The Weekly Insight Podcast – Worst Week Ever (*this year…)

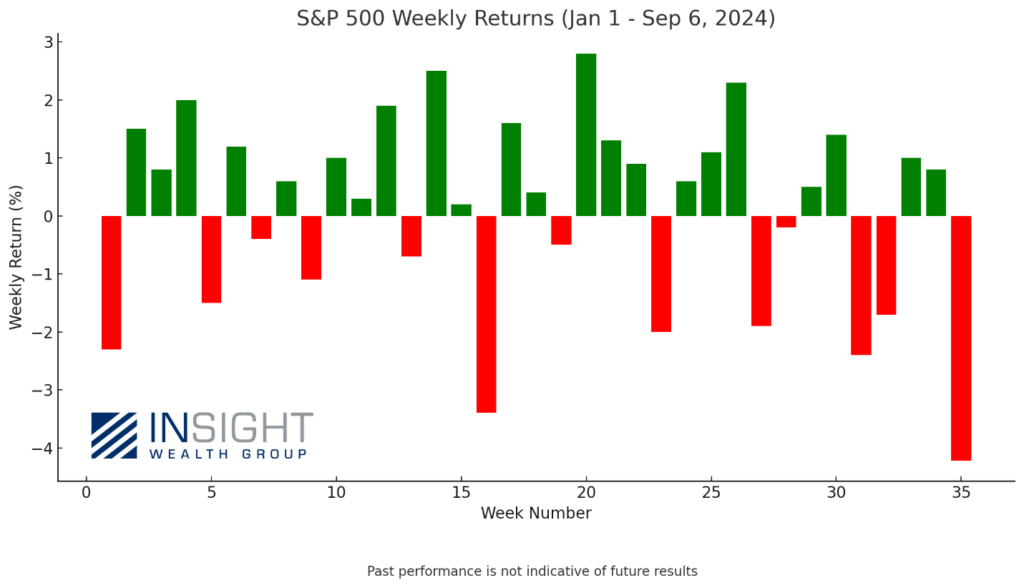

Did you feel that? That was the market’s worst week in 2024. Down 4.22% in a week. Well worse than we saw even at the beginning of August.

Was there panic in the streets? Not really.

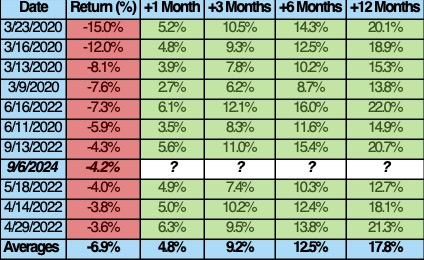

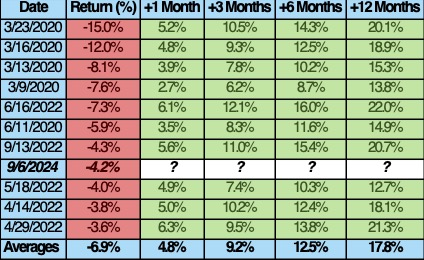

In fact, while it wasn’t a good week for anyone, it’s not as though this was some historically bad week in the market. In fact, while it was by far the worst we’ve seen this year, it is just the eighth worst week we’ve seen in the market in the last five. And historically, returns after bad weeks like these – at least this decade – have been impressive.

Past performance is not indicative of future results.

Does that mean we can guarantee 10%+ returns twelve months from now? Of course not. But it’s a reminder that the stock market’s worst moments often present the best opportunities, not signs of impending doom.

The biggest driver of volatility last week was, undoubtedly, employment data. As you’ll recall, it was exactly a month ago we got the July unemployment data, and it freaked the market out. On Friday, the august report did the same.

The irony here is the market is looking for weakness anywhere it can find it. It’s looking to be freaked out. What caused the drama a month ago? Unemployment increased from 4.1% to 4.3%. What did we see on Friday? Unemployment went down to 4.2%. Still freaked out. Why? The number of new jobs, which came in 60% higher than last month, was 13% lower than the expectation the market had.

Once again, this is happening at the margins. But it plays into the broader conversation about the Fed’s next moves. The Fed’s decision won’t impact things at the margins. It’s a big deal. So, as we approach the first rate cut, the market is pretty jittery.

Which brings us back to expectations of the Fed. We are just 9 days away from seeing Chairman Powell step to the podium and tell us what the first rate cut will be. Right now, the market is fairly certain we’re going to see a 0.25% cut in rates. The odds – as of the weekend – sat at 70% (with the other 30% anticipating a 0.50% cut).

Where things have the potential to get interesting continues to lie in the market’s expectations for cuts in the future. The market is anticipating the Fed will cut rates by 2.25% over the next 9 months. That’s nine 0.25% rate cuts in 7 meetings.

