Simon & Garfunkel’s famous song – The Sound of Silence – started with a very famous verse:

“Hello darkness, my old friend.”

Our theme for May 2021? Hello VOLATILITY my old friend. It’s back and it’s never fun. But it can mean opportunity. This week, however, we talk about why it is not the end of the world, especially in the context of everything we have been saying about the markets for the last several months.

The Inflation Boogie Man is Here

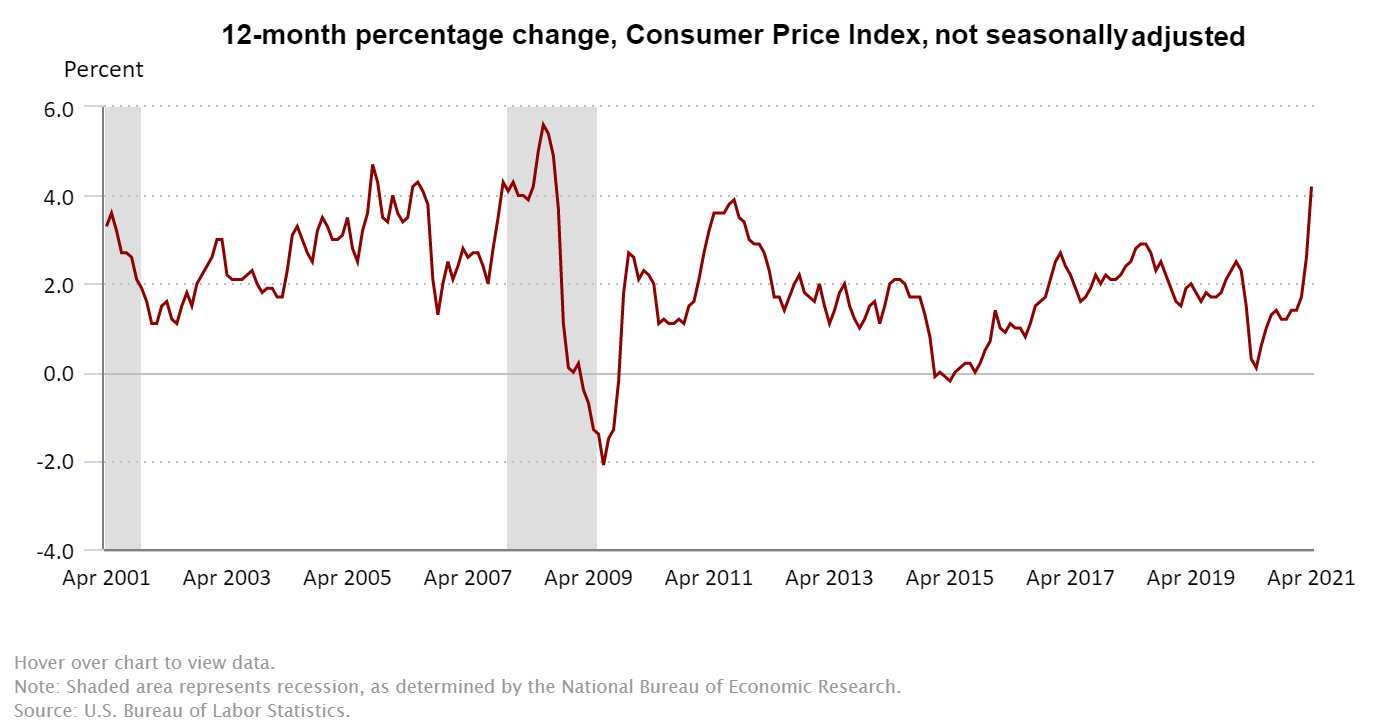

Two weeks ago, the world was grappling with a less than extraordinary jobs report. Last week the news was on inflation. And if you were reading the headline, it did not exactly sound like good news. Per the Labor Department, the Consumer Price Index (CPI) was up 4.2% in April. Wow!

But what does that really mean? And what will it mean for interest rates (the biggest driver of the stock market today)?

The first question you should be asking is what is CPI? CPI is a measurement of the changes of out-of-pocket expenses of all urban households. It is notable that this is NOT the measure of inflation used by the Federal Reserve to determine interest rate hikes (more on that later).

The second question you should be asking is “up 4.2% from what?”. This is the big one. Because CPI was up 4.2% from where it was 12 months ago. 12 months ago was the economic bottom of the COVID panic. It is not a surprise that the numbers have spiked dramatically. Just as it will not be a surprise when corporate earnings skyrocket for Q2 2021 vs. Q2 2020. This is called a “base effect”. When the base is a particularly bad place to start, it is not a surprise the numbers are significantly higher.

