The Weekly Insight Podcast – One Down, Two to Go?

Before we dive into this week’s Insights, a quick administrative note: given the Labor Day holiday next Monday, the offices of both Insight Wealth Group and Insight CPA will be closed. Consequently, the next edition of the Weekly Insight Memo and Podcast will be delayed until Tuesday, September 3rd. Thanks for your understanding! Now let’s get back to business.

For over a month, we’ve been discussing the “Big Three” themes driving the market this summer. As a quick refresher, they are:

- The rotation from tech stocks to “everything else”.

- The 2024 Presidential Election.

- The ongoing debate on interest rates/the Fed.

As we enter the final week before the unofficial end of summer, there’s significant movement on all three fronts. And is it possible that Chairman Powell took one of the three off the table last week at Jackson Hole? Let’s do a quick run through all three.

Tech Rotation

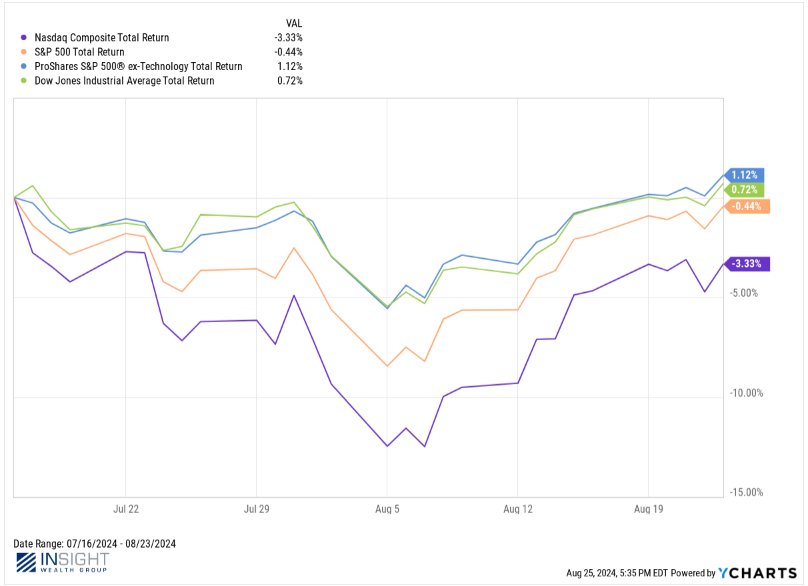

The market has largely recovered from the volatility we experienced at the end of July and through early August. But there’s a clear difference between tech and the rest. As you can see from the chart below, removing tech from the S&P 500 results in a more than 1.50% swing to the upside. And the comparison to the tech heavy Nasdaq is a nearly 4.50% swing. Everything has been up over the last two weeks – but the result still favors a rotation away from tech.

Past performance is not indicative of future results.

The next critical test in this theory comes later this week when NVIDIA reports earnings. As Barron’s put it over the weekend, “NVIDIA’s earnings are coming. Big tech needs them to be good”. All signs currently point to another solid quarter for the industry darling. But a surprise to the downside would further exacerbate the new bias away from tech. This will be the earnings report to watch for the week.

Election Update

The last four weeks has been a fascinating one in U.S. politics. Never in our lifetimes have we seen such a wild curveball in a Presidential election (Biden dropping out) nor such a change in the trajectory of a race.

That all culminated Thursday night with Vice President Harris’ acceptance of the Democratic nomination. Her speech, which was well received by the pundits, amounted to a significant shift toward the center for the Democratic party. It’s clear there are two paths to the Presidency: her plan to build a coalition of Democrats and Independents and Trump’s path to rally his base.

Which will work? Great question. We haven’t seen a “coalition” election since Obama in 2008. Since then, the two parties have battled over which can better turn out their base on Election Day. Trump’s path fits that model. Harris’ may be more of a gamble. We shall see.

