The old saying is that “the more things change, the more they remain the same”. That could not have been on better display this week when Fed Chair Jerome Powell addressed the Jackson Hole Economic Summit.

You may recall our reaction to Powell’s speech at Jackson Hole last year. It was, as we described it last week, a “barnburner”. At least as far as economic speeches from dry 70-year-old economists go!

When we reviewed Powell’s speech last year, the memo we wrote was titled “Pain?”. In it we explained that he laid out the battle ahead as one that would cause some pain, but one which the economy would be – in his mind – strong enough to manage.

He laid out that “reducing inflation is likely to require a sustained period of below trend growth” and that “there will very likely be some softening of labor market conditions”. But the message everyone heard in his remarks is that this process “will also bring some pain to households and businesses”. It was clear that Jerome Powell was not messing around. He was settling in for a lengthy battle against inflation.

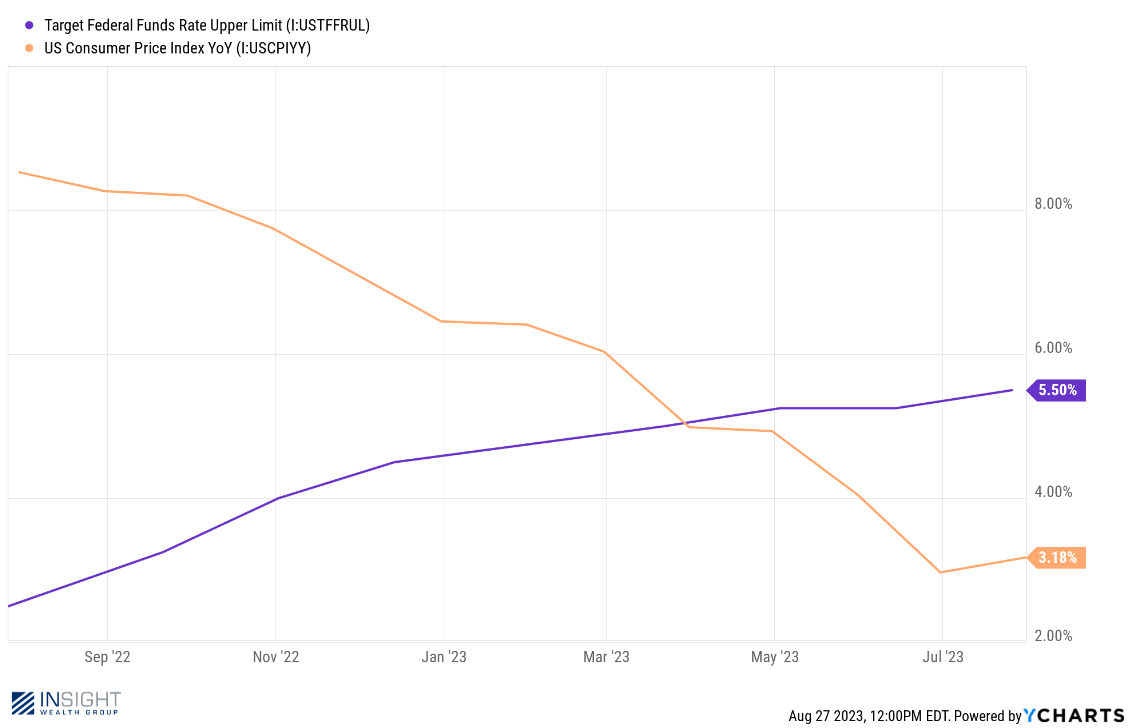

When those comments were made, Powell & Co. had raised rates from 0.00% in January to 3.25% in August. CPI was sitting at 8.25%. So, what has happened since those comments? A stunning change.

Past performance is not indicative of future results.