Base effect or not, this data had a significant impact on the market. The S&P 500 was off more than 4% over three days (now since largely recovered). The reason for the market’s concern? The same reason the market didn’t freak out about a bad jobs report. The bad jobs report meant it was less likely for the Fed to raise rates. Rising inflation, on the other hand, means it is more likely they raise rates.

But there is an important distinction between how the Fed calculates inflation (using a data point called Core PCE) and CPI. The main difference? The Fed excludes inflation in energy and food products from their calculation as they are deemed to be too volatile – and too exposed to outside influences – to be reliable indicators of inflation.

That is particularly relevant when you realize the biggest driver behind this week’s big jump in CPI: energy prices.

In the end – as we discussed last week – it all comes down to a simple calculation: how is this going to impact Fed policy. Like it or not, that is the key driver right now to the market’s success. And the Fed was clear this week. As Fed Vice Chairman Richard Clarida said: “This is one data point, as was the labor market report. But over time, we’ll be taking signal from this data and it’s going to be very important that any pressures to inflation that arise be transitory.” Simple translation: “We’re not raising rates yet.”

Remember: Volatility is NORMAL

Clients who have read these pages over the years know we have talked a lot about volatility. We would break volatility down into two (very unscientific) categories: normal volatility and “scary” volatility.

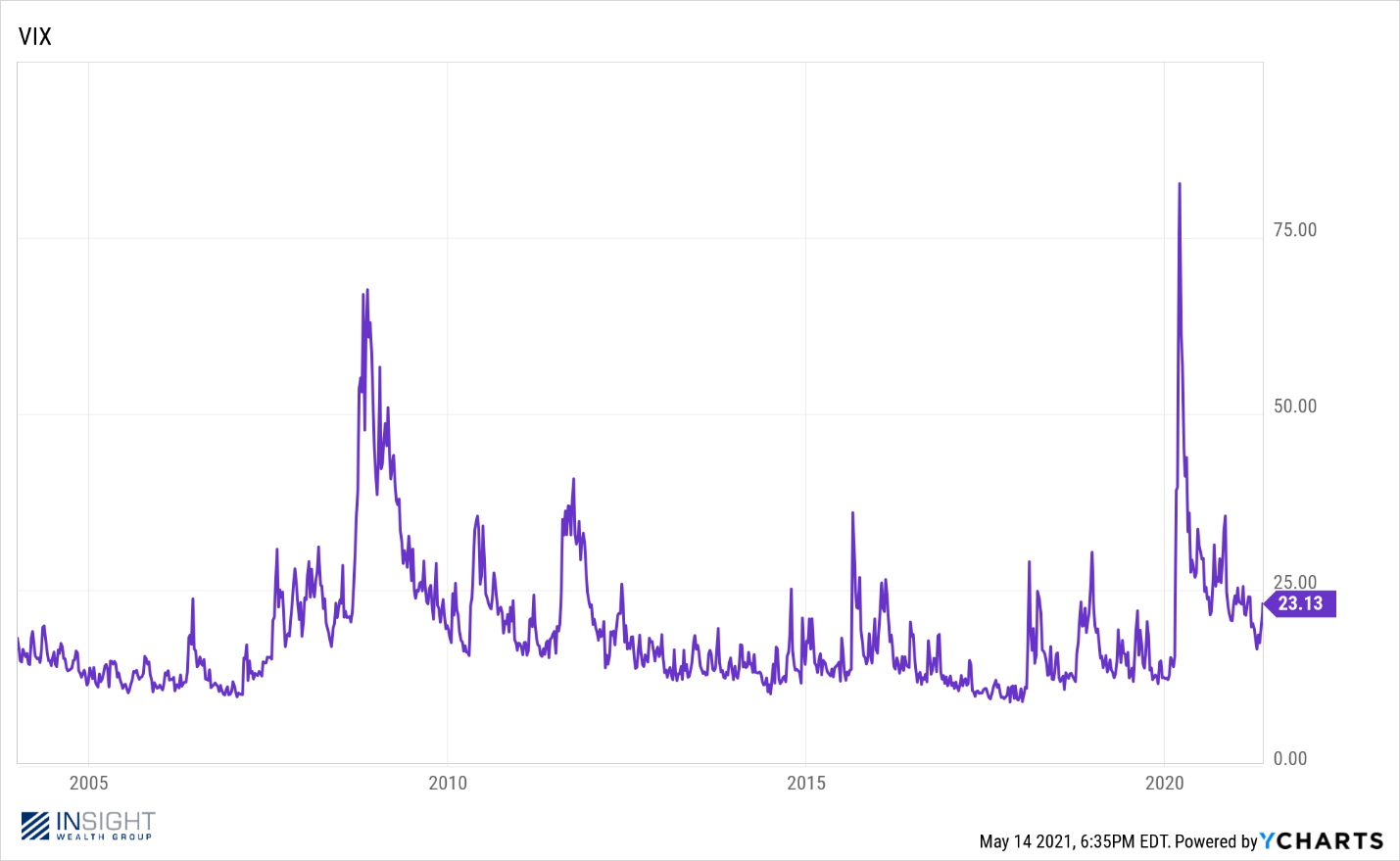

Scary volatility is what happens when the market becomes untethered. Last March was a perfect example as you can see from the chart below. The VIX – a common indicator of stock market volatility – reached levels never before seen.

Today? The VIX is sitting below where it was in February. Yes – our current reading of 23 is elevated. But it is within the bounds of a normal market.

We also know that volatility is typically elevated in the second year of a bull market. But while volatility rises, so do markets. The average stock market return in the second year of a bull is better than 12%. But the second year also experiences a drawdown of nearly 10%. The 4% move last week was not fun, but it is not enough to scare us off at this point.

Past performance is not indicative of future results

