The Weekly Insight Podcast – The Next Recession

The market has had a tough start to April. We walked through that in detail in last week’s memo (here) and the themes didn’t change much last week. Comments from numerous Fed members – including Chairman Powell – continued to press the “we’ll cut, but it may be a while” message. That, combined with continued stress in the Middle East meant last week was more of the same.

And still, our assessment of the economy today is also “more of the same”. We may be going through a pullback in equities, but the market is still up nearly 5% this year. And, from it’s peak on March 28th, the S&P is down just over 5%. Notable? Of course. But we also need to remember that the market averages over three 5% corrections every year. This is normal.

But it’s also a great moment to think about – and discuss – the next problem we’ll face in the economy. What is going to cause the next recession? And how can we position ourselves to avoid as much pain as possible?

The Base Case

Before we can dive into the next big issue, we must have a firm grasp of where we are today. And, for the first time in a while, we wholeheartedly agree with consensus: There is not a recession coming in the next 3 – 6 months. There are a few reasons for this:

- GDP continues to outperform.

- The labor economy remains strong.

- Consumers still have a lot of cash.

- There is no way Washington is cutting spending in an election year (even if they should…).

The formula for GDP is a wonderful way to break all of this down. GDP is a simple calculation: c + i + g +(x-m) = GDP. Let’s talk about each of these variables.

C = Consumption

In this formula, think of consumption as consumer spending. It makes up more than 70% of the GDP calculation. As such, the health of the consumer matters a lot. And you’ve heard us say it many times: the U.S. consumer is very health today…even if they don’t want to believe it.

There are two big factors to consumer health: the labor market and the consumer balance sheet. The labor market continues to outpace all expectations. We outlined this when walking through last month’s employment numbers. With 3.7% unemployment and 8.7 million available jobs, consumers can find work and can find ways to pay their bills.

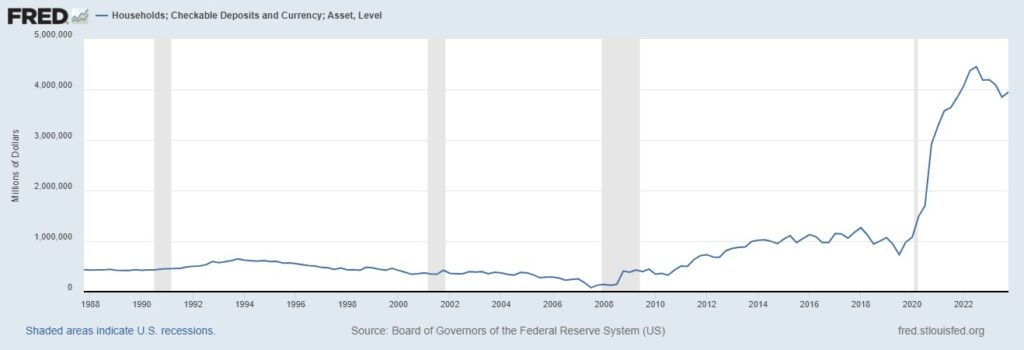

And that’s showing up in the amount of cash consumers have available. You’ve heard us talk in the past about “checkable deposits” – essentially the amount of cash consumers have readily available at any time. Here’s the most recent data set from the Fed:

Source: www.fred.stlouisfed.org

Past performance is not indicative of future results.

Yes, it’s down from its all-time high in 2023. But it’s still wildly higher than at any previous time. And that little button hook at the end is interesting. We asked some economists why this was happening, and the answer was simple: investors are finally earning something on their cash. These 5% interest rates are growing consumers’ cash hoard.

I = Business Investment

Corporate America is in good shape today. Balance sheets are strong, and margins are healthy. U.S. corporate profits – despite all the volatility we’ve seen since the start of COVID, are up 36% since the pandemic. That’s an average of 9% per year.

