The Weekly Insight Podcast – Deep Breaths

Whew. Last week was a tough one. Between the concerns about inflation data, a slow start to the earnings season, and the Iranian attack on Israel, it’s safe to say markets were flustered. We’re going to dive into each of these three issues today. But before we do, it’s important to set the stage.

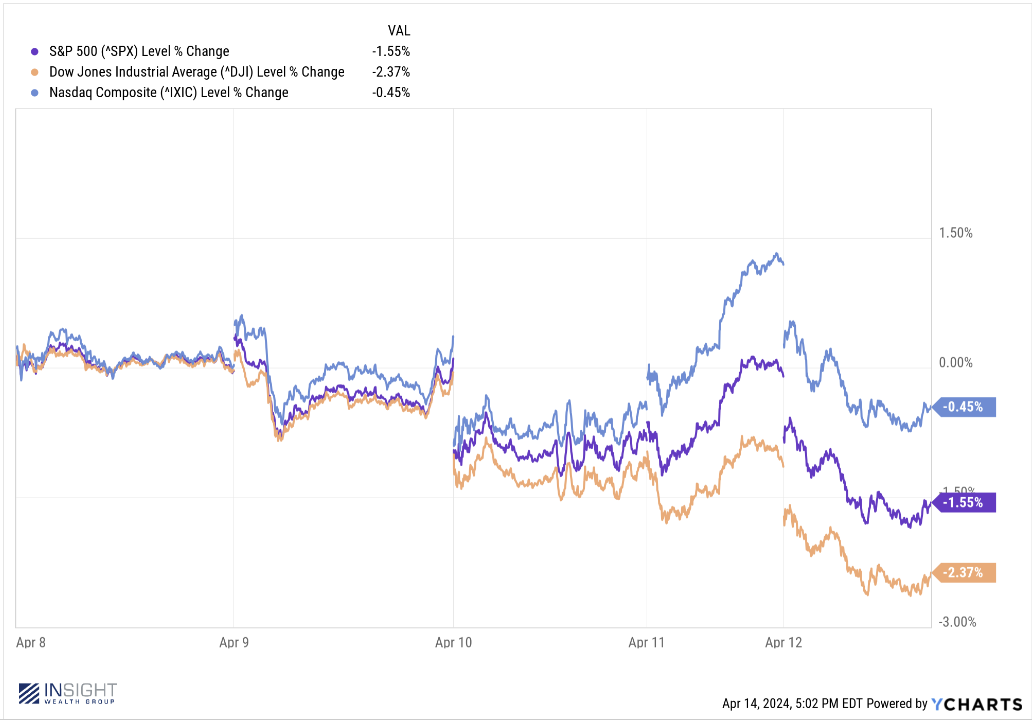

Yes – equity markets were off last week. But how bad was it?

Past performance is not indicative of future results.

Not really that bad. We probably shouldn’t include the Dow Jones in these reports because it is incredibly unrepresentative of the broader market. But it had the worst week, being down 2.37%. The reason? It has a 22% weight to financials (vs. 12% in the S&P and 0% in the Nasdaq). We’ll talk more about that when we dive into earnings.

But when looking at history, last week didn’t even sniff the “really bad week” territory. We could start by showing you some historically bad weeks, but data from 1931 doesn’t always hit as hard. How about this instead: since the start of 2022, there have been 27 weeks with worse performance than last week. That’s more than one half of a year – over just the last 2.25 years – when the market has performed worse than it did last week. There were 54 total negative weeks over that time with an average return of -2.32%.

