The Weekly Insight Podcast – Big Weeks Ahead

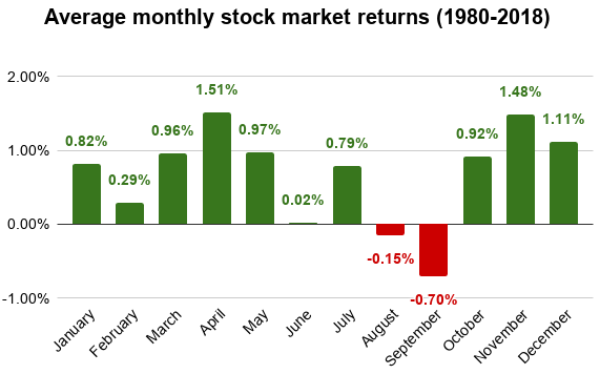

We’ve discussed it before in these pages, but the latter part of the summer tends to be a quiet time in the market. Once we get past the 4th of July, it’s typical that Wall Street starts to take their summer vacations (as does most of the rest of the country) and activity slows.

Past performance is not indicative of future results

There’s another reason for this trend – summer tends to be a time of little news. Washington, DC is largely checked out during this period (Congress traditionally takes the whole month of August off). The election process hasn’t kicked up yet (that’s coming soon — and we’ll be talking about it!). And there aren’t many calendar drivers to financial decisions like we see at the end of the year (tax harvesting) and the end of Q1 (taxes due).

This year? It’s a much different story. There is a lot of news that is going to move markets in the month of July (and potentially August). And the next few weeks are going to be vital to how the rest of this summer plays out on Wall Street. Let’s look at the big events coming and what they may mean for portfolios.

Earnings Season Begins

It’s hard to believe, but earnings season is here again. And, as usual, the big banks are going to be big drivers at the front end of this conversation. They typically set the tone for rest of the season. Thursday and Friday of this week will see reports from JP Morgan (JPM), Morgan Stanley (MS), US Bancorp (USB), Bank of New York Mellon (BK), Black Rock (BLK), and Wells Fargo (WFC).

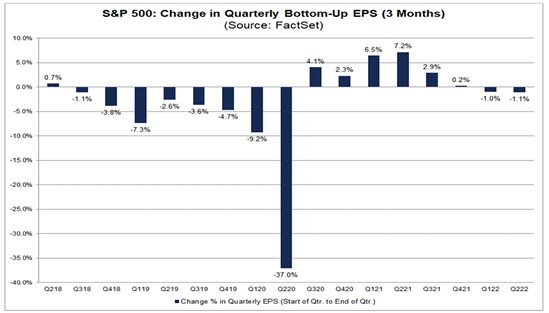

You may recall us discussing the trend that typically happens with earnings expectations in each quarter. Simply put, analysts tend to start the quarter more optimistic and revise their expectations downward as we get closer to seeing hard data reported. So, a negative earnings revision is not unexpected.

However, with all the discussion of an impending recession, one might expect the downward revisions to be more pronounced this quarter. Did that happen? According to FactSet, it didn’t. In fact, earnings were revised down 1.1% which is less than half the average of the typical quarter (2.4%).

Past performance is not indicative of future results

At the same time, analysts have increased their expectations for the back half of 2022. The result is that the expectation for all of 2022 is up 0.80% to $229.63. That would be earnings growth of nearly 10.70% for the year. Not shabby at all. And even with all the recessionary talk, analysts are expecting earnings to grow to $250.48 in 2023 (a number that has been revised down by 0.50%). That would mean earnings growth in 2023 of just over 9%. That’s not a “world is ending” analysis.

Inflation Data Comes Out

Wednesday is the big day this week. We’ve beaten this story to death in these pages, so we won’t devote a ton of time to it today. But the fact is the market is waiting anxiously to see what the CPI data looks like.

Right now, the expectations are as follows:

- Core CPI Year over Year: 5.7% (a drop from last month’s 6.0%)

- Core CPI Month over Month: 0.6% (flat from last month’s 0.6%)

- CPI Year over Year: 8.7% (up slightly from last month’s 8.6%)

- CPI Month over Month: 1.0% (flat from last month’s 1.0%)

We broke down Core CPI vs. CPI (or all items inflation) in a previous memo. You can read it here. The data above tells us that everyone else is having the same problems predicting what the price of energy will mean to all-items inflation as we noted in that previous memo. We all know energy prices have dropped substantively. But did they drop quickly enough to make it into the June inflation data? No one seems willing to make that bet right now.

The Fed’s July Meeting

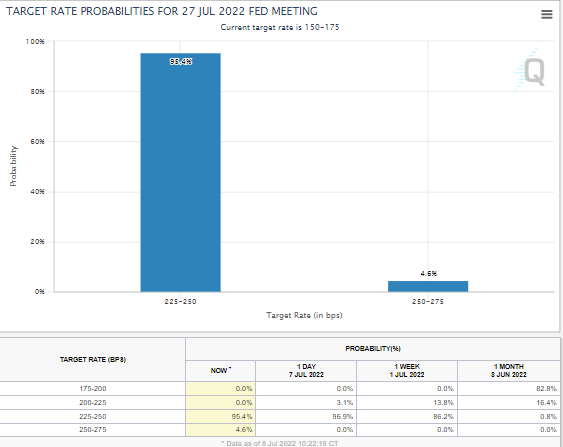

One week after we get the inflation data, we get a new Fed decision on interest rates. It’s a safe bet that we’re going to have a dramatic week between the inflation report and the Fed decision. Good inflation data should see a spike in equity prices. Bad data will get another decline. But that movement will be short-lived until it is either confirmed or contradicted by the Fed on Wednesday, July 20th.

The current expectation for the Fed’s decision is resoundingly set at a 0.75% rate increase from the current range of 1.50% – 1.75%. Notably, no one on the current CME survey is suggesting a 0.50% increase. But there are 4.6% odds of a 1.00% increase. We’ve never heard talk of that – so it’s a bit of a flyer. But we won’t know for sure until we see the inflation data.

Past performance is not indicative of future results

The markets direction for the next several months will likely be decided in the next few weeks. The base case – as we discussed last week – remains strong. But much of the “sentiment,” which has been so frustrating in recent weeks, will be determined by what we see in earnings, inflation data, and from the Fed. You’ll be hearing a lot more from us on these items in the next few memos.

Sincerely,