This week we are going to do something we have not done in a while. We are going to write a memo (largely) devoid of discussions of politics or COVID-19. We are sure this will not last…but it sure feels good right now!

All the talk of the election over the past few months has meant a lot of things to a lot of people. But for us at Insight it meant uncertainty about how the end of the year was going to look in portfolios as we thought about adjustments for potential tax law changes, policy changes, etc. Now we (mostly) know what Washington is going to look like for the next two years, and we can start moving on our plans. This week, as we are getting close to the end of the year, we are going to talk about our (and your) tax planning items which may be important as we close out 2020. And we are going to talk about some changes we made in a few of our core portfolios last week to take advantage of the current situation. Let’s dig in.

Model Changes

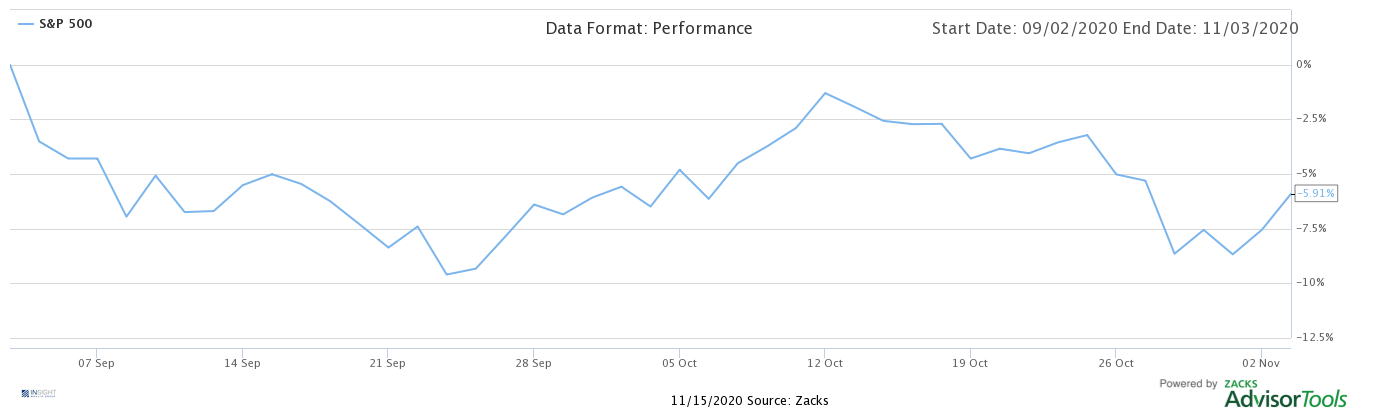

As you will likely recall, we took the opportunity to take some risk off the table in our three core model strategies back in September. Our justification for decoupling a (relatively small) portion of our market exposure was tied directly to the risk of market volatility we historically see around elections. That concern ended up being justified as the market was off more than 5.91% between its September peak and Election Day.

Past performance is not indicative of future results

The question anytime we make a move like this – which was admittedly temporary – is “what’s next”. And the problem with that question this time was a very indecisive “we’ll have to see”. We knew there would be a space to take advantage of the election results – whatever they may be – but we had to understand what those results were going to be first.

As we laid out last week, the results have made us optimistic for the market and the economy over the next 6-12 months. But where should we place that optimism? We made the decision this week to place a buy in the emerging markets sector – specifically with a 4% weight in the iShares MSCI Emerging Markets ETF (EEM). We bought the position for roughly $47.80 on Tuesday. The position closed Friday at $48.33 (+1.11%).

Many of you know we have avoided emerging markets exposure over the last few years. For good reason. When you look at this space since we exited in 2013, you’ll see broad EM exposure is up just slightly more than 10% total in the last 7+ years. So why are we dipping our toe in the water now? Let’s run through the trade.

- EM is U.S. Dollar Debt Heavy

- As you know, one of the problems over the years with EM has been the amount of debt these countries carry, and much of that debt is in U.S. dollars. That can be a real problem in a time of a strengthening dollar. But that is not where we are today. As the dollar gets weaker that is an advantage to these countries as the cost of their debt gets cheaper.

- EM Countries are Commodity Exporters

- Many emerging market economies are based on commodity exports. Once again, a weak dollar supports this sector and boosts the value they can receive for their exports.

- EEM is not a currency hedged ETF

- This fund is not hedged to the U.S. dollar, so a continued weakening of the dollar will be positive for the fund as we go forward. Signs of a strengthening dollar would be an indicator it may be time to move on – but we do not expect that for some time.

- Asian Exposure

- We have not had significant Asian exposure in our portfolios of late. EEM is a solve for that as 2/3 of the portfolio is exposure to China, Taiwan, and South Korea. This is particularly notable as each of these three countries has handled COVID-19 well and is seemingly past its largest impacts – unlike the U.S.

- The recent Asian trade deal – RECP – should also be a catalyst in this area over the next several years.

- Good Sector Exposure

- Half of the ETF is in three sectors: Consumer Discretionary, Technology and Financials. All three are areas we think can succeed coming out of the COVID recovery.

- Low Cost

- We spent a lot of time discussing utilizing this security vs. a more active manager in this space. The biggest negative was cost – nearly 100 bps of additional cost to buy a good active manager. Normally active management in this space has paid off – but given the macro trends, we are comfortable the lower cost approach will pay off here.