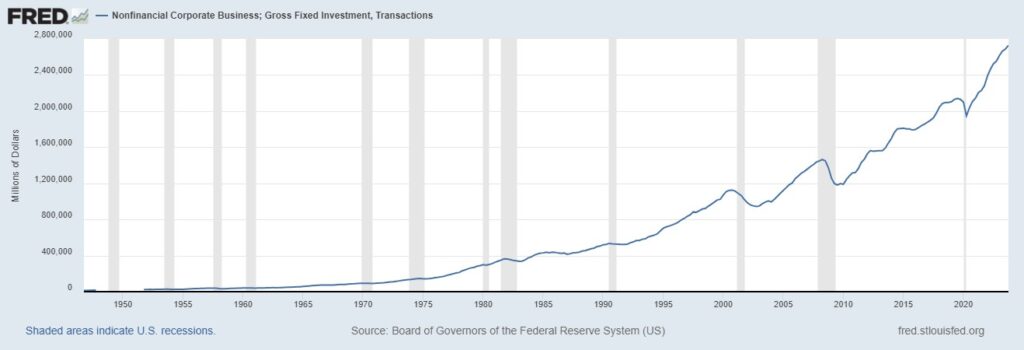

That means businesses are investing more back into the economy. In fact, business fixed investment, the data set used as a part of the GDP calculation, is at its highest level ever and rising.

Source: www.fred.stlouisfed.org

Past performance is not indicative of future results.

G = Government Spending

We don’t think you need much explanation on this one. Government spending is…rising. Way too much. When we stack up our “long-term concerns” (think 10 years +), this is the number one issue. But for the health of the economy today, government spending is stimulative.

Source: www.fred.stlouisfed.org

Past performance is not indicative of future results.

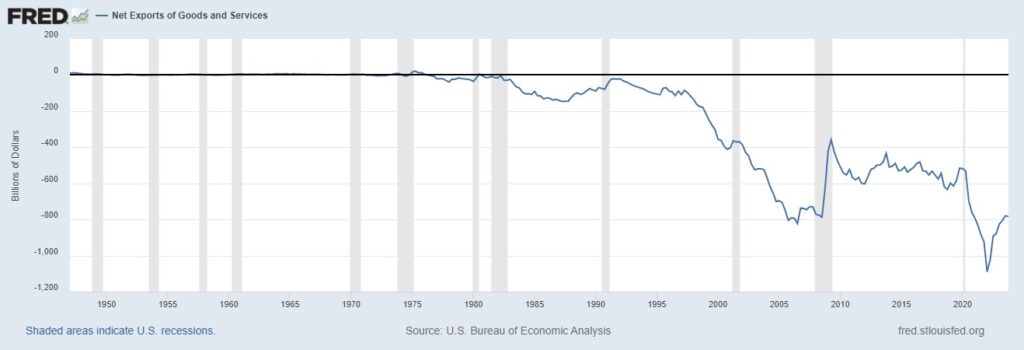

(x – m) = Net Exports

This piece has been, since the late 1970s, a drag on GDP. That isn’t going to change anytime soon. While it’s improved since the depths of COVID, the U.S. is so wealthy that we will always import more goods than we export.

Source: www.fred.stlouisfed.org

Past performance is not indicative of future results.

Altogether, the base case remains remarkably strong…for now. That strength is exactly the reason the Fed won’t be lowering rates as soon – or as much – as investors would want.

The Next Recession

Just because things are good right now doesn’t mean they can’t turn the other way. In fact, they most certainly will turn the other way. We know recessions are inevitable. We’ve had eleven of them since 1950, or roughly one every seven years. While we did technically enter a recession in the depths of COVID, the last purely economic recession (i.e., not caused by the economy being unnaturally shut down) was all the way back in 2008/2009. It has been twice as long as normal.

But what will be the cause of the next recession? We would argue there are two possibilities: high interest rates and geopolitical instability.

There is no doubt that geopolitical instability is rising. Russia/Ukraine, Israel/Iran, China/Taiwan. All have been blowing up our newsfeeds for months. For the last thirty years, the world order has been maintained by a strong United States combined with a stable world economy. Our adversaries were placated by the wealth being created.

