The Weekly Insight Podcast – Moving On (From the Fed)

If you take a look back over the last two years, what happened last week in the economy should have been quite consequential. We are just a few days away from a Federal Reserve meeting (wrapping up on Wednesday) and last week we got the final inflation print prior to the meeting via the CPI data.

We’ll go through the data in detail in a second, but let’s encapsulate it this way: any “miss” in CPI immediately before a Fed meeting in the last 24 months has been considered a calamity for the markets. While those calamities have proven to be short-lived, it was consequential, nonetheless. And last week’s CPI report was, by any definition, a miss.

But it wasn’t a particularly bad miss. Core CPI, while still dropping year-over-year, came in 0.1% higher than analysts expected. All items CPI moved up year-over-year from 3.1% to 3.2% compared to the expectation that it would remain flat at 3.1%.

The headlines were about as you would expect on Tuesday morning after the data was released:

- CPI Unexpectedly Rises

- Inflation Could Keep the Fed from Cutting Rates Anytime Soon

- Data Release Shows Inflation Stayed High

- CPI Comes in Hot for Second Straight Month

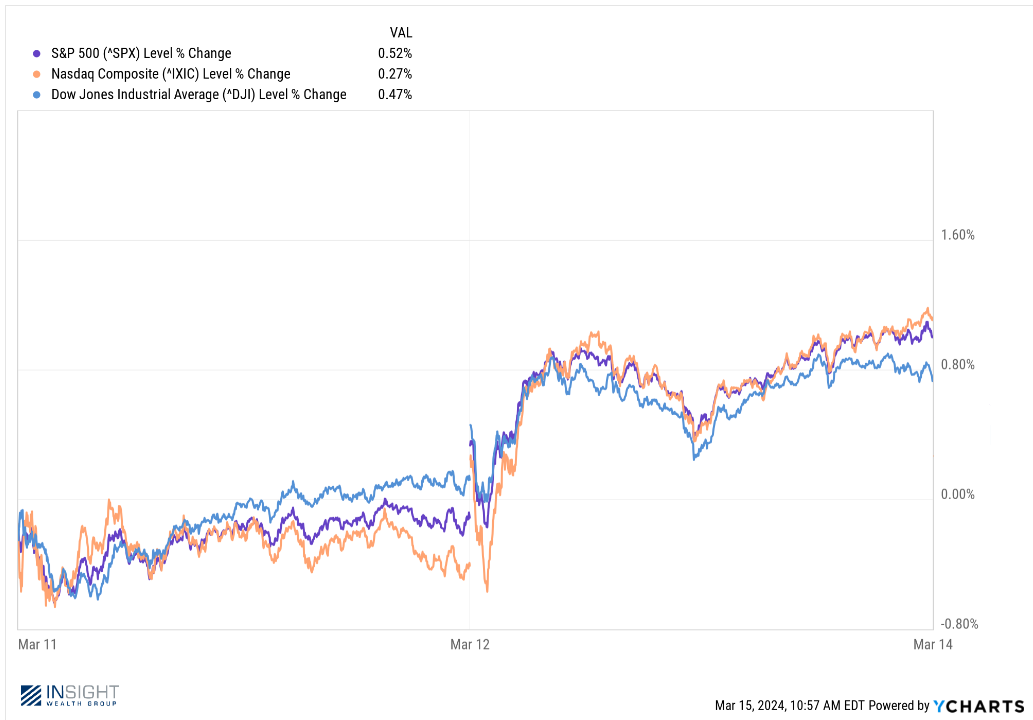

Uh-oh. Here we go again. The market, so focused on the Fed as the determinate factor in returns, surely won’t like this, right? Not exactly. In fact, after a quick drawdown after the report, the market closed up nicely from the beginning of the day, and well ahead of the previous day’s close.

Past performance is not indicative of future results.

This is, very quietly, an important moment for the market. This is the moment the stock market moved away from the Fed being the driver for success. And it may be especially important to how portfolios perform for the rest of the year.

