Want to lose sleep? Here is a headline for you: “S&P 500 Posts Worst Start to a Year Since 2016”. That’s from Yahoo Finance. Or how about “Stock, Bond Market’s Worst Start in Decade Revives 60/40 Doubt”? That’s from Bloomberg.

We will admit it: there are some weeks when coming up with something exciting to talk about is a struggle. It is hard to find something exciting to write about all the time! And, while we would like to believe we never write “click bait”, we would encourage you to look at everything you read with a bit of skepticism. And the dire headlines from Friday are no different. Was it a bummer of a week in the market? Sure – and we will dive into why. But, considering the S&P 500 is only down 1.87% year-to-date, we might suggest a headline more like this:

“Market’s slow start to the year further solidifies the fact that things have been pretty darn good for the last decade!”

Perspective matters! And in the meantime, the market does not have much information from which to work. We are in the weird “early quarter lull” when there is not hard corporate data (earnings) to rely upon. So instead the market focuses on the news. And the news is all about Fed tightening and Omicron. In just a few weeks we are going to be able to dig into real earnings numbers and the expectation is good. FactSet is reporting expected Q4 earnings growth of 21.7%.

But, in the meantime, let’s tackle the news that is moving the market.

Fed Shrinking the Balance Sheet?

The year started off on a fairly good foot last week. The markets were responding well to the news that Omicron – while very contagious – is continuing to be less virulent. President Biden, on Tuesday, continued to signal that we are going to keep the economy open. Even the new Mayor of New York is starting to sound like a COVID hawk, telling New Yorkers they need to keep schools open and that the big Wall Street banks need to get their employees back in the office.

The sentiment turned south on Wednesday, however, when the Fed released its minutes from its December meeting. The main sentiment was much as expected: an acceleration of bond purchase tapering and more than one interest rate increase in 2022. If that were all that was in the minutes, the market would not have blinked. But there was one tricky line to which the market devoted a lot of attention:

“Participants noted that, given their individual outlooks for the economy, the labor market, and inflation, it may become warranted to increase the federal funds rate sooner or at a faster pace than participants had earlier anticipated.”

Everyone expected that line. It is the next one that is interesting:

“Some participants also noted that it could be appropriate to begin to reduce the size of the Federal Reserve’s balance sheet relatively soon after beginning to raise the federal funds rate. Some participants judged that a less accommodative future stance of policy would likely be warranted and that the Committee should convey a strong commitment to address elevated inflation pressures.”

What they are saying here is that, not only should they end bond purchases on the Federal Reserve balance sheet (which everyone anticipated), they should also begin selling some of those bonds back to the open market around the time they start raising interest rates. Why is this important? It would drive bond yields higher in an attempt to slow inflation. Equity markets do not love rising bond yields.

There is a big “but” here. It is particularly important to remember that words matter in Federal Reserve minutes. Note the start of that first quote “Participants noted…” Then there is the start of the second quote “Some participants noted…” (emphasis added). That “Some” is important, because they are telling us that while the committee agrees that the Federal Funds rate may have to move earlier and quicker than originally anticipated, only some of the members (and likely not yet a majority) are interested in selling bonds back to the public market.

All of this was enough to stoke some short-term fear in the market, but we doubt enough to cause any deep correction. Instead, it is yet another thing from the Fed to keep a watchful eye on while their policy turns increasingly hawkish as the economy recovers from COVID. With Chairman Powell’s reconfirmation hearing starting tomorrow, we anticipated to hear a lot more on this issue. But we would add one more item: they would not be having these conversations if they did not think the economy was recovering from COVID. That is good news.

Taxes and Inflation

The Wall Street Journal had a great article over the weekend that we thought was worth highlighting this week (Saunders, L., January 8, 2022, What Inflation Will Do to Your 2022 Taxes). You can read it by clicking here.

