We have a member on our team who gets annoyed when we use the phrase “unprecedented” in these memos. As he says: “That phrase has been entirely overused” since the pandemic started. And he’s right. It is pretty unoriginal at this point.

But, like it or not, we have seen things happen the last 15 months that no one anticipated. Stay at home orders, breakdowns in supply chains, massive government intervention. All of that is new to the world. But the calculus since the market bottomed last March has been simple:

(Federal Stimulus + Low Interest Rates) – COVID cases = Stock Market Performance

As you know, we have spent a lot of time in these pages trying to answer the follow-on question: What is the impact of our current fiscal and monetary policy in the long-term? While we have some ideas, no one really knows for certain. And we got some economic news this week that just helped solidify that case.

Disappointing Unemployment Numbers

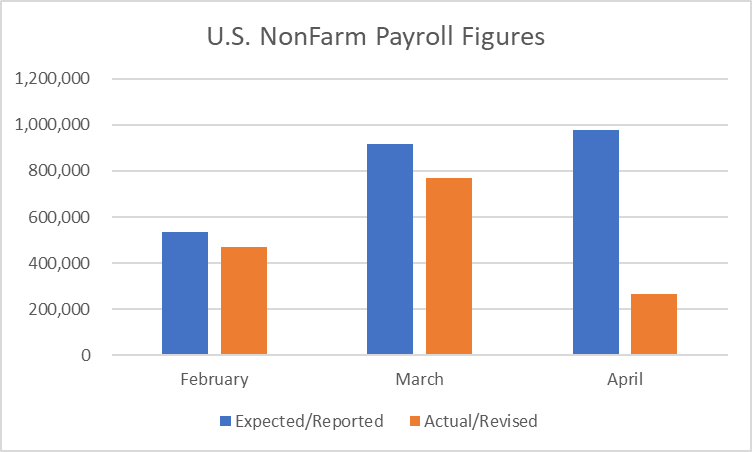

Disappointing may actually be the wrong phrase here. The April non-farm payroll numbers came out on Friday, and they were a huge whiff. The expectation was that we had created 978,000 jobs in April. Some analysts were whispering about a number larger that 1,000,000 jobs (which would have been huge). The real number? 266,000 jobs. Just 27% of the expectation.

And the damage did not stop there. Our unemployment rate actually rose to 6.1%. That’s not a horrible thing, as it means a few more people are looking for jobs. But we will get to that in detail a bit later.

On top of that, they did significant revisions to the data for February and March. It was previously reported we created 536,000 jobs in February. The actual number was 68,000. The original March number was huge at 916,000 new jobs. That came all the way back to 770,000. So, in total, the April report meant the economy has filled 926,000 less jobs over the last 3 months than analysts believed. That’s a big number.

