The Weekly Insight Podcast – A Sometimes Bubbly Path

In last week’s memo, we addressed the positive outlook we had for the market over the next 30 – 60 days. That was, of course, promptly met by the market falling at the start of the week!

But as you know by now, success in the market isn’t about day-to-day movements. It’s about having a long-term strategy in place to weather the storms and participate in the good while it happens. That’s why we’ve been so darned upbeat for a while now: there is – and has been – a lot of good in which to participate.

But the day-to-day stories make for interesting dinner table conversation and news copy – especially when there isn’t really anything to talk about. Last week was a quiet time for markets. Earnings season hadn’t quite kicked off (it starts in earnest this week) and there wasn’t a lot of meaty economic news.

So, what was it that had the market off 2% from its highs by Thursday (before gaining back half that loss on Friday)? Well… it was good news.

You’ve heard this tale from us before: good economic news in a time of high interest rates can indicate it will be less likely the Fed is going to cut interest rates. The theory is that cutting into a strengthening economy can reignite inflation and reverse all the wonderful progress we’ve seen so far. But before we get into that, let’s look at what we learned last week.

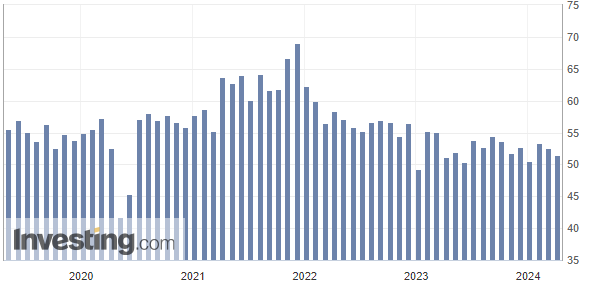

1. PMI Data Remains Resilient

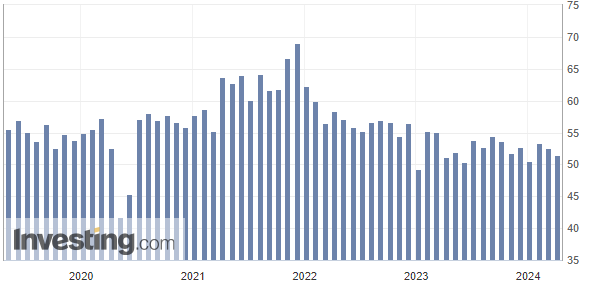

We haven’t talked about PMI data recently, but it breaks down into two basic categories: manufacturing and services. Manufacturing is…well…manufacturing. Services is everything from restaurants to movie theaters to software companies. Businesses that don’t make physical things, but instead provide services.

PMI stands for Purchasing Managers Index and is read this way: any number above 50 is expansionary and any number below 50 is contractionary. Expansionary is always good, but when concerned about inflation, we don’t want it to be too good.

Both manufacturing and services hit that mark last month. Manufacturing came in at 50.3, marking our first time in expansionary territory since January 2022.

ISM Manufacturing PMI

Source: Investing.com

Past performance is not indicative of future results.

Services came in at 51.4, below last month and the forecast, but still in the “low expansionary” camp we’ve been in since January of 2023.

ISM Services PMI

Source: Investing.com

Past performance is not indicative of future results.

It was the “good but not great” report we want to see right now.

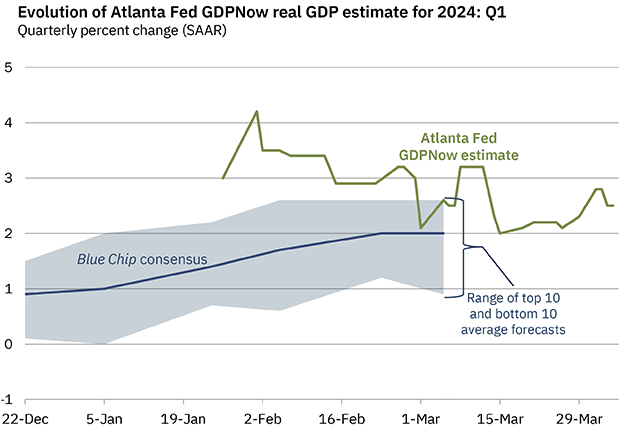

2. GDP Expectations Are Rising

Our friends at the Atlanta Fed came out with their most recent update on Q1 GDP expectations twice last week. The update on Monday bumped GDP expectations to 2.8% before they revised them on Thursday to 2.5%. Both are up strongly from the 2.0% expected in the middle of March. 2.0% is also where the “consensus” amongst economists is today.

