The Weekly Insight Podcast – A Busy, Busy Week

Here we go. It’s going to be a busy – and potentially exciting – week for the markets. There is a lot happening. The Fed is meeting. 175 members of the S&P 500 are reporting earnings. We’re going to get the regular slew of month-end economic readings. Let’s do a quick rundown of the week so you know what to expect.

Fed Meeting

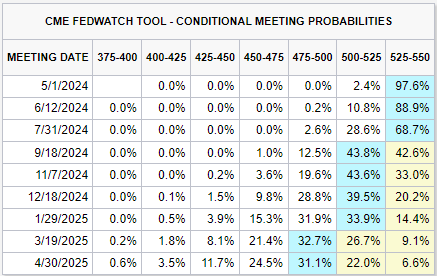

The Fed is having their third meeting of the year tomorrow and Wednesday. It comes at a time the market is concerned about improvements in inflation stalling out. And yet, it is also a meeting at which very few are expecting much news to be made. The consensus in the market is the Fed isn’t doing anything with interest rates now…or anytime soon. In fact, the target for the first rate cut has now moved to September.

Source: www.CMEGroup.com

Past performance is not indicative of future results.

The simple fact that we’ve gone from an expectation of seven interest rate cuts in 2024 to just one singular cut is the biggest story in the markets today. In January we wrote a piece called “What if the Consensus is Wrong?” discussing this very matter. At the time, we wrote:

“We’d caution you that the market’s optimistic view may set us up for a bit of disappointment. If we get to the Fed meetings in March or May and there isn’t any traction on rate cuts, we’d expect some volatility in the markets as money managers must rethink their expectations”.

Our timing was a bit off, as we’d argue the volatility arrived in April with the 5% correction we saw earlier this month. But the fact of the matter is the market has completely reset expectations and the S&P is still up 7% for the year. Not a bad result as far as we’re concerned.

There were two big data sets last week that the Fed will be discussing in detail in this meeting: Q1 GDP and the March PCE inflation numbers.

Q1 GDP came in lower than anticipated and caused a bit of a scare in the market on Thursday. The result – 1.6% growth – was well below the most recent expectation of 2.5%. But we’d remind folks that it was double the expectation of 0.8% we saw at the beginning of the quarter. Everyone got a bit too optimistic, but it didn’t mean we had a bad quarter.

Then, on Friday, we got the PCE numbers, and they did almost exactly what CPI did earlier in the month. Core PCE stayed flat at 2.8% and All Items PCE jumped a bit to 2.7%. Good? No. Bad? Not really. But it solidifies the idea that the Fed isn’t going to be cutting rates this week.

So, if doing nothing is the base case for the Fed, and there’s a near-zero chance they’re going to give the market a boost by giving us a surprise rate cut, what could the Fed do that would move the markets negatively this week?

Not much. Powell will downplay the likelihood of rate cuts anytime soon. But that’s already expected. The worst thing they could do is signal that they believe inflation is reigniting, but that isn’t showing up in any of the publicly available data we’re seeing. Simply put, this should be one of the least dramatic Fed meetings of the year. (But that doesn’t mean Powell can’t kill the market for a few hours from the podium…he has a particular knack for that!)

Earnings

We’ve talked for a few weeks now that we needed to get past all the economic discussions and move on to earnings for the market to bounce back. That, in large part, happened last week. We’d expect, barring some unexpected drama from the Fed, it will kick into gear this week as 35% of S&P 500 companies will report earnings by the end of the day Friday.

And these aren’t inconsequential companies. Amazon, Eli Lilly, Coca-Cola, and McDonalds all report – and that’s just on Tuesday. Then there’s Apple, Berkshire Hathaway, Mastercard, etc., etc. It’s going to be a big week on the earnings calendar.

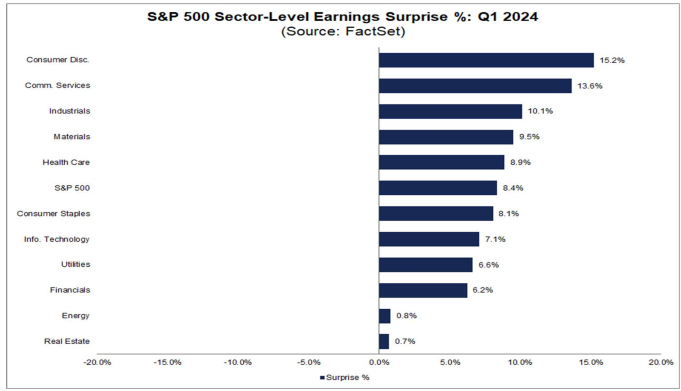

If the last several weeks have been much of an indication, that’s good news for the market. So far, 77% of S&P 500 companies that have reported have beaten their earnings expectations. That’s above the 10-year average of 74%. And the beats aren’t just little beats. The average is 8.4% above expectations, which also beats the 10-year average of 6.7%. Every single sector is showing a positive surprise so far this quarter.

Source: www.FactSet.com

Past performance is not indicative of future results.

Just a few weeks ago, the expectation for S&P 500 earnings for the quarter was 0.6%. The numbers from the last few weeks of actual results have pushed that up to 3.5%. It should go much higher this week if the progress continues.

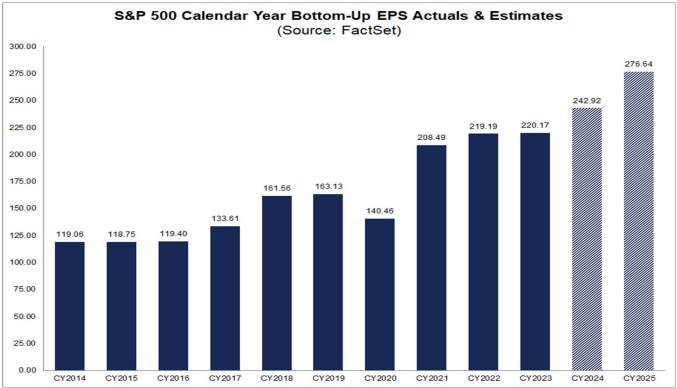

That leads to a pretty optimistic picture between now and the end of the year. Given current assumptions, analysts are now expecting 10.33% earnings growth for FY24. And FY25 looks even better at 13.88%. It’s a good reminder of just how well this economy is chugging along right now.

Source: www.FactSet.com

Past performance is not indicative of future results.

We must weather Chairman Powell and his commentary this week. But we would expect whatever is said on Wednesday will be quickly drowned out by what companies are reporting throughout the week. That should continue into the middle of May as positive facts will outweigh negative opinions.

At that point, we’ll have to seriously consider what comes next. The volatility inherent in a close Presidential election is going to be coming soon. We’ll dive into that in more detail in the coming weeks.

Sincerely,