Lower Isn’t Always Better

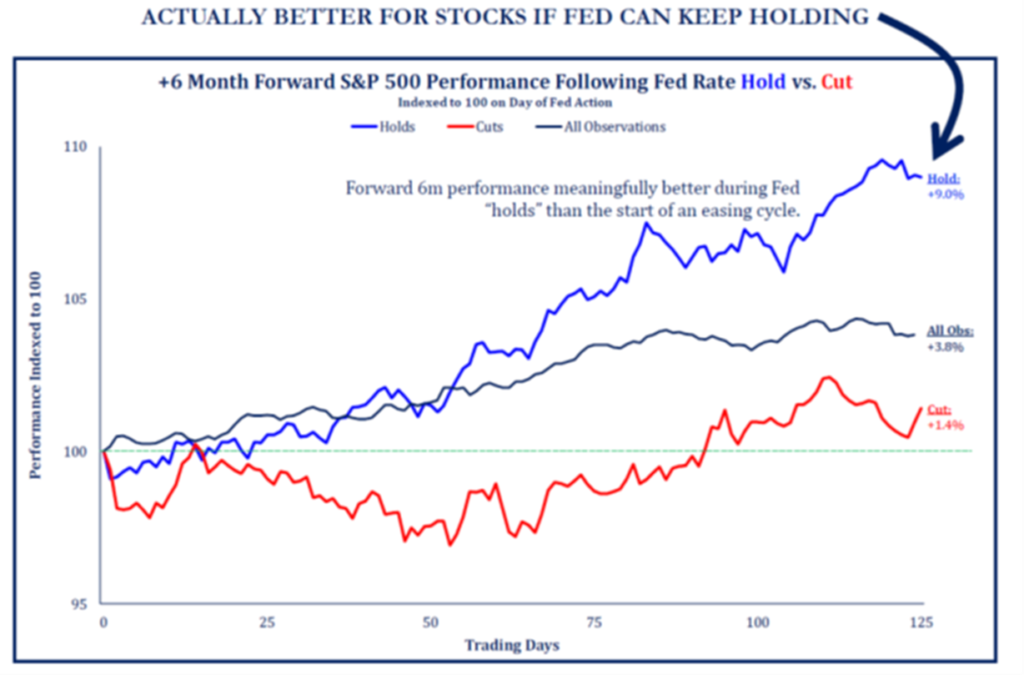

The message everyone has been receiving from the financial press is that if the Fed lowers rates, the market is going to take off! That may, in fact, be true. But history doesn’t back up that assumption. In fact, rate cuts correspond with a significantly lower market return (at least initially) than periods when the Fed is holding rates steady. And it’s not even close. Hold periods outperform by 7.4% over a 125-day period.

Past performance is not indicative of future results.

