The Weekly Insight Podcast – Old Saint Jerome

Editor’s Note: Please note that Insight’s offices (and the markets) will be closed the next two Mondays in celebration of Christmas and New Years Day. The Weekly Insight will not be published next week, but will return on Tuesday, January 2nd.

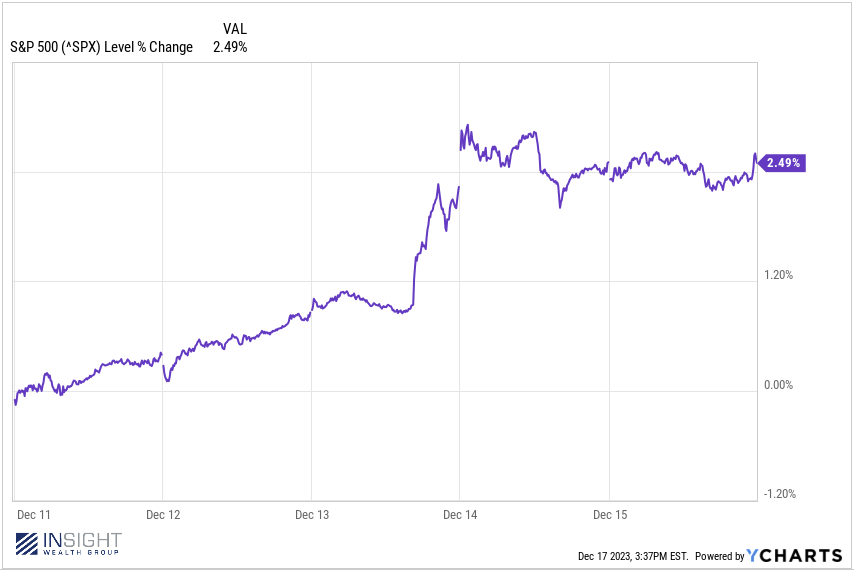

We said last week that there was one more bogey that could screw things up for the markets before year end: the last Fed meeting of the year. The question wasn’t really whether they would raise rates again – most thought that was unlikely. The real concern was whether Powell & Company would throw cold water on the idea that rate cuts may begin to happen sooner rather than later.

Well, there wasn’t any cold water. Instead, Old Saint Jerome and his merry band of elves brought gifts. Lots of them. It was a stunning shift in tone from the Fed and the market loved it. Regular readers know we have mocked Chairman Powell a bit over the years because of the market’s dire reaction when he steps to a podium. Not this week. The market took off when the Fed released their formal statement, went up when Powell spoke, and held strong through the end of the week.

Past performance is not indicative of future results.

By any measure, it was a good week. And we’re now able to say, despite all the volatility we’ve seen, 2023 has been a solid year in portfolios.

But what was said, and what can be inferred, about what is going to happen next year? Will 2024 be a positive year? Let’s take a look.

The Dot Plot

We really hate the Fed’s Dot Plot. The market puts so much emphasis on it, despite the fact it has ZERO predictive value. One need only look at the dot plot from December 2021 to understand this. The Fed, two years ago, said they intended to raise rates 0.75% in 2022. They raised rates 4.75%! Heck, they had raised rates 1.75% by June! If the Fed doesn’t know what they’re going to do six months from now, we should be extremely cautious using it as a predictor.

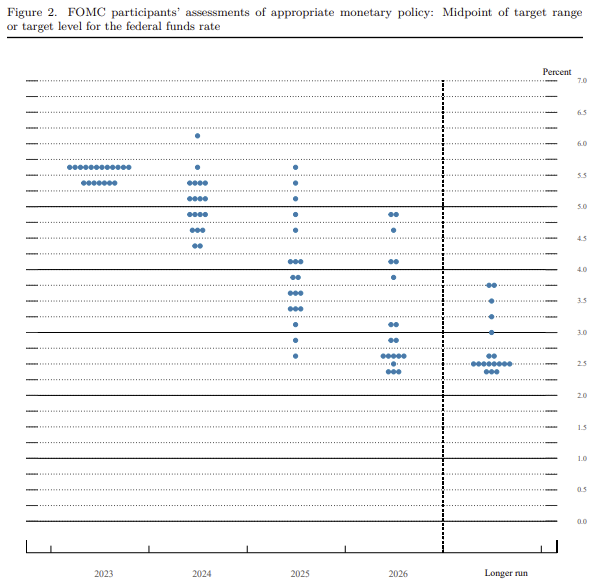

But it does have some use to understand their shifting opinions. The last time we saw the dot plot was in September. It looked like this:

