The Weekly Insight Podcast – Absolute Certainty

As we head into this holiday shortened week, we want to start by wishing each of you a Happy Thanksgiving! This holiday – with its purpose to celebrate the blessings of the year – is an important reminder to us all. We’ve written thousands of words in this memo over the last four years that have decried all the things wrong with the world, market, economy, etc. But the simple truth is that we – as citizens of this great country – are truly blessed. Even if that’s hard to remember sometimes!

So, we hope you’re able to spend time this week enjoying some amazing food, watching a little football, and celebrating those blessings. There are many!

Also, just a quick reminder that the markets, and our office, will be closed on Thursday. Additionally, the markets close early on Friday (12:00PM Central).

Now, let’s get on to business.

Have you ever been absolutely 100% certain of something? The kind of certain where you would bet the farm on your outlook? Ok, ok…we can hear you now. We’re certain that the earth is round. We’re certain the sun rises in the east. Yes, you can be certain about those things. But have you ever been that confident about something related to the market or the economy? We doubt it.

Or can you ever think of a time when there was 100% consensus about an idea related to the market? It doesn’t happen very often.

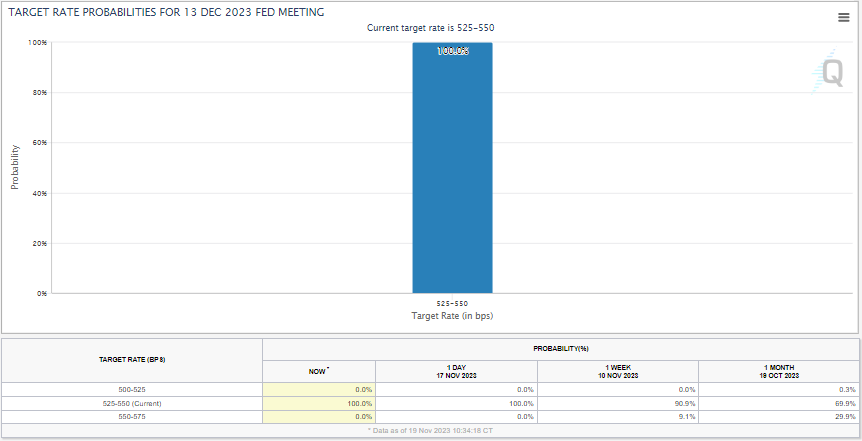

Which is why we were a little bit taken aback when we pulled the latest CME data on the probabilities surrounding future Federal Reserve interest rate decisions. You’ve become familiar with this data over the last 18 months of the Weekly Insight. It’s the clearest encapsulation of the market’s guess on what the Fed’s going to do. Look at the most recent version. 100% agreement that the Fed isn’t going to raise rates next month.

Source: CME Group

Past performance is not indicative of future results.

Having a completely unanimous take on something that’s going to happen nearly four weeks from now is unique. But it’s not completely out of line. With the CPI data we saw this week and the comments we’ve seen from Fed members in recent weeks, there is evidence to back it up.

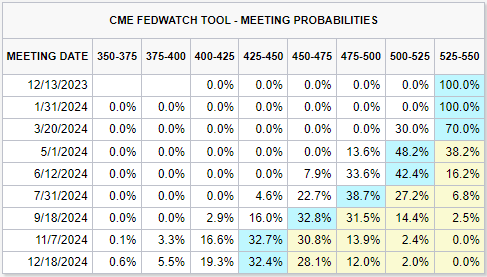

But where it gets interesting is when you look at the expectations for future meetings. There’s not just 100% consensus on what’s going to happen in December. There’s also complete consensus on what’s going to happen in January (no hike, no cut). And there’s no one…not a single soul in the market…that thinks the Fed is going to raise rates again in the current cycle.

Source: CME Group

Past performance is not indicative of future results.

So, according to this, the Fed is done raising rates. D.O.N.E. Done. And, even better, a more rapid cut in rates next year than we’ve seen for the last six months in the data. A consensus of four rate cuts over the next twelve months to a level fully 100 basis points below what we see today.