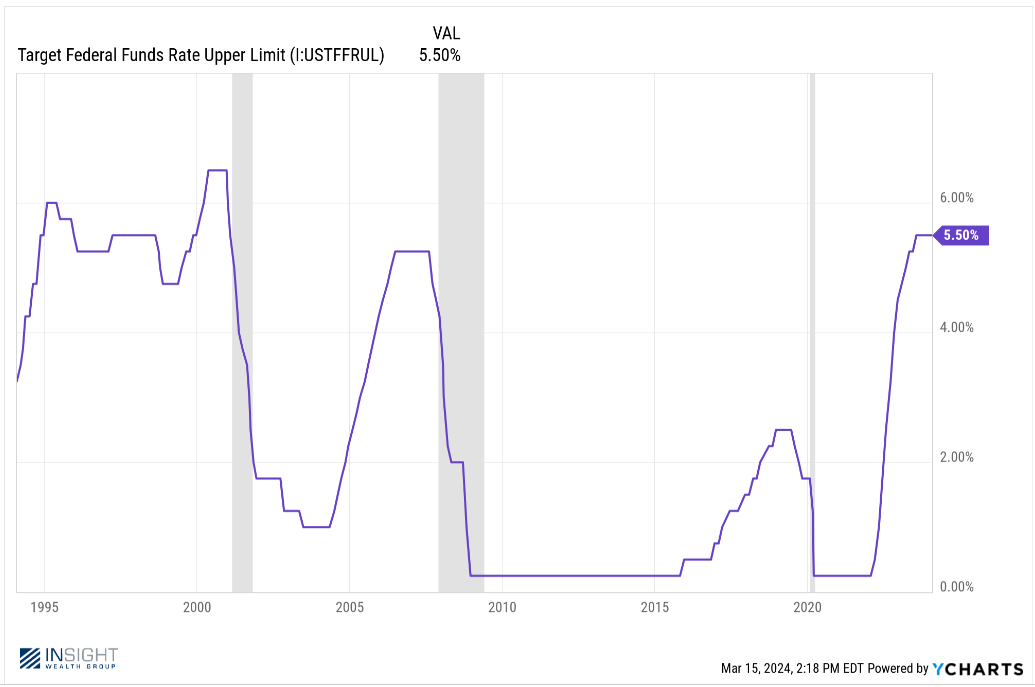

But there is an important “why” that needs to accompany this chart. When is it, historically, that the Fed is cutting rates? When the economy is slowing down. A slowing economy has as much or more impact on the market than rate cuts. The chart below clearly shows that each of the last three major rate-cutting cycles have been swiftly followed by recessions (areas shaded grey).

Past performance is not indicative of future results.

Nonetheless, it’s important to remember that rate cuts aren’t a panacea. There’s more to the market than what the Fed does, even if that seems to be all that has mattered for the last two years.

Healthy Economy May Matter More

We’ve talked in these pages many times about the one thing the market loves: certainty. There is little of it in the world today (have we ever had it?), but the Fed has given us one gift of certainty in the last three months: they aren’t raising rates anymore.

While the initial reaction of the markets was to expect – and bet on – immediate interest rate cuts, the focus has shifted. And it’s shifted to a surprisingly good place in our opinion: questions about profitability, earnings, and economic strength. And today those questions are showing us to be in a great position.

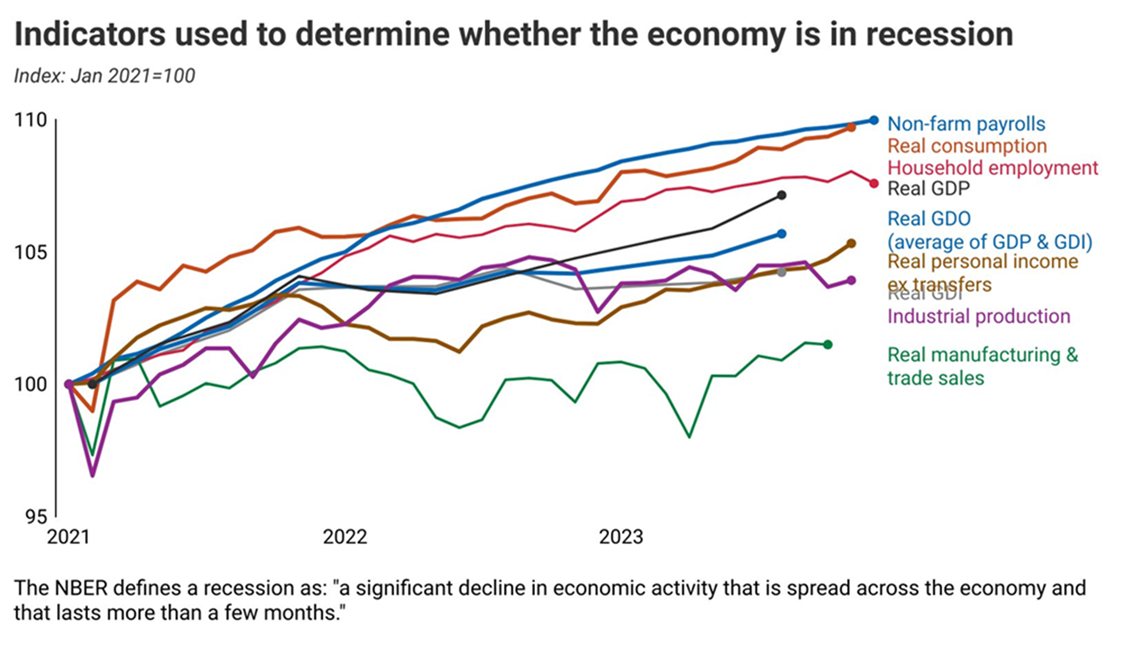

Every category measurement of the economy that the National Bureau of Economic Research looks at to determine if we’re in a recession is in expansionary territory right now (i.e., above 100 in the chart below). Not only that, almost every category is expanding more rapidly.

