The Weekly Insight Podcast – Stealth QE

If you’ve been paying attention to the Weekly Insight for a long time, you know we believe there is a direct correlation between what happens in Washington, DC and what happens in your portfolio. Politics is not everything to the market, but it’s not a small factor either.

The math is simple on this front. Estimates put the U.S. economy for 2024 at $27 – $28 trillion. The Federal government will collect $5 trillion of that in taxes. Any entity that controls nearly 19% of the entire economy will have an impact on the direction of the economy!

This is, of course, why elections matter. Where those $5 trillion get spent does create winners and losers in the economy. And there is no doubt the two sides in this election have vastly different priorities. We’ll spend more time in the coming months diving into those differences and helping you understand what they may mean for the future of our economy and ideal portfolio positioning.

But there’s another phenomenon we need to consider as well: the economic decisions that get made to boost the political prospects of a party in power. In a sense, this is the most obvious tenant of any government: the party in power will use their power to sustain their power. Why wouldn’t they? And let’s be really, really clear on this: both parties do it. There are no innocent do-gooders in this game.

The history here is long and littered with examples. There was Nixon’s election in 1972. Facing rising inflation and what he feared would be a difficult election, he implemented wage and price controls. It worked and the stable economy helped him get re-elected…until it didn’t. When the artificial controls were lifted inflation surged.

Or there was LBJ’s “Guns and Butter” strategy in 1964. “Guns” was his engagement in the Vietnam War (which was economically stimulating). “Butter” was his Great Society social programs. The only problem was he never created the revenue to pay for all those programs. But, in the short term, it meant a big boost for the economy and a landslide victory for LBJ.

So, the people who control the levers of the economy use the economy to help maintain their power. Color us shocked. It is, in our opinion, a big reason that the average S&P 500 return during Presidential years is 11.2%. And the bad years all included economic circumstances that even the most aggressive political moves couldn’t overcome.

So, if that is the case, what is Washington doing to impact this election? And, more importantly, what does that mean for your portfolio?

The easy answer – and the one many in the GOP are using – is the Fed is manipulating interest rates (or will soon be doing so) to benefit the Democrats. Even Former President Trump said as much, noting about Chairman Powell “I think he’s going to do something probably to help the Democrats, I think, if he lowers interest rates”.

It’s a great political talking point, but probably not reality. There is, of course, the fact that Trump was the one who appointed Powell the Chairman of the Fed. Or the fact that President Trump appointed three of the seven Fed Governors who will make these rate decisions. But the truth is, the time to cut rates is now. A delay to avoid seeming “political” could actually cause harm to the economy.

But that doesn’t mean the Democrats in Washington aren’t doing what every previous administration has done. It’s just that it’s happening in ways that aren’t so patently obvious. This brings us to “Stealth QE”.

QE – as you will remember – is “quantitative easing” and it was the Fed’s method to deploy liquidity into the economy. They did it post-2008 and they did again during/after COVID. Liquidity is a vitally important to the economy and the stock market. But liquidity is also inflationary. That’s why the Fed has been purposely reducing their balance sheet (and sucking liquidity out of the economy) over the last year. It’s reduced its holdings by a whopping $1.9 trillion.

But it turns out the other – much more politically motivated – side of the Federal Government is working at cross purposes with the Fed. At the same time the Fed has been sucking liquidity out of the economy, the Treasury Department has been injecting liquidity back into it.

Why? Simple: it boosts economic growth. How? That’s more complicated. It comes down to manipulating which types of government debt the Federal government is selling. Where they normally had a strict limit on the amount of short-term debt they would issue (roughly 20%) that number today is closer to 30%.

What has that meant? It’s meant a roughly $800 billion injection of liquidity into the economy. That would be equivalent, according to Hudson Bay Capital who released a research report on the topic, to a roughly 1% cut in interest rates. That’s a pretty big deal.

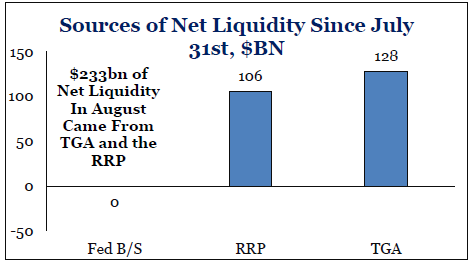

It resulted in a huge first half of August for liquidity. According to Strategas, nearly a quarter trillion of net liquidity was pumped into the economy in just a few weeks. Think that helped the stock market climb out of its early August hole? You bet.

Source: Strategas

That’s all well and good for portfolios right now. Add a little juice from interest rate cuts later this month and an argument can be made for a stimulative environment. But what happens on the other side? What happens when the Treasury Department starts to cycle back to their normal structure and starts utilizing more longer-term debt? Liquidity is sucked back out of the economy. And that won’t be good for markets. Yet another reason to be cautious in our allocations as we get closer to the end of the year.

Sincerely,