And just like that, we are writing the last Weekly Insight of 2021. It is hard to believe we are already about to turn the calendar over. We read something a long time ago that talked about how – when you get older – the days go slower, and the years go faster. This was certainly one of those years!

It is tempting at the end of the year to look backward and write a “wrap up” of how the year went, recapping all the big stories of the year and how they impacted portfolios. We have written that memo before – but the truth is there is not much we can do about the past. (It was an incredibly good year for portfolios, though!)

The other memo that is tempting to write this time of year is the “Crystal Ball” memo, laying out what we think is going to happen in 2022. The trouble is, someone broke our crystal ball, and we did not get a new one for Christmas. 😊 In all seriousness, if you find a financial advisor who can see the future, hire them. But until then, we are going to stay out of the psychic business.

Which brings us back to the core philosophy of Insight: find the best information you can about what is impacting the market and the world, use that information to craft and manage a resilient portfolio that can withstand the times we’re wrong, and at all times understand the psychology that is driving people (and markets) to make the decisions they’re making.

So, as we mark this transition into yet another New Year, we are going to do the boring thing. We are going to keep on trucking with our core philosophy and update you on the things that we think are moving the world right now and the variables we are watching for the future. We will be wrong on some (maybe a lot?) of this. But if we are thoughtful about how we construct portfolios we will be able to withstand our mistakes – and capitalize on those of others.

The Big Story (For Now) of 2022: Inflation

If you listen/watch the news, it seems like we are stuck in an endless cycle of COVID news and response. The internet, as always, found a clever way to capture this sensation of déjà vu:

It’s funny in that sense that it feels tragically true. COVID is on the rebound. Governments, businesses, and individuals are all struggling again to figure out how to respond. And the “Three Pillars” we have talked about all through 2021 remain true: the market’s success will depend on the issues of COVID, monetary policy and fiscal policy.

But the truth is, things have changed – A LOT – in the last few years. One of the biggest changes has been inflation. We have written extensively in these pages about the Fed’s plan to respond to inflation, but it has been a while since we have broken down exactly what is going on with inflation. Since it is undoubtedly going to be the big topic of 2022 (at least the first few months), we thought it important to do an update.

There was much talk this year about the “transitory” nature of inflation. The Fed officially ended that conversation when they removed the word “transitory” from their minutes and began more steeply tapering bond purchases and moving more quickly to interest rate hikes.

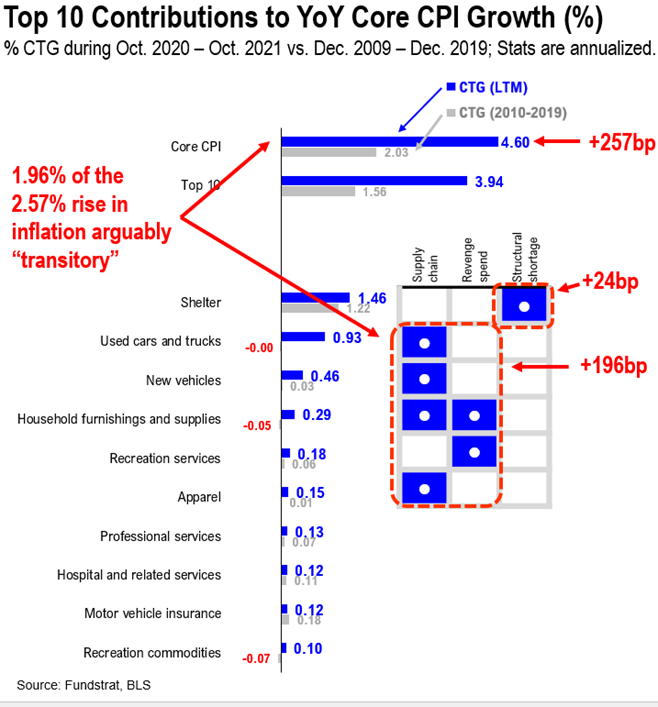

But just because the Fed is reacting more aggressively to inflation, does not mean its transitory nature is completely gone. In fact, we would argue there remains a strong transitory bent to what is happening today, as the chart below from FundStrat shows.

This chart is a little tough to decipher, so let’s walk through it in pieces:

- There has been a significant bump up in Core CPI (the one the Fed watches). The year over year change (4.60%) is 257 basis points above the 9-year average of 2.03%.

- Some of that change is definitely not transitory. For instance, the cost of shelter has gone up 1.46% which is 24 basis points higher (nearly 20% higher) than the long-term trend. Shelter prices do not typically fall dramatically once they have risen. This is a more or less “permanent” or long-term change.

- However, a big piece of the change (over 75%), is tied directly to transitory changes. For example, over 13% of inflation has come from inflation in household furnishings and supplies which had been deflationary over the last 9 years (-0.05%). All told, 196 basis points of the 257 basis point rise in costs has come from “transitory” causes.