There ARE Jobs to be Had

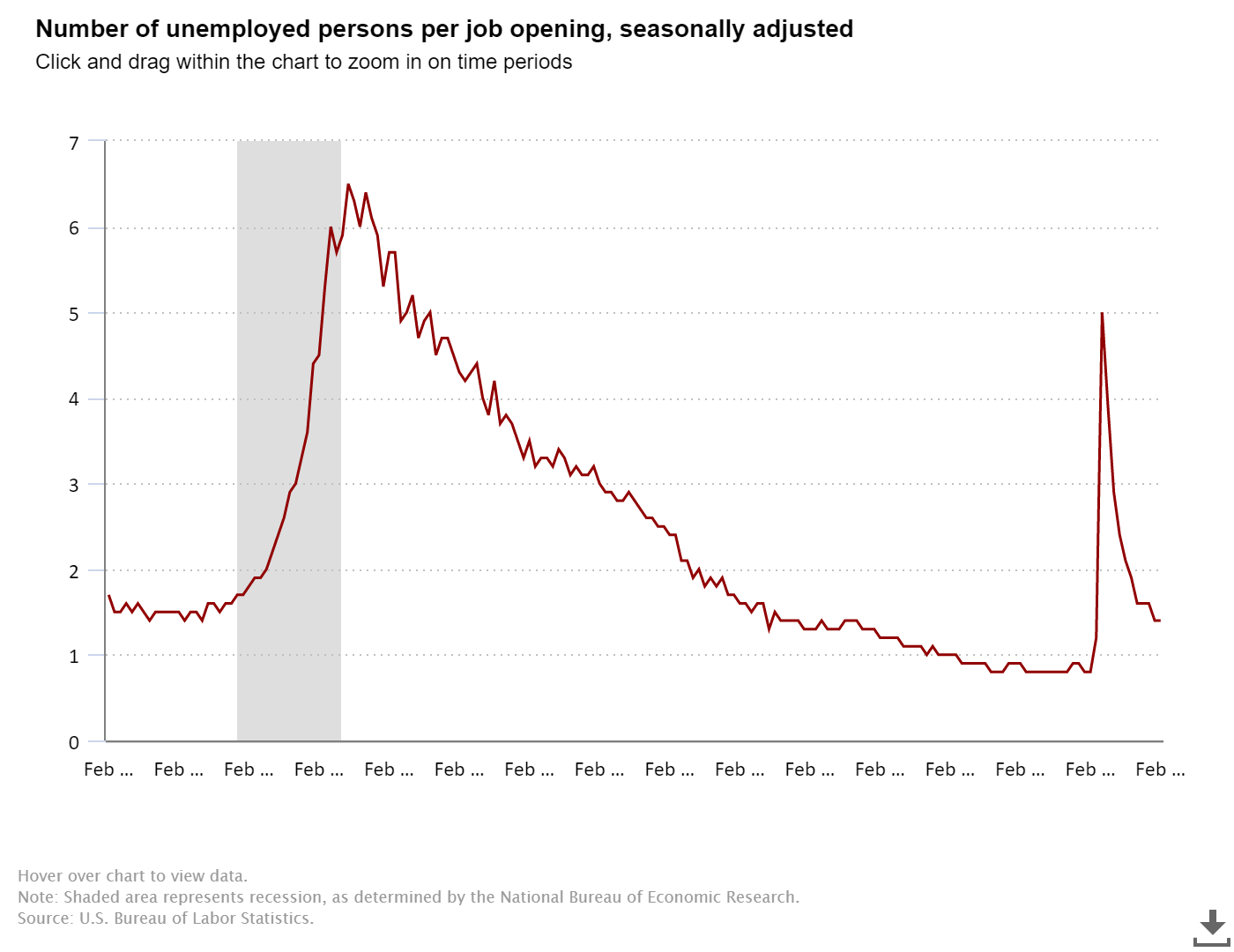

The trouble is, there are jobs available. The latest figure we have is from February, but even then, there were 7.4 million jobs available. Given the number of people who are not in the labor force that want to be, there are 1.4 jobs available today for every person looking for a job. Finding a job is not the problem.

On top of that, wages are increasing. Average hourly earnings were up $0.21 last month to $30.17 per hour. That is a 2% increase in the last 30 days. Since we also know the average worker worked 35 hours per week last month, we can deduce the annual average salary: $54,909 per year. That’s a livable wage.

What is it that’s keeping people from filling these jobs? A client put it to us well this week: these people are not stupid. They are making an educated decision. Let’s use an unemployed Iowa citizen as an example. Today they are receiving:

- $300/week in Federal unemployment assistance until September (the first $10,200 of which is not taxable)

- $511/week in Iowa unemployment assistance.

That’s $811 per week, or $42,172 per year. That is 77% of what they would be making while working. When you include the added tax benefit it gets up to nearly 80%.

Now we have reached the conundrum. Has government so effectively responded to this crisis that they have actually disincentivized the public from looking for work? If so, how do we fix it? And what happens when the rug is finally pulled out from underneath these folks when the states decide they are no longer going to foot the bill? This is uncharted territory, and no one knows the answer to these questions. We have never been here before.

The Market Actually Likes This?

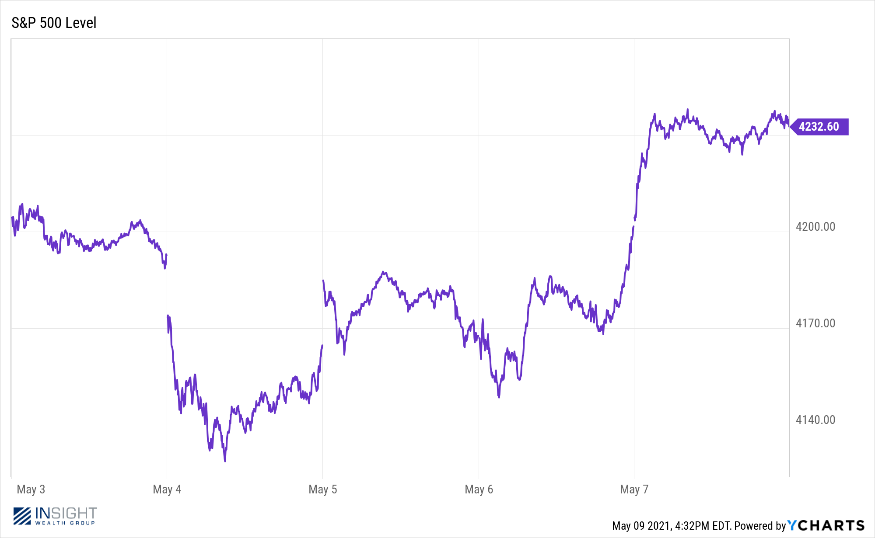

There are times when we at Insight feel a bit like Alice going through the Looking Glass. Friday was one of them. Friday was the worst jobs report we have had (as measured against expectations) since we started adding jobs back to the economy over a year ago. Yet the market was actually up for the day!

The “why” is the part that worries us a bit. As the Chief Market Strategist at TD Ameritrade, JJ Kinahan, told CNBC: “It certainly takes the pressure off the Fed and takes an imminent rate increase off the table. We’re not going to see inflation in wages, and we don’t have as many people employed as we thought, so we have to keep the party going.”

That’s right. “We have to keep the party going.”

Simply put, the market is measuring one variable right now: interest rate policy. If the Fed keeps rates low, its “To the moon!”.

To us, this doesn’t instill a lot of confidence about what the end of this game looks like. But it also reinforces one thing: we must play the cards we are dealt. And right now, the cards are telling us our “Three Pillars for 2021” we have been talking about for the last four months still make sense. If interest rates are low, COVID cases are dropping and Congress keeps pumping out cash, it is time to bet on equities. The longer it takes to see a rise in employment figures, the longer this “party” keeps going. And right now, whether we like the reasons for it or not, 2021 is looking like a pretty good year to be long equities.

Sincerely,