The Weekly Insight Podcast – 2024 Concerns and Opportunities

We’re not big “New Year’s Resolution” folks here at Insight. In our business, if there’s something you need to change, you’ll regret waiting until the new year. Better jump on that right now! But the New Year is an excellent time to take stock of things. How did last year go? What opportunities and/or concerns await us in the future? What should we be doing right now to prepare?

So, as we do each year, our first memo of 2024 will be focused on looking at the “big trends” we saw in 2023 and what we expect to see in 2024. As you’ll see, we didn’t always get everything right last year (or any year!), but overall, it was a pretty good run.

The Fed

It goes without saying that we wrote a lot about the Fed in 2023. Their battle against inflation was the biggest story line in the markets for the second year running. In our first memo of 2023 (Big Trends), we asked if the “end of rate hikes” was near.

We were pretty reserved about predicting the future of Fed policy (not dumb considering the Fed doesn’t seem able to predict the future of Fed policy!). But we did note that it was clear at the time – when the Fed Funds rate sat at 4.375% – that rates weren’t going up forever. As we wrote last January:

“The debate is not about rates going up to 6.50%. It is instead about ‘will we get a 0.50% hike in February or a 0.25% hike’ or ‘will we get 0.75% in total hikes this year or 1.00%?’…this is all around the margins. Barring dramatic changes in inflation, the era of 0.75% hikes is over. That is a good thing for the markets”.

The big miss was the timing. We noted at the time that the market consensus was rates would peak at 5.00 – 5.50% sometime in May or June and that rates would then retreat to closer to 4.50% by year end. The market nailed the total rate increase. But it was the Fed’s reluctance to retreat in the second half of this year that led to significant market volatility.

The Recession That Never Was

The common criticism levied against this commentary over the years is that we’re “too optimistic”. Maybe. But maybe that’s the point. The truth is, historically, the most catastrophic events for the market are the so-called “black swans”. The things no one sees coming and which are nearly impossible to avoid.

That’s why we’ve been so down on this recession idea for the last two years. We spent a lot more time on this topic in 2022 than last year, but the point was still the same: there is an industry of “economic gurus” telling you the world is ending. But the data is saying exactly the opposite. We remember well, in early January 2022, when famed investor (and even more famous perma-bear) Jeremy Grantham predicted a 50% correction in the stock market.

At the time, we told you an economic collapse would be necessary for that to happen. We saw no economic collapse, and thus saw no cratering of the markets.

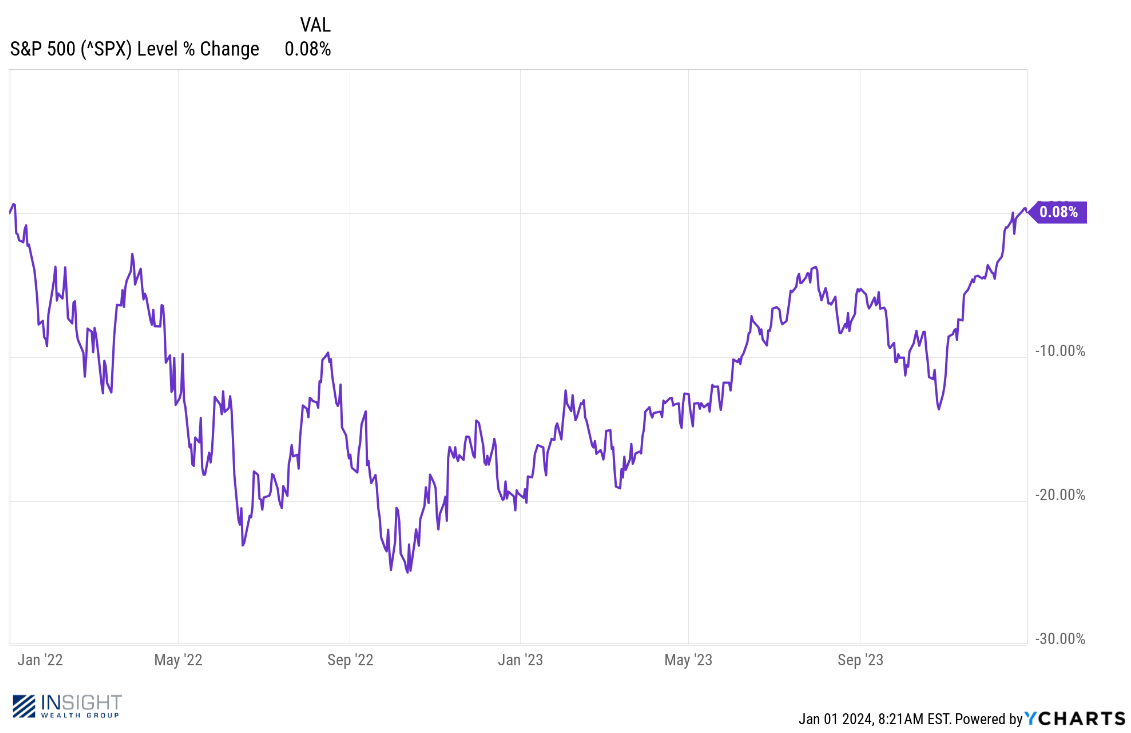

But we all know that 2022 was a rough year in markets. 2023 was a great year. The end result? The market is back where it started.

