The Weekly Insight Podcast – Slowing the Run Off

Last week, we talked about the market moving on from the Fed. But just because the market wasn’t viewing every economic data point through the lens of what the Fed would do, the Fed’s direct actions still have the ability to move markets and – most importantly – bring the current rally to a screeching halt. That’s why we ended last week’s memo with this:

If the Fed comes out and drastically changes their expectation for rate cuts, it will impact the market. If (the number of rate cuts for 2023) falls dramatically, the market will have a bad week.

Well, Fed week is over, and we’ve heard the proclamations from Mt. Powell. There was no change in the expectations for rate cuts in 2024. A market that stalled out waiting for an answer responded strongly and closed the week above 5,200 on the S&P for the first time in history. The market is done with the Fed…for now. We’ll be back to this conversation before the next meeting in May.

But while the discussion has always seemed to be about interest rates, there’s another conversation Powell had this week with reporters that is quite important: the Federal Reserve’s balance sheet. This was a much-asked question at Powell’s press conference on Wednesday, but it is not something which is discussed much in the news.

The whole point of the Fed’s policy actions is to either tighten or loosen monetary policy to impact the overall economy. If things are running too hot (inflation), they will tighten things down. Economy cooling off or a recession on the way? Loosen things up.

We’re all familiar with the most public way this happens: interest rates. Raising interest rates tightens economic conditions and can help cool off an overheating economy. The opposite for lowering rates.

But that is not the only tool in the Fed’s arsenal. The other is their balance sheet. What is that?

In general practice, the Fed’s balance sheet contains a mix of publicly traded bonds. Mostly this is U.S. government bonds, but at various times over the last 16 years, the Fed has bought and sold mortgage bonds, corporate bonds, etc. But how does that impact the economy?

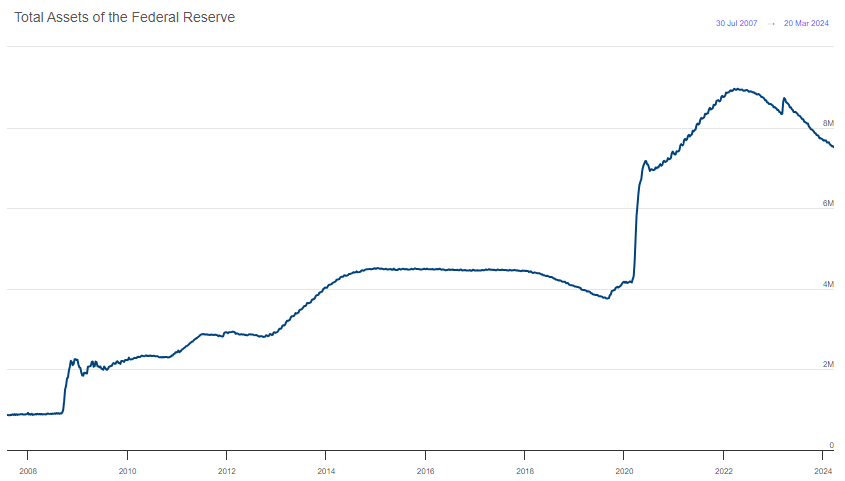

It’s basic economics. If the Fed were to go out and buy Treasuries, they would inject capital into the economy in exchange for the interest-bearing bonds they receive. That extra capital – or cash – in the economy can help stimulate economic activity. In that manner, it’s easy to “grow the Fed’s balance sheet”, which is something the Fed did in earnest coming out of the 2008/2009 financial crisis as well as during COVID. Growing the balance sheet is stimulative to the economy and – given the wrong environment – inflationary. Think of it as the cousin to cutting interest rates.

Shrinking the balance sheet, on the other hand, is the cousin to raising interest rates. Money is sucked out of the economy, tightening up money supply and slowing down the economy. The Fed has been doing that – along with raising interest rates – since the spring of 2022.

There are two ways to shrink the balance sheet. The most immediate – and draconian as it comes to slowing the economy – is for the Fed to be selling bonds in their portfolio into the public markets. That would suck cash very quickly out of the economy. But that’s not what they’re doing nor, frankly, something they intend to do.

Instead, the Fed is allowing assets on their balance sheet to “run off”. That means they’re letting bonds they have purchased mature but are not redeploying the cash received from the maturity back into the marketplace. That simple strategy has shrunk the balance sheet by $1.4 trillion in the last 22 months.

Source: www.federalreserve.gov/monetarypolicy/bst_recenttrends

Past performance is not indicative of future results.

