If you are a fan of football, you know who Greg Olsen is. He is a legendary tight end who played most of his career in the NFL with the Carolina Panthers. On the field, he was an amazing producer, which is how NFL players – just like those of us in other fields – are judged. But off the field he is a father and a husband, a role which is much more challenging right now.

He has a son, TJ, who is 8 years old. He has struggled with heart problems since birth and has had three open heart surgeries. Late last month, Olsen announced his son’s heart was failing, and he would need a heart transplant.

When he tweeted about the situation, he made a statement which really hit home:

“We do know that we are in full control of our attitudes and our outlook.” What a statement. We do not want to reduce this to something quaint, but if a man who is dealing with his son’s life-threatening heart failure can believe that, anyone can.

Controlling Our Attitude & Outlook

Mr. Olsen’s quote got us thinking about something we have talked about before in these pages – but deserves repeating. There are many failed “financial advisors” who got into this business thinking it was entirely a math problem (i.e., the Outlook). They failed when they couldn’t, or wouldn’t, understand this undertaking – while based on math – is also rooted deeply in psychology (i.e., the Attitude).

We have been blessed at Insight that our clients tend to have the right attitude about investing. You have heard the old Warren Buffet line before: “Be fearful when others are greedy and greedy when others are fearful”. It sounds great rolling off the tongue but is a lot harder to implement when the proverbial “stuff” hits the fan.

Last year was a great exercise in this process. Our clients – you! – did not freak out when the market was down more than 30% in March. You held the line which allowed us the flexibility to respond aggressively to the issues at hand. That is in stark contrast to how the average investor typically behaves in times of crisis. The fear and greed cycle is just too strong of a pull. The Dalbar Study on Investor Behavior from 2017 tells us the average equity investor has underperformed the S&P500 by nearly 3% per year over the previous 20 years. On a $100,000 investment, over the 20-year period, that equated to $84,323 less in gains. It’s equally bad for fixed income investors. The 20-year underperformance was nearly 5%, meaning $70,326 less gains on a $100,000 investment.

As we look forward, the temptation to be too greedy – or too fearful – continues to be one which must be avoided. We continue to be in strange times – but now, instead of a virus, we are dealing with monetary policy and fiscal policy driving the bus. And it is very possible they don’t have a map.

Inflation Concerns

We were doing a little research over the weekend and ran across an interesting phenomenon which we think is representative of the situation today: car shopping. For this example, we are going to use a Toyota 4Runner TRD Pro.

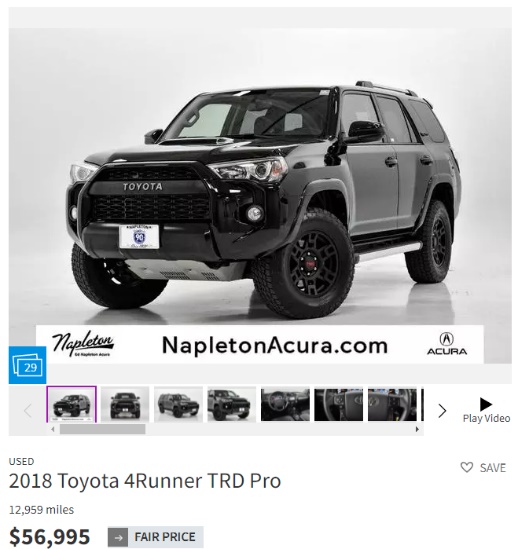

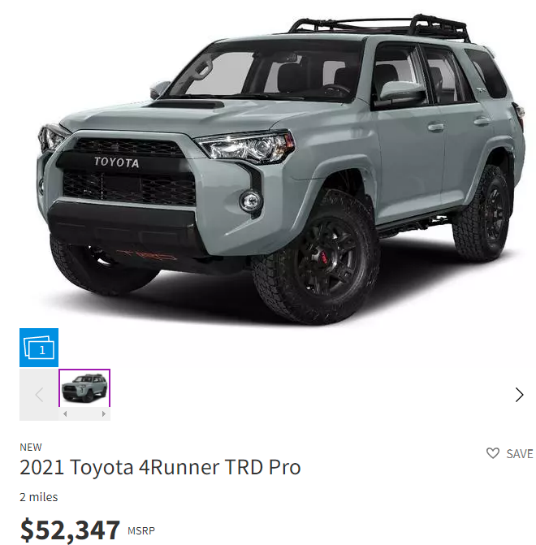

What caught our eye was an advertisement for a 2018 4Runner TRD Pro with 12,959 miles. The price? $56,995.