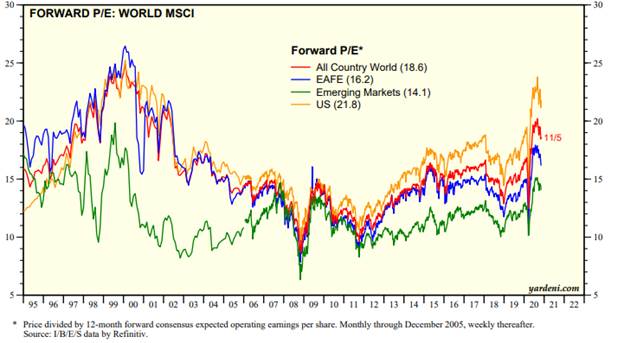

Finally, we pointed out in our last memo how favorable the S&P 500 P/E ratio is considering the situation we find ourselves in today. As you can see from the chart below, international stocks – specifically emerging markets – are trading at a significant discount to the U.S. In a weakening dollar environment, this is particularly attractive.

Past performance is not indicative of future results

This will be one we watch closely for the next few months and you may be hearing more about. If you have any questions, feel free to reach out directly to your advisor to discuss.

Are We Going to See Tax Increases?

The biggest problem with any election year is you do not know how to plan for what comes next on the tax policy side of things. This year was no different. The Biden tax plan would have had a significant impact on client portfolios and was something that caused great consternation here at the office.

It is our opinion, however, that the biggest and scariest parts of that proposal are now off the table. Admittedly, we will not know if we are wrong until January 5th (the date of the Georgia Senate runoffs), which will be too late for capital gains planning if the unexpected happens.

But something happened this week – unrelated to Georgia – which really boosted our confidence. Senator Joe Manchin (D-WV) was on Fox News earlier this week doing a post-election interview. It may seem a little strange that a Senate Democrat runs to Fox News to do his post-election commentary – but it is important you understand who Joe Manchin is. He is – by the necessity of being a Democrat in largely red West Virginia – a very conservative Democrat. In fact, over the past four years he has supported the Trump agenda 60.5% of the time – including being the only Democrat to vote to confirm Brett Kavanaugh. Simply put, Manchin cannot afford to be a progressive Democrat if he hopes to keep his seat in 2024.

Kavanaugh was asked in the interview about one of our greatest fears: ending the Senate filibuster. His response could not have been clearer:

“I commit to you tonight, and I commit to all of your viewers and everyone else that’s watching. I want to allay those fears, I want to rest those fears for you right now because when they talk about whether it be packing the courts, or ending the filibuster, I will not vote to do that. I will not vote to pack the courts and I will not vote to end the filibuster.”

That is an incredibly important statement. For anything to get accomplished in the Senate right now – including any tax changes – you need a vote to “end cloture” of three-fifths of the members present (60 votes). That means – with the filibuster – Mitch McConnell and the Senate GOP can control movement of these bills even if the Democrats win both seats in Georgia. And there is no way to end the filibuster (51 votes needed) if Joe Manchin will not support it. There would be 51 Democrats (including VP Harris) and 50 Republicans voting on that measure. With Manchin as a “No”, the GOP can shut that vote down very quickly.

So, for all of you who have asked about this risk – that’s the mitigating factor. And that’s the last we will talk of politics this week. We tried!

Year End Planning

As you know, we harp on year-end planning every year. This is a very important topic. Too often we see people walk in our door who have never had a real plan. They talk to their tax advisor when they file their taxes. The tax advisor never talks to the financial advisor. And the client is left trying to play quarterback.

We started Insight CPA to help solve this problem – and many clients have found it to be a useful collaboration. But whomever you use on the tax side, there are some important conversations you need to be having this time of year. So, we asked the Managing Partner of Insight CPA – Scott Manhart – for his thoughts on year-end topics to which clients should be paying attention. Here are his thoughts:

- Meet with your tax advisor! The meeting you have prior to filing your taxes in April is far too late. There are many options available to you which simply are not available after December 31st. Set an appointment now and get it done in plenty of time before the end of the year.

- While the Biden tax increases are (hopefully) off the table, there are still plenty of year end conversations which may make sense in this environment – especially if your income was lower this year due to COVID. Those include:

- Roth Conversions

- Capital Gains Harvesting (you may have some offsetting losses from this year’s market volatility)

- Looking to move 2021 income to 2020 or delaying 2020 deductions into 2021

- There are still many tools available to reduce both your business and personal taxable income. Those could include:

- Business

- Prepay certain 2021 expenses in 2020 (i.e. rent)

- Purchase equipment prior to year end

- Pay year-end bonus and maximize deferral to retirement plans

- Personal

- Proactive charitable planning (i.e. Donor Advised Funds)

- Maximize salary deferrals to retirement plans

- Business

- Many of our business owner clients have taken PPP loans this year. While there is still tremendous uncertainty about exactly how this program is going to work out, borrowers can now apply for forgiveness of their loans. But you may not want to do so. When the original bill was passed, Congress specifically stated that loan proceeds would not be taxable. However, the IRS found the loophole and said expenses paid with those proceeds would not be tax deductible – thus making the proceeds taxable through the back door. There is serious speculation that Congress may come down on the side of fixing that problem, but that is yet to be decided. Borrowers may want to wait until 2021 to apply for forgiveness as that would push the income into the 2021 tax year (if recognized) and gives Congress and the IRS time to get the tax side figured out.

- As a reminder, Congress decided to give retirement plan participants a pass on Required Minimum Distributions this year in response to COVID. Normally this would be the time of year we are knocking down everyone’s door reminding them to take their RMD. We are not going to do that this year. However, if you would still like to take your RMD, you can. Just shoot our team a note or call and we will get on it immediately.

That is a lot to swallow, and you may not be sure if some or all of this applies to you. If you would like to dig into your tax plan more aggressively, give us a call and we will be happy to schedule an appointment with your advisor and Scott or another member of our CPA team.

It feels good to be back into the nitty gritty that really matters in portfolios! We hope this has been helpful for you. If you have any questions, please do not hesitate to let us know. Until next week…

Sincerely,