Welcome to 2022! We hope you all had a wonderful holiday season.

Last week was a quiet one in the markets and on the economic front as most of the world was out celebrating the holidays. As such, we are going to keep this memo a little light as we address two issues: an update on the market’s reaction to Omicron and a look at earnings expectations for 2022.

But before we dig into those items, there is one housekeeping item we wanted to address as we enter the New Year.

TD Ameritrade to Schwab Transition

Nearly all our custodial assets are held on the TD Ameritrade platform. As you may be aware, Schwab has acquired TD Ameritrade and there is an inevitable transition coming. The details on this process are light at this point, but it is our understanding it will hit in full force in 2023.

In our year-end planning sessions, we concluded that we want to drive this ball forward instead of reacting when the transition is upon us. That’s a little hard, as we do not know exactly what the transition will entail. But we do know that having updated paperwork with each of our clients is going to be a priority.

As such, we are going to be auditing our client files and may be reaching out to you to update certain documents. If you receive these requests and have any questions, please don’t hesitate to let us know.

Omicron Update

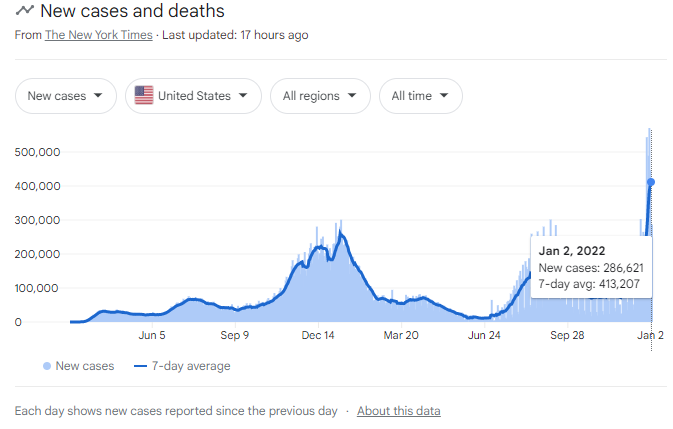

This is the one item that is bringing those “2020, too” vibes. The current case counts for the COVID virus are at the highest levels we have ever seen in the United States. And it’s not even close. Our highest single day pre-Omicron was just over 300,000 cases. The current 7-day average of new cases is now over 413,000.

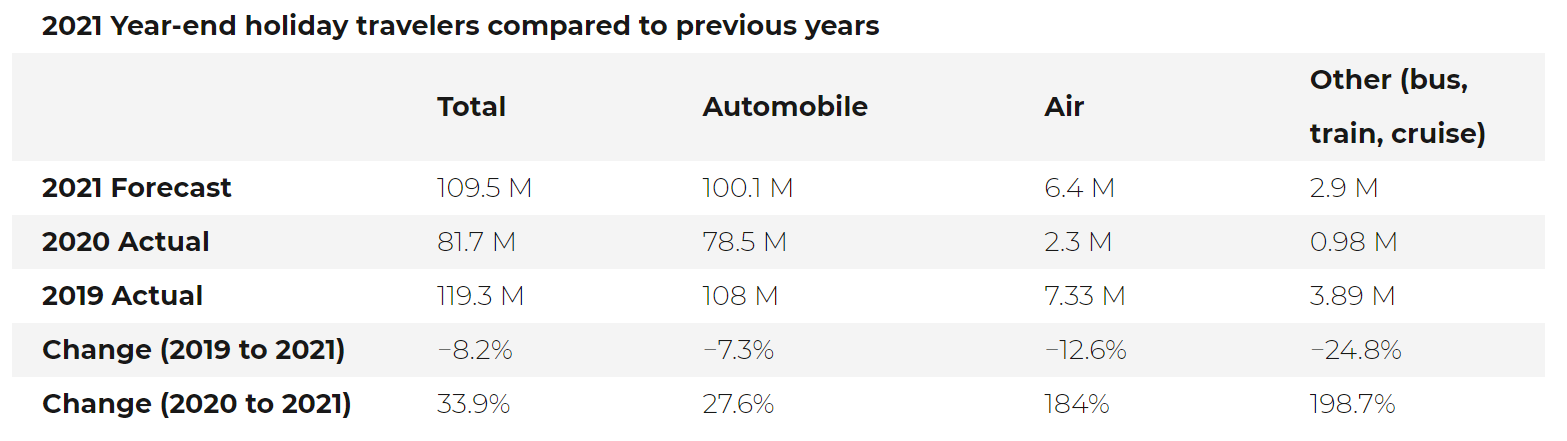

The timing of Omicron could not have been worse as Americans were traveling for the holidays en mass. AAA estimated that holiday travel was up over 33% from last year – a time when cases were starting to drop instead of starting to rise. Bluntly, Americans are over this pandemic even if the pandemic is not over us.

