The Weekly Insight Podcast – Racing Toward the Finish

It is hard to believe that we’ve entered the month of December. Just a few weeks from now, Christmas and New Years celebrations will fill our schedules and quiet down the news coming out of public markets. We’re quickly racing toward the end of the year and that means there are some year-end items that deserve our attention. Let’s take a look at what could move the needle for you, and the markets, prior to the end of the year.

Year-End Tax Planning

As December 31st approaches, it is important that we not forget the opportunities and deadlines that are bearing down on us. Let’s go through a few important items:

Tax Loss Harvesting

The end of the year is often a suitable time to take a run through your portfolio and address any gains and losses that may have accumulated throughout the year. Tax loss harvesting is a strategy we often use in clients’ non-qualified (i.e., taxable) portfolios prior to year-end.

The idea is simple: if you’re looking at a year of big realized gains in the portfolio, look for losses you can take prior to year-end to offset those gains. The problem is doing it in a way that doesn’t impact your ability to participate in any rally the market might experience.

To avoid that concern, the goal is often to buy a similar asset to replace the loss you’re realizing. For example, if you’re selling the shares of an energy company, we might buy an energy ETF to hold for the required 30 days, thus avoiding what the SEC calls a “wash sale”. Once that 30-day window has closed, you can reverse the trade and buy back the company you previously sold. If, in the meantime, energy companies rallied broadly, your ETF position should ensure some participation in that rally.

For Insight clients, we are looking at this already on your behalf. However, if there are outside assets which we may not know about that have created large gains and/or losses for the year, please give us a heads up so we can include that in our review.

Retirement Account Contributions

IRA and Roth IRA account owners are allowed to make 2023 contributions all the way up until they file their 2023 taxes (i.e., April 2024). However, for those who have closely held companies and are trying to max out their company contributions to their Solo 401(k) plans, now is the time to make sure you are appropriately calculating the salary necessary to max out those decisions.

Company contributions to a 401(k) are maxed out at the lesser of $43,500 or 25% of the employee’s payroll. For those who are owners of single employee businesses and use a Solo 401(k), that means you have to pay yourself $174,000 to max out the company contribution. If you’re not at that level but have the ability to pay a “year-end bonus”, now may be the time to calculate if that makes sense for your tax picture.

Roth Conversions

Unlike IRA and/or Roth IRA contributions, conversions of retirement assets into Roth classification must be completed by December 31st.

Roth Conversions often make the most sense for retirees who are in a lower income bracket and have room in that bracket to pull some assets from their IRA to their Roth. Let’s take, for example, a married couple aged 66. They have $45,000 in Social Security income and a large traditional IRA balance of $2,000,000. After the standard deduction of $27,700, they would only have $17,300 of taxable income, but once they get to RMD age (age 73), their IRA distributions are going to drive their taxable income into a higher tax bracket.

In this scenario, they could take $72,000 from their IRA and transfer it to their Roth while only paying 12% in Federal taxes. That money will grow tax free in the Roth and will reduce their eventual RMD in the future. Assuming tax rates and income remain the same, they could move more than $500,000 out of their IRA prior to RMD age while paying only 12%. That’s quite the deal.

One important thing to note with these items is the time it takes to execute transactions. For any item that has a December 31st deadline, we would encourage you to get going ASAP. While these items often seem simple, they also depend on groups like Schwab to execute the transaction in a timely manner. Thus, the December 31st deadline is more like December 15th to ensure it is completed on time.

One More Round with the Fed

As we’ve discussed in previous memos, the economic data coming in over the last few months has been incredibly positive. We seem more and more on pace for the long wished for “soft landing” that economists told us just wasn’t possible.

Last week provided more positive data. PCE, the Fed’s preferred measure of inflation, came in right as expected. Core PCE rose 0.2% month-over-month and 3.5% year-over-year, exactly in line with expectations and below the numbers for the prior month.

In the meantime, the Q3 GDP numbers were released and beat even the rosiest expectations. GDP grew 5.2% last quarter – while inflation was falling.

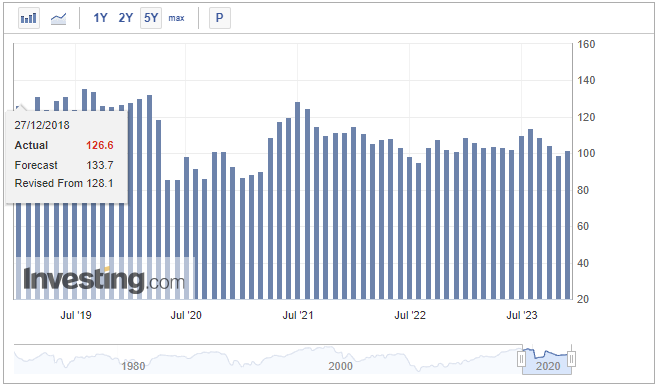

And, in the midst of that, the all-important consumer is also starting to feel a bit more confident. The Conference Board’s consumer confidence number came in at 102.0 – above the expectation of 101.0 and back into positive territory (any number above 100).

Past performance is not indicative of future results.

That gets us to the Fed. We have one more Fed meeting this year – coming up next week – and no one is expecting fireworks. The market is currently placing a 98.8% probability on the Fed keeping rates level at this meeting.

The big question has now shifted. At the beginning of the year, it was “how high will rates go?”. Then it was “are they really done raising rates?”. Now it is “when will they cut rates?”.

We don’t know the answer. But we do know that momentum is starting to shift. The probability chart is pushing the first rate cut earlier and earlier in 2024.

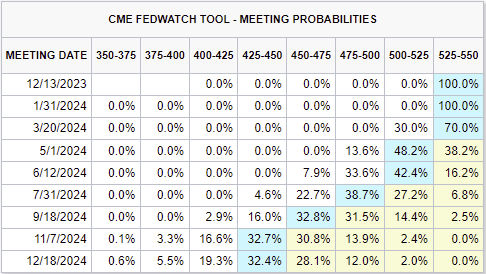

Just two weeks ago, we showed you this chart which indicated the first rate cut would likely come in May and the Fed would cut rates four times in 2024.

Source: CME Group

Past performance is not indicative of future results.

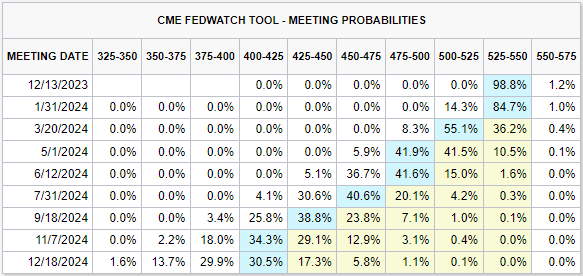

What a difference two weeks can make. The current expectation – now up to 55% – is that the Fed will start cutting in March. Even better, the odds are now showing five rate cuts in 2024.

Source: CME Group

Past performance is not indicative of future results.

It is that optimism around rate cuts which has driven market performance over the last two weeks. But we need to remember that, if Chairman Powell throws a wet blanket on this viewpoint, that trend could reverse itself pretty quickly.

If we get through next week without any reason for folks to assume the Fed is shifting gears, we would anticipate a strong finish to the end of the year. That would seem to be the last bogey we have to clear before we can put a volatile, but largely positive, 2023 behind us.

Sincerely,