The big story this week is the Federal Reserve’s meeting on Wednesday. The concern remains the same: will the Fed raise rates?

Many of us here at Insight are parents of young children. Asking this question – again – feels like when our kids ask us for candy. And then, after we say no, they ask again in five minutes. And again. You get the drift. So why, when the Fed has been perfectly clear about its intentions, should anyone be worried about this week’s meeting?

The Short Term

The short term is where investors live most of the time. It is ironic when you think about it. Long-term holders of assets tend to do very well. But everyone is trying to second guess the game in the short term.

So, once again, the short term is what investors are focused on when they stress about what the Fed will say this week. The argument goes like this:

“Yes, the Fed has said that they believe the current spikes in inflation to be “transitory.”

“But last week’s inflation data was scary.”

“What if inflation isn’t transitory?”

“What if the Fed decides it isn’t transitory?!?!”

“Oh no! The Fed is going to raise rates this week, aren’t they?!?!”

Full disclosure: The Fed may raise rates this week. Anything is possible. But everything they have said – and everything institutional money is doing right now – is saying otherwise. Let’s take a look.

The Record

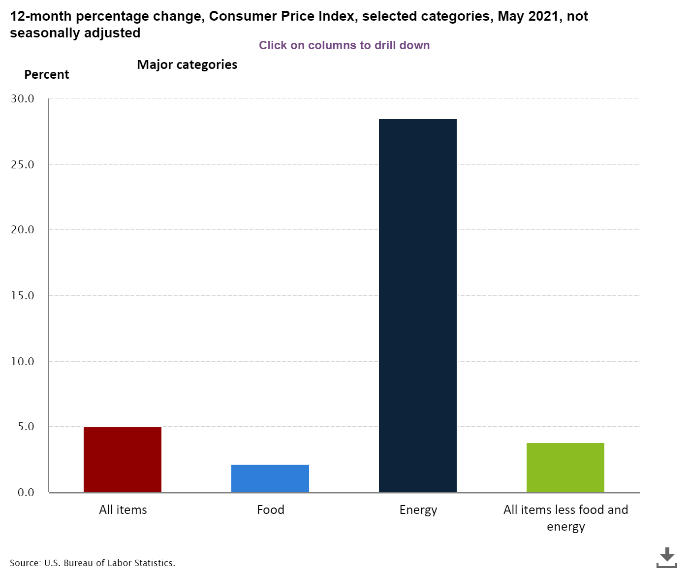

First, it’s true. Last week’s inflation data was a little scary. Core CPI, the data set the Fed chooses as their inflation guide, was up 0.7% in May and is up 3.8% over the last twelve months. Energy prices, which are not included in Core CPE, are up 28.5% over twelve months ago.

As you will recall from previous memos, the Fed has said their goal for inflation is 2%. By our math 3.8% is much higher than 2%. Rate hikes must be coming, right?

Let’s take a look at the record. And by the record, we mean let’s actually look at what the Federal Open Market Committee has said – something we would guess many commentators do not actually take the time to do.

On their 2% goal for inflation:

“The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. With inflation running persistently below this longer-run goal, the Committee will aim to achieve inflation moderately above 2 percent for some time so that inflation averages 2 percent over time and longer-term inflation expectations remain well anchored at 2 percent.” (Emphasis added)

There are two things of note in this statement:

- The Fed is going to let inflation run hot so they can average 2 percent. This is a significant policy change (made last July) from previous tactics.

- Inflation is not the only thing to pay attention to on rates. The Fed is also targeting “full employment” which we are a long way from achieving.

The idea of not raising rates too quickly is tied to two historical fumblings of interest rate policy in the last decade. The first was when the European Central Bank decided to hike rates when we saw transitory inflation coming out of 2008/2009. Those early rate hikes are often credited with slowing Europe’s recovery out of the Great Financial Crisis. The second is the Fed’s own hiccup in 2018 when the market reacted poorly to a series of rapid rate increases before inflation was able to take hold.

On “transitory” inflation:

“Readings on inflation have increased and are likely to rise somewhat further before moderating…as the very low readings from early in the pandemic fall out of the calculation and past increases in oil prices pass through to consumer energy prices…However, these one-time increases in prices are likely to have only transitory effects on inflation.”

