It’s been a year, hasn’t it? Some time ago, at the end of the 2015, we wrote a year end memo for clients. The memo was organized by month and walked through all the major events of the year and how they impacted portfolios. Can you imagine if we wrote that memo this year? We would all need a trip to the therapist when it was done.

Instead, it may be best to just rely on a simple “meme” to describe our feelings so far:

But here’s the thing: maybe it’s that the election is behind us, or maybe it’s that the holidays are approaching, or maybe we’ve just gotten so used to this “new normal” that we’re now jaded. But right now, as we look toward the next few months and years, we are hopeful. Portfolios have weathered the storm well (outside a few energy positions we feel optimistic about), and we’re all still in one piece. So, this week, instead of talking about all the potholes we are working to avoid, we are going to talk about the things that we are optimistic about as we head into 2021.

The Big One: Vaccines

There is no question as we deal with a significant new wave of COVID infections that a vaccine is a prerequisite to the world getting back on a normal footing. For whatever reason, we have just proven unable to control the spread of the virus on our own – both here in the U.S. and around the world.

Normally that would be particularly bad news. Counting on a vaccine has historically been a dangerous plan. For example, the polio pandemic started in the United States in 1894. It was not until 1961 that Jonas Salk discovered an effective vaccine. The HIV/AIDS epidemic started in the U.S. in 1981. 39 years later we still have not solved that riddle.

But what has happened with the development of the COVID vaccine is nothing short of a scientific miracle. We have best heard it described as a medical “Manhattan Project”. The U.S. and international scientific community are owed a tremendous debt for the speed and effectiveness of this effort.

So now today we stand with one vaccine (Pfizer’s) having been submitted for an Emergency Use Authorization (EUA) this week. Another (Moderna’s) is expected to be submitted the first week in December. Others are making substantive progress as well. Knowing this, let’s look at what the timeline tells us for distribution of the vaccine. Elizabeth Weise at USA Today broke down the timeline very well. You can read the article by clicking HERE. But let’s walk through it.

November 20: Pfizer vaccine submitted for EUA

December 4: Moderna vaccine expected to be submitted for EUA (bump the rest of the dates out 14 days for Moderna’s vaccine)

December 10: FDA Vaccines and Related Biological Products Advisory Committee (VRBPAC) meeting. This committee reviews the data on the vaccine and gives a non- binding recommendation to the FDA. Typically, the FDA follows this recommendation.

December 11: Once the VRBPAC gives a recommendation, the FDA typically takes a few weeks to provide authorization. However, the FDA has indicated they will provide authorization as quickly as one day after the VRBPAC vote. Vaccine can begin being shipped upon FDA authorization.

December 12: The final necessary vote comes from the CDC Advisory Committee on Immunizations Practices (ACIP) which determines who should get the vaccine and in what order. They are not allowed to make a recommendation until the FDA has provided authorization. Typically, this takes weeks, but several members of the committee have noted that this meeting will take place the day after FDA authorization. The work being done by states to develop immunization plans has helped get this ready ahead of time.

December 14: Immunizations begin!

It is anticipated there will be 40 million doses (enough to immunize 20 million people) available prior to yearend. Each vaccine requires an initial dose and a booster 28 days later, so 20 million people should be fully immunized by the end of January.

The initial doses will go to frontline healthcare workers. After that, the plan is to provide the vaccine to those most vulnerable to the disease. Finally, normally healthy adults will likely be able to begin receiving the vaccine in April of 2021. While logistical challenges remain, we can reasonably state that those who want the vaccine should be able to be fully immunized sometime in Q2 next year.

You will note we mentioned those who “want” the vaccine. There has been a significant group of Americans who have questioned the safety and efficacy of the vaccines being developed. While we think this number will shrink if/when people being to see the safe use of the vaccine in the coming months, CNN also reported over the weekend that the number of people who anticipate getting the vaccine has risen significantly in the last month. Now that the politics is out of the conversation, and people can see the science, we are comfortable this number will continue to improve.

We cannot possibly overstate what the optimism of being “post-COVID” will mean to the broader economy and the market. Getting people back to work and out of their homes spending money will be a shot of adrenaline to an already recovering economy.

Earnings in Context

We talk a lot about earnings in these pages. We do so because it is an agnostic measurement of how cheap or expensive the market is relative to the health of the economy. But it is not a simple A+B=C calculation. Context is important.

While there is a long-term historical average for earnings (15.5x forward earnings over the last 20 years), you have to look at the current economic environment to understand what is “fair value” and what isn’t. One of the good rules of thumb is the “20 minus the rate of inflation” rule. Simply put, take the number 20, subtract the rate of inflation, and the result is a historical fair value for forward earnings.

While this rule seems random, it does something important. Essentially it says that the lower inflation is, the higher the justifiable P/E ratio. Why? Because the lower inflation, the lower the return on fixed income assets. Thus, the more people are willing to pay for equities.

For example, let’s look at the market pre-2008 financial crisis. For the first nine months of 2008, before the market crashed, inflation averaged 4.58%. So, using the 20 Rule, the appropriate forward P/E for the S&P 500 should have been 15.42x earnings. Instead the market was trading at nearly 28x earnings – an 81% premium to its fair value.

Today is a much different story. Last month’s inflation number came in at 1.2%, meaning the 20 Rule would dictate a fair price of 18.8x earnings. Today we are trading at 21.06x earnings. That is a 12% premium to “fair value”. But we would also argue inflation today is not a fair way to identify how fixed income is working for investors. You would be lucky to find an investment grade bond today with a one-year yield to maturity of 0.50% – where as the “earnings yield” of the S&P 500 is currently at 4.74%.

