be following the stock market holiday calendar next week in observance of the Independence Day holiday. Accordingly, our offices will be closed on Tuesday, July 4th.

The holiday may make compliance approval for our Weekly Insight Memo and Podcast difficult next week so it may be delayed until Wednesday, July 5th.

Now on to the business at hand…

Powell means it. Or at least that is the message he was delivering to Congress last week. The Fed is fully committed to two additional rate hikes this year. The market sort of believes him. There is a strong consensus that the Fed will raise the Federal Funds Rate to 5.25% – 5.50% in the next meeting. But there is no consensus the rate will go any higher.

Source: CME Group

Past performance is not indicative of future results.

More notable, however, is the strong belief in the marketplace that the Fed will not cut rates anytime this year. That is a notable shift from previous expectations. You may recall us discussing just several weeks ago the expectation that the Fed would get rates down to 4.25% – 4.5% by the end of the year. That is now not expected until the middle of next year.

What Is a Restrictive Interest Rate Policy?

We have all heard the comment from the Fed many times in the last year: “sufficiently restrictive” rate policy. That’s what the Fed keeps telling us it wants to do. So, what exactly does that mean?

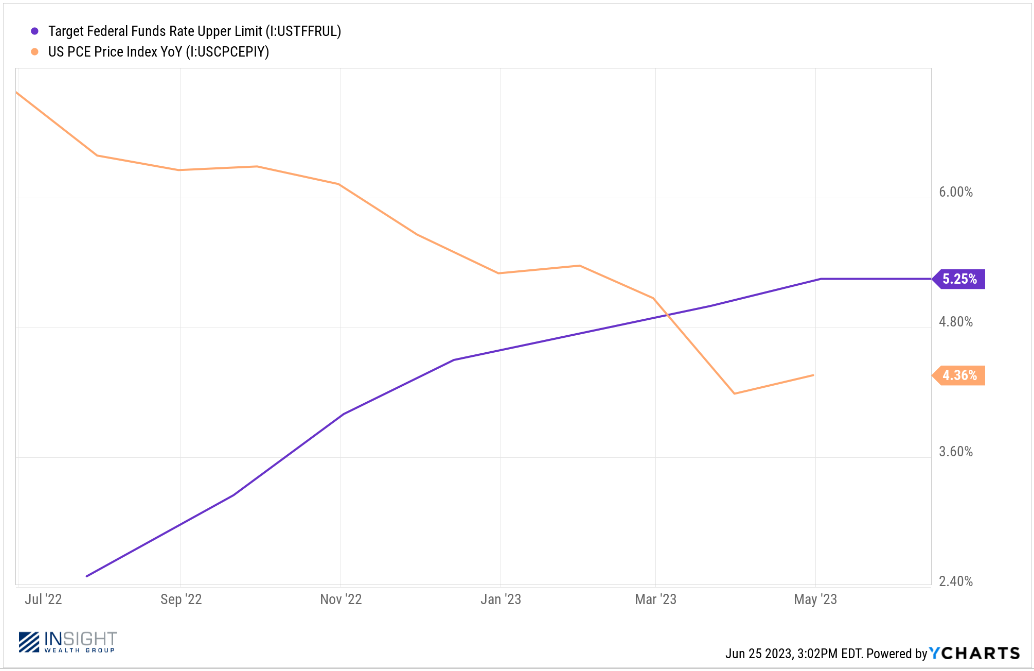

The “restrictive” part of that quote is easily definable. When the Federal Funds Rate exceeds the rate of inflation, we have officially entered “restrictive” territory. If you use the Fed’s preferred measure of inflation – Core PCE – we crossed that line back in January.

Past performance is not indicative of future results.