Source: www.atlantafed.org/cqer/research/gdpnow

Past performance is not indicative of future results.

3. Employment Data Remains Strong

Then came the employment data. There was a lot of it last week, but the big story was Friday’s jobs report which showed the economy adding 303,000 jobs in March (beating the expectation by 33,000 jobs). We live in a funny world when too many people working is a sign we might be headed for trouble!

It’s notable that our economy is now net-positive 4.63 million jobs since the start of the pandemic. You may not remember this, but the economy shed 21.238 million jobs in just the first two months of the pandemic! Since then, we’ve added back 25,868,000 jobs.

We’ve only had one month since May 2020 when we lost jobs (January 2021), but the growth was hot and heavy at certain periods. But in the last 12 months we’ve added at a pretty steady rate, averaging 250,000 jobs per month.

But when we think about jobs and risks of inflation, there are two numbers we’d encourage you to pay a bit more attention to than the number of new jobs: labor force participation and wage growth.

You remember all the concerns about low labor force participation when the COVID recovery started. By August of 2020, participation in the labor market had dropped dramatically from a high of 63.4% to 60.2%. That 3.2% drop doesn’t seem like much, but at a time when employers were looking for workers, which equated to 6.5MM less workers from which to hire. That’s why wages shot up so high.

That number has recovered nicely now to 62.7%. But it has also happened at a time when our working age population has grown. That means pre-COVID we had 130 million workers participating in the labor market. Today we have 131 million. We got all the jobs back and we have more people trying to be employed.

But the big kicker here is wage growth. Growth in average hourly earnings fell again year-over-year to 4.1%. We’re still high relative to the 3.3% wage growth we saw pre-pandemic. But we’ve come a long way from the 5.6% growth we saw in January of 2022.

So Why Did the Market Drop Last Week?

Great question, right? Strong – but not too strong – economic data and the market capitulates? We’d posit there were a few reasons:

- Not much is going on! No Fed meetings, no earnings…not much for the market to worry about. So, it could get all wrapped up in this data. That was a big driver of this.

- This week is a big week for news. Some of our biggest financial institutions release earnings this week and we get updated CPI data. This might have been a case of folks preparing themselves for bad news – even if it isn’t expected.

- There were a few big outlets this week which are now starting to predict zero rate cuts in 2024. That’s a big departure from what the Fed has said recently.

No rate cuts? We’ll see. But it’s not what Chairman Powell thinks. When commenting Tuesday on recent higher than expected inflation reads, he said they “don’t change the overall picture”:

“The recent data do not, however, materially change the overall picture, which continues to be one of solid growth, a strong but rebalancing labor market, and inflation moving down toward 2% on a sometimes bubbly path”.

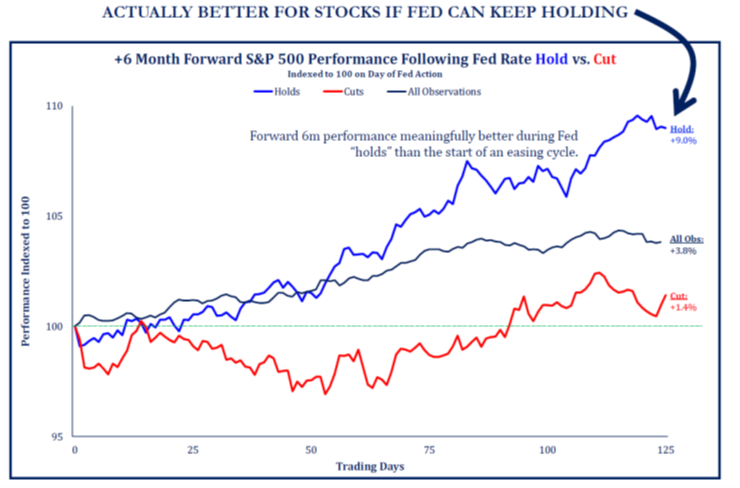

That “sometimes bubbly path” may slow up the Fed in coming months. And it will certainly induce short-term scares like we saw in the market this week. But we must remember one particularly important data point: markets perform better in stable rate environments than they do in falling rate environments!

Source: Strategas

Past performance is not indicative of future results.

Higher for longer will be a problem if it’s too long and those high rates drive us into a recession. But that’s not what is happening today. Our economy is growing. The time to run for the exits will come, but it’s not today.

Sincerely,