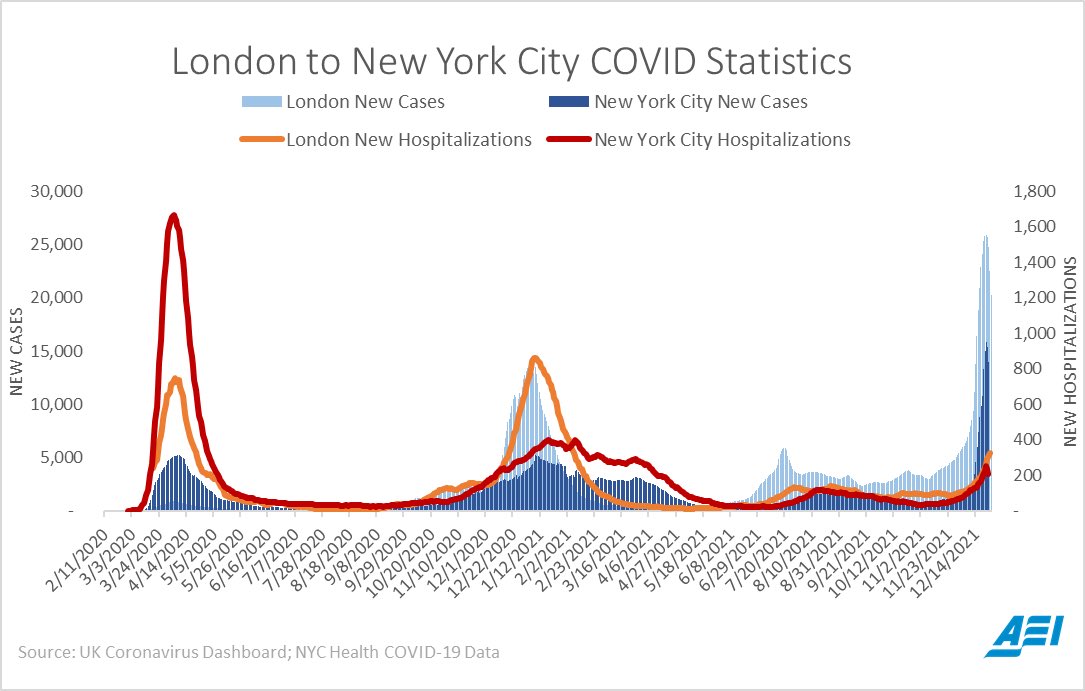

The good news is that, as hoped for, hospitalizations are not happening at the same pace saw with earlier versions of the virus.

Right now, the market is taking that as a sign that Omicron is not going to have the impact on the world economy that we saw with the initial wave of the virus. But we would also point out this: while the percentage of people hospitalized may be much lower, the sheer number of cases may still be enough to cause capacity issues at hospitals. If that becomes true, we may see more drastic measures taken by state and federal governments. That is the unknown risk to the markets heading into the New Year. And it will be worth keeping an eye on.

Earnings Outlook

We beat our readers over the heads with our “Three Pillars” in 2021:

- The path of COVID in the U.S. & abroad

- Monetary policy at the Federal Reserve

- Fiscal policy in Congress

They were, unquestionably, the three main drivers of the market. But it can’t take us away from the biggest fundamental of them all: are companies (or at least the ones we are invested in) making money? And at what level is the market rewarding those earnings?