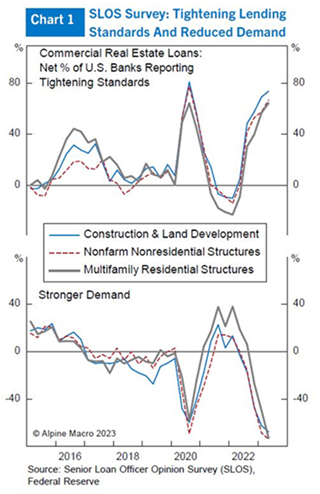

But is it really restrictive? How can we tell it is having an impact? Just look at the banks. The Senior Loan Officer Opinion Survey – known as the SLOS – tells a crystal-clear story about what lending looks like in today’s environment. Nearly 80% of U.S. banks are tightening their lending standards. And demand for loans – of all commercial types – is down dramatically.

Past performance is not indicative of future results.

The real question then becomes what does “sufficiently” mean to the Fed? How far do we have to go down this rabbit hole before enough is enough? Right now, it feels like the Fed is hell bent on driving us into a recession. Is that what it is going to take to get them to back off? Or is there some magical in-between trigger that will force them to back off on interest rate policy?

Is a Recession a Foregone Conclusion?

Is a Recession a Foregone Conclusion?

We do not have an answer to what – other than a recession – might force the Fed to back off. That means we must instead focus on monitoring economic conditions and try to understand where the risks are in today’s environment.

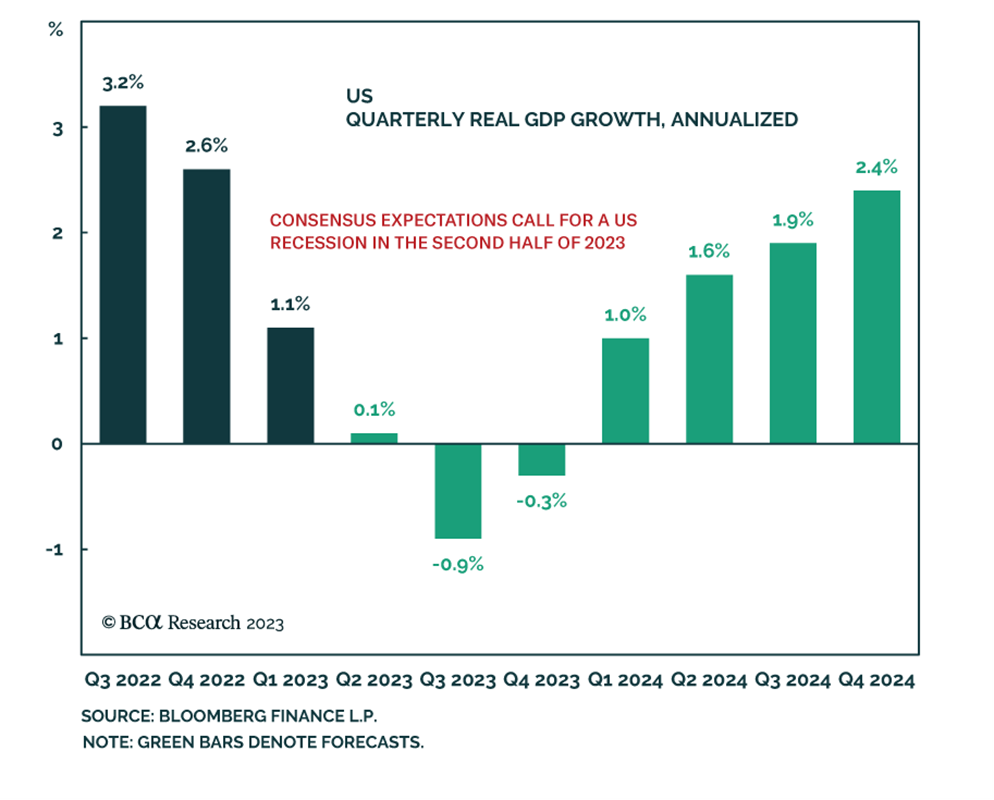

You have all heard the long-accepted definition of a recession before: two consecutive quarters of negative GDP growth. If you use that statistic, the current consensus expectation from economists is that we will meet that definition later this year.

