As we come out of Memorial Day weekend, we’ve been thinking a lot on the meaning of the holiday. To many, it is the “Start of Summer!” A time to grill burgers, enjoy your favorite beverage, and break out the swimsuits. But to many, it is a hard-earned remembrance of battles fought and loved ones lost. A time to pay tribute to those who have given their lives for the freedoms we hold so dear.

One of our authors spent much of Saturday walking his children through the graves of lost relatives, including those who battled for the Union with the Grand Army of the Republic and fought the Nazis in the skies over Germany. It was a reminder of just how lucky we are, but also of the cost to get here. There is a line by Churchill that says: “Never in the field of human conflict was so much owed by so many to so few.” He was talking about World War II – and specifically the debt owed to those “so few” which included over 407,000 Americans killed in combat.

Yet, as we sit here today, in the midst of a different kind of global conflict – the “War on Terror” – which is now nearly 20 years old, we may have lost a bit of perspective. 7,057 U.S. soldiers have died fighting for us in the last 20 years. That is a remarkably low number compared to the “so few” of World War II. But still a tragic cost to those who have lost friends and loved ones.

As we think about those who have lost their lives defending our freedoms, it is also important to think about what their sacrifice has meant – in real terms – so we’ll be willing to defend it in the future. Those of us at Insight saw it staring us right in the face at one of the other great end of May traditions in this country: High School graduation.

If you’ll excuse us a moment of personal pride, the oldest daughter of Insight – Karlton Kleis’ daughter Emerson – graduated this week. She is the oldest of 7 cousins in the Dorr/Kleis family. And – as it is her uncles writing this – we can say it is nearly impossible to believe she is old enough to be moving on to college! But as she does, it was also apparent to us just how well prepared she and her friends are for the next step. If she is any indication, the future is bright, and hopeful, for this country. As we all get older, we lose that perspective sometimes – but it’s important to keep. The world is changing – no doubt – but there is always room for optimism.

Sell in May and Go Away?

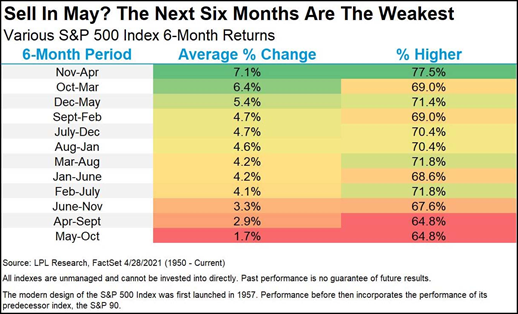

There’s an old saying in the investing world: Sell in May and go away. And the truth is, there is some historical precedent for it. As you can see from the chart below, the best six-month period for the S&P 500 is November to April. The worst? May to October.

The problem with data sets like this is they assume everything is always “average”. And we hope you’ve figured out by now that this period in history is anything but average. Massive Federal stimulus, historically low interest rates and a reopening economy make this nugget of historical trivia largely irrelevant right now.

The best example of why not to trust axioms like this? Last year. If you would have sold in May 2020 with the intention of buying again on November 1st, you would have missed out on a massive rally. The bigger question right now? Is there something that can crater the economy enough to cause a retracement? We haven’t seen it at this point, but we’re always on the lookout.

Retroactive Tax Increases?

As you know, we’ve been following President Biden’s tax proposals very carefully. Since taxes are the single largest expense our clients will have in their lifetimes, it has a huge impact on financial planning.

The discussion up to this point has been fairly…vague. We know what President Biden wants to do. Increase taxes on the wealthy and corporations through changes in corporate rates (up to 28% from 21%), income tax rates (raising the top rate to 39.6%), lowering the estate tax exemption and raising the capital gains rate for the largest earners. Still, there is always a gap between what a President wants and what he can get passed through Congress. So, while there is plenty to speculate about, there is very little hard data until we start seeing legislation proposed in Congress.

Well, last week we started to see some legislation proposed in Congress. President Biden submitted his fiscal year 2022 budget to both branches of Congress, and it contained an interesting nugget. His budget assumes his capital gains rate increase started in April (i.e., 60 days ago). That’s right…it’s retroactive. If this is successful, any financial planning tools we would hope to deploy surrounding a future increase in this rate are for naught.

The White House’s argument for this is pretty straightforward: they do not want investors to be able to dodge the higher rate if it goes into effect next year. The unstated reality is that it makes his budget proposal look much more palatable since there is significantly more revenue to offset some historic spending.

In the end, this is a negotiating point. Even Democrats in Congress don’t want to raise cap gains to 39.6%. They think 30% is much more palatable. Maybe it turns into a number somewhere in between and goes into effect at the end of the year? We’ll see. But it’s safe to say this tax policy debate is going to be as important – if not more – than the performance of the market when it comes to client’s portfolios. You’ll be hearing a lot from us on this topic.

Normalcy is Creeping In

If you’re like us, you’re noticing the little things that are changing out in public these days. Crowds are larger in public places. Less masks are seen in the grocery store. Public events are starting to happen again.

To some this can be a little nerve racking. While we’ve made significant progress on a vaccine, we’re still not where scientists would hope we would be. Currently in the U.S., 41.2% of the population has been fully vaccinated. The number of fully vaccinated people is rising at roughly 670,000 per day, meaning we’re still roughly 141 days from reaching the magical 70% threshold.

But it’s notable what is happening right now. You may recall the argument last year about the virus “going away” when the weather warmed up. That didn’t happen. In fact, cases spiked through the months of May and June last year. In Iowa, we were at a 7-day moving average of 348 new cases of COVID per day on May 30th last year.

Today, even with the world substantially more “open” than it was a year ago, the story is very different. The 7-day moving average for cases in Iowa has dropped every day this month. It currently stands at 108 and only 53 cases were reported last Friday. The vaccines are working and there is hope for a return to normal. That’s good for our portfolios, but also good for our souls!

We hope this update finds you well!

Sincerely,