The point of the article is this: while inflation is not fun, it does have an impact on many Federal programs (including taxes, Social Security, retirement savings limits, etc.) that are indexed to inflation. And that can be important for both your retirement and tax planning strategies.

There are a couple of key items we would point out from the article that will be important for you this year:

- The maximum deferral to an IRA or Roth IRA is now $6,000 with an additional $1,000 catch-up contribution allowed if you are over age 50.

- The maximum deferral to a 401(k) or Roth 401(k) is now $20,500 with an additional $6,500 catch up contribution allowed if you are over age 50.

- The annual gift tax exclusion (amount you are allowed to give to an individual without reporting it on your taxes) is now $16,000 per individual or $32,000 per couple.

- The lifetime exemption for gifts or estate tax is now $12,060,000 per individual

If you have any planned contributions or planned gifts that are funded throughout the year, now is the time to adjust the levels if you intend to max out throughout the year.

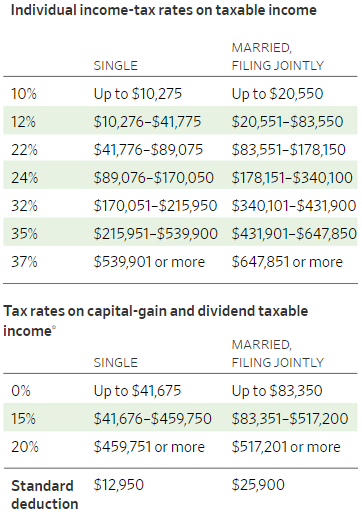

Additionally, inflation impacts tax brackets. The new tax brackets for 2022 are below. Please note these apply to 2022 income – not 2021.

Source: Internal Revenue Service via https://www.wsj.com/articles/2022-tax-table-inflation-adjustment-11641521853

Omicron Update

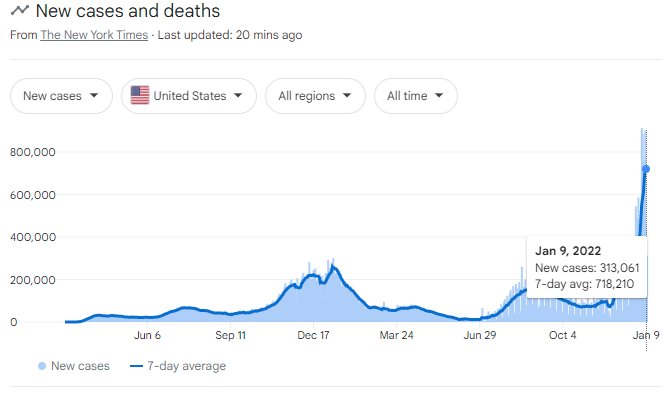

It would not be a “Weekly Insight” if we did not update on COVID. While the case counts look daunting, the news is surprisingly positive on this front.

The biggest news on the COVID policy front was the Supreme Court hearing this week on President Biden’s vaccine mandate on employers with more than 100 employees. The Court did not seem particularly persuaded by the Administration’s argument. We will see if that holds, but we should know soon as it is not likely the court will drag this out. The OSHA rule goes into effect this week, but the Administration has stated they will not start citing companies for non-compliance until February 9th.

The good news on COVID seems to be happening on the scientific front. Many have been positing that the more contagious but less virulent Omicron strain could mean the virus is entering the “endemic” instead of “epidemic” phase. A study out of South Africa last week seems to validate that theory. Researchers stated that, while Omicron moved with “unprecedented speed” it also caused much milder virus. As they stated in their report:

“If this pattern continues and is repeated globally, we are likely to see a complete decoupling of case and death rates…Omicron may be a harbinger of the end of the epidemic phase of the Covid pandemic, ushering in its endemic phase.”

If correct, that means dealing with COVID becomes more like dealing with the flu. And it also means we could soon be returning to “normal,” whatever that looks like these days. We would be big fans of that.

Sincerely,