We then went and quoted a brand new 4Runner TRD Pro. This car is three years newer and has 2 miles. The price? $52,347. $4,648 cheaper to buy a brand-new car vs. a used car.

Why? Government intervention (i.e., more cash in people’s hands) and scarcity (i.e., production still catching up).

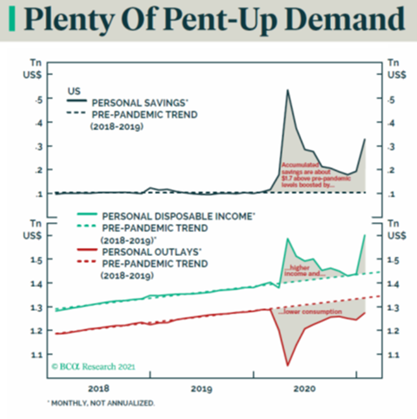

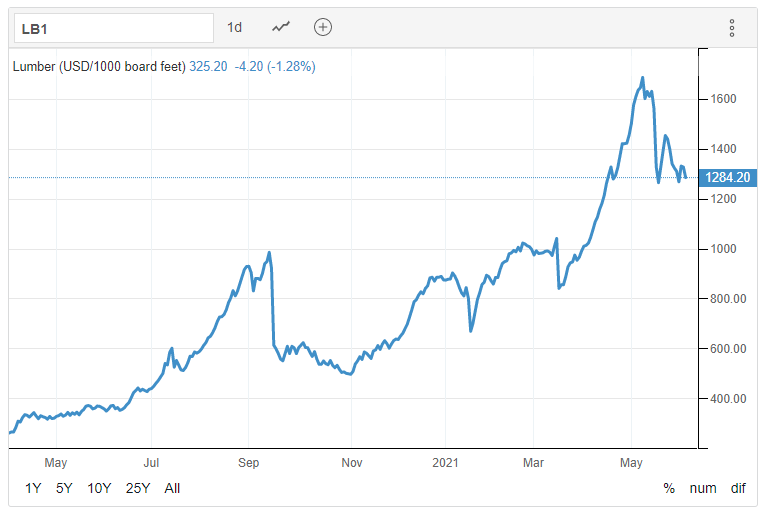

The same game is playing out in homebuilding today. A report recently found increased lumber prices are adding $36,000 to the price of a new home. When you read that, it seems like a lot. But when a prospective buyer is meeting with the banker and it means an extra $7,200 down on the loan, it doesn’t seem outlandish. You’re not going to let that stop you from owning your dream home, right? And considering many families have more cash today than they have had in a long time, it can seem like a reasonable cost.

Source: BCA

So, this is inflation, right? Yes – but that’s not the right question. The right question is: is inflation here to stay? We – along with the Fed – would say no. This is, instead, something called “transitory inflation”: a short-term hiccup when high demand meets struggling supply.

We are big believers in the old-fashioned metrics of capitalism: supply and demand. History would tell us when there is an imbalance – either way – price pressures cause equilibrium to catch up quickly. Yes, some aggressive buyer will probably pick up a used $57,000 4Runner. But will the whole market be willing to do that? Or are they more likely to wait to buy a new one for nearly $5,000 cheaper? And will every homebuyer be willing to mark up a new home $36,000 right now? Or will they wait for lumber prices to come back down?

Jobs May Tell the Story

Friday’s jobs report may give us a good look into this situation. It was a good report – or at least much better than last month. The U.S. economy created 559,000 jobs. More people are looking for work (a big positive for employers). And unemployment declined to 5.8%.

But there was one interesting bit of negative news. Construction employment was down 20,000 jobs in May and has now lost 225,000 jobs since February.

We know by now you don’t believe in coincidences. But look at this chart below. Since the end of February jobs report for Construction – when the decline started – the price of lumber has risen nearly 30% and was, at one point, up more than 60%.

So, since lumber prices skyrocketed, jobs are being lost in the construction industry. It looks like the consumer is wise to transitory inflation after all. And prices are starting to show it.

Hold the Line

We all remember the lesson from our parents on “delayed gratification”. From a financial planning perspective, this is one of those times. “Controlling our attitude and outlook” is vitally important. You may be able to afford that used Toyota – but do you need it? Or can you wait a few months to get a new one? Same goes for the house, or the new computer, or the boat. We believe if you can hold the line today, you may see some real opportunities down the road.

And by the way. Greg Olsen’s son? He received a heart transplant on Friday. We hope he can live a long, happy, and healthy life. It is clear he has a good team around him.

Sincerely,