The Weekly Insight Podcast – Devil on Your Back

Your author spent the past weekend on the road visiting family for Easter. And as is true with any road trip with young children, the battle over what’s playing on the car speakers is a good one. But sometimes the music just plays, and the car goes quiet, and you hear a lyric you didn’t notice before.

On this trip, it was a lyric from the band Florence + the Machine singing “Shake It Out”. Not exactly Beethoven, but a good jam nonetheless. But this line stood out:

“It’s hard to dance with a devil on your back”.

Maybe it had been a long week at that point. Lord knows Florence + the Machine isn’t speaking to stock market performance! But that lyric really seemed to stick when thinking about the last four years in the stock market.

Four years ago, we were in the thick of it with COVID. “15 days to slow the spread” was in full effect. The economy was shut down. And over the next 48 months we experienced massive unemployment, inexplicable government stimulus, supply shortages, labor shortages, inflation, too much wage growth, bear markets, bull markets, etc., etc., etc. It’s been a wild run. There’s always been a devil of some kind on our backs. As soon as it seemed like we fixed one problem, another came along.

But has it really been that tough? Is that devil we feel on our back legitimately dragging us down? Or is he imagined? As with all things, that depends a bit on your perspective. Did you own equities? U.S. or foreign? Bonds?

Past performance is not indicative of future results.

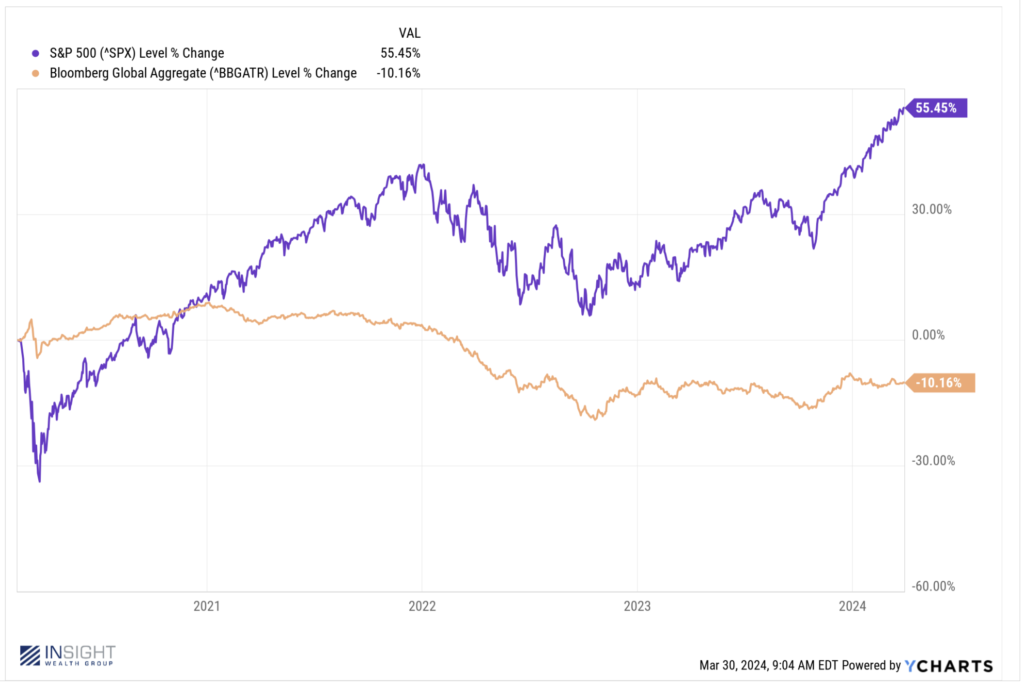

The chart above shows the big gulf between U.S. large cap equity returns and bonds since the pandemic began. Yes, anyone who owned a portfolio of nothing but U.S. Treasuries going into the pandemic – who didn’t make any changes – has had a bad four years. But we’ve never met that person.

Let’s keep it simple though: imagine you held the two assets above (S&P 500 and Bloomberg Bond Index) at a weight of 70% equities and 30% bonds. Even with the pain of early 2020 and the nightmare that was 2022, that portfolio did 8.57% per year. That’s not a devil on your back. It’s…dare we say it…pretty good performance!