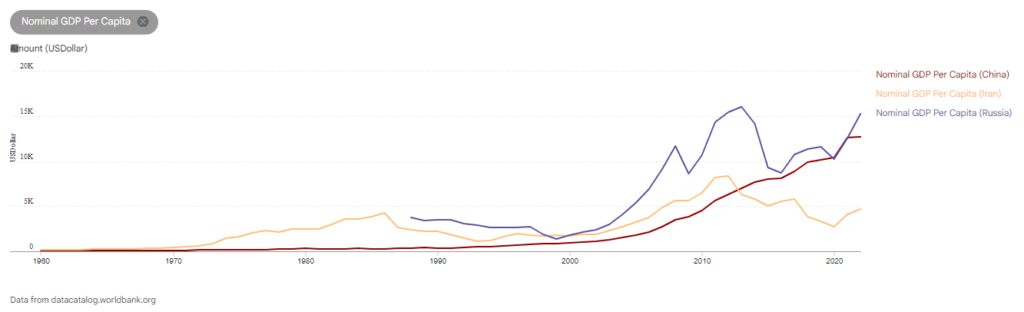

After the economic shocks of COVID and the newly unstable presence by the U.S. on the world stage, that calculus is shifting. And countries like Russia, Iran, and China have an issue. Their economies are on struggling. Iran’s GDP per capital peaked in 2012. Russia’s in 2013. China’s has now flatlined.

Past performance is not indicative of future results.

What is it that dictatorial governments do when they can’t keep their populace happy? Find an external enemy. That’s much easier to do when there is no global policeman keeping a lid on things. And that is clearly not a role the U.S. (nor most of its citizens) is interested in playing right now.

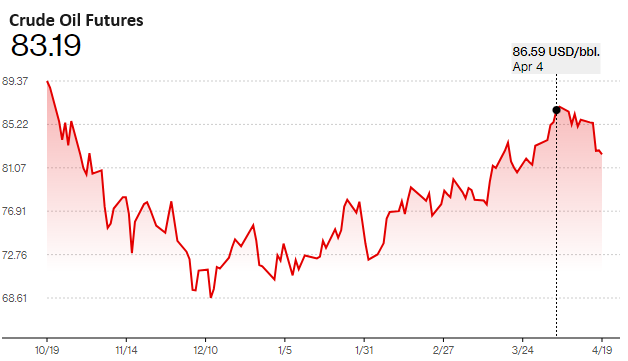

We certainly can’t say any of these conflicts are going to turn into something much larger. But, as we laid out last week, there is one clear global economic risk: Iran closing the Strait of Hormuz. That simple action would cut off 30% of the world’s oil supply and nearly guarantee a worldwide recession.

Is it happening soon? Unlikely. The world oil markets are the easiest place to track this problem and, even after Israel’s retaliatory strikes on Thursday, are trading lower than they were before the Iran strike nine days ago.

Source: www.bloomberg.com/quote/CL1:COM

Past performance is not indicative of future results.

