The Weekly Insight Podcast – One Of These Things Is Not Like The Other

A few weeks ago, we talked about “immutable truths” in the world. Things that no one can argue about. And why – in financial markets – there really isn’t such a thing. We got a great reminder of that one Wednesday. Jerome Powell stepped to the podium after last week’s FOMC meeting and…wait for it…the market went UP! And it kept going up on Thursday and Friday. What in the world?

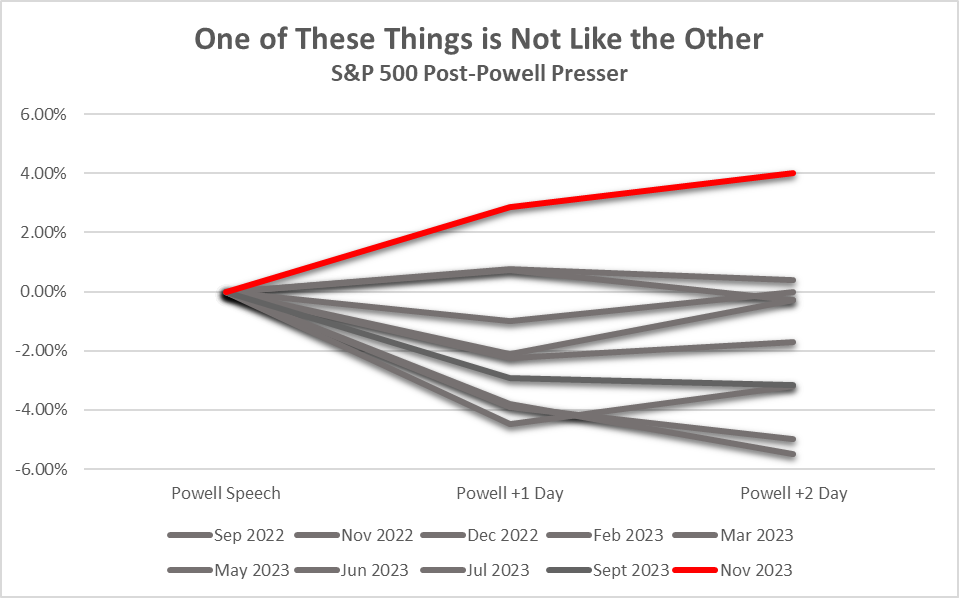

All joking aside, we’ve been talking for some time about what happens when Powell speaks. It hasn’t been pretty. Just look at the results from the last year of FOMC meetings. Anything stand out?

Source: YCharts

Past performance is not indicative of future results.

But what is it that has the market up 6% in the last week? What did Powell say and what guidance can we take from his comments for the future? Let’s dive into it.

The Fed is Done Raising Rates?

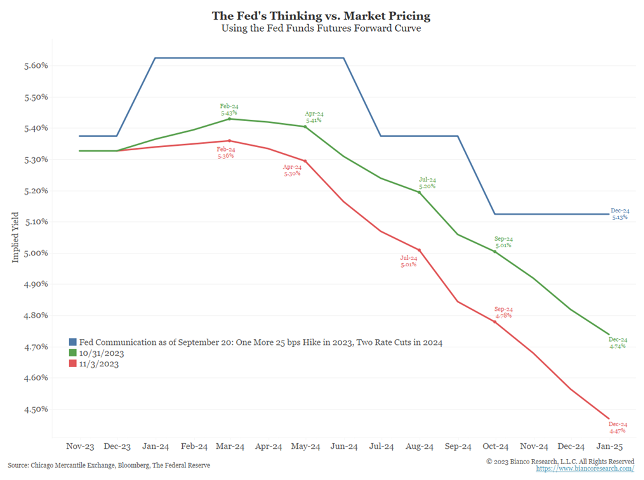

Powell did NOT say that. But it’s what the market heard. Just look at the chart below which shows the change in interest rate expectations in the last week.

Not only is the market convinced rate hikes are done, but they are also more optimistic about future cuts, now pricing in a minimum of three interest rate cuts between now and the end of next year. The probability of a rate hike in the next Fed meeting – which was as high as 39.4% one month ago – is now just 4.6%.

