The Weekly Insight Podcast – Know Who You Are

College football season is in full stride across the nation as we enter the heart of November. There is enough drama (thanks, Michigan!) and great football going on to keep even the faintest fan engaged. But one of the best – or worst (depending on the reader) – stories is happening right here in the great state of Iowa.

On Saturday, the University of Iowa football team clinched a share of the Big 10 West title and can win it outright with a victory in either of their next two games. They have been able to do that despite the following:

- The WORST offense in all of Division 1 college football. At 243 yards/game, they trail teams like Eastern Michigan, Kent State, Eastern Carolina, etc., etc.

- The loss of their starting quarterback and their two leading receivers to season ending injuries.

- Their offensive coordinator – and the son of their head coach – being unceremoniously fired mid-season by the school administration despite the head coach’s objections. Oh…but they let him coach the rest of the year!

- They have repeatedly set the record for the lowest predicted total points in a college football game by Vegas. They set a new record line this weekend against Rutgers of 28. And beat it by 6!

Despite all of that fumbling and bumbling, they are 8-2 on the season (and should be 9-1 after an unbelievably bad call brought back the game winning touchdown against Minnesota!). They are likely going to get a chance to compete for a Big 10 title in Indianapolis next month.

But why? How could a team so ridiculed for their inability to put points on the board still be sticking around and causing everyone headaches? Simply put, they – and their head coach – know exactly who they are. It isn’t pretty. But they know they have the nation’s best defense and one of the best special teams. And so, they are playing the hand they’re dealt. They are okay with being different and being mocked on ESPN because they’re confident enough in themselves to charge forward.

There is an important lesson for investors in that mindset. It reminds us of the opening lines of the famous poem If by Rudyard Kipling.

If you can keep your head when all about you

Are losing theirs and blaming it on you,

If you can trust yourself when all men doubt you,

But make allowance for their doubting too

That is the hardest part of being an investor. We are often overwhelmed by information that is either too optimistic or too pessimistic than reality. As we noted last week, it seems the only two options for the world these days are “To the moon!” or “We’re all going to die!”.

Part of it is psychological. But part of it is learned memory. Most of the people reading this memo had risk assets deployed during the beginning of the century and there is some scar tissue still embedded. If you invested a dollar in the S&P 500 at the beginning of 1999, it was worth just $1.02 on December 31, 2010 — 12 years later!

Past performance is not indicative of future results.

But let’s imagine for a second that you did not freak out during that decade. You stuck with it, you trusted your defense and special teams, and still have that dollar invested today. Almost 25 years later, you are up 259.2% – over 10% per year.

Past performance is not indicative of future results.

Admittedly, the last three years of that chart are a rollercoaster. We have been through some real turmoil, highlighted by the worst pandemic the world has seen in over 100 years. And the media is in overdrive highlighting all the horrible things that could happen next. But is the world really that bad right now (at least economically)? We don’t think so. And that is highlighted by the state of the U.S. consumer – the most powerful force in the history of the world’s economy.

Let’s look at a few examples of what the world’s saying and what the data actually shows.

1. All that COVID money is going away, and the consumer is running out of cash!

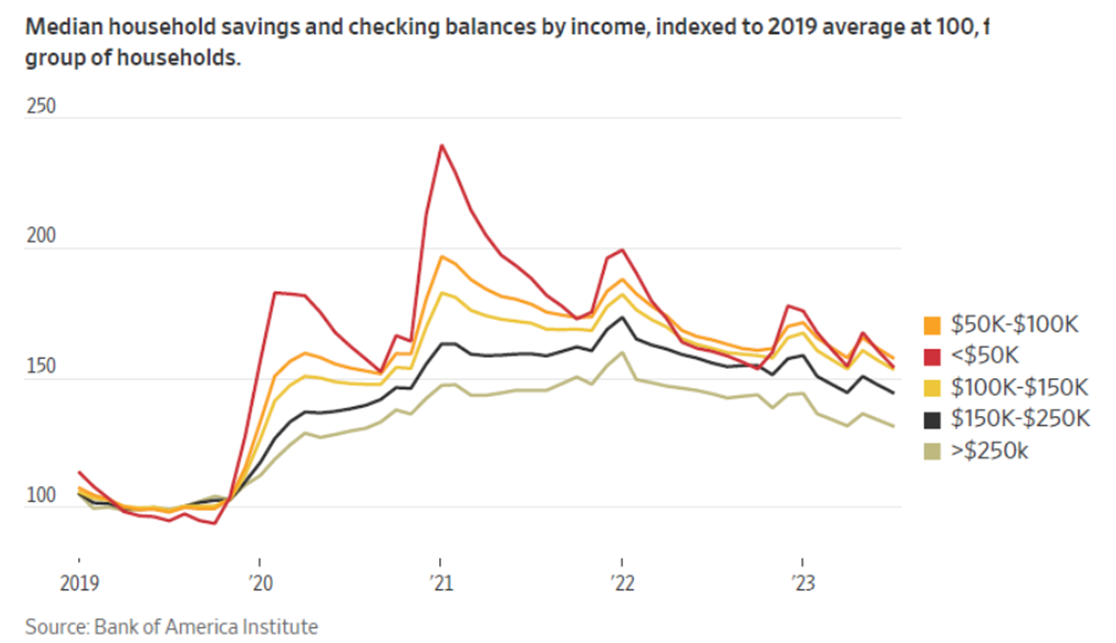

The consumer does have less cash today than they did in early 2021. That is true. But it is still way more cash than they had pre-COVID. In fact, consumers with less than $150,000 in annual income still have 50%+ more cash than they had pre pandemic.