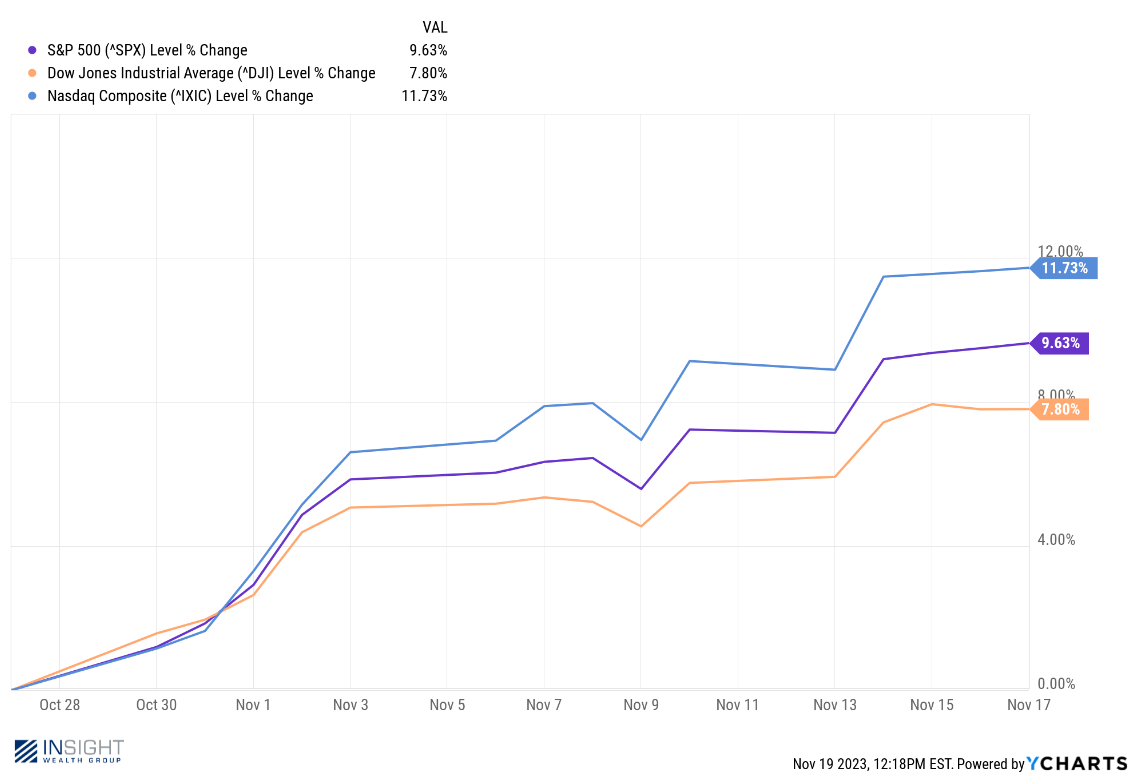

If we’re 100% certain of anything, it is that this change in sentiment around rates is entirely the reason for the incredibly positive market we’ve seen the last few weeks. It, combined with continued strong economic data, is the justification for the market being up 10% since the Friday before the last Fed meeting.

Past performance is not indicative of future results.

We love the optimism. And the good news is it comes at a time of seasonality in the markets (leading into the holidays prior to an election year), when history would tell us there is more to come. The ball is moving in the right direction, and it justifies the confidence we’ve had in the market over the course of the volatile last several months.

But we also hate certainty. There is no such thing in this world. And anytime we see such a drastic swing of sentiment, it’s a good reminder of how quickly sentiment can swing the other way. One bad jobs report, one bad set of inflation data, or one bad Fed meeting could quickly deflate this market’s ego.

Dr. Daniel Crosby’s excellent book, The Behavioral Investor, looks at the biological drivers behind risk taking in humans. In it he discusses a study by Dr. Richard Peterson which he explains “show(s) that activating the reward system leads to ‘increased risk-taking (and) increased impulsivity”. That means, as he points out, when markets go up “your brain becomes more risk seeking…and more conservative in bear markets” (emphasis added).

As he goes on to point out, “our flawed brain leads us to subjectively experience low levels of risk when risk is actually quite high” and the opposite when risk is low.

Think about it in simple terms: are you more stressed out when the market is up 20% or when the market is down 20%? We all know the answer. It’s even true for the team at Insight. But it should be exactly the opposite! We should be cherishing bear markets and fearing bulls!

Which is why, despite our broad level of confidence in the economy right now, we’re also watching closely what happens with sentiment around interest rates. Let’s participate in this rally while we can. But we shouldn’t get too cocky, or too risk forward, in portfolios. That’s a trap that has caught many an investor over the years.

Sincerely,