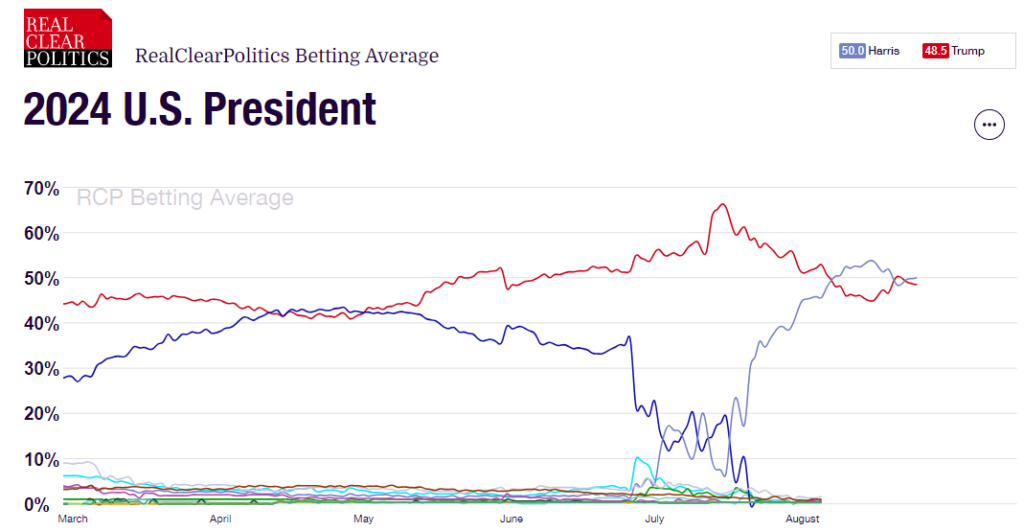

But in the meantime, we do know one thing: all the drama and all the news brought us right back to where we were in May: a tied race for the Presidency.

Past performance is not indicative of future results.

Harris’ odds of becoming President are lower than they were prior to her convention. Why? She hasn’t been able to sustain her breakout in battleground states. That may change in the post-convention polling, but right now this is an absolute toss-up. Look at the state of the polling averages for the battlegrounds:

Arizona: Trump +0.2%

Georgia: Trump +1.0%

Michigan: Harris +2.0%

Nevada: Trump +1.4%

N. Carolina: Trump +0.9%

Pennsylvania: Trump +0.2%

Wisconsin: Harris +1.0%

Harris has successfully expanded the field, adding both North Carolina and Georgia back into the toss-up category. But this race is a LONG way from over. And that means the potential for significantly more volatility as Election Day nears. These two candidates have vastly different visions for America and whomever wins will force different strategies for investors. That uncertainty means we can’t assume the volatility is over.

Powell at Jackson Hole

What is over? Interest rates at their current level! We finally made it! Powell all but made it official at Jackson Hole on Friday.

According to his remarks, inflation has been beaten: “My confidence has grown that inflation is on a sustainable path back to 2 percent”.

And the unemployment picture – the thing that freaked everyone out last month – is stable: “All told, labor market conditions are now less tight than just before the pandemic in 2019…it seems unlikely that the labor market will be a source of elevated inflationary pressures anytime soon”.

That’s good news, but while he celebrated the win on inflation, he was clear to point out that the “downside risks to employment have increased”. We can all interpret that to mean employment will be their focus in future Fed meetings.

That brings us to the big statement: “With an appropriate dialing back of policy restraint (cutting rates!), there is good reason to think that the economy will get back to 2 percent inflation while maintaining a strong labor economy”.

This is a win – and we should take it. But we can’t sit on our laurels either. There are a couple of important points to keep in mind.

First, while we all love the idea of a “soft landing”, it’s never (ever…not even once!) been executed. If we want to stick with the airplane analogy, Boeing released a study in 2019 that showed that 49% of all airplane fatalities happened during the landing. Well, now we’re on final approach…and there are still plenty of things that could go wrong.

Second, we know the idea of rate cuts – and them finally happening in just a few weeks – will be accretive to the market. But we also think the market is getting a bit too excited about it. You may recall a memo we wrote in early 2023 when the market believed the Fed would cut rates in May of that year. We cautioned that not executing on that plan may lead to additional volatility. It did.

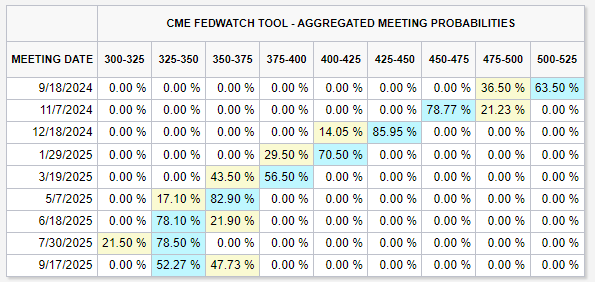

The current prediction for the next 10 months is even more optimistic. The current projection has the Fed cutting rates eight times – fully 2 percent – between now and June of 2025.

Source: www.CMEGroup.com

We don’t buy it. Eight rate cuts in seven Fed meetings would be incredibly aggressive. And barring some sort of significant economic downturn would lead us back into an inflationary condition.

So, again, we’ll take this win. But we should be watching the markets’ reaction very closely over the coming weeks and months. Overhyping expectations can turn good news into bad very quickly.

Sincerely,