The big one, however, is automobiles. When you combine used and new vehicles, they have accounted for 55% of the growth in costs. We have written a lot about this situation over the last year. The story is well defined: the failures of “just in time” manufacturing and the lack of the silicone chips needed to operate modern vehicles have created a failure in the supply chain.

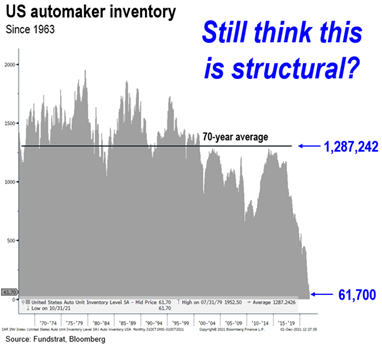

But our good friend Phil Kosmala showed us a chart last week – via FundStrat and Bloomberg – that blew our minds. The average inventory held by U.S. automakers over the last 70 years has come in at 1.3 million cars. Today? That number is just 61,700.

There is zero question this is a transitory trend. But it is one that is so pronounced it is going to feel permanent for a while. There is no way to plug a 1.2 million unit hole in inventory quickly. And it is likely a big reason Powell and the Fed are looking to move more quickly. Transitory or not, inflation is going to be a big – and important – story for 2022 and beyond.

Rate Hikes & The Market

We touched on this last week, but it is important to keep this top of mind: how the market reacts to monetary policy over the coming weeks and months is going to be a big driver for success (or struggles) in portfolios. Thankfully the market showed us over the last two weeks of trading that the Fed was doing exactly what the market anticipated it would do. Any volatility has had to do with Omicron – not the Fed – and as more information comes in on the virus, we believe there is underlying strength in the market.

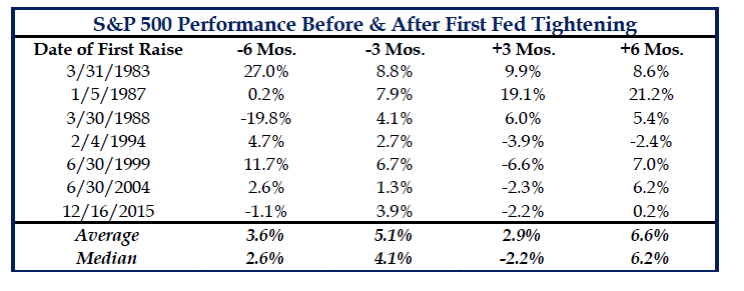

The good news is this: the beginning of an interest rate hiking cycle is not automatically a problem for the market. In fact, as you can see by the chart below, the average market return six months after the first rate hike is +6.6%.

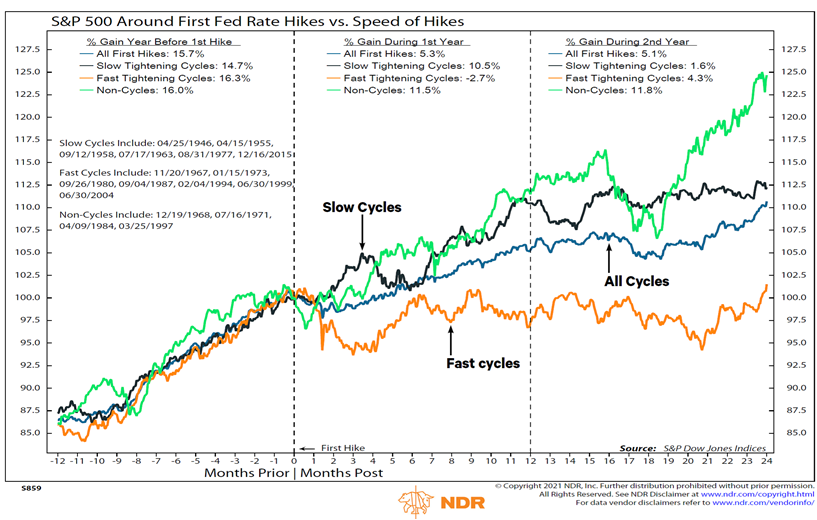

More important is how the Fed raises rates. Markets average +5.3% in the first year of a rate hiking cycle and +5.1% in the second year. That’s seemingly good news. But there is a broad divergence between a fast tightening cycle and slow tightening cycle as you can see from the chart below.

The current expectation for rate hikes is somewhere between “fast” and “slow” with an anticipated three rate hikes in 2022 and another three in 2023. But as we explained last week in our discussion of the “Dot Plot,” it wouldn’t be wise to put much credence in the “expectation” for the next few years.

In the end, it means this: we shouldn’t be too scared of the first rate hike (expected in June) and its impact on 2022. We should, however, watch closely how the Fed messages its plans over the coming year. if they start to get particularly aggressive, we may need to adjust our strategy.

And that is a wrap on 2021! We want to thank you again for your patronage and friendship throughout this year. It has been a great year for portfolios, and we look forward to what 2022 will bring. We’ll see you next year!

Sincerely,