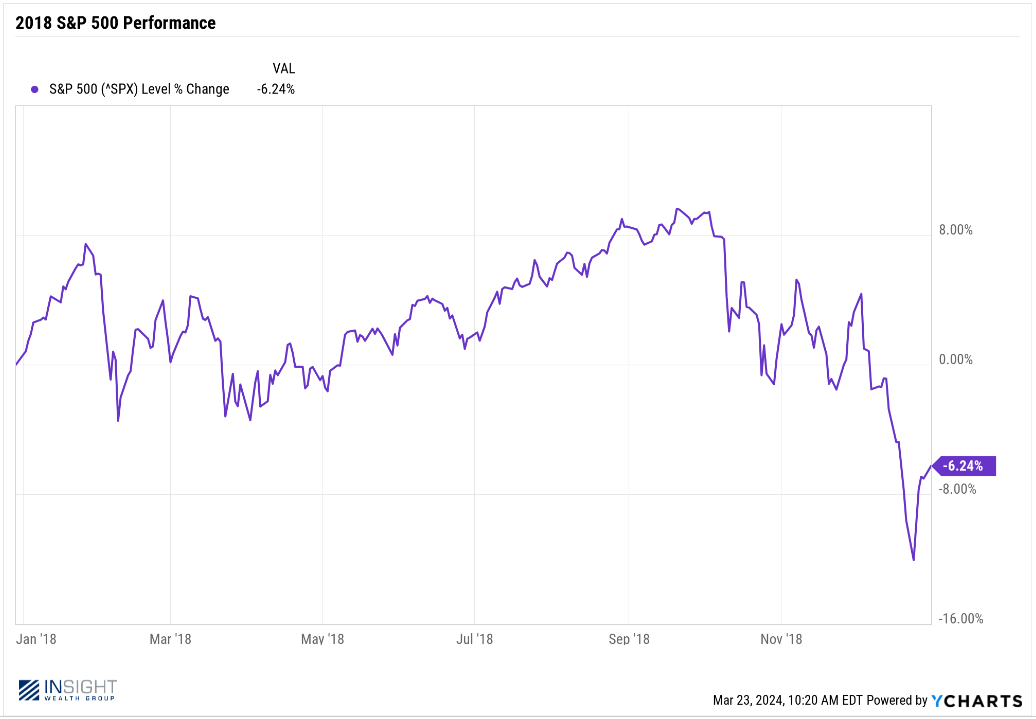

As you can see from the chart below, using the Fed’s balance sheet to manage the economy is a fairly new practice. Pre-2008, the Fed holding enormous amounts of public securities on their balance sheet was unheard of. But it became the heart of monetary policy throughout the 2010s. It wasn’t until 2018 that the Fed started trying to trim their balance sheet and the first try didn’t work out well. The combination of rate increases and tightening lead to an oft forgotten, but pretty ugly 2018 in the markets.

Past performance is not indicative of future results.

That’s reminiscent of what we experienced during the heart of this tightening cycle in 2022. But Powell & the Fed didn’t immediately reverse course like they did back in 2018. That’s about to change. They’re getting close to backing off and it impacts what our expectations should be coming out of Fed meetings for the next few months.

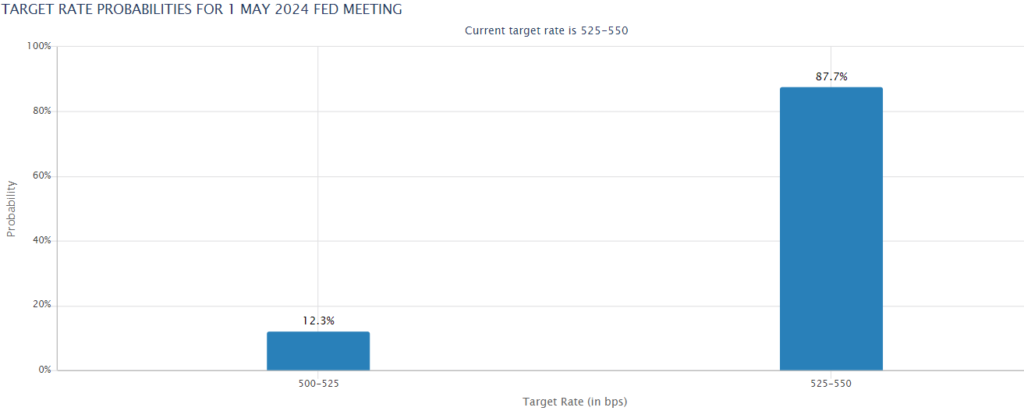

There is strong consensus that the Fed isn’t going to cut interest rates in the May meeting. The current probabilities show an 87.3% chance of the Fed holding rates steady, up from a 76.4% chance 30 days ago.

Source: www.cmegroup.com

Past performance is not indicative of future results.

We also know there won’t be another “Dot Plot” until the June meeting. So, barring any wild swings in inflation, the interest rate conversation is – while still important – on the backburner until June 12th.

That leaves the balance sheet conversation. And Powell seemed to indicate that slowing the pace of the runoff was coming soon – potentially as early as May:

“Turning to our balance sheet, our securities holdings have declined by nearly $1.5 trillion since the Committee began reducing our portfolio. At this meeting we discussed issues related to slowing the pace of decline in our securities holdings…The general sense of the Committee is that it will be appropriate to slow the pace of runoff fairly soon”.

How do they slow the pace? They start buying more treasuries with the proceeds from matured bonds. While that doesn’t mean more cash in the system, it does mean less cash removed from the system. And that, in its own way, will be stimulative – or at least less restrictive – on the economy. It’s a half measure to rate cuts.

Right now, the market is loving this path. And it means, much like we discussed last week, the market can forget about the Fed for the time being (at least the next six weeks!) and instead focus on what’s ahead. And what’s ahead is an earnings season which has the potential to be incredibly positive for the markets. We’ll get into that next week.

Sincerely,