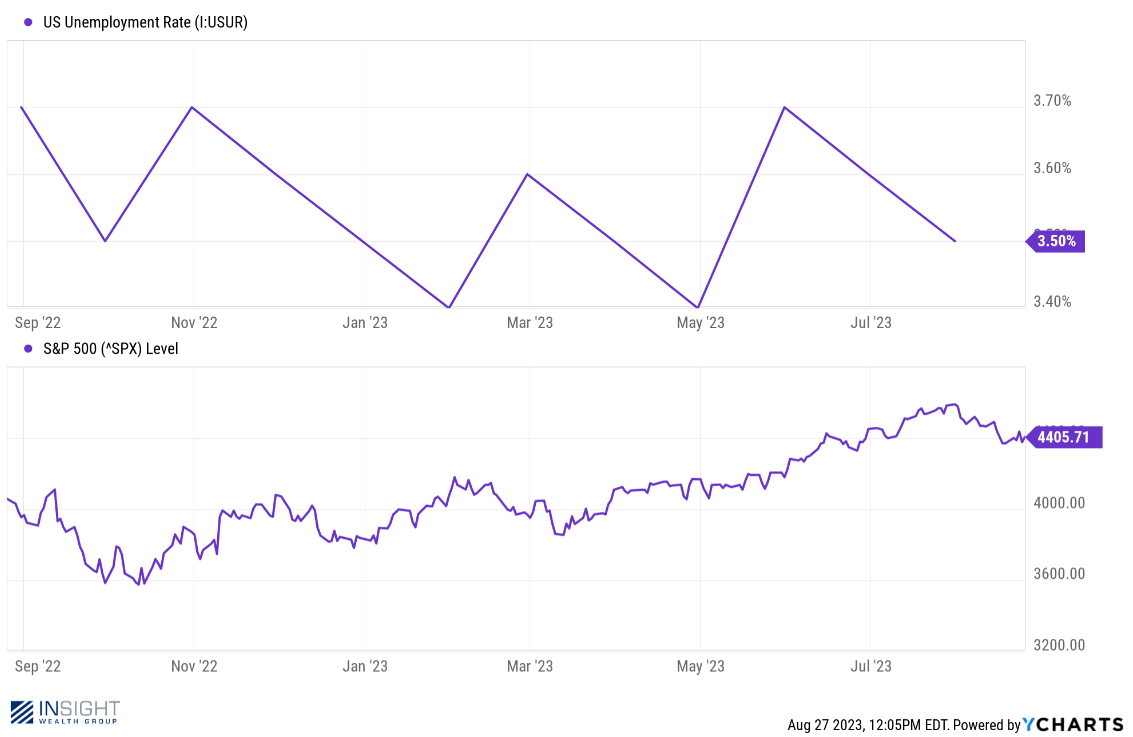

The Fed has continued to raise rates – as we all know – and CPI has dropped precipitously. The plan is working. But Powell was not right about everything. His “period of below trend growth” has resulted in a stock market – even after a bad month – being up 8.5% over the last year. And the “softening of labor markets” has not materialized at all. Unemployment is 0.20% lower than it was last year.

Past performance is not indicative of future results.

Last year we interpreted what Powell was saying as this:

“What he’s saying is the economy is strong enough right now to handle the medicine. But if we let it get sicker (i.e., let inflation come back) – and must take drastic action later – it will be much more painful”.

Say what you want about Powell, but he was correct about this one. While there is no question 5.5% Fed Funds rates are painful to some (i.e., new homebuyers), the economy has shown incredible resiliency.

So, what did Powell say this year? His comments were not a victory lap, but he did highlight the progress we have seen so far while also highlighting the issues that remain. The Fed’s 2% inflation target remains intact which means the battle is far from over.

He broke that battle into three sections: core durable goods, housing, and services. Let’s look at each.