Past performance is not indicative of future results.

The only problem with that is expectations for GDP are growing right now, not shrinking. You will note above the 0.1% consensus estimate for our current quarter. We are just a few days away from the end of the quarter now. What do we know today that economists did not know earlier in the quarter? The “blue chip consensus” for GDP has now risen to nearly 1%. And the Atlanta Fed GDPNow forecast – which has been remarkably accurate – is now at nearly 2%.

Past performance is not indicative of future results.

But there is one other problem with predicting an oncoming recession: the actual definition of a recession is not “two consecutive quarters of negative GDP growth”! That tends to be an accurate predictor of whether a recession will be called. But recessions are technically defined by the National Bureau of Economic Research (NBER). They define a recession as “a significant decline in economic activity that is spread across the economy and lasts for more than a few months”.

The NBER also has an extremely specific basket of economic measures they utilize to determine if there has been “a significant decline in economic activity”. Here is what those measures look like today:

Past performance is not indicative of future results.

Anything over 100 in that chart means the measure is expanding/growing. Anything below is contracting. We do not yet have the May figures for manufacturing and consumption, but every measure in the NBER’s calculation is currently expanding. Simply put, we are not dipping into a recession anytime in the next few months.

In the end, we really do not know what the Fed is seeing today that the rest of the world isn’t. It just might be the ghost of Paul Volcker. And their current policy may end up driving us into a recession. But it is not going to happen soon. The economy is healthy enough to bear a little bit of uncertainty from the Fed even if we are all getting impatient for the final act of this play.

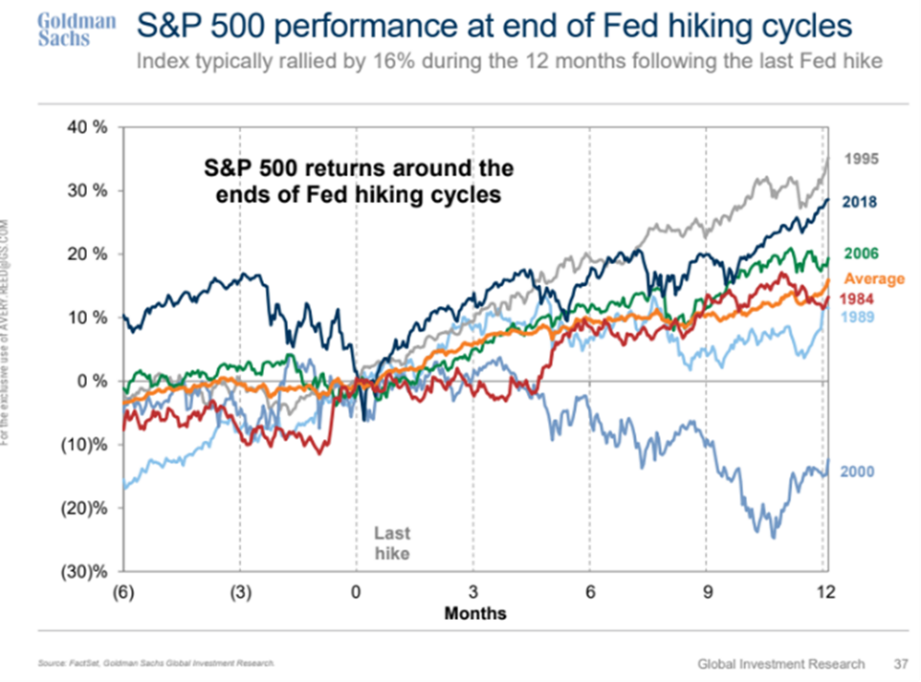

And when the final act finally does come? It has the potential to be a fun ride. History tells us the market performs very strongly after the last move in a rate hike cycle.

Past performance is not indicative of future results.

We are getting close. That’s “sufficiently” good news.

Sincerely,