Past performance is not indicative of future growth.

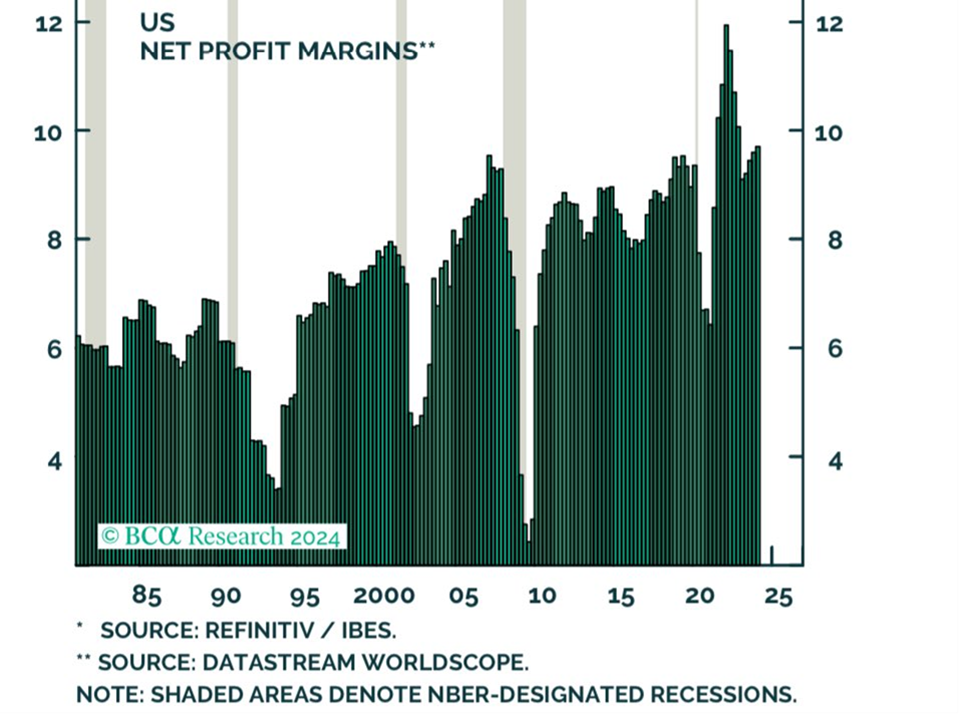

Corporate profits – which should matter a lot when determining market value – may no longer be at the all-time post-COVID highs. But they are expanding and now above the pre-pandemic highs.

Source: BCA

Past performance is not indicative of future results.

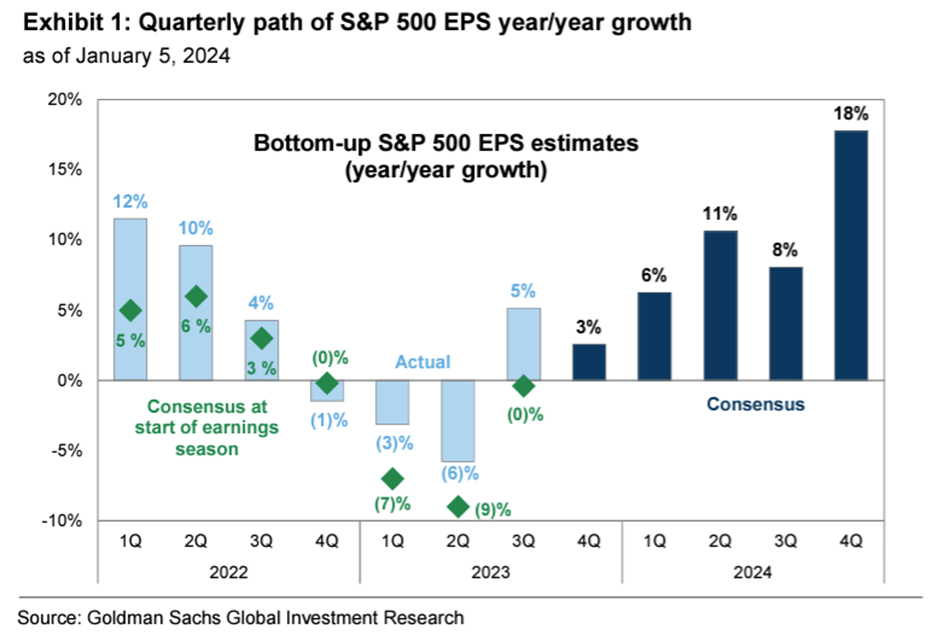

And, perhaps most important to the market, the earnings recession of 2023 is officially over. S&P 500 EPS growth for 2024 is anticipated to be quite strong, building upon the results we saw in the last half of 2023. As of Friday, the consensus estimate is that FY24 earnings will be 13.3% higher than FY23. That won’t be bad for market returns.