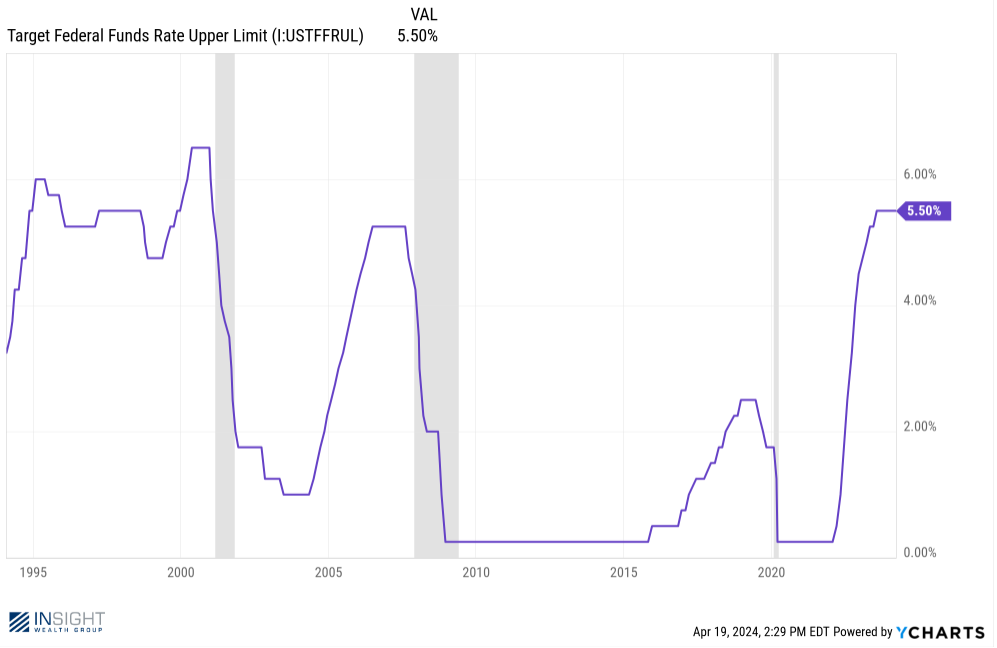

The second significant risk is much more likely in our opinion – even if it won’t happen until late this year or early next: the pressure of high interest rates finally forcing the economy to slow.

It is, of course, strange to be concerned about the very thing economists have been hoping for to actually happen. But it’s important to remember there is a substantial difference between a “soft landing” and the result that has happened nearly every time the Fed has artificially elevated interest rates. One only needs to look at the chart below to see the correlation (shaded areas are recessions).

Past performance is not indicative of future results.

We’re not here to say the Fed can’t pull this off. But this is a very delicate balancing act. Cut rates too quickly and you risk inflation going for a run again. Cut rates too late and you get a recession. What are the odds the Fed can time it perfectly? Probably pretty slim considering they’ve never done it perfectly before.

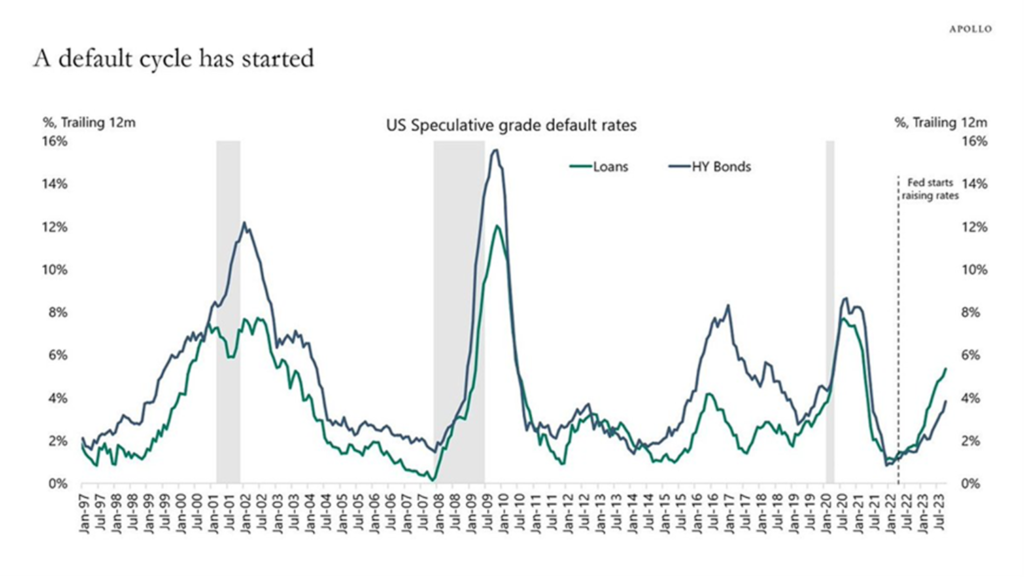

One of the easiest ways to understand what interest rates are doing to the economy is to watch speculative grade credit defaults. These are the bonds and loans that are going to go bad first in any changing economic cycle. And we’re starting…just starting…to see the beginnings of a default cycle.

It is important to note that defaults remain much lower than they were during COVID, or the Great Financial Crisis, or the Tech Bubble. In fact, they’re lower than they were in 2017. But we’re going to be paying a lot of attention to these numbers over the coming months as they may be a sign of things to come.

Source: Apollo

Past performance is not indicative of future results.

Last week we asked you to take a “deep breath” over concerns about the market’s small correction this month. We mean it. The opportunities in the coming weeks – especially as earnings season kicks into full gear – are meaningful. But as we look out over the horizon, a few storm clouds are starting to build. Now is the time to ensure we’ve got a good roof over our heads.

Sincerely,