Real estate and the housing market play an integral role in the lives of nearly every American. The idea of a place of one’s own lies at the core of The American Dream. At its most basic level, a home provides much needed shelter and comfort to you and your family. And on a deeper level, it is where some of life’s greatest memories are made.

As it turns out, the housing market also plays a very important role in the broader economy. Real estate, whether in the form of a primary residence or investment property, is the greatest source of wealth and savings for most Americans. Additionally, the housing market is a source for millions of jobs throughout the nation. Although housing is a small part of the economy relative to overall consumer spending, fluctuations in the housing market reverberate throughout the entire economy. There is no better example of this than the sub-prime mortgage crisis which triggered the Great Recession in 2008.

Many long-time clients of ours vividly remember that difficult, scary time. And while 13 years seems like a long time ago, the housing market is still dealing with the aftermath – a decade of under-building which has led to a major supply shortage.

Too Many Buyers, Too Little Inventory

The pandemic has been both a blessing and curse to many people. On the positive side it has meant spending more quality time at home with family members. On the other hand, many people have come to the realization that they really need more space (maybe to provide some space from family members?). This dynamic – along with increased household savings, stimulus checks, and record low mortgage rates – has led to a red-hot housing market.

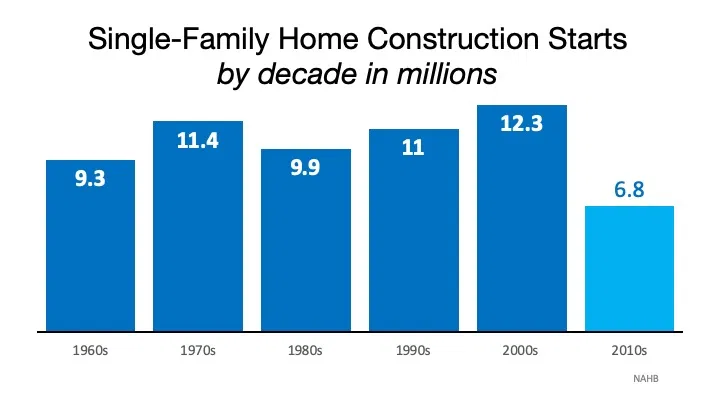

The market has been so hot lately that there is not nearly enough supply to keep up with demand – making it a very frustrating time to be a buyer. There has been a long running deficit in new home construction dating back to the aftershock of the Great Recession. Consider the drop-off in single-family home construction over the last decade shown below.

Source: National Association of Homebuilders

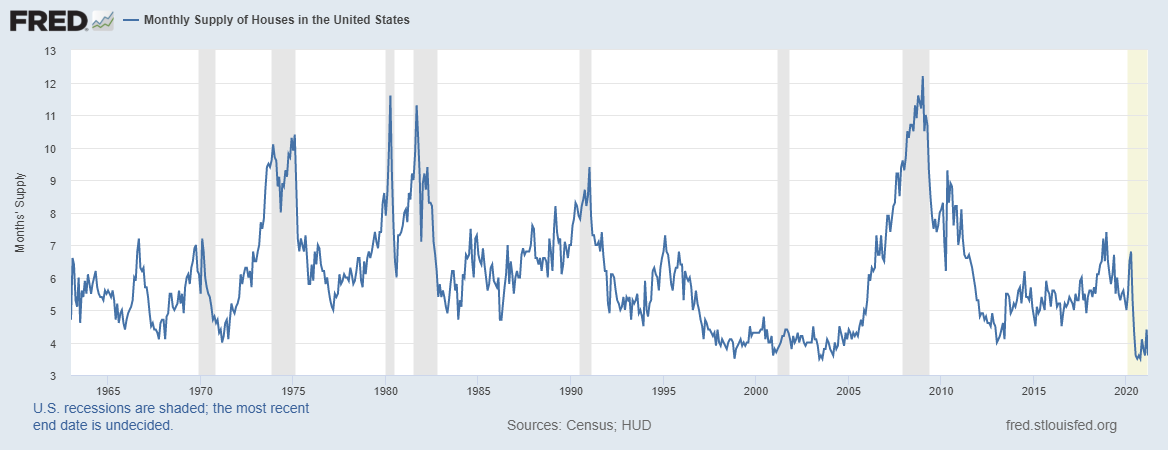

It is estimated that the US needs roughly 1.5 million housing starts a year based on population growth and other demographic factors, but we have not built that many new homes in any calendar year since 2006. On top of that, recent data estimates that the supply of existing homes for sale at the end of April was down 20% from a year ago. There were just 1.16M homes for sale, representing a 2.4-month supply at the current sales pace. That is the lowest level we have seen since the 1960s.

