The Weekly Insight Podcast – Beggars’ Night

Happy Halloween! If you, like us, live in Central Iowa, you are familiar with the experience of Beggars’ Night. It’s an interesting phenomenon and confusing to those who move to the area. Instead of kids wandering the streets on Halloween to scare their neighbors and learn about pre-diabetes, they head out the day before. October 30th is Beggars’ Night and it’s when we celebrate Halloween.

The “why” on this one is interesting. It started as a tradition in 1938 as a response to what the City of Des Moines considered a “high volume of mischief and vandalism” reported each Halloween. (Yes…it turns out kids have always done stupid stuff!) The theory was that if they moved the date from October 30th, it would reduce the shenanigans and the tradition has lived on for 85 years.

It seems like such an odd solution to the problem. Aren’t teenagers still going to be wandering neighborhoods in the anonymity of costumes? Don’t the problems just move a day forward from October 31st to October 30th?

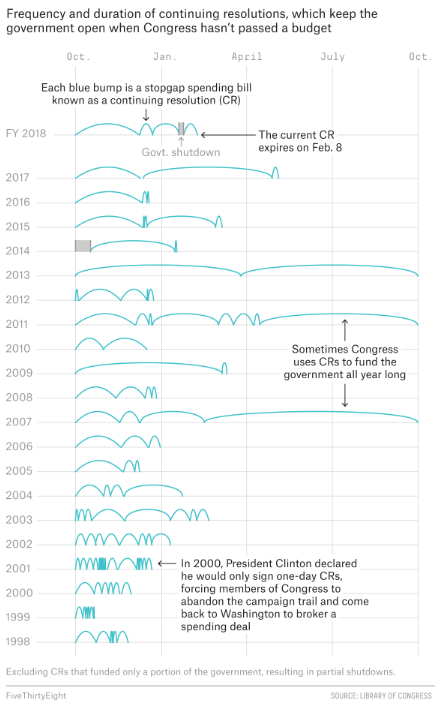

It reminds us a little bit of how Congress has been running the budgeting process for the last 35 years. If you punt the problem to another day (i.e., pass a continuing resolution) it doesn’t change the fact that you still have a problem that needs to be dealt with!

The chart below isn’t up to date (it only runs through 2018), but is a great descriptor of how Washington has been handling the budgeting process since the late 1990’s. We all know it hasn’t been any better in the last five years.

Source: fivethirtyeight.com

Past performance is not indicative of future results.

And so we run, panic-to-panic, through a process that doesn’t allow the American consumer or the markets the ability to plan for the future. It is an absolute failure of leadership. But until we start holding our representatives accountable for the most basic functions of their job, nothing will change.

Which brings us to today. On September 30th, Congress passed a continuing resolution to fund the government through November 17th. And then, just a few days later, the House paralyzed itself when Republicans fired Speaker Kevin McCarthy. The ensuing, nearly month-long battle to replace him has consumed Washington and meant no work has been done to move the budgeting process forward.

And so now, with 19 days remaining until the next potential government shutdown, Washington is hopefully getting to work. New House Speaker Mike Johnson (R-LA) has his hands full. How does he navigate a caucus that fired the last guy for compromising on the budget? Can he put together a plan that will pass the House and get Senate and White House approval?

Johnson laid out a specific plan to members of the GOP Conference last week. It calls for a return to the old way of legislating spending which includes passing through the Appropriations Committee individual spending bills for each area of government. But he was also clear that it’s not going to happen by November 17th. As such, he has asked the Conference to do just one more continuing resolution. (That reminds us of our kids asking to go to just one more house on Beggars Night…).

It seems he has won over some of McCarthy’s previous opponents on this issue. Representative Matt Gaetz (R-FL), who initiated McCarthy’s removal, has said he would be willing to support this “bridge” to a more normalized process. It will be interesting to see if Johnson can rally the support necessary over the next two weeks. It doesn’t matter what side of the aisle you fall, a government shutdown right now would not be good for the world, or our economy.

Fed Week

It’s Fed Week again. So, it comes as no surprise that all eyes will be on Chairman Powell Wednesday as he announces the latest Fed decisions from the podium at the Eccles Building in Washington, D.C.

There was a lot of economic news last week which the Fed will be digesting. Let’s go through a few of the most telling items.

GDP

GDP came in much hotter than many had been anticipating at 4.9% for Q3. The consensus estimate was 4.3%.

That 4.9% number might be familiar to you, however, as readers of the Weekly Insight. You’ll recall that we track the Atlanta Fed’s GDPNow forecast. It has been one of the most accurate in predicting inflation for the current quarter. Just a few weeks ago they were projecting Q3 GDP at…4.9%.

Which brings up an interesting question: where is GDP going for Q4? You have all been pounded with news stories that “a recession is coming!”, but is it coming soon? Not according to the Atlanta Fed. Their current projection for Q4 is 2.3%. That would be right in line with what we saw in Q1 and Q2, meaning 2023 is on pace to be a strong year for economic growth.

Source: atlantafed.org

Past performance is not indicative of future results.

Manufacturing PMI

We haven’t talked for a while about “PMI”. It’s the Purchasing Managers Index and is measured on a scale where below 50 means contraction and above 50 means expansion. There are two key measures of PMI: manufacturing and services. A dip in either has indicated a slowdown in the economy, but that’s been especially true of the manufacturing sector.

And that’s exactly what we’ve seen. Manufacturing PMI peaked in February of 2021 and has been falling from unsustainable highs created by the pandemic. It entered into “contraction territory” in November of last year and bottomed out in March of this year.

The improvement has been marked by fits and starts, but there has been a steady climb over the past several months and last week we got a big surprise: PMI jumped to 50, meaning it is no longer contracting. Given this is reporting on a period during the UAW strike (which now seems to be ending), is particularly good news for the economy.

PCE Inflation

We’ve talked before about the many measures of inflation, but you’ll recall that PCE is the Fed’s “preferred measure”. As we got the September PCE data last week there was talk in the media about a “hot read” on inflation. But it really wasn’t. Core PCE dropped from 3.8% to 3.7% (in line with expectations) and All Items PCE stayed at the same level as the previous month – 3.4% – which was exactly as anticipated.

We’re getting to the point we talked about last week. Inflation numbers are stabilizing. So, what will the Fed do?

The consensus right now is nothing. As of Friday, the current CME Group model shows a 99.9% chance of no change in rates and a 0.1% chance the Fed lowers rates by 25 basis points.

Source: CMEGroup.com

Past performance is not indicative of future results.

That’s good news for the time being. But it means we’re left yet again to read the tea leaves of Powell’s comments to guess what the future brings. Expect a volatile day in the market on Wednesday as folks try to figure it out. We’ll be back next week with our take.

Sincerely,