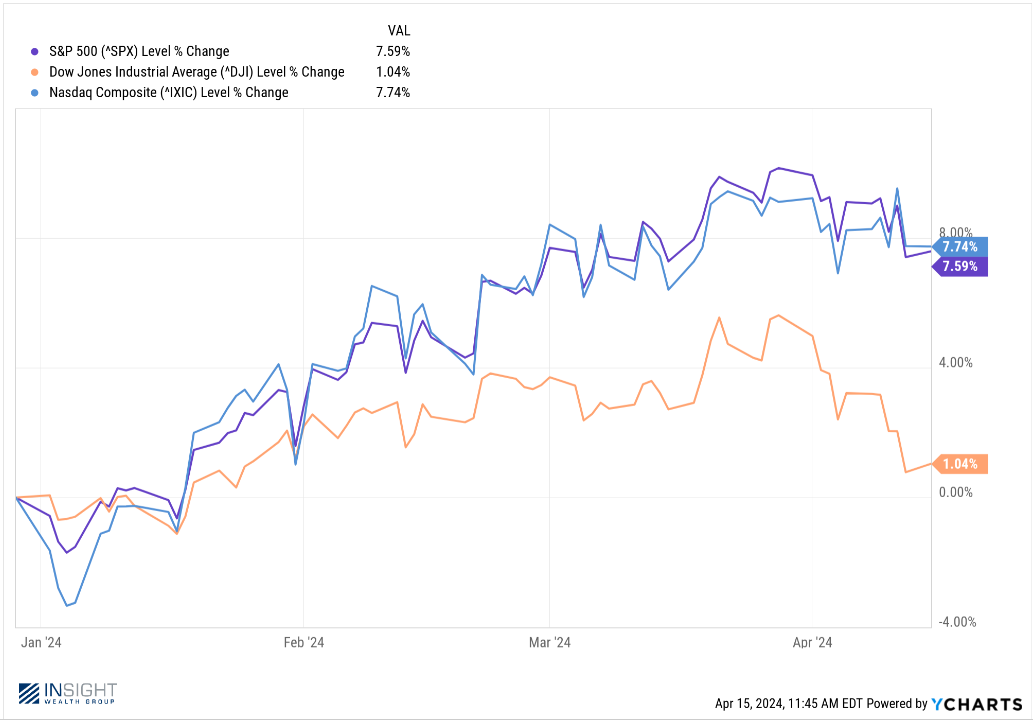

So, it’s time for a deep breath. And an important moment to remember that markets are still up strongly for the year. The last two weeks haven’t been fun. But it is also not a catastrophe.

Past performance is not indicative of future results.

Bad Inflation Data?

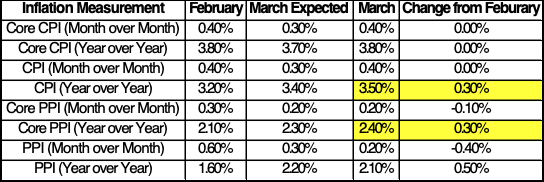

Now that we’ve established the world isn’t ending, let’s look at what caused so much consternation last week. The biggest issue by far was the supposedly “bad” CPI read we got last week. Here it is compared to last month and the expectations for this month.

Source: https://www.bloomberg.com/markets/economic-calendar

Past performance is not indicative of future results.

In the grand scheme of things, there wasn’t much of a miss. The problem wasn’t missing high (although we did on CPI and Core PPI). The problem was the miss relative to expectations.

Simply put, inflation isn’t falling as quickly as some would like. We could get into the debate about whether CPI is a good relative measurement of inflation (that housing data is still junk!). But we’ve written repeatedly that the Fed’s 2% target is largely made up and exceedingly difficult to reach in this environment.

The problem the market has is this continues to push back their expectations of a rate cut. We’re now seeing the first expected rate cut in September and only one or two rate cuts expected between now and the end of the year.

But if you had told us we’d go from the seven rate cuts the market was expecting last December to two just five months later and the market would be up better than 7%, we would have never believed you. Was it not so great news? Of course. But we still have a pretty strong hand.

