The Weekly Insight Podcast – Swifties Unite

Just a quick note before we dive into this week’s memo:

As our clients know, the transition from TD Ameritrade to Schwab took place over the Labor Day weekend. In our review early this morning, it looks like the move was broadly successful. That said, there are a few things to note:

- There are some accounts that are not yet feeding into our Insight360 client reporting system (which you can access here). That seems to be a function of the overnight download process, not an issue with the transition. These should be showing up in our system tomorrow.

- Please remember, if you want direct Schwab login access, to set up your log-in if you have not already. Instructions were emailed by your advisor on August 25th. If you need that info again, let us know.

- There is one additional issue of note: we have a very small number of clients that had set up direct withdrawals from their TD Ameritrade account to pay certain bills (i.e., a monthly mortgage payment). Those instructions will need to be updated. Please contact our office and we can work with you to do so.

There will, undoubtedly, be a few issues with this transition. Anytime we move several thousand accounts from one system to another, it is almost a certainty that something will get missed. We are going to be actively reviewing all the accounts to ensure a proper transition, but if you see something of note please do not hesitate to give us a call directly so we can clean it up for you.

Now let’s get on to the Weekly Insight!

Well…it’s over. Summer has passed and the kids are back at school. And with Labor Day weekend behind us, fall is soon to arrive.

But as we put a bow on summer and move into autumn, there were some really interesting things happening in the economy that we thought would be fun to go through (okay…maybe we’re the only ones who think this stuff is fun!). There is a good bit of momentum happening as we wrap up Q3 – and where we are getting it is interesting as well. Let’s dive in.

Girl Power!

You have heard us say before that 70% of the U.S. economy is consumer spending. The American consumer is a mighty beast. And when it gets rolling, it can have dramatic impacts on the worldwide economy. But it is also true that, when we are trying to fight inflation, a ramp up in personal consumption makes that process more and more difficult.

It turns out, however, that the ramp up in personal consumption might have been a one-off. And it might just be coming to an end soon.

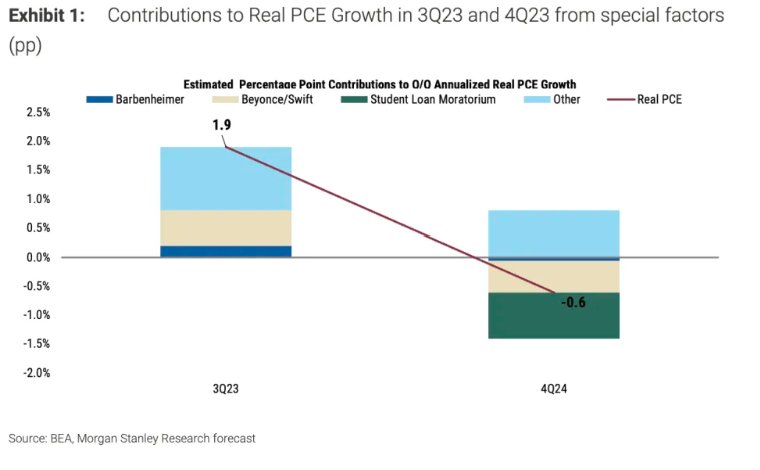

Morgan Stanley economist Sarah Wolfe put out an interesting piece this week that pointed out where a lot of that spending was coming from. And it might just blow you away. The combination of the Barbie movie, the Taylor Swift Tour, and the Beyonce Tour – three things your authors sadly did not get to experience this summer! – contributed $8.5 billion to U.S. growth this quarter alone! That is more than one-third of the growth in consumption spending expected this quarter.

These events were massive in their scale. Barbie’s opening, combined with the opening of the Oppenheimer movie, created more than $425 million in ticket sales in their first weekend. And that does not include all the toy sales that surely came out of the Barbie phenomenon. Beyonce’s Renaissance World Tour, which ends next month, is expected to rake in more than $500 million. And those Swifties…they are a powerful bunch. It is estimated that Taylor Swift’s tour generated more than $2 billion in ticket sales alone. That does not include the swag, hotel rooms, dinners, and airplane tickets for everyone who did all they could to see Taylor perform.

In all, that was a substantial portion of the 1.9% jump in personal consumption expenditures this quarter. But it is also all going away. Taylor is done with her tour. Beyonce is almost there. Barbieheimer is well past its prime. When you combine that going away with upcoming student debt payments, the expectation for consumption next quarter is a drop of 0.6%. Exactly what the Fed is hoping to see as it battles inflation.