Which brings us to the next few months. In this period where everything has seemed “tough”, the next two months don’t look it. There’s really nothing to expect from the Fed right now. The next meeting isn’t until May, and no one expects them to do anything on rates at that meeting. The next potential rate conversation happens in June, at the same time as the next dot plot.

And, in the meantime, Powell seems happy about where we’re at with inflation. In responding to Friday’s PCE inflation data, he described it as “along the lines of what we want to see”. The market shrugged its shoulders and moved on.

It’s also the start of earnings season. Consensus estimates for Q1 are…meh. The market is expecting S&P 500 earnings for the quarter to have grown 3.6% over the same quarter in 2023. That’s not a big hurdle to clear. And given the current broadening of the rally – towards areas other than the Magnificent 7 – it should be positive for the market.

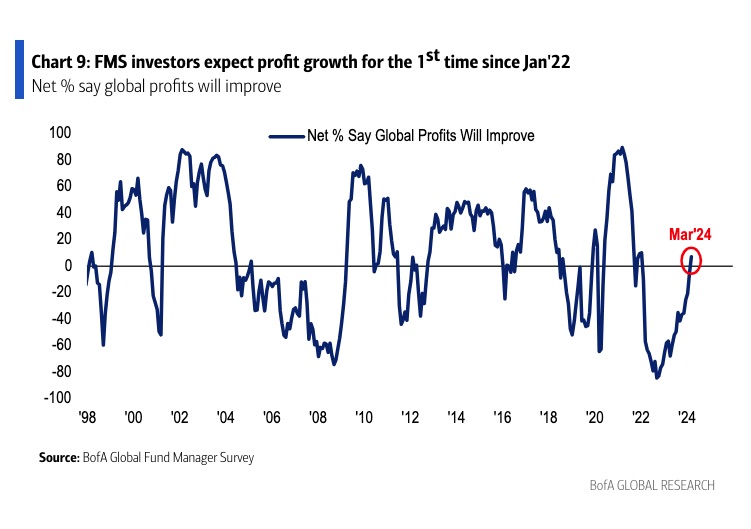

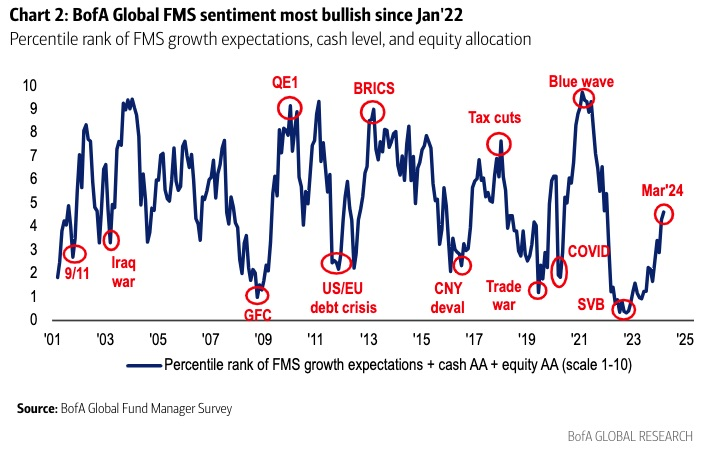

We’re not the only ones who think so. Bank of America runs a regular survey of institutional fund managers. Last month’s edition – which included responses from more than two hundred fund managers with more than $500 billion under management – showed the most bullish optimism we’ve seen since the Fed started raising interest rates.

Managers are now predicting profit growth in the market for the first time since January 2022.

Past performance is not indicative of future results.

And their bullish sentiment is the highest we’ve seen since that time as well. But what’s notable is it is not an absurd or outlandish amount of bullishness. It’s instead in line with what would be described as “middle of the road” for the last 24 years.

Past performance is not indicative of future results.

Simply put, the devil is off our back. For right now. This is a bit of a goldilocks period. We don’t expect it to last long. The volatility inherent with a close Presidential election is going to raise its head this summer. The Fed has the potential to make it a long summer as well. But, for this moment – and the next 60 – 90 days – things are looking rather good for the markets. Let’s enjoy it while we can!

Sincerely,