Source: Federal Reserve Economic Data (FRED)

And demand for housing is not likely going anywhere in the foreseeable future. A Pew Research study found that in 2019 Millennials surpassed the Baby Boomers as the largest living generation. As this huge demographic enters the housing market for the first time, sales are expected to continue trending higher.

Current State of the Housing Market

Some relief may be coming around the corner for potential buyers as the number of building permits for future construction currently sit at the highest level since 2006. However, despite such strong demand and sentiment in the housing market, housing starts (the beginning of house construction) declined 9.5% in April. How is that? First, homebuilders are facing difficulties finding enough qualified workers to build new houses at their expected rate. This should hopefully resolve itself as enhanced unemployment benefits expire and the labor market continues to heal. The bigger issue resides with supply chain constraints and sky-high commodity prices.

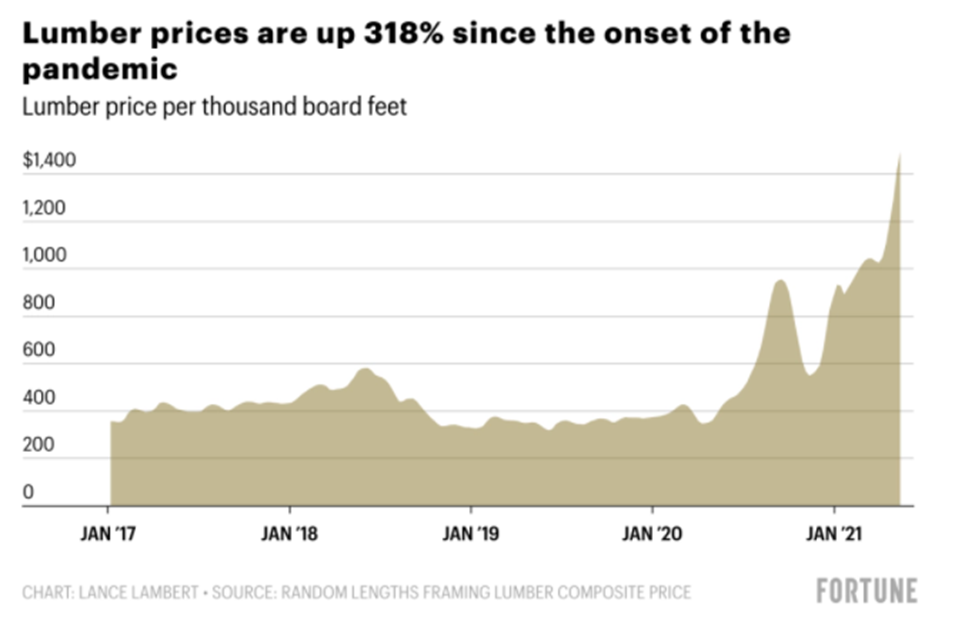

By now, everyone has either talked about, heard about, or experienced first-hand the ridiculous prices of lumber. The chart below says it all.

Source: Fortune.com

With lumber often representing a homebuilders biggest material cost, many contractors are delaying production or adding escalation clauses to their sale prices due to the commodity constraints. Roughly 15% of builders say they are putting down concrete foundations and then holding off on framing the house. While technically this counts as a “housing start” for statistical purposes, a foundation is far from a finished product.