Past performance is not indicative of future growth.

Labor Market Returning to Normal

Much noise has been made by Jerome Powell over the last two years about the labor market and its impact on the battle against inflation. Too many jobs being sought by too few workers were driving up labor costs and serving as a catalyst for the inflation we have been seeing.

That demand for labor shifted the power in the employer/employee relationship to the worker. And it resulted in what was commonly known as the Great Resignation as employees looked for other/better opportunities. But according to recruiting site Indeed, the Great Resignation may in fact be over.

Job opening numbers remain high. According to last week’s JOLTS report, there were 8.83 million available jobs in the U.S. But that number is the lowest it has been in two years. And the number of hires is starting to fall as well.

Past performance is not indicative of future results.

Employees are not dumb. Everyone, whether they realize it or not, is making an economic judgement about their lives as they look to improve their position. That is why the fact that “voluntary departures” are now back to pre-pandemic levels. After three years of jockeying for better positions, they now realize the market is moving away from them and they are not willing to walk away from the positions they hold today.

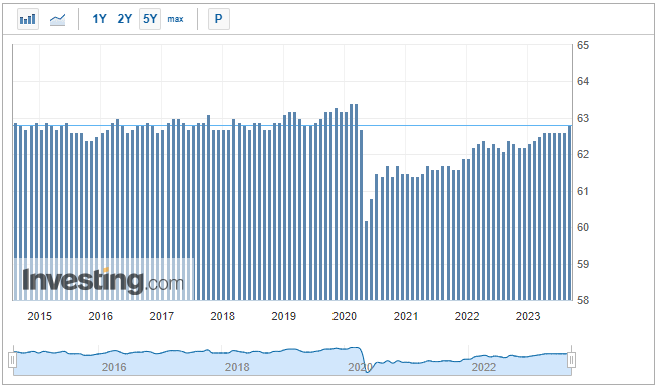

We also saw labor market participation jump a bit as well. The August data came out on Friday and the participation rate jumped to 62.8%. That is not quite the pre-pandemic 63.4%, but it is quite similar to what we saw throughout the five years leading up to the pandemic.

Past performance is not indicative of future results.

And finally, there is the average hourly earnings number. We still see robust growth in this area, with earnings growing at a 4.3% clip. But we continue the slow and steady decline back towards more normalized numbers. Simply put, the labor market is cooling off, but it is doing so in a healthy way.

Hurricane Season

So, what can throw a wrench into this orderly return to a more normalized economy? A lot. More things than we could possibly name! But one item popped up this week that we thought was worth reviewing: the impact of hurricanes on the U.S. economy.

This week’s category four storm, Idelia, which swept through rural Florida was a rough one if you lived in its path. The good news for everyone in Florida – and the U.S. economy – was that not many people lived in its path. It could not have hit a less populated portion of the Florida coastline if it tried. As such, the impact on the economy should be negligible.

But a big storm, in the wrong place, can have significant impacts. With hurricane season just getting started, we thought it might be worthwhile to do a little research into what that may mean for the economy.

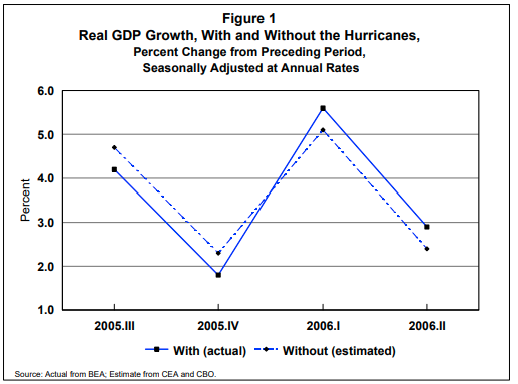

The U.S. Department of Commerce put a piece out on this issue after 2005, which was one of the worst years for hurricanes in the United States (remember Katrina?). What they found made sense – but seemed a little counterintuitive at first.

Unsurprisingly, they found that GDP fell in the immediate quarters after the hurricane. That makes sense as people are without work and trying to rebuild their lives. But the impact of the recovery from the hurricane had a stimulative effect on the economy in the following two quarters. The end result? It was pretty much a wash.

Past performance is not indicative of future results.

In the end, hurricane season has the potential to cause short-term pain in the economy. But we should not overestimate its long-term impact.

We’ll wrap it up there this week. We hope you had a wonderful Labor Day weekend and look forward to connecting with each of you soon!

Sincerely,