“With regards to interest rates, we continue to expect it will be appropriate to maintain the current 0 to ¼ percent target range for the federal funds rate until labor market conditions have reached levels consistent with the Committee’s assessment of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time. I would note that a transitory rise in inflation above 2 percent this year would not meet this standard.” (Emphasis added)

– Fed Chairman Jerome Powell

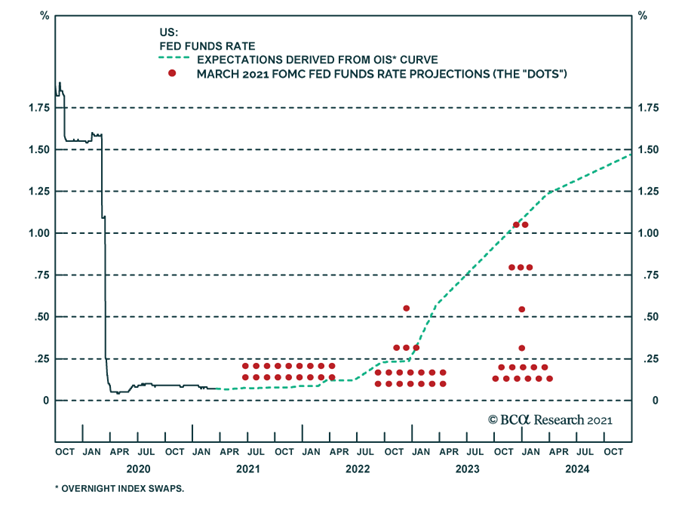

Chairman Powell is clear in his remarks – from just one month ago – these kinds of spikes in inflation are not going to change their view. This is consistent with what we know about how the Committee is voting. No member expects a rate hike in 2021.

What Is the Bond Market Saying?

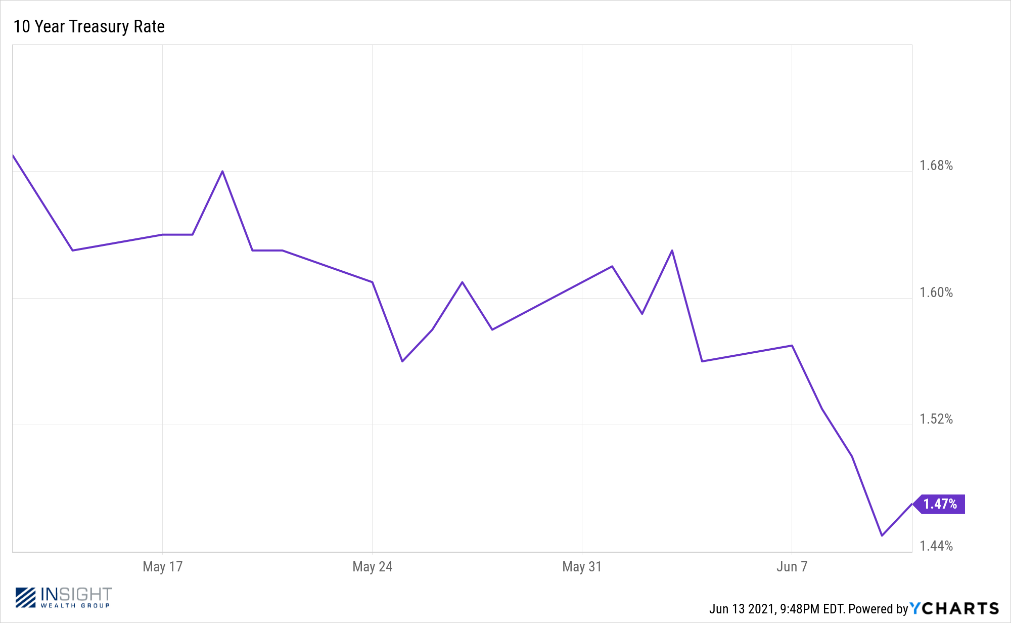

While we know the pundits can make a lot of noise, we must get past the din and focus on what the market is really saying. In this case, it is pretty easy. Just look at 10-year treasury yields. If the market were concerned about a rate hike, Treasury yields would be spiking. Instead, amid all this inflation talk, Treasury yields have actually declined 13% over the last 30 days. The market thinks the Fed means what they say.

What if We Are Wrong?

Truthfully, we are not that worried about being wrong this week. If we are, it would be a stunning about face by the Fed and they would typically start to message something like that ahead of time. But, just to play the devil’s advocate, we will say this: if the Fed does jump the gun on rates this week the market will freak out a bit in the short-term. Bond yields will spike, equities will drop. The big, over valued tech names will suffer the most. But we also know the first-rate hike in a cycle does not mean the end of equities. As the chart below shows, equities have historically still performed well in a rising rate environment.

We will be watching anxiously on Wednesday to see what Chairman Powell has to say when he steps to the podium. While we know this game cannot go on forever, we do not anticipate any changes that should cause you heartburn. If that changes, we promise you will hear from us!

Sincerely,