Earnings

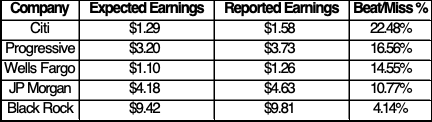

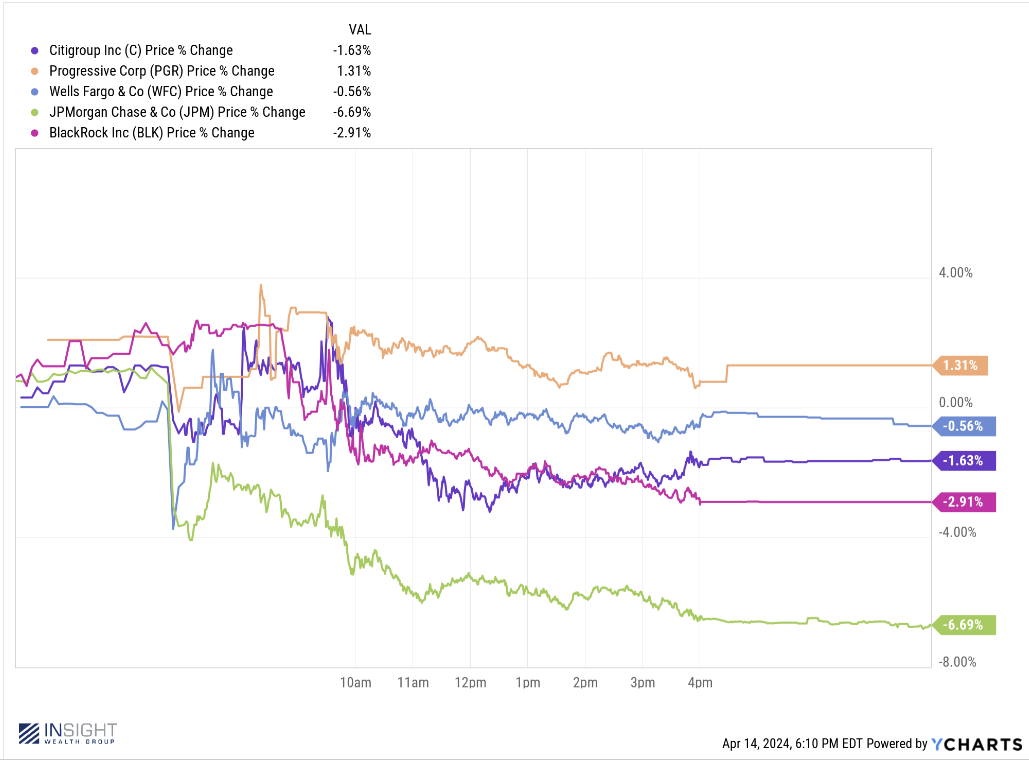

Earnings season kicked off this week with, as usual, some of the biggest financial services companies reporting. To say they surprised would be an understatement. But looking at the Financial Services sector stock performance this week, you would have never guessed they surprised…to the GOOD.

In fact, 100% of financial services companies beat their earnings expectations. Not only did they beat them, they stomped them pretty good.

Source: www.YCharts.com

Past performance is not indicative of future results.

Each of the companies below reported on Friday. You would have thought their earnings were a bloodbath – especially JP Morgan.

Past performance is not indicative of future results.

Why? To some degree we would guess it was broader sentiment around inflation. But what really stood out with JP Morgan was the fact that – despite beating earnings by over 10% – their interest income was down from record highs in Q4. That seems like quite the overreaction when the company still had an excellent quarter. Sometimes sentiment is a fickle friend.