The story looks even better when you consider the rest of the market beyond the S&P 500. For example, the S&P 600 Small Cap index is currently priced at 18.8x forward earnings (perfectly fair value using the 20 Rule!), and most international indices are trading at significant discounts to the 20 Rule. That is exactly the reason we run balanced strategies – with significant weightings to markets outside of the S&P – to provide clients access to those discounted assets.

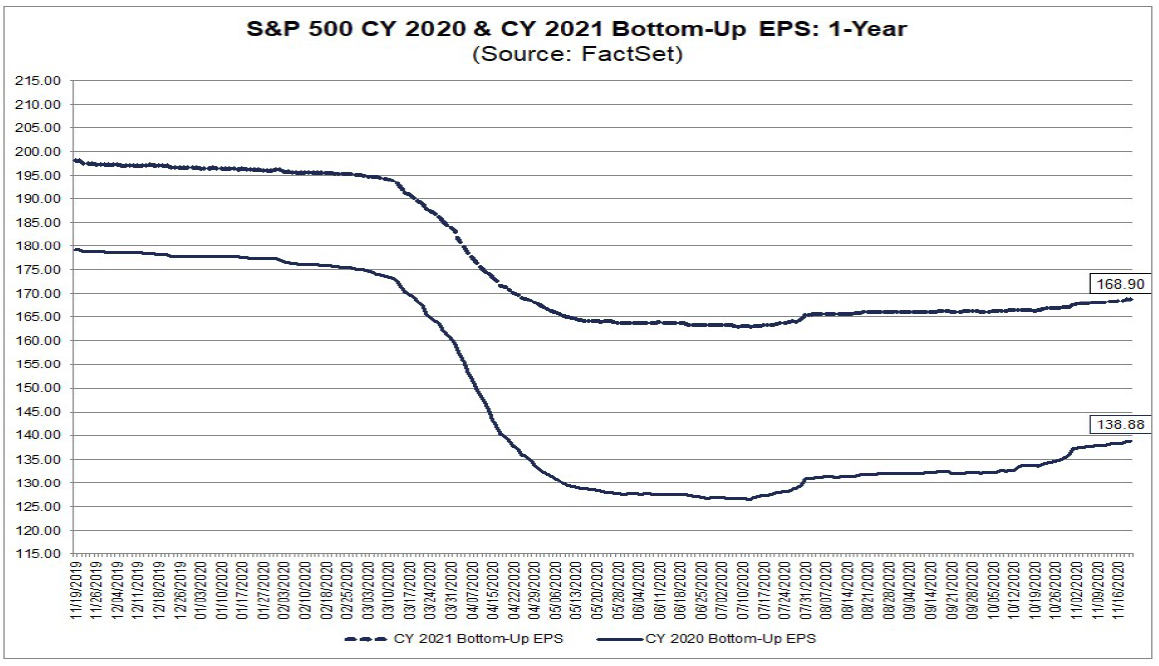

It is also important to understand that these expectations are not made on overly optimistic expectations for earnings. The consensus S&P 500 earnings estimate for 2021 is currently only $5 higher than it was at the bottom of the COVID crisis. And it is still 13.38% lower than the 2021 estimates made pre-COVID. These are not boom market expectations.

Past performance is not indicative of future results

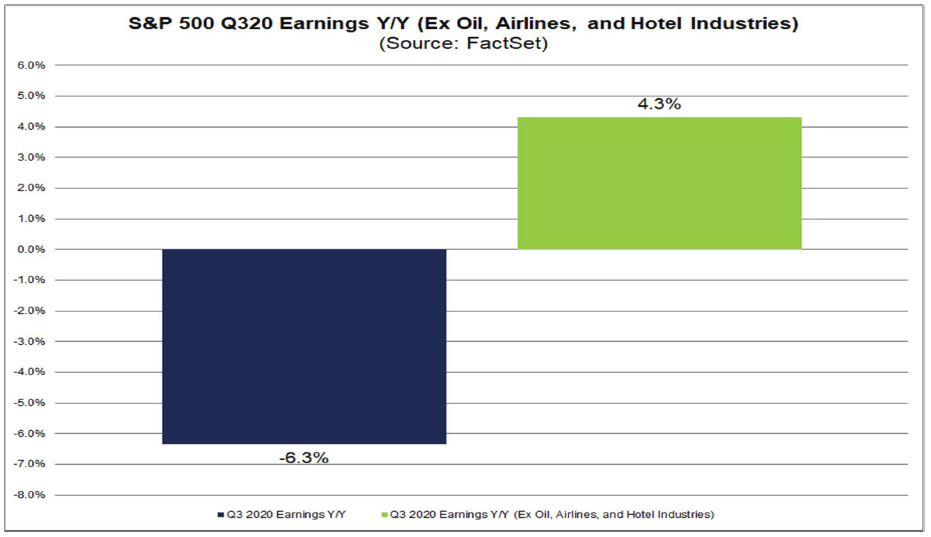

As we look backward at Q3, there are other very hopeful signs. We all know the industries which have been hit hardest during COVID: airlines, hospitality, and energy. And while earnings for the market were down in Q3, if you take those three industries out the mix, the rest of the S&P 500 had year-over-year earnings growth in Q3. That means Q3 2020 was better than Q3 2019 for all but three industries in the S&P. Imagine what those industries will do once people are willing to travel again!

Past performance is not indicative of future results

Do not misinterpret this memo. We have not changed. We still worry every day about the risks which may impact your portfolio. But as we close out 2020 (a year we believe may end up positive for investors!) there is reason for HOPE in 2021. We’ve all earned it after 2020!

Sincerely,