The Weekly Insight Podcast – The Consumer’s Not Done Yet

There are countless esoteric data sets regarding the economy and the market. Yield curves, P/E ratios, earnings targets, etc., etc. If you have a view of the economy today (positive or negative), we can find you a data set to support it. As Vin Scully once said, “Statistics are used much like a drunk uses a lamppost: for support, not illumination”.

In the end, it is our belief that it’s the “big things” that matter. Is the Fed going to raise rates again? That’s a big thing. Is Washington going to raise or lower taxes? That’s a big thing.

But what is the biggest thing of all to the world economy? It’s you. The U.S. consumer. U.S. consumer spending makes up 70% of the U.S. economy – the largest economy in the world. So, as the U.S. consumer goes, so goes the economy and your investment portfolio.

You know the story by now: economists have been predicting a crushed consumer and a recession for some time now. The projections for Q3 were particularly egregious when compared to the actual results. Not only did the big brains miss on GDP, but they also missed on personal consumption, unemployment, disposable income, etc., etc. The differences were pretty stunning.

Past performance is not indicative of future results.

But Q3 is the past, and the world can change very quickly. Last weekend we got a much more direct snapshot into what is going on in the world of the consumer: Black Friday. There is no other single day of the year which can give us better insight into what’s happening with the consumer. Given all the dire forecasts we’ve seen for the economy, one could assume a big bust for retailers.

But that’s not what happened. In fact, according to Forbes, this year’s Black Friday set records:

- U.S. consumers spent $9.8 billion online Friday. That’s up 7.5% year-over-year.

- In-store traffic at retail stores was up 2.1% compared to 2022. We don’t yet know what the sales figures are, but traffic count is a big predictor of success.

- Total “Holiday Spending”, which is tracked from October through December, is on pace to grow 4% year-over-year.

All of that tracks with the expectations of the National Retail Federation, which predicted this year’s Thanksgiving Weekend shopping would have the most shoppers ever, well up from pre-pandemic levels.

Past performance is not indicative of future results.

But how is this possible? How are we still hanging in there? Is it just dumb consumers spending money they don’t have? For some, undoubtedly. But for the majority? No.

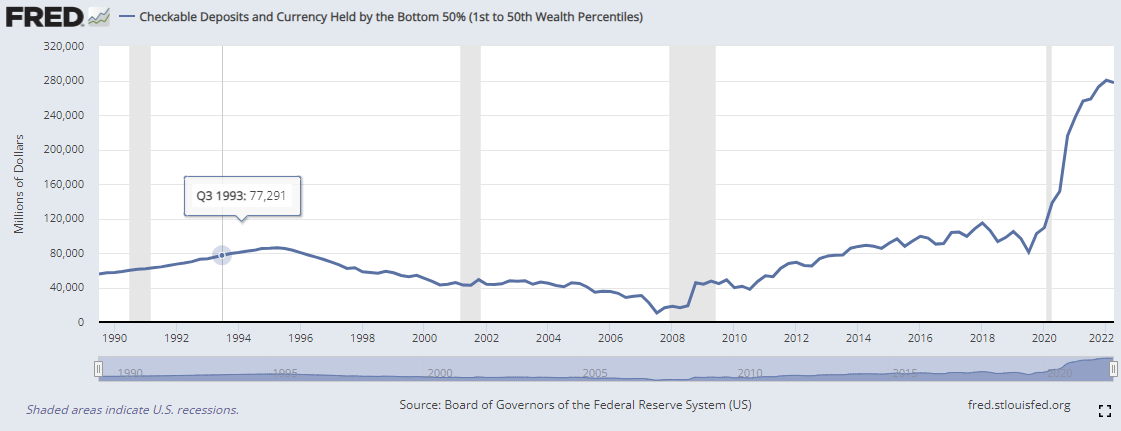

You’ve heard us talk about this statistic (remember what we said about statistics!) before, but it’s still valid: consumers have more cash today than at almost any time in human history. But what’s interesting is that, while that number is starting to trend down a bit, most of the downward trend is happening in the upper income echelons. For those people in the bottom half of income earners, cash is still nearly at its all-time peak. And that’s after a pretty rough run of inflation.

Past performance is not indicative of future results.

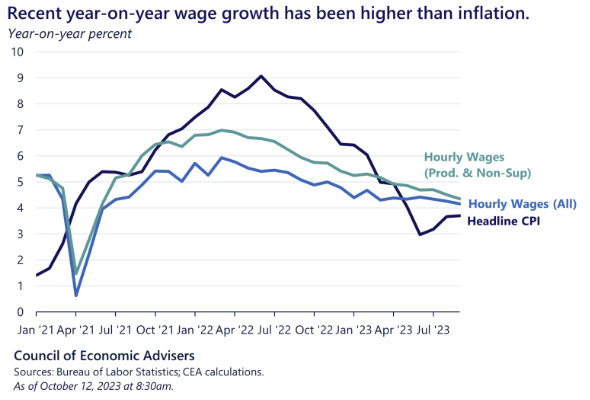

It turns out there’s a good reason for this. While inflation was undoubtedly a pain, we’ve now reached the point where wage growth is growing faster than inflation. People are making more money – inflation adjusted – than they have in some time.

Past performance is not indicative of future results.

Will this all continue indefinitely? Of course not. But it bodes well for the economy in the short term. And it bodes well for retailers as we march through the holiday season.

We’re going to see a lot more about consumers this week. New consumer confidence data comes out. The Fed’s preferred measure of inflation – PCE – will be released Thursday. And we’re also going to get the personal spending data from October. All seem to be tracking in the right direction. Barring any surprises – and some continued holiday shopping cheer – December might just be a good close to a volatile year.

Sincerely,