You’re familiar with Fed Speak by now. There are no hard edges to Chairman Powell’s comments. Everything is purposefully obtuse. So, while there were no specific guideposts to rate hikes being over, there were several points that laid out the path.

One Pesky Word

After a meeting like this – when the FOMC chooses to do nothing – the formal statement they release tends to change extraordinarily little. That was the case again on Wednesday. Oxford Economics was kind enough to create a redline version that showed the main changes of the statement:

“Solid” vs. “strong” economic activity. “Slowed” vs. “moderated” job gains. Most of it is semantics. But the addition of one pesky little word is important. Powell & Co. added “financial” conditions to the things weighing on economic activity – in addition to the previously mentioned “credit” conditions.

That’s a fancy way of saying the rise in bond yields over the past several weeks has been doing the Fed’s job for them. They don’t see a need to continue to raise rates if the public bond markets are going to do it for them. And my have they! The rise in 10-year treasury yields has been one of the fastest – and highest – in the last 25 years.

Past performance is not indicative of future results.

But that gets us to the “chicken or the egg” of Fed projections. Many market makers judged Powell’s comments to be “dovish” (more on that in a bit). That interpretation – that the Fed is done raising rates and the economy is looking good – meant a significant easing of financial conditions. The very thing Powell was relying on to do the work for him started to work against him as soon as the words came out of his mouth. Look at 10-year treasury yields since his speech. They’ve almost given back all the gains from the last month.

Past performance is not indicative of future results.

This isn’t necessarily catastrophic, but it’s something to watch. If bond yields won’t do the job for Powell, he may have to do it himself with future rate increases – or leaving them higher for longer.

Is Powell Becoming a Dove?

If you’ve been watching the news in the last few days – especially on CNBC – you’d think there had been some dramatic change in the state of the world. The optimism was palpable. Hosts were clamoring over one another to talk about why we’re going to get a rally through the end of the year. Your author watched one money manager (sorry…we didn’t get her name!) on Friday trying to make a more balanced argument and she couldn’t have been shouted down quicker by the panel. It seems the two options for the world are “nothing will ever go wrong again!” and “we’re all going to die!”.

The truth, as always, is somewhere in between. Powell isn’t becoming a dove yet. He was clear they will continue to raise rates again if they need to. One simply needs to hear what he said in response to the first question at his press conference:

“As for the Committee, we are committed to achieving a stance of monetary policy that’s sufficiently restrictive to bring inflation down to 2 percent over time. And we’re not confident yet that we have achieved such a stance”.

Powell isn’t confident yet. But the market sure is. Therin lies the rub. If we’re being honest with ourselves, the market is a much better predictor, historically, of what the Fed is going to do than the Fed is. One only needs to go back and look at the “dot plot” from December 2021 to know that’s true.

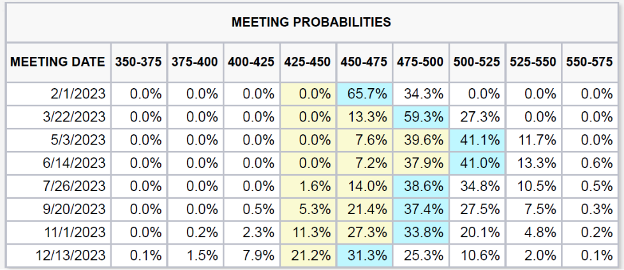

But that only works until it doesn’t. This year has been a testament to that. At the beginning of 2023, the market thought the Fed would peak rates at 5.00% – 5.25%. That’s not that far off the 5.25% – 5.50% at which we currently sit. But the market also thought the rate would peak in May and be back to 4.5% – 4.75% by the end of the year. That was flat out wrong.

Source: CME Group (January 3, 2023)

Past performance is not indicative of future results (clearly!).

That miss has led to a year where the market has gone up, down, and sideways, but really hasn’t made considerable progress. We can’t tell you when it’s “over”. But the good news is the Federal Reserve signaled last week that we’re a lot closer than we have been for the last 18 months. And that has all of us feeling just a bit brighter this week.

Sincerely,