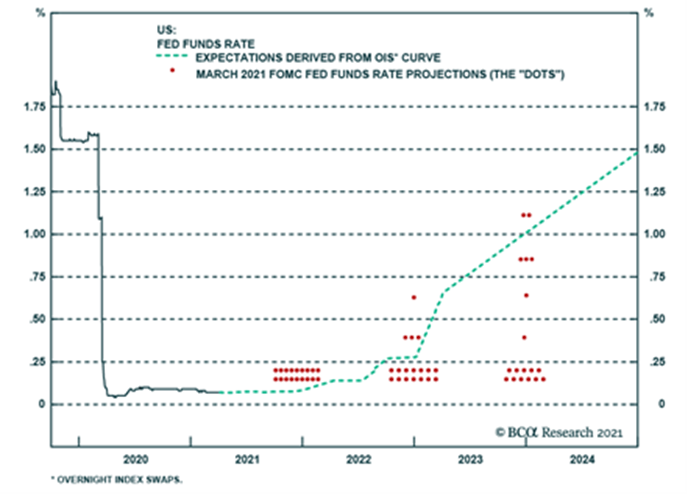

In the end, our base case has not changed. Should we continue to pay close attention to things like inflation and the jobs reports? Of course. But our big signal is going to come from the Fed and, as you can see from the chart below, they are still very dovish on interest rates. There is 100% agreement from Fed governors that they will not be raising rates in 2021. And all but four members of the Fed do not expect to be raising rates in 2022 either.

Planning Topics: Biden Tax Plan

We spend a lot of time around the office looking at ways we can get a jump on the market and policy makers. One of the most difficult discussions right now is tied to a question we are getting from a lot of clients: What can we do to prepare for Biden’s new tax plan?

While we have run through countless scenarios about what might be in the bill, we simply do not know at this point. Will Biden really stick to his “no tax increase for those making $400,000 or less”? Where will the breakpoint happen for capital gains tax increases? What will happen to the corporate rate? All of these are unknowable. We do know the Democrats intend to push the House version of the bill through the reconciliation process in July, so we should know more then. But the real negotiations are going to happen in the Senate.

But there is one topic that we think is worth addressing – even if it only impacts a small number of investors. You have heard us talk a lot about Section 1031 exchanges in the past. As a brief refresher, a 1031 exchange allows you to sell an “income producing property” (i.e., farmland, office building, etc.) and roll the proceeds into another income producing property tax free. This is a tremendous boon to real estate investors.

There is talk of eliminating Section 1031 exchanges in the upcoming bill. We do not know if it will happen. But we do know that if you are already considering selling a piece of real estate to take advantage of this tax rule, it would likely be better to get it done now than wait until the bill has passed. The impacts of waiting could potentially be huge.

If you are considering a 1031 exchange – or would like to know more about them – reach out to your advisor and we can walk you through your options.

We will leave it there for now. Hopefully, this week is a little quieter and you can enjoy some spring weather! We hope this update finds you all well.

Sincerely,