Past performance is not indicative of future results.

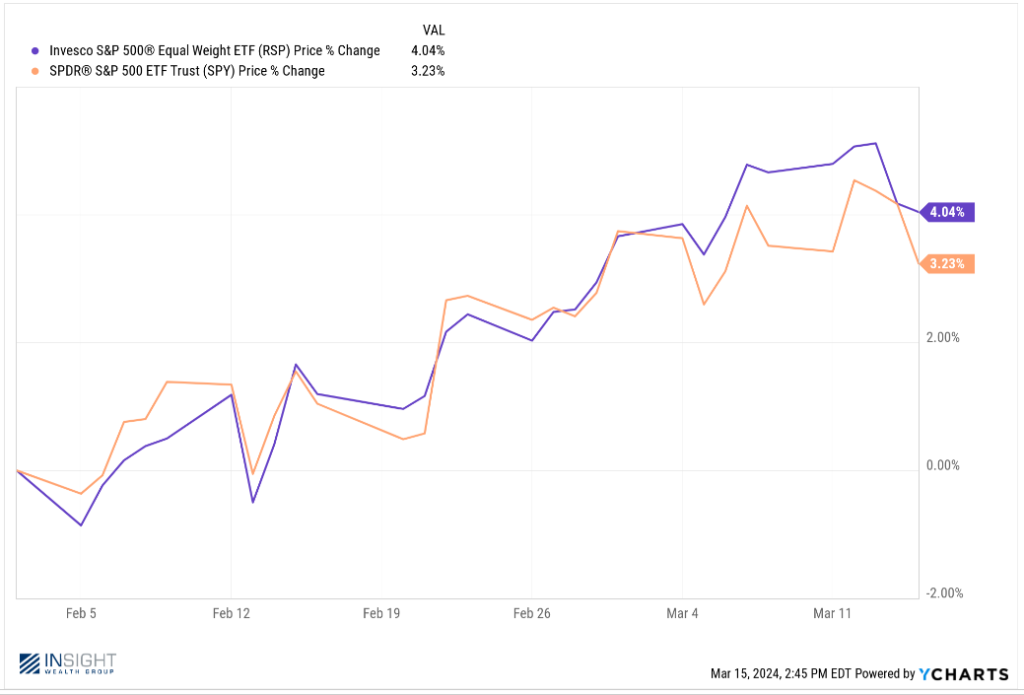

All of this also explains why we’re starting to see a broadening of the market’s performance. The last three years the market has been excessively tied to the performance of large cap equities. Large cap – primarily big tech – was the biggest riser in 2021 and 2023. And it pulled markets down with it in 2022.

But since early February, an equal weight S&P 500 investment has outperformed the market cap weighted version that highlights the performance of the biggest names in the index.

Past performance is not indicative of future results.

The Return of the Dreaded SEP

None of this is to say, sadly, that what the Fed announces on Wednesday doesn’t matter. It does and always will. And, whether we like it or not, this Fed meeting also includes the release of the latest version of the “Summary of Economic Projections” or SEP.

The SEP is where the Fed lays out, four times per year, the infamous “Dot Plot”. You’ve heard us be very frustrated in the past about how much value the market ascribes to the Dot Plot. It has zero predictive function, but investors let it play with their emotions four times a year anyway.

And so, we’ll be watching the Dot Plot carefully. If the Fed comes out and drastically changes their expectation for rate cuts, it will impact the market. In December they were predictive three cuts. If that number – after last week’s CPI data – falls dramatically, the market will have a bad week. We just need to be patient and understand that the fundamentals the market is finally paying attention to again haven’t changed. And they’re looking pretty solid at this point.

Sincerely,