Past performance is not indicative of future results.

2. That may be true, Insight, but debt is getting out of control again!

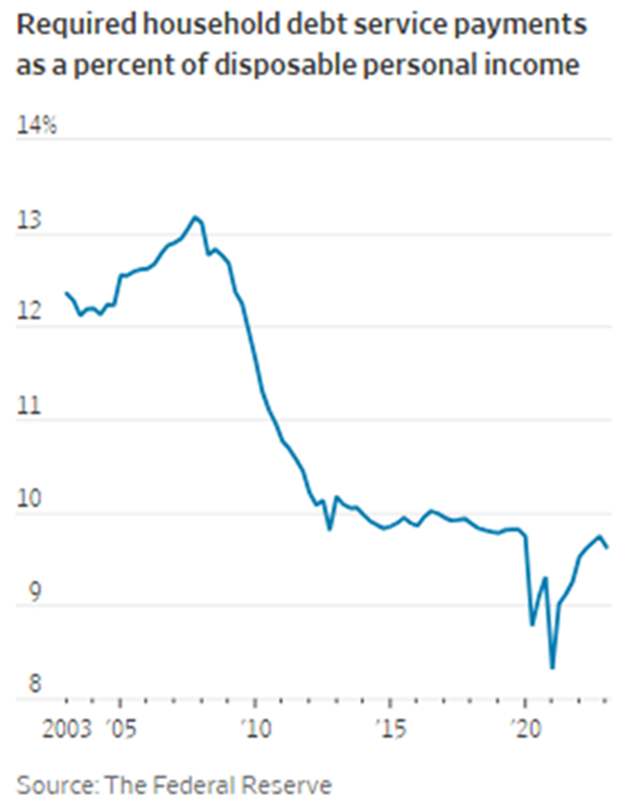

Nope. Not yet at least. We have, understandably, seen a bounce off the bottom as it relates to the percent of income being used for required debt service payments (it helps when people did not have to pay mortgages or student loans!), but we’re still below the pre-pandemic numbers.

Source: Wall Street Journal

Past performance is not indicative of future results.

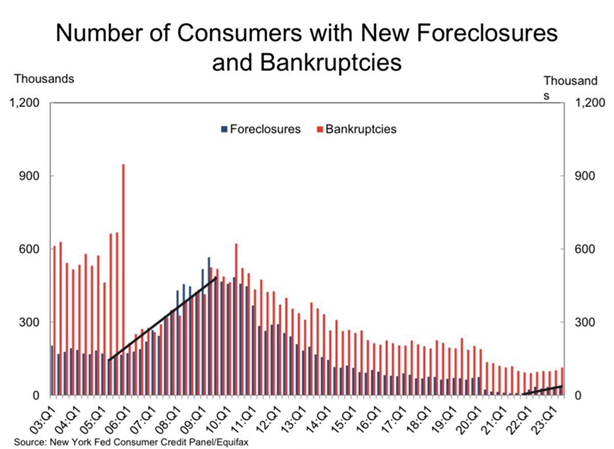

3. But bankruptcies and foreclosures are rising!

Again, they are. But off pre-pandemic lows. If you want to get a sense of just how bad the world is today vs. what we experienced in 2008, the chart below is a doozy. What we are experiencing today is nothing compared to that rodeo.

Past performance is not indicative of future results.

There are still a lot of things that could go wrong in this world. The conflict in the Middle East could expand. The conflict in Ukraine could expand. China could invade Taiwan. The Fed could screw up the inflation battle. Heck, we could have another pandemic!

But here’s the thing: we always have “Black Swans”. Always. That is why there’s a name for them. And we cannot ever predict them. But we can train ourselves to block out the noise and commit to a path of long-term investing. The overwhelming data tells us that those who stuck with it through the tough times have inevitably come out ahead of those who panicked. And these do not even qualify as tough times right now.

The market’s offense isn’t working so great right now. But we still have our defense and special teams. And we should be able to ride that to a few wins. Just don’t do what Kipling recommends later in If:

If you can make one heap of all your winnings

And risk it on one turn of pitch-and-toss

And lose, and start again at your beginnings

And never breath a word about your loss

Let’s hope he stuck to poetry and never worked in finance!

Sincerely,