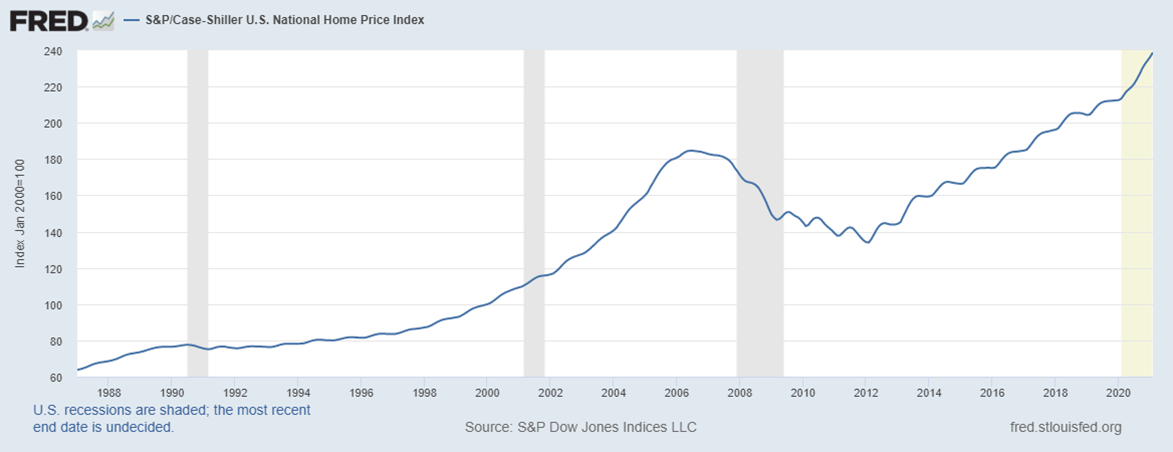

The National Association of Home Builders estimates that the increase in lumber alone has added $36,000 to the cost of building the average single-family home. Prices in the existing homes market are just as crazy due to the chronic shortage of supply paired with raging demand and intense competition.

Source: Federal Reserve Economic Data (FRED)

Based on this information we could go down several different rabbit holes: Are these price increases sustainable? Is the housing market too hot? Are we bound for another housing market bubble? But the more important question to ask right now is when will commodity prices come back down to earth. And is this cycle of inflation truly “transitory”?

The Case for and Against Transitory Inflation

We pick on the Fed in these pages from time to time. But we must also give credit where it is due. They have been holding the line on interest rates and have not folded to the mounting pressures of inflation. For months Fed Chairman Jerome Powell has been using the word “transitory” to describe the threat of inflation. Yes, prices are rising throughout the economy, but this is mostly due to supply-demand imbalances. Unfortunately, the economy cannot turn on a dime or increase production at the flip of a switch. It is going to take time for suppliers to catch up. The Fed is banking on the premise that as supply chain disruptions work themselves out in the months ahead inflation should come back in line. Only time will tell if they are right.

Conventional wisdom in the commodities business states that the cure for high prices is high prices. When raw material prices go up farmers plant larger crops, oil companies drill new wells, and lumber companies build new sawmills. The flood of new supplies entering the market typically brings prices back down.

As a result of high lumber prices, one would expect more sawmills to start popping up. However, executives in the highly cyclical lumber industry seem to be content raking in cash while prices are at record highs and they are not in a hurry to build new mills which can take several years and millions of dollars to build. With this dynamic in play, supplies could remain tight and prices high into next year.

Homebuilding Stocks

Unsurprisingly, equities tied to the housing market are up big so far this year. Below is a small sample of stocks from our Dividend Portfolio which have benefited from recent trends in home construction and improvement.

Past performance is not indicative of future results

The Home Depot (HD), which is currently one of the top holdings in the Dividend Portfolio, reported very strong Q1 earnings just last week. Earnings per share came in at $3.86 vs. an expected $3.08. Most impressively, sales rose 32.7% to $37.5B for the quarter.

This strong performance can be attributed to increasingly confident consumers/homeowners who are flush with cash and looking past the higher cost of materials…for now. What happens in real estate will have a ripple effect throughout the entire economy. With rising home values, homeowners become encouraged to spend more than they normally would due to increased confidence in the economy and higher home equity for which they can borrow against. The Great Recession taught us that this can end poorly. But for now – with low rates, constrained supply, and strong demand –we likely will not be seeing an end to the housing boom any time soon.

Sincerely,