Past performance is not indicative of future results.

So, while we never got the recession (one that will come eventually), we did get a “recession” in the stock market back in 2022. The great lesson from this? Avoiding the collapse in 2022 meant significantly better returns over the two-year period. The irony was that, despite our supposed optimism, we were more conservative in 2022 than the broader market. The result has been positive for clients over the long term.

2024 Concerns and Opportunities

So that leads us to 2024. What are our biggest concerns? And where are the places where we can find opportunities to make money? It turns out they are inextricably linked.

Government Shutdown

Washington is always a concern for us. We all know the outsized impact policy and politics have on the broader market and economy. But 2024 is particularly primed to be a year in which politics plays a huge role in your portfolio.

It starts later this month when we face yet another “government shutdown” debate. The good news, as you will recall, is that Congress suspended the debt ceiling until the end of this year, so we won’t have to worry about Washington not paying its bills. But on January 19th, the government will shut down without a budgetary agreement between House Republicans and the White House.

This is happening in the charged atmosphere of a Presidential election year, so all bets are off on what the result will be. An extended shutdown will undoubtedly impact the market. A short-term shutdown much less so. We’ll be watching this closely over the coming days and weeks.

Presidential Election

You’re going to hear us talking about elections more this year than we have in years past. Why? This one is going to be crazy. While we all have our personal opinions about what the best outcome would be, this memo will stay agnostic about the pros and cons about each candidate. The bigger concern for us is your portfolio.

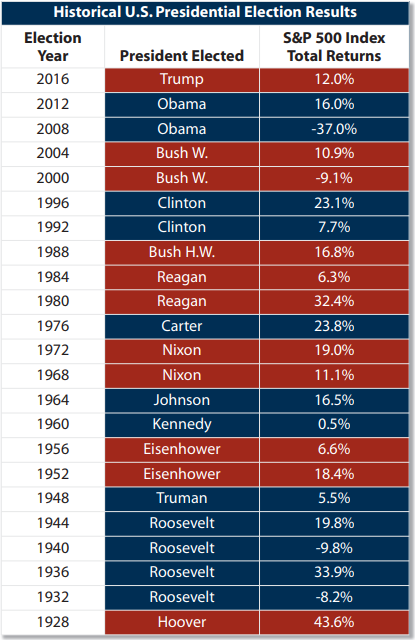

Historically, a Presidential election year has been exceptionally good for portfolios. Going back to the 1928 election, the average stock market return in a Presidential election year has been 11.28% – no matter which party won the election. We’d take that in a heartbeat. There have only been four election years in that time which have seen negative stock market returns: twice during the Great Depression (1932 & 1940), when the tech bubble burst (2000) and during the Great Financial Crisis (2008). One could make a compelling argument that external events besides the election were moving returns negatively.

Source: First Trust Portfolios

Past performance is not indicative of future results.

The timing of these returns, however, is particularly important. They tend to come early in the election year, or after the election. Volatility jumps dramatically in the 60 days before the election. If we assume the two candidates this year are Trump and Biden, we expect that trend to continue. As such, you may see us get a bit smaller in portfolios as the election nears, then look to put our foot on the gas in the closing months of the year.

International Affairs

This is a bit of a catch all section, but it’s an important reminder. The U.S. is important – but there’s a lot that happens elsewhere in the world that can impact your retirement. Nearly 40% of the revenue in the S&P 500 comes from overseas.

What will be the drivers in 2024? Does China start to pull out of their economic malaise? What happens in Ukraine if U.S. politics allows Putin a window to advance? Does a broader conflict expand in the Middle East?

We don’t have any great insight into these issues beyond knowing they must be carefully monitored. If they start to rear their head in a negative way, we may need to look at derisking parts of our international holdings.

The Big Picture

In the end, the big picture remains today what it was before the calendar turned. The U.S. economy is strong and expanding. Inflation is falling. The Fed is looking to begin rate cuts. And a recession is still several months away in the worst-case scenario.

While we’ll watch our “concern” list closely, this should be a year of opportunity in portfolios. We’re looking forward to seeing what the next twelve months bring!

Happy New Year!

Sincerely,