Source: FederalReserve.gov

That plot called for one rate hike before the end of 2023. And it had the median expectation for the Federal Funds rate at 5.0% – 5.25% at the end of 2022.

We all know we haven’t gotten another hike since September. That was good news no matter what. But the change in expectations for next year was substantial. You’ll note from the most recent dot plot below that the Committee is much more clustered around cuts (no more outliers at 6%+), and the median rate is now down to 4.50% – 4.75%. That’s a full 0.50% lower than just three months ago.

Source: FederalReserve.gov

That is what we call a pivot. And, frankly, it’s a big one.

Powell’s Poker Face

Hopefully, you’re not the nerds who schedule time out of your day to watch Jerome Powell’s press conferences. We’ll do that for you. But if you did, the dot plot wasn’t the only thing that shifted. The other was Powell’s tone. He had an extremely tough time keeping his “don’t take this as good news” poker face on.

It started right out of the gate, in the first paragraph of his prepared remarks. He noted that “inflation has eased from its highs, and this has come without a significant increase in unemployment. That’s very good news”. (emphasis added). When was the last time you heard Jerome Powell describe what was happening in the economy as “very good news”?

It continued throughout his remarks and the answers to the questions posed by reporters. There were the normal caveats that “inflation remains above the 2 percent target”, the FOMC will “proceed carefully”, and they reserve the right to raise rates again if necessary. But he couldn’t help himself. Much like Old Saint Nick, he felt rather good handing out presents last Wednesday.

While he never did declare victory, it was in an answer to a question from Rachel Siegel of the Washington Post that he got the closest. She asked him if he could “confidently say that the economy has avoided a recession”. His response was telling.

While he – appropriately – reminded the group that we always have a risk of a recession (see last week’s memo), he pointed out he believed it was possible to get past this current bout of inflation and interest rate hikes without a recession.

“I have always felt, since the beginning, that there was a possibility, because of the unusual situation, that the economy could cool off in a way that enabled inflation to come down without the kind of large job losses that have often been associated with high inflation and tightening cycles. So far, that’s what we’re seeing. That’s what many forecasters on and off the committee are seeing”.

That is the Chairman of the Fed telling you he thinks we’re going to get a soft landing. He goes on to note that “this result is not guaranteed” but given his reticence in the past to be optimistic on this point, it’s a positive sign.

The Market Doesn’t Believe the Fed

The next big question is when do the cuts start? Powell was very non-committal on that front. Notoriously hawkish New York Fed President John Williams came out later in the week and said it was still “premature” to even be discussing rate cuts. So that leaves us with three cuts at an undetermined – and potentially far away – time.

The market isn’t buying it. In fact, the market isn’t buying three rate cuts. It thinks the cuts will start quickly and be more dramatic than Powell & Co. have projected. Current models have cuts starting in March. The total anticipated number of cuts is six!

Source: CME Group

Don’t get us wrong – we would love six rate cuts. That would make for a heck of a year in public markets. But the majority that we will end 2024 at 3.75% – 4.00% or below seems a bit optimistic. Counting on a March cut seems the same.

The truth is it’s not like we can expect smooth sailing and sunny skies throughout 2024. There is a lot to be worked through: a potential government shutdown in January, a contentious Presidential election in November, a potentially slowing economy and/or a recession. But right now, at this moment, things are looking positive. The battle with inflation and interest rates has nearly reached its end. We can figure out the next battle as it comes. In the meantime, enjoy this holiday present from Old Saint Jerome!

Sincerely,