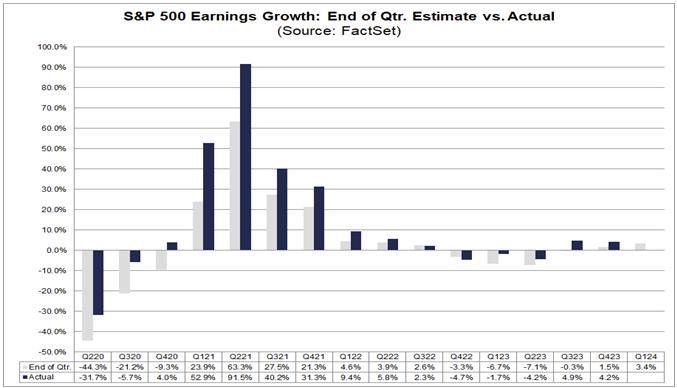

In the meantime, FactSet came out this week with a strong reminder that earnings are on pace for a pretty solid quarter. 83% of companies have beaten expectations, despite the usual game of expectations falling into the start of earnings. If history repeats itself, FactSet is now estimating that earnings could be up more than 7% for Q1. That would be a great start to the year.

Source: www.Factset.com

Past performance is not indicative of future results.

Iran vs. Israel

Anytime conflict in the Middle East rears its head, it is cause for concern. The region – ripe with the fuel that runs the world economy – has a long history of violence and the ability to draw the rest of the world into their conflicts. So, this weekend’s attack on Israel by Iran is notable.

First and foremost, this is the first time Iran has directly attacked the state of Israel. Yes, Iran has been attacking Israel for years. It’s proxies – Hamas and Hezbollah – have launched countless attacks against Israel, most notably the horrific Hamas attack on October 7th.

But this attack – in response to Israel’s bombing of the Iranian consulate in Syria – stepped the two countries closer to direct confrontation. That’s enough to scare anyone – especially the markets.

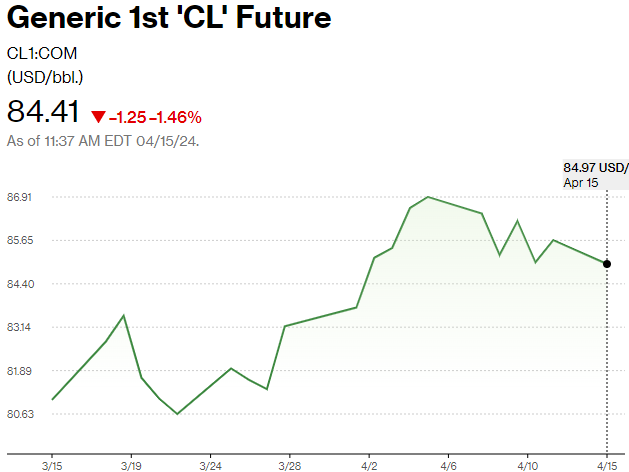

The number one market concern is the price of oil. It’s assumed that, if an all-out war were to start, Iran would immediately close the Strait of Hormuz with its navy. This tactically important stretch of water handles the flow of 20 million barrels of oil per day. That’s more than 30% of the total world oil supply.

Right now, the market is continuing to be calm. Oil was up on the news of the attack, but as of this morning was nearly 3% below the highs we saw earlier this month. That trade will be important to watch this week.

Source: www.bloomberg.com/quote/CL1:COM

Past performance is not indicative of future results.

The bigger question is how far this conflict goes. As hard as it is to believe, there is some argument that Iran’s attack was meant to signal strength – but also to limit the spread of the conflict. The attack was telegraphed, not aimed at civilians, and largely defeated by Israeli air defense and support by the U.S., U.K., and other allies.

Just last week, while Tehran was raging about its response, it was also telling Arab nations its response would be “measured”. That was, in fact, the result. Now the ball is in Israel’s court. Some, like their National Security Minister, are calling for violent reprisals. But, according to U.S. officials, Israel has told us it is “not looking for a significant escalation”.

Can calmer heads prevail? We hope so. A full-scale war in the Middle East will undoubtedly have negative economic effects. But if the market’s reaction over the weekend is much of an indication, that’s not the base case expectation at this point.

And so, we take another deep breath and dig into a week that should bring more positive earnings news and some important commentary from Fed Chair Powell on Tuesday. We’ll update you next Monday.

Sincerely,