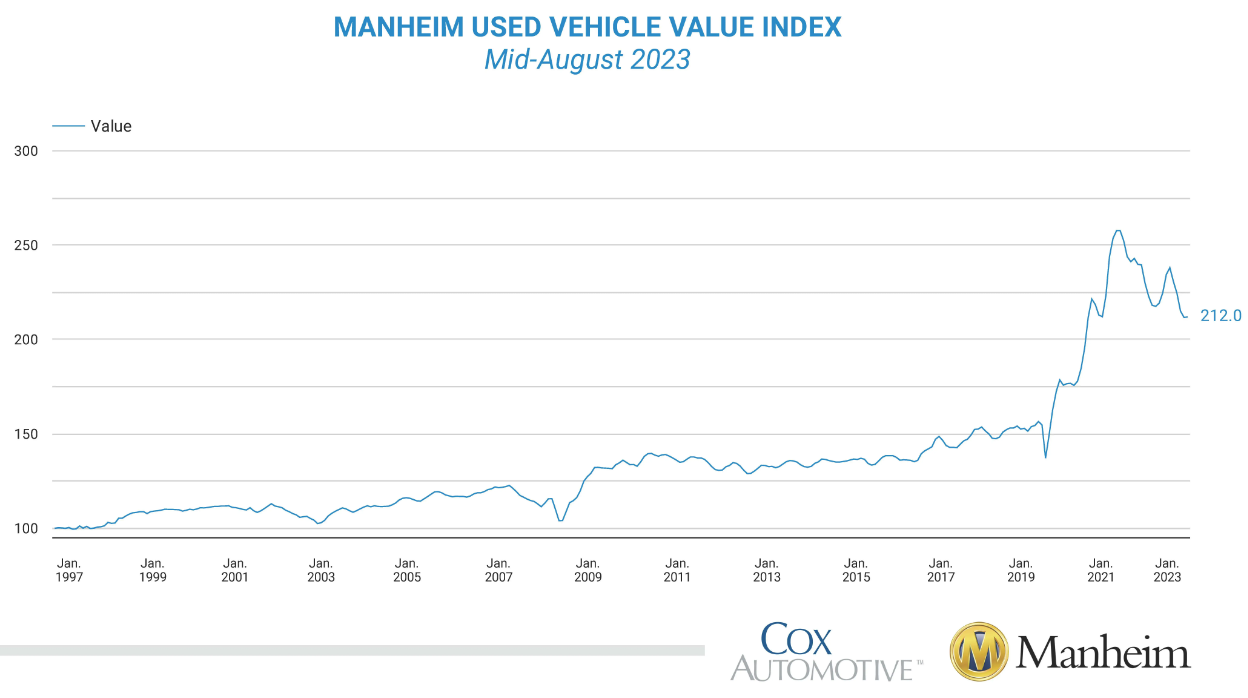

On durable goods, Powell highlighted the auto industry as one that has been emblematic of the inflation saga. Low interest rates combined with excess cash during the pandemic drove higher demand for cars. A limited supply of microchips cratered supply. Higher demand with lower supply – as we all learned in Econ 101 – means price inflation.

But as Powell pointed out, “As the pandemic and its effects have waned, production and inventories have grown, and supply has improved. At the same time, higher interest rates have weighed on demand…and customers report feeling the effect of higher rates on affordability”. This is shown quite clearly in the large drops we have seen in the wholesale prices of used cars. Prices have come down, but they are still a long way from pre-pandemic numbers.

Past performance is not indicative of future results.

On services, Powell noted that this sector had moved sideways since the rate hiking cycle began. That was due to the rising cost of labor. But the improvements we have seen in the labor economy (labor force participation rising, payrolls falling) over the past year have meant that we are starting to see improvement in this area. This is the area most concerning to the Fed.

And then there is housing. You have heard us repeatedly complain about the Fed’s seeming lack of appreciation of what is happening in the housing market. Powell finally seemed to admit that housing over the coming year will help draw down inflation: “The slowing growth in rents for new leases over roughly the past year can be thought of as ‘in the pipeline’ and will affect measured housing services inflation over the coming year”. Where housing has hurt us in the past, it should help in the coming months. About time!

The market loved Powell’s comments on Friday. All three major indices were positive for the day and commentators called his speech a “Goldilocks” speech. Not too hot and not too cold. That was based upon one of his closing comments:

“…real interest rates are now positive and well above mainstream estimates of the neutral policy rate. We see the current stance of policy as restrictive, putting downward pressure on economic activity, hiring, and inflation”.

Let’s put that in English: rates are high enough now to bring down inflation if we stick to it. That is why, even after his speech, the odds of an interest rate “pause” in September remained at 80%.

He did leave himself some wiggle room to raise rates again if necessary. His closing paragraphs stated that they would “proceed carefully as we decide whether to tighten further, or instead, to hold the policy rate consistent…”.

But there was one other sentence we thought was notable as well:

“Getting inflation sustainably back down to 2% is expected to require a period of below-trend economic growth as well as some softening in labor market conditions”.

Sound familiar? That sentence was ripped right out of his 2022 Jackson Hole speech. The one that scared everyone to death!

The more things change….

Sincerely,