The truth is the market is going back to past historical examples. Interest rate policy since 2000 has been a wild ride of aggressive swings to combat economic issues facing the nation:

- Tech bubble and 9/11: Rates were cut 4.75% in 13 months.

- Greenspan Rate Hikes: Rates were hiked 4% in 24 months.

- 2008 Crisis: Rates were cut 5% in 16 months.

- COVID: Rates were cut 2.5% in 9 months (and 1.75% in one month).

- Post COVID inflation: Rates were hiked 5.25% in 14 months.

We have seen nothing but swings from one extreme to the next for a quarter century. So, the market is expecting the same. Deep cuts in rates assume the economy is failing. They assume a significant recession is coming. But what if it’s not?

We’ve discussed before how a recession is actually identified. It’s not – as the media would tell you – two consecutive quarters of negative GDP growth. Based on that metric, we’re a long way from a recession. GDP was up 3% in Q2 and is currently anticipated to be up 2.1% in Q3.

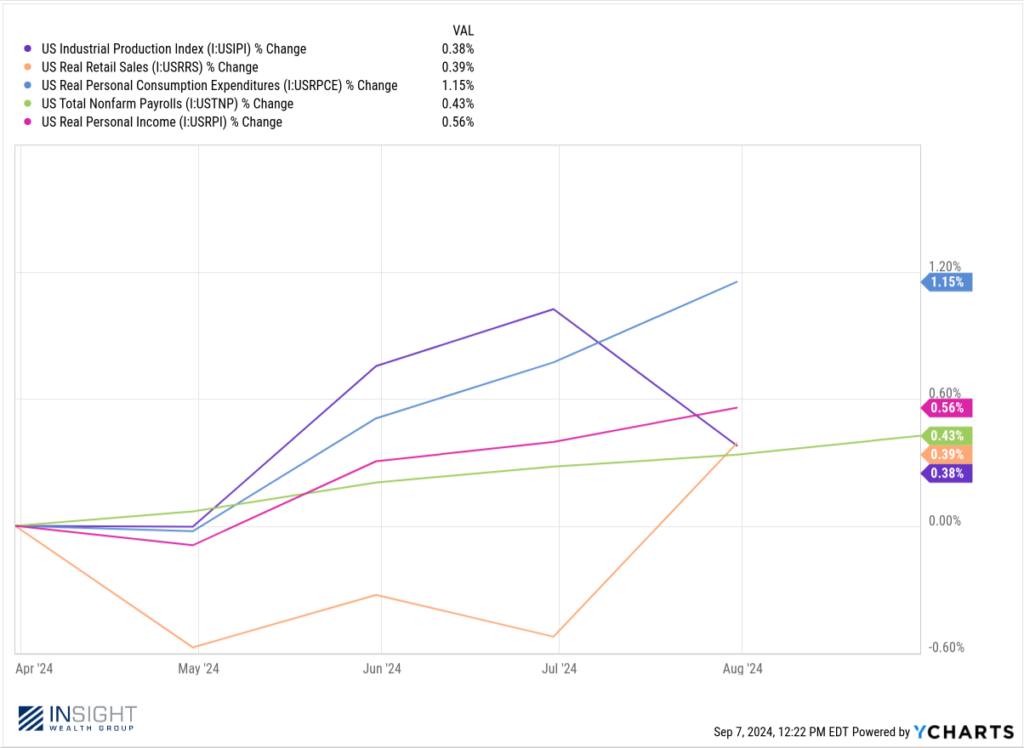

Instead, the National Bureau of Economic Research (NBER) calculates a recession as a sustained downward trend in a bucket of economic measurements. Here’s how those measures have done over the last six months.

Past performance is not indicative of future results.

They’re all positive for the period. Does that mean they can’t all go negative and do so quite quickly? Of course not. But it does mean there’s no reason to believe a recession is going to start tomorrow. And if that’s the case, we would argue, there is no reason to believe the Fed is going to be overly aggressive on rate cuts. Remember, they’re still cautious about repeating the mistakes of the 1970s.

So where does that leave us? A moment the market would have celebrated just a few months ago – our first rate cut – has the potential to be a negative moment for the market! Why? Because it’s quite possible Powell will step to the podium next week and downplay the path for future rate cuts.

Combine that with the problems in tech stocks and a remarkably close Presidential election? Our warnings of volatility between now and Election Day have the potential to prove accurate.

And that brings us full circle and back to the table from the start of this memo:

Past performance is not indicative of future results.

Are bad periods – weeks, months, or quarters – really unwelcome news for your portfolio? That depends not on the market, but on your reaction. The data consistently shows that patience pays off, especially if you have dry powder ready to invest into the correction. Happily, there has been no time in the history of the firm when we’ve had more dry powder to deploy.

We can be nervous about this moment. But it’s okay to be a little excited about it as well. There may be some fun opportunities coming down the pike.

Sincerely,