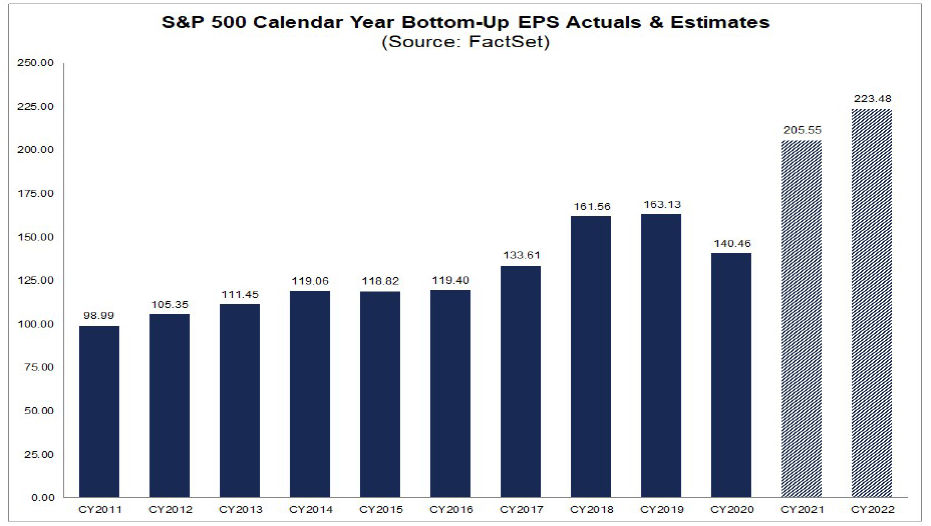

The “Three Pillars” have justified (rightfully) some changing expectations on earnings. But that does not mean they are any less important. And the good news is the expectation for 2022 remains positive. The market is assuming earnings growth of 9% for 2022. That may seem a little “wimpy” compared to the year we just had, but historically it would be a successful year if it comes to fruition.

In fact, if you look at the earnings growth from 2011 to 2019 (pre-COVID), you will see that the trend averaged 7.13%. If that trend continued unabated through to today, we would have expected 2022 earnings to come in at $186 per share in 2022. Even with the impacts of COVID, the expectation is 20% higher than the trend.

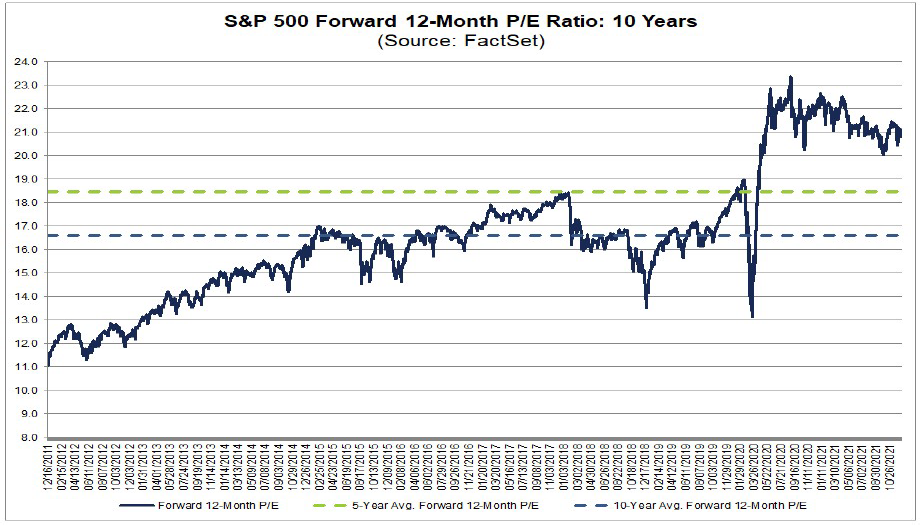

Earnings is just one part of the equation, however. The other part is the price being paid for those earnings. We have maintained for some time that, while the market is sitting at a higher price-to-earnings ratio than the historical norm, some of that is justified by the tremendously low yields available on fixed income. What is notable, however, is that – even with the great returns in the market in 2021 – the price to earnings ratio of the market consistently fell throughout the year.

These expectations could change quickly if the impact of Omicron is worse than the market is anticipating. But, as of today, the earnings fundamentals look positive. Now we must turn those expectations into profits.

These expectations could change quickly if the impact of Omicron is worse than the market is anticipating. But, as of today, the earnings fundamentals look positive. Now we must turn those expectations into profits.

Sincerely,