The Weekly Insight Podcast – On Base Percentage

Your author had a conversation with a client last week in which they said something to the effect of, “You guys put everything on the record so we can see if you were right or wrong”. Hate to admit it, but he’s right. For the last four years, you can go back and see exactly what we thought about every market fluctuation, jobs report, Fed meeting, etc., etc. That kind of transparency is great as long as everyone accepts that we’re not going to be right all the time!

And we’re not right all the time. Take for example this quote from the very first Weekly Insight Memo (published at the very beginning of the COVID-19 panic):

The current estimate is the COVID-19 outbreak will likely have a 1.5% drag on the Chinese GDP and a 0.4% drag on global GDP. That is not insignificant, but in both scenarios would still see the Chinese and global economy growing in 2020”.

Ha! We wish it worked out that way. But even in such a wild time as the start of a global pandemic, which would shut down the global economy and kill millions, the big fundamental truths about investing continued to be true.

And the biggest of the big fundamental truths is that investors can control just a few important actions relative to the success of their portfolio. There are three big levers you can pull:

1.Time

Simply put, the longer you’re invested/investing, the better. The “average stock market return” gets quoted a lot by talking heads. It’s great that the S&P 500 has averaged 7.8% since 1928. But do you know how many years were within 1% +/- of that average? Just three! 1959, 1968, and 1993 were the only three years since 1928 that have averaged between 6.8% and 8.8% in the market.

Yes, the bad years hurt. But the good years have more than made up for it for a long, long time. But if you’re not participating in the market when they happen, you miss out.

2. Contributions

Well, duh, Insight. Of course, we’ll make more money if we put more money in. We know this one is obvious, but the most successful investors are those that purposely focus on saving.

3. Investment Performance

In some ways, this is the least important of the three. Without time and contributions, there’s extraordinarily little that investment performance can do for you. But don’t fool yourself, bad choices can very quickly be a recipe for disaster. Just ask those who put their life savings into GameStop (GME) in January of 2021. They’re down 81% with little prospect for recovery.

Which brings us to what happened in the market last week. This time we were right. The Fed didn’t rock anyone’s world and the market returned its focus to earnings. With the addition of oil prices falling below $80, one can easily plot a course where, by the end of this month, we’ve recovered all we lost in April and then some.

Powell’s comments didn’t change a lot last week. The same comments about having a “sufficiently restrictive” policy to bring inflation down to 2% over time. The most strident of his comments were reiterating that the Fed’s next move wouldn’t be a rate hike, and quickly stepping on any mention of “stagflation”. To quote the Chairman,

“I don’t really understand where that’s coming from. I don’t see the ‘stag’ or the ‘-flation’.”

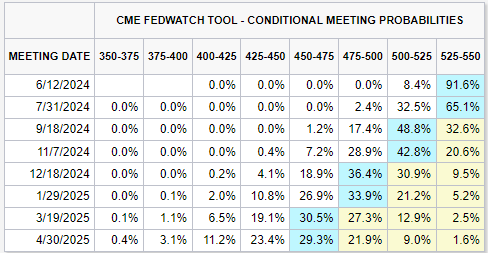

In the end, markets loved his comments. And expectations shifted from one rate hike this year to two. Is that real? Who knows. But it means inflation and rates are off our backs for a few weeks. At least until we get the next inflation read or the next Fed meeting in June.

Source: www.CMEGroup.com

Past performance is not indicative of future results.

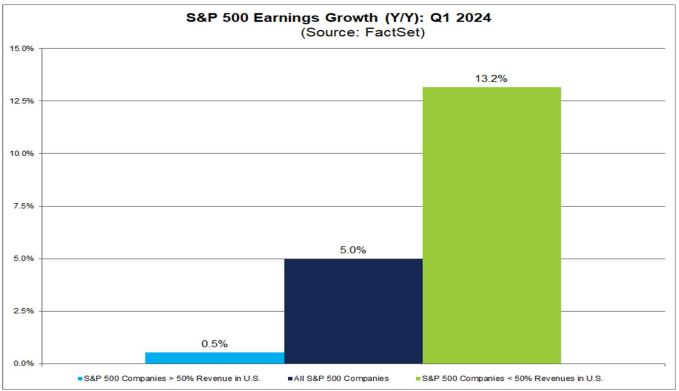

While the world was focused on Powell, earnings did much like we expected and had a fantastic week. We mentioned in our last memo that the positive results we’d seen had moved earnings expectations for the quarter up from less than 1% to 3.5%. The results from last week moved the number up from 3.5% to 5.0%. We’re currently on pace for the best quarter we’ve seen since Q2 2022.

But there is one important stat we saw this week that is worth keeping an eye on. The U.S. is a country dependent upon the global economy due to our vast reach and influence around the world. It shouldn’t be a surprise that 40% of all sales in the S&P 500 come from outside the United States.

Which is why it is particularly notable the significant difference in earnings growth between companies which receive most of their earnings inside the U.S. vs. those who receive a majority of earnings outside the U.S.

Source: www.FactSet.com

Past performance is not indicative of future results.

We know the global economy is behind the U.S. in the post-COVID recovery, so if anything, this is good news for the rest of the world. But those anemic numbers from inside the U.S. are worth paying attention to in the coming weeks and months.

Which brings us to where we go next. We have a number of big baseball fans in our office. Not only is it America’s game, some might argue it is a nearly perfect combination of strategy and athleticism (one being your author…). One of the reasons we love the game so much is that even though the flashy stats (i.e., home runs) are fun, it’s teams that do the most basic, fundamental things well (OBP – On Base Percentage) that win games. Just look at the leaders in OBP in the major leagues today. The top teams in OBP are also the teams winning the most games.

When it comes to investment performance – one of those big three things you can control – the team at Insight is looking much more to OBP than it is home runs. Don’t get us wrong, we love grand slam investments! But we’re just as happy to get hit by a pitch (money market yields at 5%, anyone?) if it means we’re making clients’ money.

The rest of this year is likely to be an OBP year. Swinging for the fences is not in our future. In fact, with our expectations of upcoming volatility from the election and a potentially slowing economy, we would expect to begin taking risk out of portfolios soon. Why? A big piece of controlling investment performance is avoiding downside risk wherever possible. That’s just as important as any grand slam investment idea.

Sincerely,